Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

12th Edition

ISBN: 9781259144387

Author: Richard A Brealey, Stewart C Myers, Franklin Allen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 12, Problem 17PS

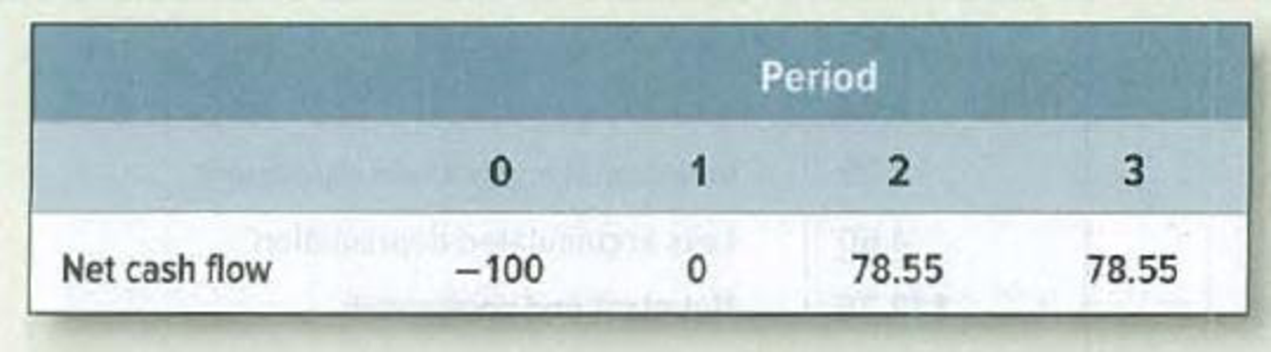

Economic income* Consider the following project:

The internal rate of return is 20%. The NPV, assuming a 20%

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

consider a project lasting one year which costs x > 0 in year zero and generates a cash flow of y in year one. The project has an internal rate of return of 10%. this means that:

Consider the following information about a project:

Calculate the NPV assuming 10% discount rate

Determine in which year will be the payback

Calculate (ROI)?

A project that costs $50 million is expected to generate $20 million per year over the next 4 years. The project's cost of capital is 6%. a) Find the payback period (PP).b) Find the net present value (NPV).c) Find the internal rate of return (IRR).d) Find the modified internal rate of return (MIRR).

Chapter 12 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Ch. 12 - Prob. 1PSCh. 12 - Terminology Define the following: a. Agency costs...Ch. 12 - Prob. 3PSCh. 12 - EVA Here are several questions about economic...Ch. 12 - Accounting measures of performance The Modern...Ch. 12 - Economic income Fill in the blanks: A projects...Ch. 12 - Prob. 7PSCh. 12 - Prob. 8PSCh. 12 - Prob. 9PSCh. 12 - Prob. 10PS

Ch. 12 - Management compensation We noted that management...Ch. 12 - Prob. 12PSCh. 12 - Prob. 13PSCh. 12 - Prob. 14PSCh. 12 - EVA Herbal Resources is a small but profitable...Ch. 12 - Prob. 16PSCh. 12 - Economic income Consider the following project:...Ch. 12 - EVA Use the Beyond the Page feature to access the...Ch. 12 - Accounting measures of performance Use the Beyond...Ch. 12 - EVA Ohio Building Products (OBP) is considering...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Using a MARR of 12%, find the external rate of return (ERR) for the following cash flow. Is this project economically attractive?arrow_forwardA project is projected to have the following net income: Year 1 = $80,000; Year 2 = $40,000; Year 3 = –$30,000. The same project has an initial investment of $300,000 and will lose value at a rate of $100,000 per year. The numerator in the average accounting return method will be?arrow_forwardSuppose a project with a 6% discount rate yields R5000 for the next three years. Annual operating costs amount to R1000 for each year, and the one time initial investment cost is R8000. a. Calculate the Net Present Value (NPV) of this project.b. Calculate the cost-benefit ratio for the project. c. Is the project acceptable? Motivate your answer.arrow_forward

- The project’s payback is 1.5 years, and it has a weighted average cost of capital of 10 percent. What is the project’s modified internal rate of return (MIRR)? MIRR>21%arrow_forwardFind the present worth at time 0 of the chrome plating costs shown in the cash flow diagram. Assume i = 10% per year.arrow_forwardCalculate the Rate of Return of the project. Explain, how and why? Rate of interest = 10%arrow_forward

- Suppose that a project requires an initial investment of 20 000 USD at the begynning of year 1. The project is expected to return 25 000 USD at the end of year 1. The required rate of return for the project is 20%. Calcualte the Net Present Value of the project as well as the Internal Rate of Return.arrow_forwardConsider the following sets of investment projects: Compute the equivalent annual worth of each project at i = 10%, and determine the acceptability of each project.arrow_forwardAn investment project has expected cash flows as shown below. The required rate of return for the project is 11.8%. What is the project's net present value (NPV)? Assume that the cash flows after year 0 occur at the end of each year. Year 0 cash flow= -91,000 Year 1 cash flow=21,000 Year 2 cash flow= 40,000 Year 3 cash flow= 43,000 Year 4 cash flow= 55,000 Year 5 cash flow= 19,000arrow_forward

- Use the ERR method to evaluate the economic worth of the diagram shown below. The value of the external reinvestment rate, ∈, is 8% per year. The MARR = 10% per year.arrow_forwardDetermine the ending value of the investment. Rate of return = 10%arrow_forwardExplain how the internal rate of return and net present value are related. If a project has an NPV of $50,000 using a 10 percent discount factor, what does this imply about that project's IRR?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Internal Rate of Return (IRR); Author: The Finance Storyteller;https://www.youtube.com/watch?v=aS8XHZ6NM3U;License: Standard Youtube License