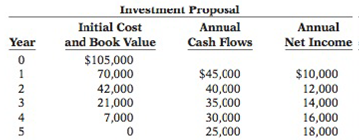

Drake Corporation is reviewing an investment proposal. The initial cost and estimates of the book value of the investment at the end of each year, the net cash flows for each year, and the net income for each year are presented in the schedule below. All cash flows are assumed to take place at the end of the year. The salvage value of the investment at the end of each year is equal to its book value. There would be no salvage value at the end of the investment’s life.

Drake Corporation uses an 11% target rate of

Instructions

(a) What is the cash payback period for this proposal?

(b) What is the annual rate of return for the investment?

(c) What is the

(CMA-Canada adapted)

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Managerial Accounting: Tools For Business Decision Making, Seventh Edition Wileyplus Card

- Drake Corporation is reviewing an investment proposal. The initial cost is $105,700. Estimates of the book value of the investment at the end of each year, the net cash flows for each year, and the net income for each year are presented in the schedule below. All cash flows are assumed to take place at the end of the year. The salvage value of the investment at the end of each year is assumed to equal its book value. There would be no salvage value at the end of the investment's life. Year 1 2 3 4 Investment Proposal Book Value $70,500 42,400 20,600 6,800 Annual Annual Cash Flows Net Income $9,700 11.100, $44,900 39.200 36,000 29,100 25,205 14,200 15,300 18,405 Drake Corporation uses an 11% target rate of return for new investment proposals. Click here to view the factor table. SUarrow_forwardWade Corporation is reviewing an investment proposal. The initial cost is $105,000. Estimates of the book value of the investment at the end of each year, the net cash flows for each year, and the net income for each year are presented in the schedule below. All cash flows are assumed to take place at the end of the year. The salvage value of the investment at the end of each year is equal to its book value. There would be no salvage value at the end of the investment's life. Year 1 2 3 4 5 Investment Proposal Annual Book Value Cash Flows $70,000 42,000 21,000 7,000 0 $45,000 40,000 35,000 30,000 25,000 Annual Net Income $16,000 18,000 20,000 22,000 24,000 Wade Corporation uses a 15% target rate of return for new investment proposals. a. What is the cash payback period for this proposal? b. What is the annual rate of return for the investment? c. What is the net present value of the investment?arrow_forwardMetro Car Washes, Inc., is reviewing an investment proposal. The initial cost as well as the estimate of the book value of the investment at the end of each year, the net after-tax cash flows for each year, and the net income for each year are presented in the following schedule. The salvage value of the investment at the end of each year is equal to its book value. There would be no salvage value at the end of the investment's life. Year 0 1 2 3 Initial Cost and Book Value $240,000 160,000 96,000 48,000 16,000 Annual Net After-Tax Cash Flows Exercise 16-37 Part 3 $103,000 89,000 75,000 61,000 47,000 Annual Net Income $23,000 25,000 27,000 29,000 31,000 Management uses a 14 percent after-tax target rate of return for new investment proposals. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) 3. Compute the proposal's net present value. (Round intermediate calculations to the nearest whole dollar.) Net present valuearrow_forward

- ! Required information [The following information applies to the questions displayed below.] Metro Car Washes, Inc. is reviewing an investment proposal. The initial cost as well as the estimate of the book value of the investment at the end of each year, the net after-tax cash flows for each year, and the net income for each year are presented in the following schedule. The salvage value of the investment at the end of each year is equal to its book value. There would be no salvage value at the end of the investment's life. Year 0 1 2 3 4 5 Initial Cost and Book Value $315,000 210,000 126,000 63,000 21,000 0 Annual Net After-Tax Cash Flows $138,000 119,000 100,000 81,000 62,000 3. Compute the proposal's net present value. Annual Net Income Management uses a 12 percent after-tax target rate of return for new investment proposals. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Answer is complete but not entirely correct. Net present $ 70,475 X…arrow_forwardRequired information [The following information applies to the questions displayed below.] Metro Car Washes, Inc. is reviewing an investment proposal. The initial cost as well as the estimate of the book value of the investment at the end of each year, the net after-tax cash flows for each year, and the net income for each year are presented in the following schedule. The salvage value of the investment at the end of each year is equal to its book value. There would be no salvage value at the end of the investment's life. Year 0 1 2 3 4 5 Initial Cost and Book Value $345,000 230,000 138,000 69,000 23,000 0 Annual Net After-Tax Cash Flows $162,000 141,000 120,000 99,000 78,000 Annual Net Income $47,000 49,000 51,000 53,000 55,000 Management uses a 14 percent after-tax target rate of return for new investment proposals. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: 1. Compute the project's payback period. Assume that the cash flows in…arrow_forwardMountain Frost is considering a new project with an initial cost of $205,000. The equipment will be depreciated on a straight-line basis to a zero book value over the four-year life of the project. The projected net income for each year is $20,000, $20,900, $24,600, and $16,900, respectively. What is the average accounting return? Please make sure its correctarrow_forward

- Mountain Frost is considering a new project with an initial cost of $180,000. The equipment will be depreciated on a straight-line basis to a zero book value over the four-year life of the project. The projected net income for each year is $19,500, $20,400, $24,600, and $16,400, respectively. What is the average accounting return?arrow_forwardCaves Beach Tiles is reviewing a capital investment proposal. The initial cost of the project and the net cash flows for each year are presented in the table below It is estimated that there would be no salvage value at the end of the investment's life. Year Initial cost and carrying value Annual net cash flows Annual net profit 0 150,000 1 70,000 50,000 15,000 2 42,000 45,000 17,000 3 21,000 40,000 19,000 4 7,000 35,000 21,000 5 |0 30,000 23,000 Caves Beach Tiles uses a rate of return of 8.5% to evaluate capital investment projects. REQUIRED: (a) Calculate the internal rate of return of the project (b) Should the project be accepted and why? (c) List three reasons why it is important for management to analyze capital expenditure projects.arrow_forward3. Kansas Corporation is reviewing an investment proposal that has an initial cost of $70,500. An estimate of the investment's end-of-year book value, the yearly after-tax net cash inflows, and the yearly net income are presented in the schedule below. Yearly after-tax net cash inflows include savings from the depreciation tax shield. The investment's salvage value at the end of each year is equal to book value, and there will be no salvage value at the end of the investment's life. Yearly After-Tax Net cash Inflows Yearly Net Income $ 8,500 9,500 10,500 11,500 12,500 Initial Cost and Book Value Year $41,000 27,000 16,500 9,500 $ 26,000 23,500 21,000 18,500 16,000 2 3 4 $105,000 $52,500 Kansas uses a 14% after-tax target rate of return for new investment proposals. PV of $1 at 14% FV of $1 at 14% 1.140 1.300 1.482 1.689 1.925 2.195 FV of an ordinary annuity at 14% 1.000 2.140 3.440 4.921 6.610 8.536 PV of an ordinary annuity at 14% Year 0.877 0.769 0.675 0.592 0.519 0.456 0.877 1.647…arrow_forward

- An investor is considering an investment property, but will only pay the price that will result in their desired IRR, given expected cash flows. The property is expected to generate the following cash flows from operations: year 1: $12,000; year 2: $12,600; year 3: $13,230; and year 4: $13,890. Assume that at the end of year 4, the property could be sold to net $190,000. What price must an investor offer to receive an expected IRR of 10%? O $139,518 $153,396 O $159,752 O $145,254 O $170,522arrow_forwardAn investor is considering an investment property, but will only pay the price that will result in their desired IRR, given expected cash flows. The property is expected to generate the following cash flows from operations: year 1: $12.000; year 2: $12,600, year 3: $13,230, and year 4: $13,890. Assume that at the end of year 4, the property could be sold to net $190,000. What price must an investor offer to receive an expected IRR of 10%? (a) $139,518 (b)$153,396 (c) $159,752 (d) $145,254 (e) $170,522arrow_forwardThe management of SoComfy Hotel wishes to capitalize on an investment project that will cost the management to pay $85,000 as an initial cost. This project will take three years to finish with the net cash flows stream of $18,000 for the first year, $21,000 for the second year, and $22,500 for the third year. Should the management accept the project by analyzing the net present value (NPV) of the cash flow stream if they have 12.00% minimum required rate of return on the project?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning