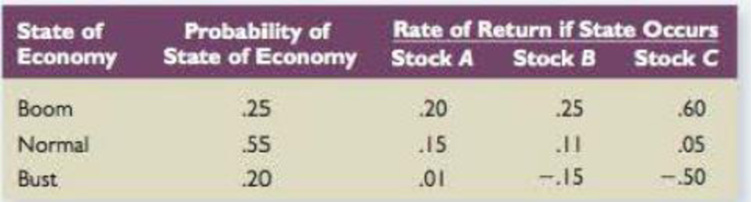

Portfolio Returns and Deviations Consider the following information about throe stocks:

- a. If your portfolio is invested 40 percent each in A and B and 20 percent in C, what is the portfolio expected return? The variance? The standard deviation?

- b. If the expected T-bill rate is 3.80 percent, what is the expected risk premium on the portfolio?

- c. If the expected inflation rate is 3.50 percent, what are the approximate and exact expected real returns on the portfolio? What are the approximate and exact expected real risk premiums on the portfolio?

a.

To determine: The Expected Return, Variance and Standard Deviation.

Introduction: Expected Return is a process of estimating the profits and losses an investor earns through the expected rate of returns. Standard deviation is apportioned of distribution of a collection of figures from its mean.

Answer to Problem 22QP

The Expected Return is 10.65%, Variance is 0.02317 and Standard Deviation is 15.22%.

Explanation of Solution

Determine the Portfolio Return for each Stock

Therefore the Portfolio Return for Boom is 30%, Normal is 11.40%, and Bust is -15.60%.

Determine the Expected Return

Therefore the Expected Return on Portfolio is 11.17%.

Determine the Variance

Therefore the Variance on Portfolio is 0.02317.

Determine the Standard Deviation

Therefore the Standard Deviation on Portfolio is 15.22%.

b.

To determine: The Expected Risk Premium on Portfolio.

Introduction: Expected Return is a process of estimating the profits and losses an investor earns through the expected rate of returns. Standard deviation is apportioned of distribution of a collection of figures from its mean.

Answer to Problem 22QP

The Expected Risk Premium on Portfolio is 6.85%.

Explanation of Solution

Determine the Expected Risk Premium on Portfolio

Therefore the Expected Risk Premium on Portfolio is 6.85%.

c)

To determine: The Approximate and Exact Expected Real Returns and Approximate and Exact Expected Real Risk Premium on Portfolio.

Answer to Problem 22QP

The Approximate Real Returns is 7.15% and Exact Expected Real Returns is 6.91% and Approximate Real Risk Premium is 6.85% and Exact Expected Real Risk Premium is 6.62%.

Explanation of Solution

Determine the Approximate Expected Real Returns

Therefore the Approximate Expected Real Returns is 7.15%.

Determine the Exact Expected Real Returns

Using Fisher equation we calculate the exact expected real returns as,

Therefore the Exact Expected Real Returns is 6.91%.

Determine the Approximate Real Risk-free Rate

Therefore the Exact Expected Real Returns is 0.30%

Determine the Exact Real Risk-free Rate

Using Fisher equation we calculate the exact expected real returns as,

Therefore the Exact Real Risk-free Rate is 0.29%

Determine the Approximate Real Risk Premium

Therefore the Approximate Real Risk Premium is 6.85%

Determine the Exact Real Risk Premium

Therefore the Exact Real Risk Premium is 6.62%.

Want to see more full solutions like this?

Chapter 11 Solutions

CORPORATE FINANCE (LL)-W/ACCESS

- You have observed the following returns over time: Assume that the risk-free rate is 6% and the market risk premium is 5%. What are the betas of Stocks X and Y? What are the required rates of return on Stocks X and Y? What is the required rate of return on a portfolio consisting of 80% of Stock X and 20% of Stock Y?arrow_forwardTwo-Asset Portfolio Stock A has an expected return of 12% and a standard deviation of 40%. Stock B has an expected return of 18% and a standard deviation of 60%. The correlation coefficient between Stocks A and B is 0.2. What are the expected return and standard deviation of a portfolio invested 30% in Stock A and 70% in Stock B?arrow_forwardThe following table reports the percentage of stocks in a portfolio for nine quarters: a. Construct a time series plot. What type of pattern exists in the data? b. Use trial and error to find a value of the exponential smoothing coefficient that results in a relatively small MSE. c. Using the exponential smoothing model you developed in part (b), what is the forecast of the percentage of stocks in a typical portfolio for the second quarter of year 3?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning