Concept explainers

Capital Structure of any company is the mix of different levels of debt and equity. An optimal capital structure is the appropriate mix of debt and equity, striking a balance between risk and return to achieve the goal of maximizing the price of the firm’s stock. Therefore, a target proportion of capital structure and cost of each financing can be used to determine the WACC of the company.

Weighted Average Cost of Capital (WACC) is the required

Here,

Proportion of debt in the target capital structure “

Proportion of preferred stock in the target capital structure “

Proportion of equity in the target capital structure “

After tax cost of debt, preferred stock,

EPS analysis at a given level of EBIT helps in determining the optimal capital structure of the firm, that is the structure at which the EPS will be the highest.

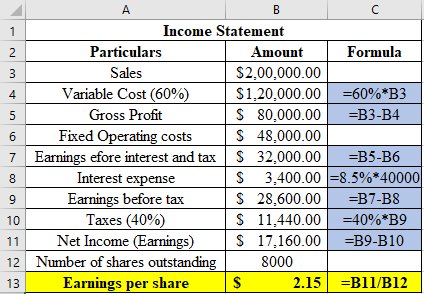

At a sale of $200,000 and debt to total asset ratio of 20%, the company has total assets $200,000, cost of debt 8.5% and number of shares outstanding 8,000.

Explanation of Solution

Income statement of the company is prepared with a debt of $40,000 (20%*$200,000) and interest rate on the debt of 8.5%.

Therefore, when D/TA is 20% and sales is $200,000, the company’s EPS would be

Want to see more full solutions like this?

- Klynveld Companys balance sheet shows total liabilities of 94,000,000, total stockholders equity of 75,000,000, and total assets of 169,000,000. Required: Note: Round answers to two decimal places. 1. Calculate the debt ratio. 2. Calculate the debt-to-equity ratio.arrow_forwardBrower Co. is considering the following alternative financing plans: Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming that income before bond interest and income tax is 2,000,000.arrow_forwardErnst Companys balance sheet shows total liabilities of 32,500,000, total stockholders equity of 8,125,000, and total assets of 40,625,000. Required: Note: Round answers to two decimal places. 1. Calculate the debt ratio. 2. Calculate the debt-to-equity ratio.arrow_forward

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forwardVigo Vacations has $200 million in total assets, $5 million in notes payable, and $25 million in long-term debt. What is the debt ratio?arrow_forwardRatio Analysis Rising Stars Academy provided the following information on its 2019 balance sheet and state mcnt of cash flows: Long-term debt S 4,400 Interest expense S 398 Total liabilities 8,972 Net income 559 Total assets 38,775 Interest payments 432 Total equity 29,803 Cash flows from operations 1.015 Operating income 1.223 Income tax expenses 266 Income taxes paid 150 Required: Calculate the following ratios for Rising Stars: (a) debt to equity, (b) debt to total assets, (c) long-term debt to equity, (d) times interest earned (accrual basis), and (e) times interest earned (cash basis). (Note: Round answers to three decimal places.) CONCEPTUAL CONNECTION Interpret these results. 3.What does it mean if a bond is callablearrow_forward

- Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8 Instructions Debt ratioarrow_forwardRatios Analyses: McCormick Refer to the information for McCormick above. Additional information for 20X3 it as follows (amounts in millions): Required: Next Level Compute the following for 20X3. Provide a brief description of what each ratio reveals about McCormick 1. return on common equity 2. debt-to-assets 3. debt-toequity 4. current 5. quick (McCormick uses cash and equivalents, short-term securities and receivables in their quick ratio calculation.) 6. inventory turnover days 7. accounts receivable turnover days 8. accounts payable turnover days 9. operating cycle (in days) 10. total asset turnover Use the following information for 14-17 and 14-18: The Hershey Company is one of the worlds leading producers of chocolates, candies, and confections. It sells chocolates and candies, mints and gums, baking ingredients, toppings, and beverages. Hersheys consolidated balance sheets for 20X2 and 20X3 follow.arrow_forwardAsap XYZ Company has the following information: Total Assets $500,000, Total Liabilities $200,000, and Equity $300,000. Calculate the debt-to-equity ratio and the equity multiplier.arrow_forward

- The total assets of Gs Co. is funded by both debt and equity with a debt to equity ratio of 100%. If Gs Co. has a retained earnings breakpoint of P1,225,000, the additions to the retained earnings during the year amounts toarrow_forwardUsing the following facts to calculate the Current Ratio, and the Debt Ratio: Ending Total Assets = $705,000; Ending Total Liabilities = $360,000; Ending Current Assets = $295,000; and Long Term Liabilities = $210,000arrow_forwardCalculate ‘Total Assets to Debt ratio’ from the following information : Equity Share Capital 4,00,000 Long Term Borrowings 1,80,000 Surplus i.e. Balance in statement of Profit and Loss 1,00,000 General Reserve 70,000 Current Liabilities 30,000 Long Term Provisions 1,20,000arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning