PRINCIPLES OF TAXATION F/BUS.+INVEST.

22nd Edition

ISBN: 9781259917097

Author: Jones

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 4AP

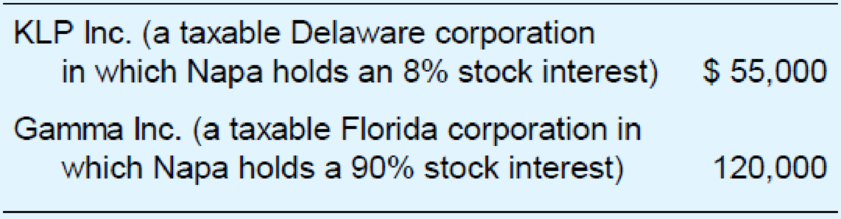

This year, Napa Corporation received the following dividends.

Napa and Gamma do not file a consolidated tax return. Compute Napa’s dividends-received deduction.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Green Corporation is required to change its method of accounting for federal income tax purposes. The change will require an adjustment to income to be made over three tax periods. Joe, the sole shareholder of Green, wants to better understand the implications of this adjustment for E&P purposes, because he anticipates a distribution from Green in the current year. Explain to Joe the impact of the adjustment on E&P.

Which of the following statements regarding losses is true?

A. A personal net operating loss may be carried back but not forward to other tax years.

B. A sole proprietor may deduct business losses against any form of income.

C. In a regular corporation, entity level losses are passed through to the shareholders.

D. In a S corporation, entity level losses are fully deductible by the shareholder under any circumstance.

During the current year, Ecru Corporation is liquidated and distributes its only asset, land, to Kena, the sole shareholder. On the date of distribution, the land has a basis of $100,000, a fair market value of $800,000, and is subject to a liability of $900,000. Kena, who takes the land subject to the liability, has a basis of $200,000 in the Ecru stock. What are the income tax Consequences to Kena and Ecru Corporation with respect to the liquidating distribution of the land?

Chapter 11 Solutions

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Ch. 11 - Prob. 1QPDCh. 11 - Prob. 2QPDCh. 11 - Prob. 3QPDCh. 11 - Prob. 4QPDCh. 11 - Prob. 5QPDCh. 11 - Libretto Corporation owns a national chain of...Ch. 11 - Prob. 7QPDCh. 11 - Prob. 8QPDCh. 11 - Prob. 9QPDCh. 11 - In your own words, explain the conclusion that...

Ch. 11 - Prob. 1APCh. 11 - Prob. 2APCh. 11 - Corporation P owns 93 percent of the outstanding...Ch. 11 - This year, Napa Corporation received the following...Ch. 11 - This year, GHJ Inc. received the following...Ch. 11 - In its first year, Camco Inc. generated a 92,000...Ch. 11 - Prob. 7APCh. 11 - Prob. 8APCh. 11 - Cranberry Corporation has 3,240,000 of current...Ch. 11 - Hallick Inc. has a fiscal year ending June 30....Ch. 11 - Landover Corporation is looking for a larger...Ch. 11 - Prob. 12APCh. 11 - Prob. 13APCh. 11 - Prob. 14APCh. 11 - Prob. 15APCh. 11 - Prob. 16APCh. 11 - In each of the following cases, compute the...Ch. 11 - Prob. 18APCh. 11 - Prob. 19APCh. 11 - Jackson Corporation has accumulated minimum tax...Ch. 11 - Prob. 21APCh. 11 - Callen Inc. has accumulated minimum tax credits of...Ch. 11 - Prob. 23APCh. 11 - Prob. 24APCh. 11 - Prob. 25APCh. 11 - James, who is in the 35 percent marginal tax...Ch. 11 - Leona, whose marginal tax rate on ordinary income...Ch. 11 - Prob. 28APCh. 11 - Prob. 29APCh. 11 - Prob. 30APCh. 11 - Prob. 1IRPCh. 11 - Prob. 2IRPCh. 11 - Prob. 3IRPCh. 11 - Prob. 4IRPCh. 11 - Prob. 5IRPCh. 11 - Prob. 6IRPCh. 11 - Prob. 7IRPCh. 11 - Prob. 8IRPCh. 11 - Prob. 1RPCh. 11 - Prob. 2RPCh. 11 - Prob. 3RPCh. 11 - This year, Prewer Inc. received a 160,000 dividend...Ch. 11 - Prob. 1TPCCh. 11 - Prob. 2TPC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- frumer Inc. is the parent corpration of a parent subsidiary controlled group. the subsdiaries were acquired this year. it is considering filing a consolidaded tax return. what are the advantages or disadvantages of this?arrow_forwardWhich of the following is false? Individual and Corporate taxpayers must declare their intention to avail of the OSD in their annual income tax Return. The option to avail of the OSD shall be irrevocable for the whole taxable year. The option to avail of the OSD is applicable to taxpayers subject to regular income tax on their net income None of the above A corporation may be formed by one person only. Every partnership shall be taxed in the same manner as a corporation. The share of a partner in the income of a professional partnership shall be subject to regular income tax. None of the abovearrow_forwardCarolina Corporation, an S corporation, has no corporate Earnings and profit from its years as a C corporation. At the end of the year, it distributes a small parcel of land to its sole shareholder, Shadiya. The fair market value of the parcel is $96,600, and its tax basis is $59,000. Shadiya's basis in her stock is $23,500. Assume Carolina Corporation reported $0 taxable income before considering the tax consequences of the distribution. Note: Leave no answer blank. Enter zero if applicable. d. Assume the fair market value of the land is $40,200 rather than $96,600. How much gain must Shadiya recognize (if any) as a result of the distribution, what is her basis in her Carolina Corporation stock after the distribution, and what is her basis in the land? Gain Recognized Stock Basis Land Basisarrow_forward

- Which of the following statements is false? A. A corporation must file a Federal income tax return even if it has no taxable income for the year. B. Dividend received deduction is calculated as the dividend received times deduction percentage. C. A corporation cannot deduct net capital losses against its operating income. D. A C corporation with taxable income of $100,000 in the current year will have a tax liability of $21,000. E. Schedule M-1 is used to reconcile net income as computed for financial accounting purposes with taxable income reported on the corporation's income tax return.arrow_forwardCrocker and Company (CC) is a C corporation. For the year, CC reported taxable income of $563,000. At the end of the year, CC distributed all its after-tax earnings to Jimmy, the company's sole shareholder. Jimmy's marginal ordinary tax rate is 37 percent and his marginal tax rate on dividends is 23.8 percent, including the net investment income tax. What is the overall tax rate on Crocker and Company's pretax income?arrow_forwardCarolina Corporation, an S corporation, has no corporate E&P from its years as a C corporation. At the end of the year, it distributes a small parcel of land to its sole shareholder, Shadiya. The fair market value of the parcel is $70,000, and its tax basis is $40,000. Shadiya’s basis in her stock is $14,000. Assume Carolina Corporation reported $0 taxable income before considering the tax consequences of the distribution. (Leave no answer blank. Enter zero if applicable.) a. What amount of gain or loss, if any, does Carolina Corporation recognize on the distribution?arrow_forward

- Carolina Corporation, an S corporation, has no corporate E&P from its years as a C corporation. At the end of the year, it distributes a small parcel of land to its sole shareholder, Shadiya. The fair market value of the parcel is $70,000, and its tax basis is $40,000. Shadiya’s basis in her stock is $14,000. Assume Carolina Corporation reported $0 taxable income before considering the tax consequences of the distribution. (Leave no answer blank. Enter zero if applicable.) c. Assume the fair market value of the land is $25,000 rather than $70,000. What amount of gain or loss, if any, does Carolina Corporation recognize on the distribution?arrow_forwardGrand Corporation owns all of the stock of Junior, Ltd., a corporation that has been declared bankrupt and holds no net assets. Junior still owes $1,000,000 to Wholesale, Inc., one of its suppliers, and $2,500,000 to the IRS for unpaid Federal income taxes. Grand and Junior always have filed Federal income tax returns on a consolidated basis. What is Grand’s exposure concerning Junior’s outstanding income tax liabilities?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License