Concept explainers

Nowjuice, Inc., produces Shakewell® fruit juice. A planner has developed an aggregate

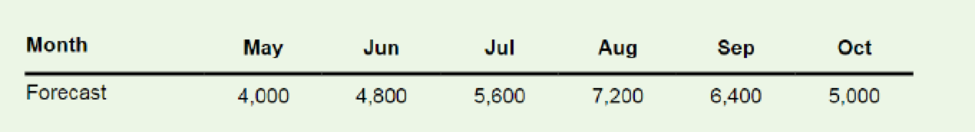

Use the following information to develop aggregate plans.

Develop an aggregate plan using each of the following guidelines and compute the total cost for each plan. Which plan has the lowest total cost? Note: Backlogs are not allowed.

a. Use level production. Supplement using overtime as needed.

b. Use a combination of overtime (500 cases per period maximum), inventory, and subcontracting (500 cases per period maximum) to handle variations in demand.

C. Use overtime up to 750 cases per period and inventory to handle variations in demand.

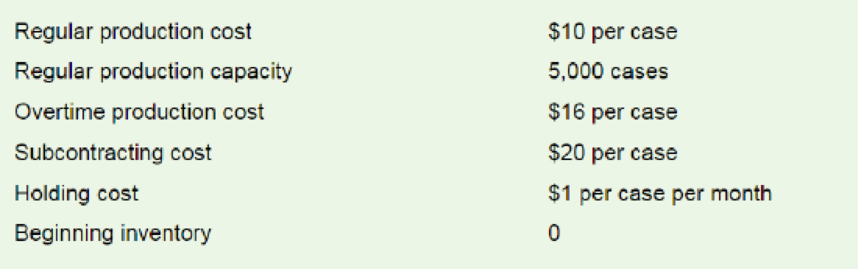

a)

To determine: The total cost using level strategy of aggregate planning.

Introduction: Level production strategy is a production strategy used to produce at a constant rate. This strategy keeps constant level of workforce and backlog of demand.

Answer to Problem 8P

Explanation of Solution

Given information:

Regular production cost is $10, overtime production cost is $16, subcontracting cost is $20, holding cost is $1, regular capacity is 5,000 units, and beginning inventory is given as 0 units. In addition to this forecast for 6 months is given as follows:

| Month | July | June | July | August | September | October | Total |

| Forecast | 4,000 | 4,800 | 5,600 | 7,200 | 6,400 | 5,000 | 33,000 |

Determine the total cost of the plan:

It is given that regular productions should be used. No backlogs are allowed. Supplements can be satisfied using overtime.

Supporting explanation:

Calculate the difference for the month of May:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 1,000 units.

Calculate the difference for the month of June:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 1,000 units.

Calculate the difference for the month of July:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is -600 units.

Note: The calculation repeats for all the months.

Beginning inventory:

The initial inventory is given as 0. For the remaining months, ending inventory of previous month would be the beginning inventory of present month.

Ending inventory for the month of May:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 1,000 units.

Ending inventory for the month of June:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 1,200 units.

Ending inventory for the month of July:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 600 units.

Note: The calculation repeats for all the months.

Average inventory for the month of May:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 500 units.

Average inventory for the month of June:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 1,100 units.

Average inventory for the month of July:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 900 units.

Note: The calculation repeats for all the months.

Calculate the regular time cost for the month of May:

Regular time cost per unit is given as $10 and regular time unit is given as 5,000. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $50,000.

Calculate the regular time cost for the month of June:

Regular time cost per unit is given as $10 and regular time unit is given as 5,000. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $50,000.

Calculate the regular time cost for the month of July:

Regular time cost per unit is given as $10 and regular time unit is given as 5,000. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $50,000.

Note: The calculation repeats for all the months.

Calculate the total regular time cost:

It is calculated by adding the regular time cost of all the months.

Hence, the total regular time cost is $300,000.

Calculate the overtime cost for the month of May:

Overtime cost per unit is given as $16 and overtime unit is given as 0. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $0.

Calculate the overtime cost for the month of June:

Overtime cost per unit is given as $16 and overtime unit is given as 0. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $0.

Calculate the overtime cost for the month of July:

Overtime cost per unit is given as $16 and overtime unit is given as 0. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $0.

Calculate the overtime cost for the month of August:

Overtime cost per unit is given as $16 and overtime unit is given as 1,600. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $25,600.

Note: The calculation repeats for all the months.

Calculate the total overtime cost:

It is calculated by adding the overtime cost of all the months.

Hence, the total overtime cost is 48,000.

Calculate the subcontract cost for the month of May:

Subcontract cost per unit is given as $20 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Calculate the subcontract cost for the month of June:

Subcontract cost per unit is given as $20 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Calculate the subcontract cost for the month of July:

Subcontract cost per unit is given as $20 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Note: The calculation repeats for all the months.

Calculate the total subcontract cost:

It is calculated by adding the subcontract cost of all the months.

Hence, the total subcontract cost is $0.

Calculate the inventory cost for the month of May:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $500.

Calculate the inventory cost for the month of June:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $1,100.

Calculate the inventory cost for the month of July:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $900.

Note: The calculation repeats for all the months.

Calculate the total inventory cost:

It is calculated by adding the inventory cost of all the months.

Hence, the total inventory cost is $2,800.

Calculate the total cost of the plan:

It is calculated by adding the total regular time cost, overtime cost, subcontract cost, and inventory cost.

Hence, the total cost of the plan is $350,800.

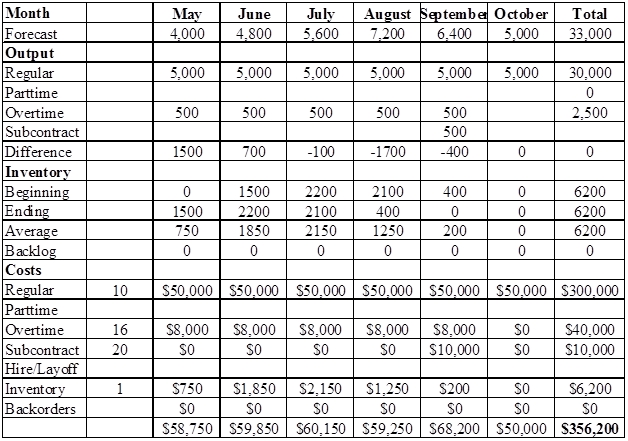

b)

To determine: The total cost using level strategy of aggregate planning.

Introduction: Level production strategy is a production strategy used to produce at a constant rate. This strategy keeps constant level of workforce and backlog of demand.

Answer to Problem 8P

Explanation of Solution

Given information:

Regular production cost is $10, overtime production cost is $16, subcontracting cost is $20, holding cost is $1, regular capacity is 5,000 units, and beginning inventory is given as 0 units. Maximum subcontract capacity is 500 units and maximum overtime capacity is 500 units. In addition to this forecast for 6 months is given as follows:

| Month | July | June | July | August | September | October | Total |

| Forecast | 4,000 | 4,800 | 5,600 | 7,200 | 6,400 | 5,000 | 33,000 |

Determine the total cost of the plan:

It is given that regular productions should be used. No backlogs are allowed. Supplements can be satisfied using overtime.

Supporting explanation:

Calculate the difference for the month of May:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 1,500 units.

Calculate the difference for the month of June:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 700 units.

Calculate the difference for the month of July:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is -100 units.

Note: The calculation repeats for all the months.

Beginning inventory:

The initial inventory is given as 0. For the remaining months, ending inventory of previous month would be the beginning inventory of present month.

Ending inventory for the month of May:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 1,500 units.

Ending inventory for the month of June:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 2,200 units.

Ending inventory for the month of July:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 2,100 units.

Note: The calculation repeats for all the months.

Average inventory for the month of May:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 750 units.

Average inventory for the month of June:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 1,850 units.

Average inventory for the month of July:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 2,150 units.

Note: The calculation repeats for all the months.

Calculate the regular time cost for the month of May:

Regular time cost per unit is given as $10 and regular time unit is given as 5,000. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $50,000.

Calculate the regular time cost for the month of June:

Regular time cost per unit is given as $10 and regular time unit is given as 5,000. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $50,000.

Calculate the regular time cost for the month of July:

Regular time cost per unit is given as $10 and regular time unit is given as 5,000. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $50,000.

Note: The calculation repeats for all the months.

Calculate the total regular time cost:

It is calculated by adding the regular time cost of all the months.

Hence, the total regular time cost is $300,000.

Calculate the overtime cost for the month of May:

Overtime cost per unit is given as $16 and overtime unit is given as 500. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $8,000.

Calculate the overtime cost for the month of June:

Overtime cost per unit is given as $16 and overtime unit is given as 500. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $8,000.

Calculate the overtime cost for the month of July:

Overtime cost per unit is given as $16 and overtime unit is given as 500. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $8,000.

Note: The calculation repeats for all the months.

Calculate the total overtime cost:

It is calculated by adding the overtime cost of all the months.

Hence, the total overtime cost is 40,000.

Calculate the subcontract cost for the month of May:

Subcontract cost per unit is given as $20 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Calculate the subcontract cost for the month of June:

Subcontract cost per unit is given as $20 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Calculate the subcontract cost for the month of July:

Subcontract cost per unit is given as $20 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Note: The calculation repeats for all the months.

Calculate the total subcontract cost:

It is calculated by adding the subcontract cost of all the months.

Hence, the total subcontract cost is $10,000.

Calculate the inventory cost for the month of May:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $750.

Calculate the inventory cost for the month of June:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $1,850.

Calculate the inventory cost for the month of July:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $2,150.

Note: The calculation repeats for all the months.

Calculate the total inventory cost:

It is calculated by adding the inventory cost of all the months.

Hence, the total inventory cost is $6,200.

Calculate the total cost of the plan:

It is calculated by adding the total regular time cost, overtime cost, subcontract cost, and inventory cost.

Hence, the total cost of the plan is $356,200.

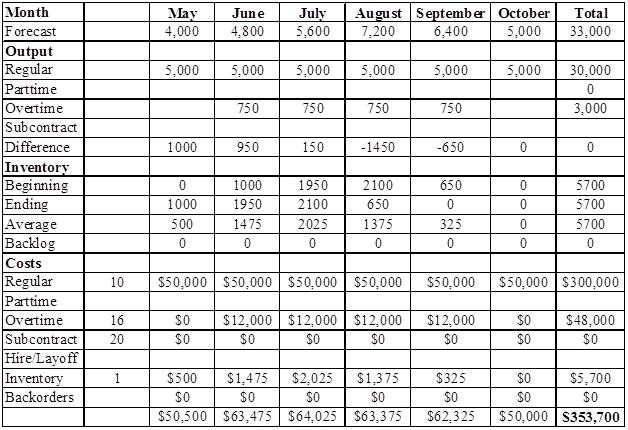

c)

To determine: The total cost using aggregate planning.

Introduction: Level production strategy is a production strategy used to produce at a constant rate. This strategy keeps constant level of workforce and backlog of demand.

Answer to Problem 8P

Explanation of Solution

Given information:

Regular production cost is $10, overtime production cost is $16, subcontracting cost is $20, holding cost is $1, regular capacity is 5,000 units, overtime capacity is 750 units, and beginning inventory is given as 0 units. In addition to this forecast for 6 months is given as follows:

| Month | July | June | July | August | September | October | Total |

| Forecast | 4,000 | 4,800 | 5,600 | 7,200 | 6,400 | 5,000 | 33,000 |

Determine the total cost of the plan:

It is given that regular productions should be used. No backlogs are allowed. Supplements can be satisfied using overtime.

Supporting explanation:

Calculate the difference for the month of May:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 1,000 units.

Calculate the difference for the month of June:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 950 units.

Calculate the difference for the month of July:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 150 units.

Note: The calculation repeats for all the months.

Beginning inventory:

The initial inventory is given as 0. For the remaining months, ending inventory of previous month would be the beginning inventory of present month.

Ending inventory for the month of May:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 1,000 units.

Ending inventory for the month of June:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 1,950 units.

Ending inventory for the month of July:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 2,100 units.

Note: The calculation repeats for all the months.

Average inventory for the month of May:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 500 units.

Average inventory for the month of June:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 1,475 units.

Average inventory for the month of July:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 2,025 units.

Note: The calculation repeats for all the months.

Calculate the regular time cost for the month of May:

Regular time cost per unit is given as $10 and regular time unit is given as 5,000. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $50,000.

Calculate the regular time cost for the month of June:

Regular time cost per unit is given as $10 and regular time unit is given as 5,000. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $50,000.

Calculate the regular time cost for the month of July:

Regular time cost per unit is given as $10 and regular time unit is given as 5,000. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $50,000.

Note: The calculation repeats for all the months.

Calculate the total regular time cost:

It is calculated by adding the regular time cost of all the months.

Hence, the total regular time cost is $300,000.

Calculate the overtime cost for the month of May:

Overtime cost per unit is given as $16 and overtime unit is given as 0. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $0.

Calculate the overtime cost for the month of June:

Overtime cost per unit is given as $16 and overtime unit is given as 0. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $0.

Calculate the overtime cost for the month of July:

Overtime cost per unit is given as $16 and overtime unit is given as 0. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $0.

Calculate the overtime cost for the month of August:

Overtime cost per unit is given as $16 and overtime unit is given as 1,600. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $25,600.

Note: The calculation repeats for all the months.

Calculate the total overtime cost:

It is calculated by adding the overtime cost of all the months.

Hence, the total overtime cost is 48,000.

Calculate the subcontract cost for the month of May:

Subcontract cost per unit is given as $20 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Calculate the subcontract cost for the month of June:

Subcontract cost per unit is given as $20 and subcontract unit is given as 750. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $12,000.

Calculate the subcontract cost for the month of July:

Subcontract cost per unit is given as $20 and subcontract unit is given as 750. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $12,000.

Note: The calculation repeats for all the months.

Calculate the total subcontract cost:

It is calculated by adding the subcontract cost of all the months.

Hence, the total subcontract cost is $48,000.

Calculate the inventory cost for the month of May:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $500.

Calculate the inventory cost for the month of June:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $1,475.

Calculate the inventory cost for the month of July:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $2,025.

Note: The calculation repeats for all the months.

Calculate the total inventory cost:

It is calculated by adding the inventory cost of all the months.

Hence, the total inventory cost is $5,700.

Calculate the total cost of the plan:

It is calculated by adding the total regular time cost, overtime cost, subcontract cost, and inventory cost.

Hence, the total cost of the plan is $350,800.

Conclusion: Plan from Part (a) should be selected, as it has the lowest cost ($350,800).

Want to see more full solutions like this?

Chapter 11 Solutions

OPERATIONS MANAGEMENT (LL) >CUSTOM<

Additional Business Textbook Solutions

Operations Management

OPERATIONS MANAGEMENT IN THE SUPPLY CHAIN: DECISIONS & CASES (Mcgraw-hill Series Operations and Decision Sciences)

Business in Action

Business in Action (8th Edition)

Operations Management: Sustainability and Supply Chain Management (12th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- Deb Bishop Health and Beauty Products has developed a new shampoo and you need to develop its aggregate schedule. The cost accounting department has supplied you the cost relevant to the aggregate plan and the marketing department has provided a four-quarter forecast. the four-quarter forecast. Quarter Forecast 1 1,400 2 1,100 3 1,700 4 1,300 the costs relevant to the aggregate plan. Costs Previous quarter's output 1,600 units Beginning inventory 0 units Stockout cost for backorders $55 per unit Inventory holding cost $11 per unit for every unit held at the end of the quarter Hiring workers $50 per unit Layoff workers $75 per unit Unit cost $35 per unit Overtime $20 extra per unit Subcontracting Not available Your job is to develop an aggregate plan for the next four quarters. Part 2 a) Try hiring and layoffs (to meet the forecast) as necessary…arrow_forwardThe swim department sales for summer are being planned up by 3.2%. Last year's actual sales were $3,880,000. What is the sales dollar plan for swim for this year?arrow_forwardDevelop a chase aggregate plan for Draper using apermanent workforce of 12 employees supplemented by overtime.All demand must be met each period.(a) Show what would happen if this plan were implemented.(b) Calculate the costs associated with this plan.(c) Evaluate the plan in terms of cost, customer service,operations, and human resources.arrow_forward

- A manager is attempting to put together an aggregate production plan for the coming nine months. She has obtained forecasts of aggregate demand for the planning horizon. The plan must deal with highly seasonal demand; demand is relatively high in months 3 and 4, and again in month 8, as can be seen below: The company has 20 permanent employees, each of whom can produce 10 units of output per month at a cost of $6 per unit. Inventory holding cost is $5 per unit per month, and back-order cost is $10 per unit per month. The manager is considering a plan that would involve hiring two people to start working in month 1, one on a temporary basis who would work until the end of month 5. The hiring of these two would cost $500. Beginning inventory is 0.Start with 20 permanent workers. Prepare a minimum cost plan that may use some combination of hiring ($250 per worker), subcontracting ($8 per unit, maximum of 20 units per month, must use for at least three consecutive months), and overtime…arrow_forwardDAT, Inc., needs to develop an aggregate plan for its product line. Relevant data are Management prefers to keep a constant workforce and production level, absorbingvariations in demand through inventory excesses and shortages. Demand not met is carriedover to the following month.Develop an aggregate plan that will meet the demand and other conditions of theproblem. Do not try to i nd the optimum; just i nd a good solution and state the procedureyou might use to test for a better solution. Make any necessary assumptions.arrow_forwardHow does the Wilson approach handle demand forecasting and inventory planning for new product launches?arrow_forward

- Deb Bishop Health and Beauty Products has developed a new shampoo and you need to develop its aggregate schedule. The cost accounting department has supplied you the cost relevant to the aggregate plan and the marketing department has provided a four-quarter forecast. the four-quarter forecast. Quarter Forecast 1 1,400 2 1,100 3 1,700 4 1,300 aggregate plan. Costs Previous quarter's output 1,600 units Beginning inventory 0 units Stockout cost for backorders $55 per unit Inventory holding cost $11 per unit for every unit held at the end of the quarter Hiring workers $50 per unit Layoff workers $75 per unit Unit cost $35 per unit Overtime $20 extra per unit Subcontracting Not available Your job is to develop an aggregate plan for the next four quarters. Part 2 a) Try hiring and layoffs (to meet the forecast) as necessary (enter your responses as whole…arrow_forwardNowJuice, Inc. produces bottled pickle juice. A planner has developed an aggregate forecast for demand (in cases) for the next four months. Use the following information to develop an aggregate plan using the LEVEL strategy. Inventory holding cost is $1 per month per case and backlog cost is $5 per month per case. Beginning inventory is zero. Month May June July August Forecast 452 520 600 719 Cost Per Unit Monthly Capacity Regular Production 19.40 400 Overtime Production 1.5 x Regular Prod Cost 400 What is the TOTAL cost of the LEVEL plan over the planning horizon? Correct Answer 51,588.6 CAN SOMEONE SHOW ME HOW THEY GOT THE ANSWER 51588.6arrow_forwardList the capacity options and demand options of aggregate planning and explain the difference between them. Which strategy or model always gives the aggregate plan with the minimum total cost?arrow_forward

- Developing alternative plans is step four in the planning process .with the use of original examples differentiate between various standing plans Implemented at the new Richmond park pickup pointarrow_forwardHow is it possible for you to solve the Aggregate Planning problem?arrow_forward3. What information is necessary for an operations manager to create the aggregate plan? List the capacity options and demand options of aggregate planning and explain the difference between them. Which strategy or model always gives the aggregate plan with the minimum total cost?arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.