Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

12th Edition

ISBN: 9781259144387

Author: Richard A Brealey, Stewart C Myers, Franklin Allen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 19PS

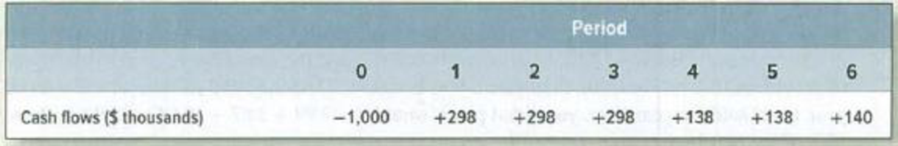

EVA Use the Beyond the Page feature to access the Excel program for calculating the profitability of the Nodhead project. Now suppose that the cash flows from Nodhead’s new supermarket are as follows:

- a. Recalculate economic

depreciation. Is it accelerated or decelerated? - b. Rework Tables 12.2 and 12.3 to show the relationship between (a) the “true”

rate of return and bookROI and (b) true EVA andforecasted EVA in each year of the project’s life.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Use the information provided to answer the questions

Calculate the Accounting Rate of Return (on average investment) of Project B (expressed to twodecimal places).Calculate the Net Present Value of each project (with amounts rounded off to the nearest Rand). Use your answers from previous question to recommend the project that should be chosen. Motivateyour choice.

You have determined the profitability of a planned project by finding the present value of all the cash flows from that project. Which of the following would cause the project to look more appealing in terms of the present value of those cash flows?

A. The discount rate increases.

B. The cash flows are extended over a longer period of time, but the total amount of the cash flows remains the same.

C. The discount rate decreases.

D. Answers B and C above.

E. Answers A and B above.

A company is considering three alternative Investment projects with different net cash flows. The present value of net cash flows is

calculated using Excel and the results follow.

Potential Projects

Present value of net cash flows (excluding initial investment)

Initial investment

Complete this question by entering your answers in the tabs below.

a. Compute the net present value of each project.

b. If the company accepts all positive net present value projects, which of these will It accept?

c. If the company can choose only one project, which will it choose on the basis of net present value?

Required A Required B

Compute the net present value of each project.

Potential Projects

Project A

Present value of net cash flows

Initial investment

Net present value

Required C

Project E

Project C

$10,685

(10,000)

Chapter 12 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Ch. 12 - Prob. 1PSCh. 12 - Terminology Define the following: a. Agency costs...Ch. 12 - Prob. 3PSCh. 12 - EVA Here are several questions about economic...Ch. 12 - Accounting measures of performance The Modern...Ch. 12 - Economic income Fill in the blanks: A projects...Ch. 12 - Prob. 7PSCh. 12 - Prob. 8PSCh. 12 - Prob. 9PSCh. 12 - Prob. 10PS

Ch. 12 - Management compensation We noted that management...Ch. 12 - Prob. 12PSCh. 12 - Prob. 13PSCh. 12 - Prob. 14PSCh. 12 - EVA Herbal Resources is a small but profitable...Ch. 12 - Prob. 16PSCh. 12 - Economic income Consider the following project:...Ch. 12 - EVA Use the Beyond the Page feature to access the...Ch. 12 - Accounting measures of performance Use the Beyond...Ch. 12 - EVA Ohio Building Products (OBP) is considering...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Net Present Value Use Exhibit 128.1 and Exhibit 128.2 to locate the present value of an annuity of $1, which is the amount to be multiplied times the future annual cash flow amount. Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. a. Campbell Manufacturing is considering the purchase of a new welding system. The cash benefits will be $480,000 per year. The system costs $2,650,000 and will lam 10 years. b. Evee Cardenas is interested in investing in a women's specialty shop. The cost of the investment is $180,000. She estimates that the return from owning her own sta will be $35,000 per year. She estimates that the shop will have a useful life of 6 years. c. Barker Company calculated the NPV of a project and found it to be $63,900. The project's life was estimated to be 8 years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $135,000. Required: 1.…arrow_forwardCalculate the Accrual accounting rate of return based on net initial investment (Assume straight-line depreciation.Use the average annual savings in cash operating costs when computing the numerator of the accrualaccounting rate of return.) for the special-purpose bottling machine.arrow_forwardBarry company is considering a project that has the following cash flow and WACC data. what is the projects NPV? Note that you should use the WACC as the discount ratearrow_forward

- Use the information provided to answer the questions.Use the information provided below to calculate the following. Where applicable, use the presentvalue tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. QUESTION) Calculate the Accounting Rate of Return (on average investment) of Project B (expressed to twodecimal places). INFORMATION Zeda Enterprises has the option to invest in machinery in projects A and B but finance is only available to invest inone of them. You are given the following projected data:Project A Project BInitial cost R300 000 R300 000Scrap value R40 000 0Depreciation per year R52 000 R60 000Net profitYear 1 R20 000Year 2 R30 000Year 3 R50 000Year 4 R60 000Year 5 R10 000Net cash flowsYear 1 R90 000Year 2 R90 000Year 3 R90 000Year 4 R90 000Year 5 R90 000 Additional informationThe discount rate used by the company is 12%. Transcribed Image Text:Number of Periods 1 2 3 4 5 6 7 8 m 10 11 12 13 14 15 1% 2% 0.9901 0.9804 0.9709 3% 3.9020 3.8077…arrow_forwardQUANTITATIVE. Fill in the following statements based on the below project financial analysis. a. The Net Present Value is b. The Return on Investment is c. The project will break even (make back its costs) in Year d. This project Created by: Praju Manageski Note: Change the inputs, such as discount rate, number of years, costs, and benefits. Be sure to Discount rate Costs Discount factor Discounted costs Benefits Discount factor Discounted benefits profitable because the ROI and NPV are both Financial Analysis for Project GGU Assume the project is completed in Year 0 Discounted benefits -costs Cumulative benefits - costs ROI 5% 10,000 1.00 10,000 0 1.00 0 (10,000) (10,000) 16% 0 0.95 2,000 0.95 1,905 Year 0 0.91 5000 0.91 4,535 1,905 4,535 (8,095) (3,560) 0 0.86 . 6000 0.86 5,183 5,183 1,623 10,000 11,623 1,623 NPVarrow_forwardShow the answer on excel and how you did it: Puppet is evaluating two alternative, mutually exclusive methods for delivering cloud platforms It has developed the following estimated after-tax cost savings for each alternative. Project managers want to see an incremental IRR and NPV before making the decision. If the project discount rate is 9%, which method would you recommend? Explain and provide evidence. Show all cash flows and related analyses. Clearly specify your recommendation and reasoning clearly on your worksheet. clearly show inputs and outputs areas.(Input Area: Show all of your key inputs, with appropriate labels, before creating your analysis. Add lines as needed.)(Output Area: Show the development of your answers to each question below. Clearly label inputs, steps and identify key results.) Project cash flows are as follows: Software Solution 1: To: -115,000, T1: 45,000, T2: 40,000, T3: 35,000, T4: 20,000, T5: 10,000 Software Solution 2: To: -175,000, T1: 5,000,…arrow_forward

- Reset the Data Section of the CAPBUD2 worksheet to the original values. In requirement 4, you assessed the sensitivity of the investment’s internal rate of return to changes in some of the input data. This was done in a trial-and-error fashion. Click the Chart sheet tab. Presented on the screen is a graphical analysis of the sensitivity of the internal rate of return to changes in annual cash flows. To demonstrate the usefulness of such a chart, note the ease with which you are able to answer the following questions that might be of interest to the owner: What annual cash flow (approximately) is required to: earn 0% rate of return? _______________ earn 10% rate of return? _______________ earn over 20% rate of return? _______________ Approximately, how much is the rate of return reduced for each drop of $10,000 annual cash flow? When the assignment is complete, close the file without saving it again. Worksheet. The CAPBUD2 worksheet handles only cash inflows that are even in amount each year. Many capital projects generate uneven cash inflows. Suppose that the new store had expected cash earnings of $80,000 per year for the first two years, $140,000 for the next four years, and $220,000 for the last four years. The new store will generate the same total cash return ($1,600,000) as in the original problem, but the timing of the cash flows is different. Alter the CAPBUD2 worksheet so that the NPV and IRR calculations can be made whether there are even or uneven cash flows. When done, preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as CAPBUDT. Hint: One suggestion is to label column F in the scratch pad as Uneven cash flows. Enter the uneven cash flows for each year. Modify FORMULA3 to include these cash flows. Modify the formulas in the range E30 to E39 to include the new data. Then set cell E10 (estimated Annual Net Cash Inflow) to zero. When you have even cash flows, use cell E10 and set column F in the scratch pad to zeros. If you have uneven cash flows, set cell E10 to zero and fill in column F in the scratch pad. Note that this solution causes garbage to come out in cells E15 and E16 because those formulas were not altered. Check figure for uneven cash flows: NPV (cell E17), $68,674. Chart. Using the CAPBUD2 file, develop a chart just like the one used in requirement 6 to show the sensitivity of net present value to changes in cost of the investment amount from $440,000 to $500,000 (use $10,000 increments). Complete the Chart Tickler Data Table and use it as a basis for preparing the chart. Enter your name somewhere on the chart. Save the file again as CAPBUD2. Print the chart.arrow_forwardWhich of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. O a. If a project's IRR is positive, then its NPV must also be positive. O b. A project's regular IRR is found by compounding the cash inflows at the WACC to find the present value (PV), then discounting the TV to find the IRR. O c. A project's IRR is the discount rate that causes the PV of the inflows to equal the project's cost. O d. If a project's IRR is smaller than the WACC, then its NPV will be positive. O e. A project's regular IRR is found by compounding the initial cost at the WACC to find the terminal value (TV), then discounting the TV at the WACC.arrow_forwardWhich of the following statements is true? The internal rate of return is the rate of return of an investment project over its useful life. When the net cash inflow is the same every year for a project after the initial investment, the internal rate of return of a project can be determined by dividing the initial investment required in the project by the annual net cash inflow. This computation yields a factor that can be looked up in a table of present values of annuities to find the internal rate of return. Multiple Choice Only statement I is true. Only statement II is true. Both statements are true.arrow_forward

- ARCI Instruments manufactures a ventilation controller designed for monitoring and controlling carbon monoxide in parking garages, boiler rooms, tunnels, etc. The net cash flow associated with one phase of the operation is shown on the next page. (a) How many possible rate of returnvalues are there for this cash flow series? (b) Find all the rate of return values between 0 and 100% using tabulated factors and a spreadsheet.arrow_forwardThe manager of a canned food processing plant is trying to decide between two labelling machines. a) Construct the incremental net cash flow table for each year. b) Determine the number of positive roots for the incremental cash flow. c) Determine the rate of return for the incremental cash flow based on PW analysis. d) Determine which machine should be selected. Use MARR of 20% per year. Please enter your final answers below in addition to uploading your detailed answer to your professor MS Teams after the exam. Machine 1 Machine 2 First Cost $ 15.000 25,000 Annual Operating Cost $ per year -1,600 -400 3,000 4,000 Salvage Value $ 4 Life, yearsarrow_forwardConsider an investment where the cash flows are: – $946.21 at time t = 0 (negative since this is your initial investment) $377 at time t = 1 in years $204 at time t = 2 in years $499 at time t = 3 in years (a) Use Excel's "Solver" to find the internal rate of return (IRR) of this investment. Take a screen shot showing Solver open with your entries for the function clearly visible. Paste the screen shot into an application (like Paint), and save it as a (.png) file. Upload your screenshot below. (b) What is the value of IRR found by Solver?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Essentials Of Business Analytics

Statistics

ISBN:9781285187273

Author:Camm, Jeff.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License