Concept explainers

(Supplement 12B) Preparing a Statement of Cash Flows, Indirect Method: T-Account Approach

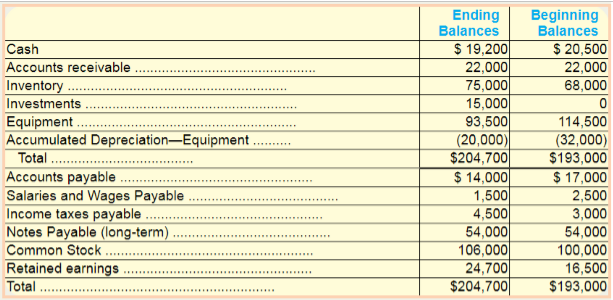

Golf Universe is a regional and online golf equipment retailer. The company reported the following for the current year:

• Purchased a long-term investment for cash, $15,000.

• Paid cash dividend, $12,000.

• Sold equipment for $6,000 cash (cost, $21.000;

• Issued shares of no-par stock, 500 shares at $12 cash per share.

• Net income was $20,200.

• Depreciation expense was $3,000.

Its comparative balance sheet is presented as follows.

Required:

1. Following Supplement 12B, complete a T-account worksheet to be used to prepare the statement of cash flows for the current year.

2. Based on the T-account worksheet, prepare the statement of cash flows for the current year in proper format.

(a)

Concept introduction:

Cash flow statements: It shows the inflow and outflow of cash along with the reasons, during a particular period of time. All the cash transactions are categorized in three types of activities i.e., operating, investing and financing activities.

To show:

The t-shape accounts for all the items.

Explanation of Solution

T-shape accounts for non-cash items:

| Accounts Receivable | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 22,000 | ||

| Increase | 0 | ||

| Ending Balance | 22,000 | ||

| Inventory | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 68,000 | ||

| Increase | 7,000 | ||

| Ending Balance | 75,000 | ||

| Investment | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 0 | ||

| Purchased | 15,000 | ||

| Ending Balance | 15,000 | ||

| Equipment | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 114,500 | ||

| Disposal | 21,000 | ||

| Ending Balance | 93,500 | ||

| Accumulated Depreciation | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 32,000 | ||

| Decrease | 12,000 | ||

| Ending Balance | 20,000 | ||

| Accounts Payable | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 17,000 | ||

| Decrease | 3,000 | ||

| Ending Balance | 14,000 | ||

| Salaries and Wages Payable | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 2,500 | ||

| Decrease | 1,500 | ||

| Ending Balance | 1,000 | ||

| Income Tax Payable | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 3,000 | ||

| Decrease | 1,500 | ||

| Ending Balance | 4,500 | ||

| Notes Payable (long-term) | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 54,000 | ||

| Increase | 0 | ||

| Ending Balance | 54,000 | ||

| Common Stock | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 100,000 | ||

| Decrease | 6,000 | ||

| Ending Balance | 106,000 | ||

| Retained Earnings | |||

| Particulars | $ (debit) | Particulars | $ (credit) |

| Beginning Bal | 16,500 | ||

| Dividend | 12,000 | Net Income | 20,200 |

| Ending Balance | 24,700 | ||

T-shape accounts for cash account:

| Particulars | $ (debit) | Particulars | $ (credit) |

| Operating Activities | |||

| Net Income | 20,200 | Inventory | 7,000 |

| Depreciation Expense | 3,000 | Accounts Payable | 3,000 |

| Income tax payable | 1,500 | Salaries and Wages Payable | 1,000 |

| Net Cash flow from operating 13,700 | |||

| Investing Activities | |||

| Sold Equipment | 6,000 | Purchased Investments | 15,000 |

| Net cash used by Investing | 9,000 | ||

| Financing | |||

| Proceed from issue of stock | 6,000 | Paid Dividends | 12,000 |

| Net Cash used by Financing Activities | 6,000 | ||

| Net decrease in cash | 1,300 | ||

| Beginning Cash | 20,500 | ||

| Ending cash | 19,200 | ||

(b)

Concept introduction:

Cash flow statements: It shows the inflow and outflow of cash along with the reasons, during a particular period of time. All the cash transactions are categorized in three types of activities i.e., operating, investing and financing activities.

To prepare:

The cash flow statement.

Explanation of Solution

| Particulars | $ |

| Operating Activities: | |

| Net Income | 20,200 |

| Depreciation | 3,000 |

| Cashflow from operating activities before working capital changes | 23,200 |

| (-) Increase in inventory | (7,000) |

| (-) Decrease in Accounts Payable | (3,000) |

| (-) Decrease in Wages and Salaries Payable | (1,000) |

| (+) Increase in Income tax payable | 1,500 |

| Cashflow from operating activities | 13,700 |

| Investing Activities: | |

| (+) Cash proceeds from sale of equipment | 6,000 |

| (-) Purchase of investments | (15,000) |

| Cashflow used in investing activities | (9,000) |

| Financing Activities: | |

| Proceeds from issue of stock | 6,000 |

| (-) Paid dividends | (12,000) |

| Cashflow used in financing activities | (6,000) |

| Net decrease in cash | (1,300) |

| Beginning Cash | 20,500) |

| Ending Cash | 19,200 |

Want to see more full solutions like this?

Chapter 12 Solutions

WHITECOTTON MGRL ACCTG (LL)

- Net Cash Flow from Operating Activities The following are accounting items taken from Tyrone Shoelaces Required: a. Net income, 22,900 b. Payment for purchase of land, 4,000 c. Payment for retirement of bonds, 6,000 d. Depreciation expense, 7,800 e. Receipt from issuance of common stock, 7,000 f. Patent amortization expense, 2,700 g. Increase in accounts receivable, 3,400 h. Payment of dividends, 5,000 i. Decrease in accounts payable, 2,600 Required: Prepare the operating activities section of Tyrones statement of cash flows using the indirect method.arrow_forwardStatement of Cash Flows A list of Fischer Companys cash flow activities is presented here: a. Patent amortization expense, 3,500 b. Machinery was purchased for 39,500 c. At year-end, bonds payable with a face value of 20,000 were issued for 17,000 d. Net income, 47,200 k. Inventories increased by 15,400 e. Dividends paid, 16,000 f. Depreciation expense, 12,900 g. Preferred stock was issued for 13,600 h. Investments were acquired for 21,000 i. Accounts receivable increased by 4,300 j. Land was sold at cost, 11,000 k. Inventories increased by 15,400 l. Accounts payable increased by 2,700 m. Beginning cash balance, 19,400 Required: Prepare Fischers statement of cash flows.arrow_forwardStatement of Cash Flows The following are several items involving Tejera Companys cash flow activities: a. Net income, 60,400 b. Receipt from issuance of common stock, 32,000 c. Payment for purchase of equipment, 41,500 d. Payment for purchase of land, 19,600 e. Depreciation expense, 20,500 f. Patent amortization expense, 1,200 g. Payment of dividends, 21,000 h. Decrease in salaries payable, 2,600 i. Increase in accounts receivable, 10,300 j. Beginning cash balance, 30,700 Required: Prepare Tejeras statement of cash flows using the direct method.arrow_forward

- In which section of the statement of cash flows would each of the following transactions be included? For each, identify the appropriate section of the statement of cash flows as operating (O), investing (I), financing (F), or none (N). (Note: some transactions might involve two sections.) A. borrowed from the bank for business loan B. declared dividends, to be paid next year C. purchased treasury stock D. purchased a two-year insurance policy E. purchased plant assetsarrow_forwardStatement of Cash Flows The following items involve the cash flow activities of Rocky Horror Picture Co.: a. Net income, 41,000 b. Payment of dividends, 16,000 c. Ten year, 28,000 bonds payable were issued at face value d. Depreciation expense, 11,000 e. Building acquired at a con of 40,000 f. Accounts receivable decreased by 2,000 g. Accounts payable decreased by 4,000 h. Equipment acquired at a cost of 8,000 i. Inventories increased by 7,000 j. Beginning cash balance, 13,000 Required: Prepare Rocky Horror Pictures statement of cash flows using the indirect method.arrow_forwardThe following balance sheets and income statement were taken from the records of Rosie-Lee Company: Additional transactions were as follows: a. Sold equipment costing 21,600, with accumulated depreciation of 16,200, for 3,600. b. Issued bonds for 90,000 on December 31. c. Paid cash dividends of 36,000. d. Retired mortgage of 108,000 on December 31. Required: 1. Prepare a schedule of operating cash flows using (a) the indirect method and (b) the direct method. 2. Prepare a statement of cash flows using the indirect method.arrow_forward

- Statement of cash flowsdirect method The comparative balance sheet of Martinez Inc. for December 31, 20Y4 and 20Y3, is as follows: The income statement for the year ended December 31, 20Y3, is as follows: Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: A. Equipment and land were acquired for cash. B. There were no disposals of equipment during the year. C. The investments were sold for 588,000 cash. D. The common stock was issued for cash. E. There was a 528,000 debit to Retained Earnings for cash dividends declared. Instructions Prepare a statement of cash flows, using the direct method of presenting cash flows from operating activities.arrow_forwardComponents of the Statement of Cash Flows Identify each of the following items as operating (O), investing (I), financing (F), or not on the statement of cash flows (N). ______ 1. Paid for supplies ______ 2. Collected cash from customers ______ 3. Purchased land (held for resale) ______ 4. Purchased land (for construction of new building) ______ 5. Paid dividend ______ 6. Issued stock ______ 7. Purchased computers (for use in the business) ______ 8. Sold old equipmentarrow_forwardWhich item is added to net income when computing cash flows from operating activities? a. Gain on the disposal of property, plant, and equipment b. Increase in wages payable c. Increase in inventory d. Increase in prepaid rent Use the following information for Multiple-Choice Questions 11-9 and 11-10: Cornett Company reported the following information: cash received from the issuance of common stock, $150,000; cash received from the sale of equipment, $14,800; cash paid to purchase an investment, $20,000; cash paid to retire a note payable, $50,000; and cash collected from sales to customers, $225,000.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,