a)

Determine the expected net income when 500 people buy the ticket

a)

Explanation of Solution

Given information:

The sale price of ticket is $28. Fee is $10,000 fixed.

The formula to calculate the net income:

Compute the net income:

Hence, the net income is $4,000.

The price of the speaker will remain same irrespective of fixed fee or fee of $20 per ticket sold.

b)1.

Determine the net income and percentage change in net income if the sale of tickets is 10% higher than expected

b)1.

Explanation of Solution

Given information:

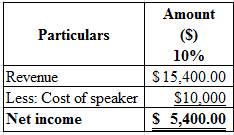

Refer above part for net income:

Compute the net income:

The net income is $5,400.

Compute the percentage growth in net income:

Hence, the percentage growth in net income is 35%.

2.

Determine the net income and percentage change in net income if the sale of tickets is 10% lower than expected and the fixed fee is $10,000.

2.

Explanation of Solution

Given information:

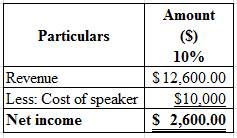

Refer part a) for net income:

Compute the net income:

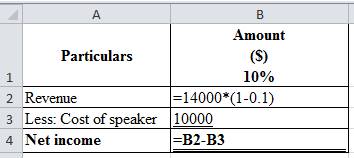

Excel spread sheet:

Excel workings:

The net income is $2,600.

Compute the percentage growth in net income:

Hence, the percentage growth in net income is 35%.

3.

Determine the net income and percentage change in net income if School P pays Person L $20 per ticket sold. The sale of tickets is 10% higher than expected.

3.

Explanation of Solution

Given information:

Refer part a) for net income:

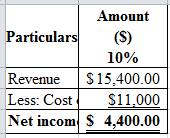

Compute the net income:

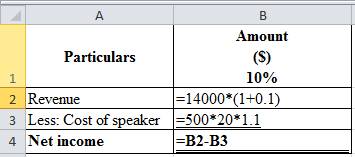

Excel spread sheet:

The net income is $4,400.

Excel workings:

Compute the percentage growth in net income:

Hence, the percentage growth in net income is 10%.

4)

Determine the net income and percentage change in net income if School P pays Person L $20 per ticket sold and the sale of tickets is 10% lower than expected.

4)

Explanation of Solution

Given information:

Refer part a) for net income:

Compute the net income:

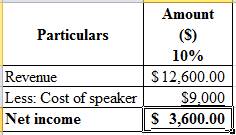

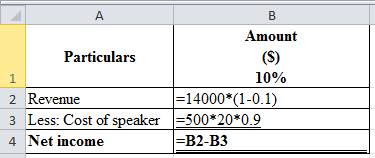

Excel spread sheet:

The net income is $3,600.

Excel workings:

Compute the percentage growth in net income:

Hence, the percentage growth in net income is 10%.

c)

Discuss the discrepancies if any arises on the computation presented at the board by the spokesperson and by the other groups.

c)

Explanation of Solution

There are no discrepancies in the computation presented at the board by the spokesperson and by the other groups.

d)1.

The kind of cost structure produces the greater growth potential in the profitability of the company.

d)1.

Explanation of Solution

The fixed cost structure produces the higher growth potential in company’s profitability.

This is because of operating leverage.

2.

The type of cost structure produces the higher risk of company’s declining profitability.

2.

Explanation of Solution

The fixed cost structure produces the higher risk of company’s declining profitability.

This is because of operating leverage.

3.

The circumstances under which the company pursue to establish a fixed cost structure

3.

Explanation of Solution

The circumstances where the sales of the company expected to raise are where the fixed cost structure is established.

4.

The circumstances under which the company pursues to establish a variable cost structure

4.

Explanation of Solution

The circumstances where the sales of the company expected to drop are where the variable cost structure is established.

Want to see more full solutions like this?

Chapter 11 Solutions

SURVEY OF ACCOUNTING 360DAY CONNECT CAR

- Exercise 2-49 Journalizing Transactions Kauai Adventures rams and sells surfboards, snorkeling, and scuba equipment. During March, Kauai engaged in the following transactions: March 2 Received $51,500 cash from customers for rental, 3 Purchased on credit ten new surfboards (which Kauai classifies as inventory) for $180 each. 6 Paid wages to employees in the amount of $9,200. 9 Paid office rem for the month in L1]: amount of$l,000. 12 Purchased a new Ford truck for 340.800: paid 51,000 down in cash and secured a loan from Princeville Bank for the $39,800 balance. March 13 Collected a $1,050 account receivable. 16 Paid an account payable in the amount of $950. 23 Borrowed $10,000 on a 6-month, 8% note payable. 27 Paid the monthly telephone hill of $185. 30 Paid a monthly advertising bill of $1,550. Required: Prepare a journal entry for each of these transactions.arrow_forwardProblem 2-62B Comprehensive Problem Mulberry Services sells electronic data processing services to firms too Email to own their own computing equipment. Mulberry had the following amounts and amount balances as of January 1, 2019: During 2019, the following transactions occurred (the events described below are aggregations of many individual events): During 2019, Mulberry sold $690,000 of computing services, all on credit. Mulberry collected $570,000 from the credit sales in Transaction a and an additional $129,000 from the accounts receivable outstanding at the beginning of the year. Mulberry paid the interest payable of $8,000. A Wages of $379,000 were paid in cash. Repairs and maintenance of $9,000 were incurred and paid. The prepaid rent at the beginning of the year was used in 2019. In addition, $28,000 of computer rental costs were incurred and paid. There is no prepaid rent or rent payable at year-end. Mulberry purchased computer paper for $13,000 cash in late December. None of the paper was used by year-end. Advertising expense of $26,000 was incurred and paid. Income tax of $10,300 was incurred and paid in 2019. Interest of $5,000 was paid on the long-term loan. (Continued) Required: Establish a T-account for the accounts listed above and enter the beginning balances. Use a chart of accounts to order the T-accounts. Analyze each transaction; Journalize as appropriate. (Note: Ignore the date because these events are aggregations of individual events.) Post your journal entries to the T-accounts. Add additional T-accounts when needed. Use the ending balances in the T-accounts to prepare a trial balance.arrow_forwardProblem 2-55A Events and Transactions The accountant for Boatsman Products Inc. received the following information: Boatsman sent its customers a new price list. Prices were increased an average of 3% on all items. Boatsman accepted an offer of 5150.000 for land that it had purchased 2 years ago for 130,000. Cash and the deed for the property are to be exchanged in 5 days. Boatsman accepted $150,000 cash and gave the purchaser the deed for the property described in Item b. Boatmens president purchased 600 shares of the firms common stock from another stock-holder; The president paid $15 per share. The former stockholder had purchased the stock from Boatsman for $4 per share. Boatsman leases its delivery trucks from a local dealer. The dealer also performs maintenance on the trucks for boats man. Boats man received a $1.254 bill for maintenance from the dealer. Required: l. CONCEPTUAL CONNECTION Indicate whether or not each item qualifies as a transaction and should be recorded in the amounting system. Explain your reasoning. 2. CONCEPTUAL CONNECTION What accounting concept is illustrated by Item d?arrow_forward

- Dj 2 accounting I need help with question 2 and 3 if anyone can help would be much appreicatyed E-SCOOTER Ltd You are the recently appointed accountant at E-SCOOTER Ltd a new company, which will be incorporated on 1st Sept 2022. Initially, the company will manufacture and sell a single electronic product used in the production of drones. The following details relate to the company’s first financial year: The selling price is £300 per unit. Direct materials cost £85 per unit Direct labour is 6 hours per unit for the first 2 months, reducing to 5 hours per unit thereafter. Direct labour cost £13 per hour Sales targets for the forthcoming financial year are as follows: Units Sept 2022 1,200 Oct 1,400 Nov 1,500 Dec 1,900 Jan 2023 2,000 Feb 2,000 Mar 2,100 Apr 2,200 May 2,000 Jun 1,800 Jul 1,800 Aug 1,900 85% of sales will be on credit terms, with customers paying two months later. The remaining sales are paid for immediately. Closing inventory is planned to be 10% of…arrow_forwardPart 2: Determining the business expenses The Happy Toddlers (THT) is a preparatory school for children three to five years old. There are ten teachers employed by THT: five senior teachers with a salary of P30,000 a month and five junior teachers at P18,000 a month. There are also four administrators with average monthly salary of P35,000. Annual depreciation for furniture and fixtures amounted to P100,000. Utilities starting operation totals P200,000. Required: Examine and list down the expenses of THT as of December 31 by nature. Which type of expense is the highest and lowest?arrow_forwardProject - Comprehensive Problem RETL 261 For the past several years, Kell Dice has operated a part-time consulting business from his home. As of June 1, 2020, Kell decided to move to rented quarters and to operate the business, which was to be known as Dice Consulting, on a full-time basis. Dice Consulting entered into the following transactions during June. Transactions: June: Kell Dice deposited $55,000 into Dice Consulting as the sole owner. Dice Consulting purchased supplies, $3,500; and office equipment, $17,500 with a 3 year note payable of $10,000 and the remainder in cash. Paid three months’ rent on a lease rental contract, $ 6,000. Paid the yearly premium on property and casualty insurance policies, $3,000. Paid cash for a newspaper advertisement, $120. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $7,000. Purchased…arrow_forward

- HRM Incident 2: The Announcement Dave Johnson, HR manager for Eagle Aircraft, had just returned from a brief vacation in Cozumel, Mexico. Eagle is a Wichita, Kansas, maker of small commercial aircraft. Eagle's workforce in 1998 totaled 236, Dave's friend Carl Edwards, vice president for marketing, stopped by to ask Dave to lunch, as he often did. In the course of their conversation Car asked Dave's opinion on the president's announcement concerning expansion. "What announcement?r" was Dave's response. Carl explained that there had been a special meeting of the ezecutive council tv announce a major expansion involving a new plant to be built near St. Louis, Missouri. He continued, "Everyone at the meeting seemed to be completely behind the president. Joe Davis, the controller, stressed our independent financial position. The production manager had writsen a complete report on the equipment we are going to need, including availability and cost information. And I have been pushing for…arrow_forwardChapter One Challenge Exercise 1 Expands on: E1-7 LO: 4 Wunderkind Photography entered into the following transactions during February 2022. Stockholders invested $5,000 in the business. Bought photography equipment for a cash payment of $1,000. Bought more photography equipment by signing a $500 note payable. Performed photography services for $400 cash. Performed photography services, and billed the customer $900 on account. Collected $900 from the customer in transaction 5. Paid for February developing and printing, $150. Advertised the business in the Platteville Journal. The $100 cost will be billed to Wunderkind. Paid the advertising bill from transaction 8. Paid $200 for photography supplies. Received $300 cash advance payment from a customer for a photography job to be performed in April. Paid $250 dividend to the stockholders. Instructions: Indicate whether each transaction increases or decreases assets, liabilities, or stockholders’ equity.…arrow_forwardIntegrative Cases 2-85 (Static) Analyze the Impact of a Decision on Income Statements (LO 2-2) You were appointed the manager of Storage Solutions Section (S3) at Milbank Technologies, a manufacturer of mobile computing parts and accessories late last year. S3 manufactures a drive assembly for the company’s most popular product. Your bonus is determined as a percentage of your division’s operating profits before taxes. One of your first major investment decisions was to invest $2 million in automated testing equipment for device testing. The equipment was installed and in operation on January 1 of this year. This morning, the assistant manager of the division told you about an offer by Joliet Systems. Joliet wants to rent to S3 a new testing machine that could be installed on December 31 (only two weeks from now) for an annual rental charge of $460,000. The new equipment would enable you to increase your division’s annual revenue by 7 percent. This new, more efficient machine…arrow_forward

- Problem 2-20 (IFRS) William Company operates a customer loyalty program.The entity grants loyalty points for goods purchased. The loyalty points can be used by the customers in exchange for goods of the entity. The points have no expiry date. During 2020,the entity issued 100,000 award credits and expects that 80% of these award credits shall be redeemed. The total stand-alone selling price of the award credits granted is reliably measured at P2,000,000. In 2020, the entity sold goods to customers for a total consideration of P8,000,000 based on stand-alone selling price. The award credits redeemed and the total award credits expected to be redeemed each year are as follows: Redeemed Expected to be redeemed 2020 30,000 80% 2021 15,000 1. What is the revenue from points for 2020? a. 1,600,000 b 1,500,000 C. 600,000 d 480,000 2. What is the revenue from points for 2021? a.240,000 B.200,000 C. 120,000 d 0arrow_forwardProblem 3-69BRevenue Recognition and Matching Process Aunt Bea's Catering Service provides catering service for special occasions. During 2022, Aunt Bea performed $128,300 of catering services and collected $118,500 of cash from customers. Salaries earned by Aunt Bea's employees during 2022 were $38,500. Aunt Bea paid employees $35,000 during 2022. Aunt Bea had $1,200 of supplies on hand at the beginning of the year and purchased an additional $8,000 of supplies inventory during the year. Supplies on hand at the end of 2022 were $1,830. Other selling and administrative expenses incurred during 2022 were $5,800. Required: 1. Calculate revenue for 2022.$fill in the blank 44385ef9bfd7010_1 Calculate expenses for 2022.$fill in the blank 44385ef9bfd7010_2 2. Prepare the 2022 statement of earnings. Aunt Bea's Catering Service Statement of Earnings For the Year Ended December 31, 2022 CONCEPTUAL CONNECTION: Describe the accounting principles used to prepare the…arrow_forwardExercise 9-5 (Algo) Calculate earned revenues LO 1 Big Blue University has a fiscal year that ends on June 30. The 2019 summer session of the university runs from June 7 through July 26. Total tuition paid by students for the summer session amounted to $112,000.Required:a. How much revenue should be reflected in the fiscal year ended June 30, 2019? b. Would your answer to part a be any different if the university had a tuition refund policy that no tuition would be refunded after the end of the third week of summer session classes?multiple choice Yes noarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning