Economic rents Taxes are a cost, and, therefore, changes in tax rates can affect consumer prices, project lives, and the value of existing firms. The following problem illustrates this. It also illustrates that tax changes that appear to be “good for business” do not always increase the value of existing firms. Indeed, unless new investment incentives increase consumer demand, they can work only by rendering existing equipment obsolete.

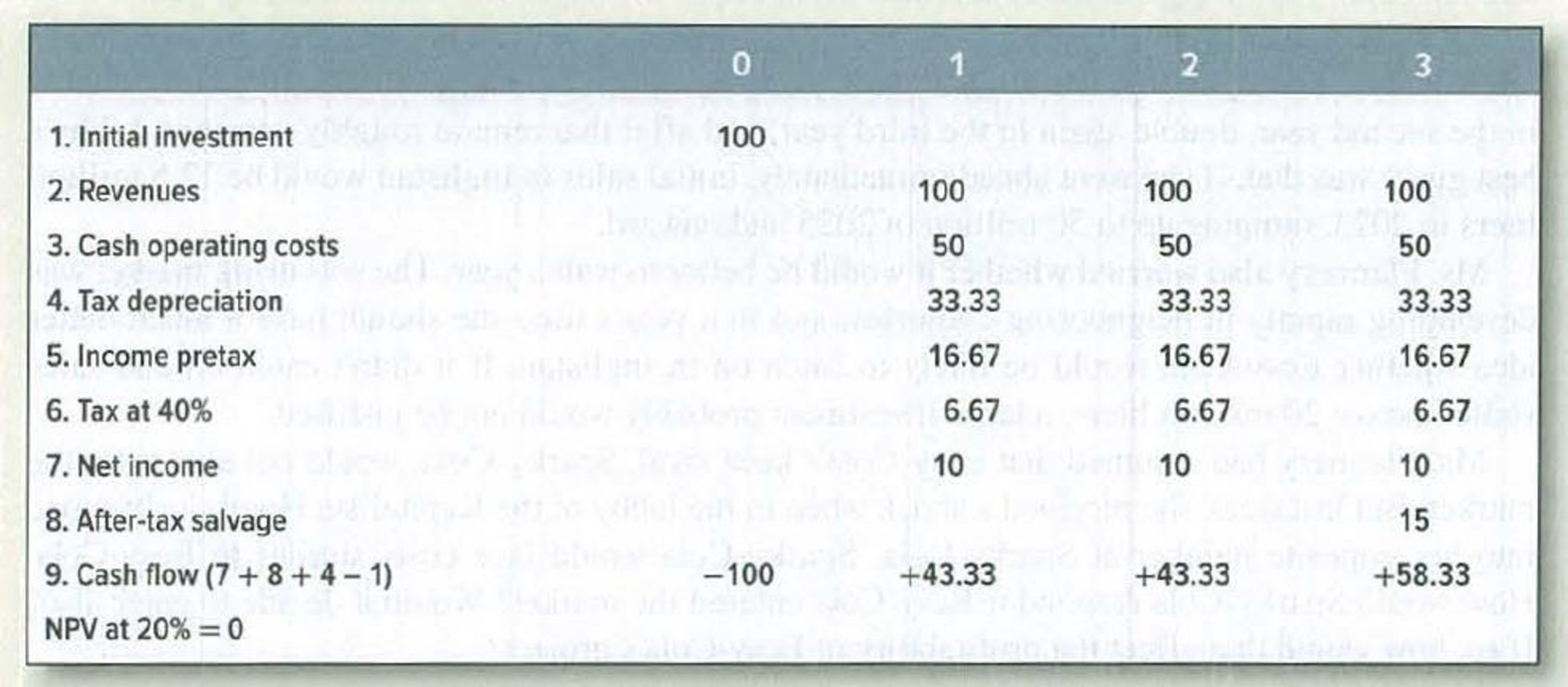

The manufacture of bucolic acid is a competitive business. Demand is steadily expanding, and new plants are constantly being opened. Expected cash flows from an investment in a new plant are as follows:

Assumptions:

- 1. Tax depreciation is straight-line over three years.

- 2. Pretax salvage value is 25 in year 3 and 50 if the asset is scrapped in year 2.

- 3. Tax on salvage value is 40% of the difference between salvage value and

depreciated investment. - 4. The cost of capital is 20%.

- a. What is the value of a one-year-old plant? Of a two-year-old plant?

- b. Suppose that the government now changes tax depreciation to allow a 100% writeoff in year 1. How does this affect the value of existing one- and two-year-old plants? Existing plants must continue using the original tax depreciation schedule.

- c. Would it now make sense to scrap existing plants when they are two rather than three years old?

- d. How would your answers change if the corporate income tax were abolished entirely?

a)

To determine: values of one year old plant and two year old plant.

Explanation of Solution

Here, value in the sense, present value.

Calculation of present value of one-year old plant:

Hence, the present value of one-year old plant is $76.62.

Calculation of present value of two-year old plant:

Hence, the present value of two-year old plant is $48.61.

b)

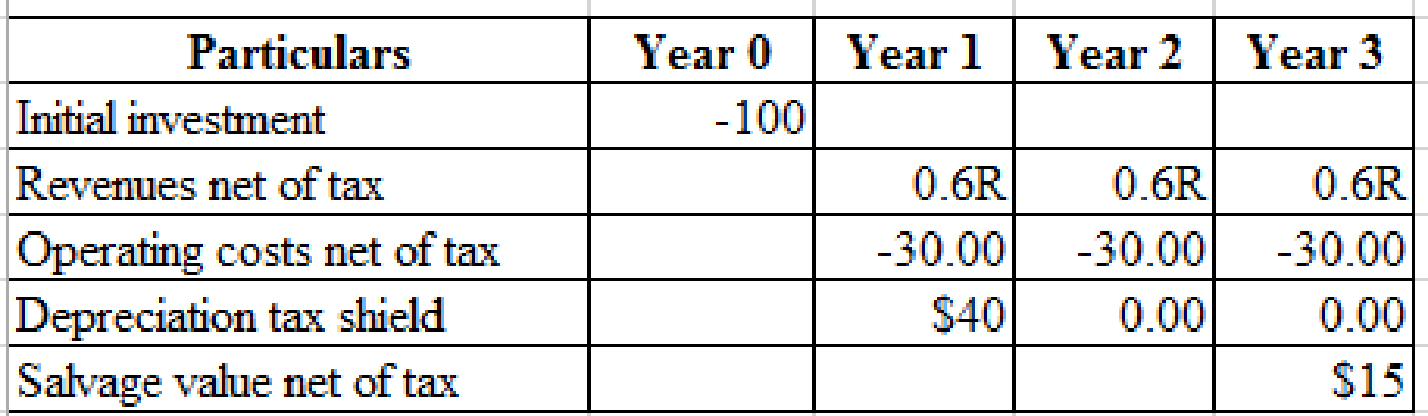

To determine: Effect of government on taxes on one and two year old plant and existing plants should continue using the schedule of original tax depreciation.

Explanation of Solution

Given the industry is competitive, the investments in new plant producing the product must yields zero NPV.

Calculation of Revenues (R) at which the NPV of new plant is zero:

Hence,

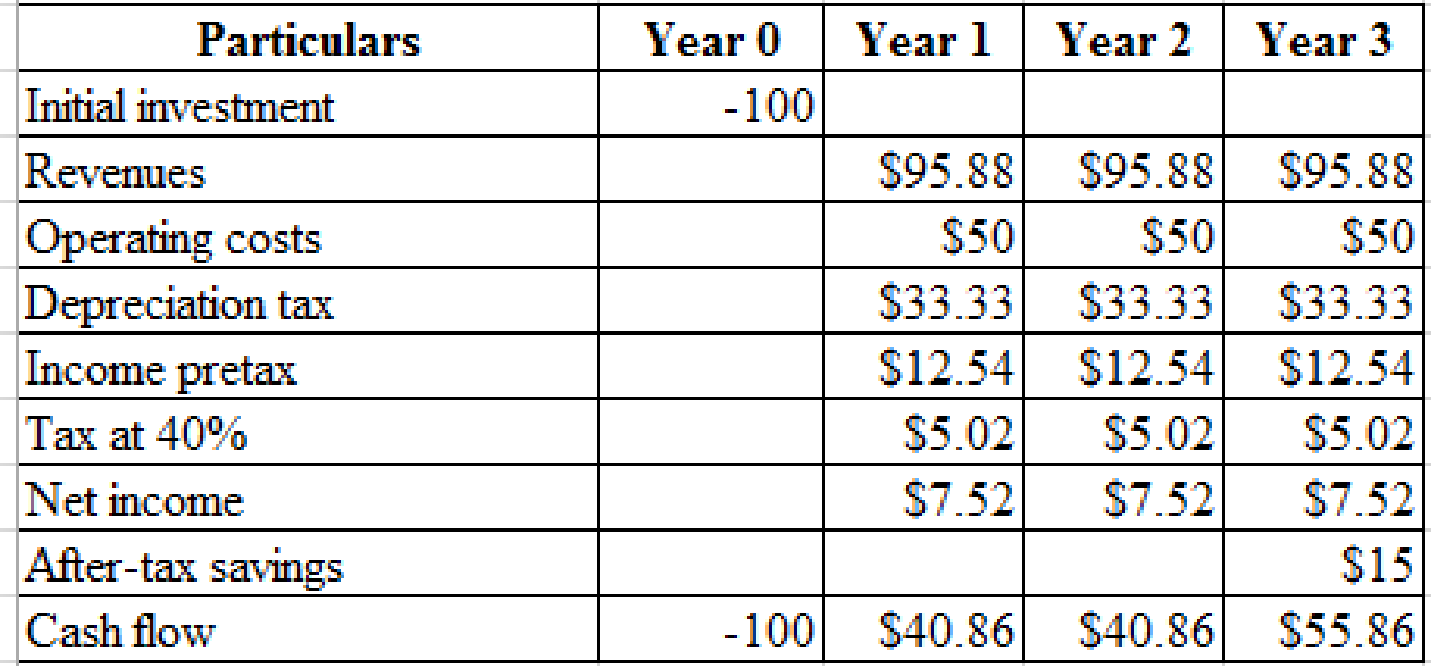

By solving this, the value of R= $95.88.

By using the value of R we can calculate the present values of existing one and two years old plants.

Calculation of present value of one and two-year old plants:

Hence, the present value of one-year old plant is $72.84.

Hence, the present value of two-year old plant is $46.55

c)

To determine: Net salvage value of two year old plant.

Explanation of Solution

Calculation of salvage value:

The salvage value is $43.33.

d)

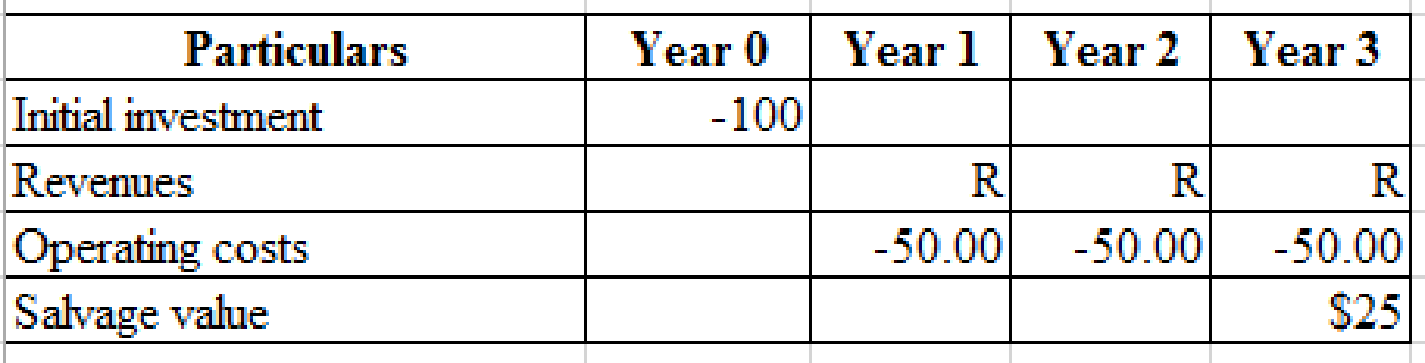

To determine: Values the corporate tax rates are abolished entirely.

Explanation of Solution

Solving for zero NPV:

By using the revenues of $90.60

Calculation of present value of one-year old plant:

Hence, the present value of one-year old plant is $79.40.

Calculation of present value of two-year old plant:

Hence, the present value of two-year old plant is $54.67

Want to see more full solutions like this?

Chapter 11 Solutions

EBK PRINCIPLES OF CORPORATE FINANCE

- Finance rocks had decided to reduce its fixed costs by seller some of its manufacturing facilities and assigning the production of certain parts to a group of predecessors suppliers, by doing so the company is trying to adjusts its operating leverage, financial leverage or tax burden?arrow_forwardA paper published in the Harvard Business Review points out a new way to calculate economic profit that could be more appropriate for service firms and other people-intensive companies. Instead of focusing on investment and return on investment, the focus is on employee productivity, in terms of both generating revenues and reducing costs. The approach is to first determine economic profit in the conventional way, except that we ignore taxes, so that economic profit is before tax, as follows: Economic profit = Operating profit − Capital charge Assume the following information for a hotel chain that wishes to adopt the new method. The firm has $100 million in operating profit, has $1 billion in investment, and uses a cost of capital rate of 5%, so the capital charge is $50 million and the economic profit is $50 million. Relevant calculations are contained in Part 1 of the following schedule: Part 1: Economic Profit (in thousands, except cost of capital rate) Revenue $…arrow_forwardA paper published in the Harvard Business Review points out a new way to calculate economic profit that could be more appropriate for service firms and other people-intensive companies. Instead of focusing on investment and return on investment, the focus is on employee productivity, both in terms of generating revenues and reducing costs. The approach is to first determine economic profit in the conventional way, except that we ignore taxes, so that economic profit is before tax, as follows: Economic profit = Operating profit − Capital charge Assume the following information for a hotel chain that wishes to adopt the new method. The firm has $100 million in operating profit, has $1 billion in investment, and uses a cost of capital rate of 5%, so the capital charge is $50 million and the economic profit is $50 million. Relevant calculations are contained in Part 1 of the following schedule: Part 1: Economic Profit (in thousands, except cost of capital rate)…arrow_forward

- CEO: "If we were to increase the price of our goods the company's break-even point would be lower," he noted in a strategy meeting. The vice president of finance answered by adding, "Then we should boost our pricing. As a result, the organization is less likely to suffer a financial loss." Do you share the president's sentiments? To what end? Is the vice president correct? To what end?arrow_forwardIn competitive markets economic profit becomes zero in the long-run. However, it is also possible for some firms to earn a greater accounting profit and to enjoy a higher producer surplus than other firms. How is it possible? Explain in detail. explain it examplesarrow_forwardSuppose you are analyzing a firm that is successfully executing a strategy that differentiates its products from those of its competitors. Because of this strategy, you project that next year the firm will generate 6.0% revenue growth from price increases and 3.0% revenue growth from sales volume increases. Assume that the firms production cost structure involves strictly variable costs. (That is, the cost to produce each unit of product remains the same.) Should you project that the firms gross profit will increase next year? If you project that the gross profit will increase, is the increase a result of volume growth, price growth, or both? Should you project that the firms gross profit margin (gross profit divided by sales) will increase next year? If you project that the gross profit margin will increase, is the increase a result of volume growth, price growth, or both?arrow_forward

- If the firm is in a very competitive, mature industry, what effect will the competitive conditions have on residual income for the firm and others in the industry? Now suppose the firm holds a competitive advantage in its industry, but the advantage is not likely to be sustainable for more than a few years. As the firm’s competitive advantage diminishes, what effect will that have on that firm’s residual income? and If a firm’s residual income for a particular year is positive, does that mean the firm was profitable? Explain. If a firm’s residual income for a particular year is negative, does that mean the firm necessarily reported a loss on the income statement? Explain. What does it mean when a firm’s residual income is zero?arrow_forwardCompanies have found that offering discounts to customers in return for early payment can be counterproductive in terms of the resulting adverse effect on profitability. This is when the reduction in profitability outweighs any marginal improvements gained from the benefit of a reduction in the working capital requirement. Required: Given the above critically discuss the alternative measures to offering discounts to customers that could prove more effective in reducing the working capital requirement for a company with only minimal potential reductions in profitability.arrow_forwardIf the government institutes a specific tax for a good that has a perfectly inelastic demand curve A)the producer passes the entire tax on to the consumer. B)the equilibrium price drops. C)the producer must absorb the entire tax. D)the producer can generally only pass part of the tax onto the consumer.arrow_forward

- Suppose firms in this economy pay their workers efficiency wages. This practice will likely lead to a (faster, slower) adjustment of the economy to its long-run equilibrium because firms will be (less, more) likely to (reduce, raise) the wages of their employees.arrow_forwardA corporation has an excess input VAT due to its excessive local purchases of goods and services. This excess input VAT is accumulating every month and reached a significant value. The management is considering to deal with the excess input VAT. a. Determine the best option for the corporation in treating its excess input VAT to gain maximum tax benefit. Justify your answer. b. Assume that the excess input VAT is directly attributable to its Zero-rated VAT Sales, explain the options that could possibly be considered by the management.arrow_forwardThe difference between the average customer’s willingness to pay and the total costs of a product is known as ______. When a company makes a profit, the difference between the price of the product and the cost of production is known as what? Value creation and value capture are key concepts for which parts of business? If a company innovates in a way that reduces its production costs without affecting any features of the product, would that create value? Suppose a price war was to erupt in the airline market, which causes prices for flights to decline, but affected nothing else about the industry. Would this change the value created by airlines? Suppose a price war was to erupt in the airline market, which causes prices for flights to decline, but affected nothing else about the industry. Would this change the value captured by airlines? Please solve all part and do not give solution in image format thankuarrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningBusiness/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningBusiness/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning