Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 13E

Payback Period and Simple

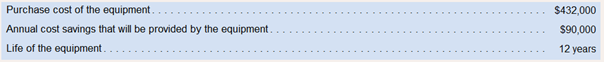

A piece of labor-saving equipment has just come onto the market that Mitsui Electronics, Ltd, could use to reduce costs in one of its plants in Japan Relevant data relating to the equipment follow:

Required:

1. What is the pevb.ck period for the equipment? If the company requires a prb.ck period of four years or less, would the equipment be purchased?

2. What is the simple rate of return on the equipment? Use straight-line

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Payback Period and Simple Rate of Return Computations

A piece of labor-saving equipment has just come onto the market that Mitsui Electronics, Ltd., could use to reduce costs in one of its plants in Japan. Relevant data relating to the equipment follow:

Required:

1. What is the payback period for the equipment? If the company requires a payback period of four years or less, would the equipment be purchased?

2. What is the simple rate of return on the equipment? Use straight-line depredation based on the equipment’s useful life. Would the equipment be purchased if the company’s required rate of return is 14%?

A piece of labor-saving equipment has just come onto the market that Mitsui Electronics, Ltd., could use to reduce costs in one of its plants in Japan. Relevant data relating to the equipment follow:

Purchase cost of the equipment

$

560,500

Annual cost savings that will beprovided by the equipment

$

95,000

Life of the equipment

10 years

Required:

1a. Compute the payback period for the equipment.

1b. If the company requires a payback period of four years or less, would the equipment be purchased?

2a. Compute the simple rate of return on the equipment. Use straight-line depreciation based on the equipment’s useful life.

2b. Would the equipment be purchased if the company’s required rate of return is 16%?

A piece of laborsaving equipment has just come onto the market that Mitsui Electronics, Ltd., could useto reduce costs in one of its plants in Japan. Relevant data relating to the equipment follow (currency is inthousands of yen, denoted by ¥):Purchase cost of the equipment ............. ¥432,000Annual cost savings that will beprovided by the equipment .................. ¥90,000Life of the equipment .............................. 12 yearsRequired:(Ignore income taxes.)1. Compute the payback period for the equipment. If the company requires a payback period of fouryears or less, would the equipment be purchased?2. Compute the simple rate of return on the equipment. Use straight-line depreciation based on theequipment’s useful life. Would the equipment be purchased if the company’s required rate of returnis 14%?

Chapter 12 Solutions

Introduction To Managerial Accounting

Ch. 12.A - Basic Present Value Concepts Annual cash inflows...Ch. 12.A - Basic Present value Concepts Julie has just...Ch. 12.A - Prob. 3ECh. 12.A - Prob. 4ECh. 12.A - Basic Present Value Concepts The Atlantic Medical...Ch. 12.A - Prob. 6ECh. 12 - What is the difference between capital budgeting...Ch. 12 - Prob. 2QCh. 12 - Prob. 3QCh. 12 - Prob. 4Q

Ch. 12 - Why are discounted cash flow methods of making...Ch. 12 - Prob. 6QCh. 12 - Identify two simplifying assumptions associated...Ch. 12 - Prob. 8QCh. 12 - Prob. 9QCh. 12 - Prob. 10QCh. 12 - Prob. 11QCh. 12 - Prob. 12QCh. 12 - How is the project profitability index computed,...Ch. 12 - Prob. 14QCh. 12 - Prob. 15QCh. 12 - Prob. 1AECh. 12 - The Excel worksheet form that appears below is to...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 3F15Ch. 12 - Prob. 4F15Ch. 12 - Prob. 5F15Ch. 12 - Prob. 6F15Ch. 12 - Prob. 7F15Ch. 12 - Prob. 8F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 11F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 13F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Payback Method The management of Unter...Ch. 12 - Net Present Value Analysis The management of...Ch. 12 - Internal Rate of Return Wendell’s Donut Shoppe is...Ch. 12 - Uncertain Future Cash Flows Lukow Products is...Ch. 12 - Prob. 5ECh. 12 - Simple Rate of Return Method The management of...Ch. 12 - Prob. 7ECh. 12 - Payback Period and Simple Rate of Return Nicks...Ch. 12 - Prob. 9ECh. 12 - Prob. 10ECh. 12 - Preference Ranking of Investment Projects Oxford...Ch. 12 - Prob. 12ECh. 12 - Payback Period and Simple Rate of Return...Ch. 12 - Comparison of Projects Using Net Present Value...Ch. 12 - Internal Rate of Return and Net Present Value...Ch. 12 - Net Present Value Analysis Windhoek Mines, Ltd.,...Ch. 12 - Net Present Value Analysis; Internal Rate of...Ch. 12 - Net Present Value Analysis Oakmont Company has an...Ch. 12 - Simple Rate of Return; Payback Period Paul Swanson...Ch. 12 - Prob. 20PCh. 12 - Prob. 21PCh. 12 - Prob. 22PCh. 12 - Comprehensive Problem - Lou Barlow, a divisional...Ch. 12 - Prob. 24PCh. 12 - Prob. 25PCh. 12 - Prob. 26PCh. 12 - Net Present Value Analysis In five years, Kent...Ch. 12 - Prob. 28PCh. 12 - Prob. 29P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Flanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.15. The machine will increase fixed costs by $18,250 per year. The information they will use to consider these changes is shown here.arrow_forwardAverage rate of returncost savings Maui Fabricators Inc. is considering an investment in equipment that will replace direct labor. The equipment has a cost of 125,000 with a 15,000 residual value and an eight-year life. The equipment will replace one employee who has an average wage of 28,000 per year. In addition, the equipment will have operating and energy costs of 5,150 per year. Determine the average rate of return on the equipment, giving effect to straight-line depreciation on the investment.arrow_forwardShonda & Shonda is a company that does land surveys and engineering consulting. They have an opportunity to purchase new computer equipment that will allow them to render their drawings and surveys much more quickly. The new equipment will cost them an additional $1.200 per month, but they will be able to increase their sales by 10% per year. Their current annual cost and break-even figures are as follows: A. What will be the impact on the break-even point if Shonda & Shonda purchases the new computer? B. What will be the impact on net operating income if Shonda & Shonda purchases the new computer? C. What would be your recommendation to Shonda & Shonda regarding this purchase?arrow_forward

- New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer’s base price is $1,080,000, and it would cost another $22,500 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $605,000. The MACRS rates for the first 3 years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $15,500. The sprayer would not change revenues, but it is expected to save the firm $380,000 per year in before-tax operating costs, mainly labor. Campbell’s marginal tax rate is 35%. What is the Year-0 cash flow? What are the net operating cash flows in Years 1, 2, and 3? What is the additional Year-3 cash flow (i.e., the after-tax salvage and the return of working capital)? If the project’s cost of capital is 12%, should the machine be purchased?arrow_forwardAverage rate of return-new product Hana Inc.is considering an invetment in new equipment that will be used to manufacture a smart-phone.The phone is expected to generate additional annual sales of 10,000 units at $300 per unit. The equipment has a cost of $ 4,500,000,residual value of $500,000,and a 10-year life.The equipment can only be used to manufacture the phone.The cost to manufacture the phone follows: Determine the average rate of return on the equipment.arrow_forwardNEED ASAP !!!! WITH EXPLANATION Santos Company needs a new cutting machine. The company is considering two machines: machine X and machine Y. Machine A costs$18,000, has a useful life of ten years, and will reduce operating costs by $7,000 per year. Machine B costs only $12,500, will also reduceoperating costs by $3,500 per year, but has a useful life of only five years.The payback period formula is = Investment required / Annual Net Cash Inflow Which machine should be purchased according to the payback method? a)Machine Xb) none of the abovec) Machine Yd) Both have the same payback periodarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License