PRINCIPLES OF TAXATION F/BUS.+INVEST.

22nd Edition

ISBN: 9781259917097

Author: Jones

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 5AP

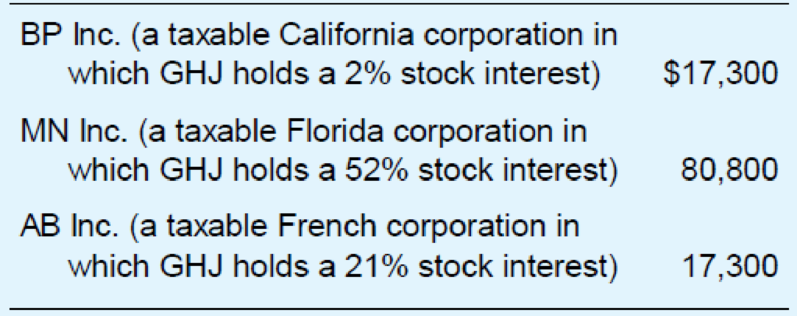

This year, GHJ Inc. received the following dividends.

Compute GHJ’s dividends-received deduction.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Determine the amount of the dividends received deduction in each of the following instances. In all cases, the net income figure includes the full dividend. Use Dividends deduction table.

Dividend of $11,500 from a 45% owned corporation; taxable income before DRD of $54,500.

Dividend of $19,900 from a 15% owned corporation; taxable income before DRD of $78,000.

Dividend of $13,000 from a 60% owned corporation; taxable income before DRD of $7,000.

Dividend of $3,500 from a 10% owned corporation; taxable income before DRD of $2,760.

a.

Dividend received deduction

b.

Dividend received deduction

c.

Dividend received deduction

d.

Dividend received deduction

Determine the amount of the dividends received deduction in each of the followinginstances. In all cases, the net income figure includes the full dividend.a. Dividend of $10,000 from a 45% owned corporation; taxable income before DRDof $50.000.b. Dividend of $19.000 from a 15% owned corporation;taxable income before DRD of$75.000.c. Dividend of $22,000 from a 60% owned corporation; taxable income before DRD ofSI1.000.d. Dividend of $8.000 from a 10% owned corporation; taxable income before DRD of$7.000.

a) Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated

b) If at the beginning of the year, Archer had a basis of 20,000 compute Archer’s basis at the end of the year.

c) Assume that Voyager reported a loss of $70,000 instead (and no separately stated items or distributions). If Janeway had a basis of 10,000 in her stock at the beginning of the year, what is the amount of loss she can report on her return?

Chapter 11 Solutions

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Ch. 11 - Prob. 1QPDCh. 11 - Prob. 2QPDCh. 11 - Prob. 3QPDCh. 11 - Prob. 4QPDCh. 11 - Prob. 5QPDCh. 11 - Libretto Corporation owns a national chain of...Ch. 11 - Prob. 7QPDCh. 11 - Prob. 8QPDCh. 11 - Prob. 9QPDCh. 11 - In your own words, explain the conclusion that...

Ch. 11 - Prob. 1APCh. 11 - Prob. 2APCh. 11 - Corporation P owns 93 percent of the outstanding...Ch. 11 - This year, Napa Corporation received the following...Ch. 11 - This year, GHJ Inc. received the following...Ch. 11 - In its first year, Camco Inc. generated a 92,000...Ch. 11 - Prob. 7APCh. 11 - Prob. 8APCh. 11 - Cranberry Corporation has 3,240,000 of current...Ch. 11 - Hallick Inc. has a fiscal year ending June 30....Ch. 11 - Landover Corporation is looking for a larger...Ch. 11 - Prob. 12APCh. 11 - Prob. 13APCh. 11 - Prob. 14APCh. 11 - Prob. 15APCh. 11 - Prob. 16APCh. 11 - In each of the following cases, compute the...Ch. 11 - Prob. 18APCh. 11 - Prob. 19APCh. 11 - Jackson Corporation has accumulated minimum tax...Ch. 11 - Prob. 21APCh. 11 - Callen Inc. has accumulated minimum tax credits of...Ch. 11 - Prob. 23APCh. 11 - Prob. 24APCh. 11 - Prob. 25APCh. 11 - James, who is in the 35 percent marginal tax...Ch. 11 - Leona, whose marginal tax rate on ordinary income...Ch. 11 - Prob. 28APCh. 11 - Prob. 29APCh. 11 - Prob. 30APCh. 11 - Prob. 1IRPCh. 11 - Prob. 2IRPCh. 11 - Prob. 3IRPCh. 11 - Prob. 4IRPCh. 11 - Prob. 5IRPCh. 11 - Prob. 6IRPCh. 11 - Prob. 7IRPCh. 11 - Prob. 8IRPCh. 11 - Prob. 1RPCh. 11 - Prob. 2RPCh. 11 - Prob. 3RPCh. 11 - This year, Prewer Inc. received a 160,000 dividend...Ch. 11 - Prob. 1TPCCh. 11 - Prob. 2TPC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- With respect to GRIP and LRIP balances, which of the following statements is NOT correct? A CCPC'S GRIP account is increased by 72% percent of the company's taxable income. A CCPC'S GRIP account is reduced by the amount of eligible dividends designated in the preceding taxation year. A CCPC'S GRIP account is increased by the amount of eligible dividends received during the current year. A public company's LRIP account is increased by the amount of non-eligble dividends received.arrow_forwardDuring the current year, Swallow Corporation, a calendar year C corporation, has the following transactions: Income from operations $660,000 Expenses from operations 760,000 Dividends received from Brown Corporation 240,000 Click here to view the dividend received deduction table. Question Content Area a. Swallow Corporation owns 12% of Brown Corporation's stock. How much is Swallow's taxable income or NOL for the year? Swallow's taxable income after deducting the dividends received deduction is $fill in the blank fd6fd0f8303e049_2 . Feedback Area Feedback The purpose of the dividends received deduction is to mitigate multiple taxation of corporate income. Without the deduction, income paid to a corporation in the form of a dividend would be taxed to the recipient corporation with no corresponding deduction to the distributing corporation. Later, when the recipient corporation paid the income to its shareholders, the income would again be subject to taxation with no corresponding…arrow_forwardDuring the current year, Swallow Corporation, a calendar year C corporation, has the following transactions: Income from operations $660,000 Expenses from operations 760,000 Dividends received from Brown Corporation 240,000 Click here to view the dividend received deduction table. a. Swallow Corporation owns 12% of Brown Corporation's stock. How much is Swallow's taxable income or NOL for the year?Swallow's taxable income after deducting the dividends received deduction is $. b. Assume instead that Swallow Corporation owns 26% of Brown Corporation's stock. How much is Swallow's taxable income or NOL for the year?Swallow's NOL after deducting the dividends received deduction is $.arrow_forward

- Crane and Loon Corporations, two unrelated C corporations, have the following transactions for the current year. Crane Loon Gross income from operations $283,500 $453,600 Expenses from operations 396,900 476,280 Dividends received from domestic corporations (15% ownership) 170,100 340,200 Click here to access the dividends received deduction table. a. Compute the dividends received deduction for Crane Corporation. b. Compute the dividends received deduction for Loon Corporation.arrow_forwardIn each of the following independent situations, determine the dividends received deduction for the calendar year C corporation. Assume that Oak Corporation owns 25%, Elm owns 15% and Mahogany owns 60% of the stock in the corporations paying the dividends. OakCorporation ElmCorporation MahoganyCorporation Income from operations $650,000 $900,000 $825,000 Expenses from operations (525,000) (1,050,000) (830,000) Qualifying dividends 160,000 160,000 160,000 Click here to view the dividend received deduction ownership percentages and corresponding deduction percentage. a. The dividends received deduction for Oak Corporation is b. The dividends received deduction for Elm Corporation is c. The dividends received deduction for Mahogany Corporation isarrow_forwardThe following comment appeared in the notes of Colorado Corporation's annual report: “Such distributions, representing proceeds from the sale of Sarazan, Inc., were paid in the form of partial liquidating dividends and were in lieu of a portion of the Company's ordinary cash dividends.” How would a partial liquidating dividend be accounted for in the financial records?arrow_forward

- With respect to the Eligible RDTOH account, which of the following statements is correct? A. The balance is reduced by any refund resulting from eligible dividends paid during the year. B. The balance is increased by 38-1/3 percent of any eligible dividends received. C. The total dividend refund for the current year cannot exceed the balance in this account. D. The balance is increased by the amount of the refundable Part I tax for the yeararrow_forwardAs of the beginning of the year, Devers, Inc. acquired common stock of Verdugo Limited at book value. During the current year, Verdugo earned $12.5 million and declared dividends of $4 million. Indicate the amount shown for Investment in Verdugo on Devers Inc.’s balance sheet on December 31 and the amount of total income Devers would report on the income statement for the year related to its investment under the assumption that Devers did the following: A. Paid $2 million for a 10-percent interest in Verdugo and classifies the investment as a passive investment. The fair value of the investment at December 31st was now $2.3 million. B. Paid $7 million for a 35-percent interest in Verdugo and uses the equity method. The fair value of the investment at December 31st was now $7.3 million. Please dont provide handwritten or image based answers thank youarrow_forwardHaze Corporation, a calendar year C corporation, owns stock in Lava Corporation and has taxable income of $127,000 for the year before considering the dividends received deduction. In the current year, Lava Corporation pays Haze Corp a dividend of $172,000, which was considered in calculating the $127,000. What amount of dividends received deduction may Haze claim if it owns 15% of Lava's stock? A. $0 B. $111,800 C. $86,000 D. $63,500arrow_forward

- In 2023, Avalanche Corporation has $70,000 of net income from operations during the current year. In addition, Avalanche received $180,000 of dividend income from a corporation in which Avalanche has a 35% ownership interest. What is Avalanche's dividends received deduction for 2023?arrow_forwardMartin Company provided the following data for the current year: -On March 1, Martin received P600,000 cash dividend from Paul Company in which Martin owns 30% interest. -Martin owns 12% interest in James Company, which declared and paid P3,000,000 cash dividend on December 15. - On September 1, Martin received an P80,000 liquidating dividend from Luke Company. Martin owns a 5% interest in Luke Company. What amount should Martin Company report as dividend income for the current year?arrow_forwardThe record of ABAKA Corporation, a closely-held corporation shows the following calendar years: Year 2018 Gross income, P4,500,000Allowable expenses, P 2,800,000Rental income, net of 5% withholding tax, P 475,000Interest on money market placement (net), P 90,000Inter-corporate dividends, P480,000Additional information: Dividends paid, P 1,700,000Payments, first three quarters, P 50,000Ordinary shares, P700,000Share premium, P200,000Year 2019 Gross income, P 3,200,000Expenses, P 3,000,000Net Income, P200,000Retained Earnings, P 500,000How much is the improperly accumulated earnings tax in 2018 ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

How to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation; Author: ETMONEY;https://www.youtube.com/watch?v=QdJKpSXCYmQ;License: Standard YouTube License, CC-BY

How to Calculate Federal Income Tax; Author: Edspira;https://www.youtube.com/watch?v=2LrvRqOEYk8;License: Standard Youtube License