Concept explainers

a.

To calculate: The book value of the old equipment.

Introduction:

Book value:

It refers to the total worth of the company if it liquidates all its assets and pays off all the liabilities. It can also refer to the price of an asset as recorded in the balance sheet.

MACRS

Modified Accelerated Cost Recovery System (MACRS) is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with predetermined depreciation periods.

a.

Answer to Problem 33P

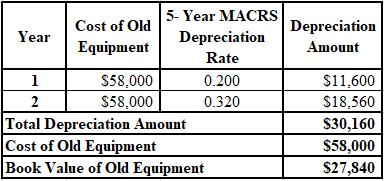

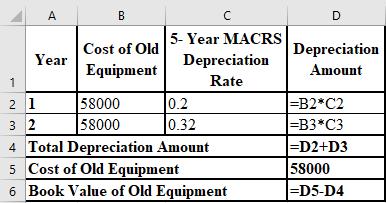

The calculation of the old equipment’s book value is shown below:

Hence, the book value of the old equipment is $27,480

Explanation of Solution

The formulae used for calculation of old equipment’s book value are shown below:

b.

To calculate: The tax loss that will be incurred on the sale of the old equipment.

Introduction:

Tax loss:

It is that loss incurred when the total deduction that can be claimed in a financial year exceeds the total assessable income of that year.

b.

Answer to Problem 33P

The tax loss that will be incurred on the sale of the old equipment is $3,040.

Explanation of Solution

The calculation of the tax loss on the sale of the old equipment is shown below.

c.

To calculate: The tax benefit from the sale of the old equipment.

Introduction:

Tax benefit:

It refers to the allowable deductions on the assessable income of the taxpayer with the intent of reducing their tax liability and burden.

c.

Answer to Problem 33P

The tax benefit from the sale of the old equipment is $1,064.

Explanation of Solution

The calculation of the tax benefit from the sale of the old equipment is shown below.

d.

To calculate: The

Introduction:

Cash inflow:

It is the money received by the firm as the result of its operating, investing and financing activities and is recorded in the cash flow statement.

d.

Answer to Problem 33P

The cash inflow from the old equipment’s sale is $25,864.

Explanation of Solution

The calculation of the cash inflow from the old equipment’s sale is shown below.

e.

To calculate: The new equipment’s net cost.

Introduction:

Net cost:

The cost computed by deducting all the benefits related to an object from its gross cost is termed as the net cost.

e.

Answer to Problem 33P

The net cost of the new equipment is $122,136.

Explanation of Solution

The calculation of the net cost of the new equipment is shown below.

f.

To prepare: The depreciation schedule of new equipment.

Introduction:

Depreciation schedule:

A table that shows the amount of depreciation of a particular asset over the years of its usage is termed as depreciation schedule.

MACRS depreciation method:

Modified Accelerated Cost Recovery System (MACRS) is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with predetermined depreciation periods.

f.

Answer to Problem 33P

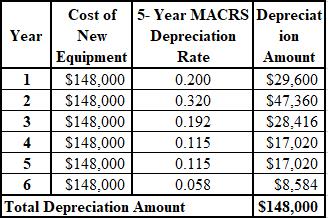

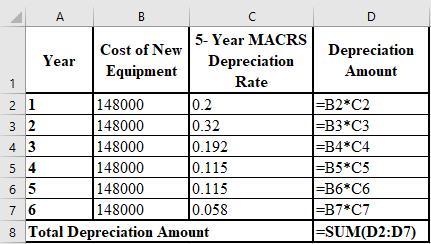

The depreciation schedule of new equipment is shown below.

Explanation of Solution

The formulae used for the preparation of the depreciation schedule of the new equipment are shown below.

g.

To prepare: The depreciation schedule for the old equipment of its remaining years.

Introduction:

Depreciation schedule:

A table that shows the amount of depreciation of a particular asset over the years of its usage is termed as depreciation schedule.

MACRS depreciation method:

Modified Accelerated Cost Recovery System (MACRS) is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with predetermined depreciation periods.

g.

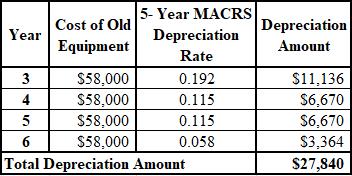

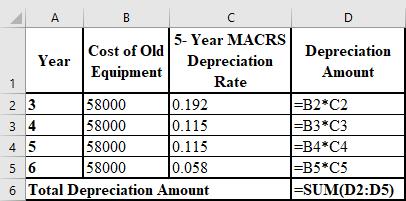

Answer to Problem 33P

The depreciation schedule for the old equipment of its remaining years is shown below:

Explanation of Solution

The formulae used for the preparation of the depreciation schedule of the residual years of the old equipment are shown below.

h.

To calculate: The incremental depreciation with respect to the old and the new equipment and the depreciation tax shield benefit.

Introduction:

MACRS depreciation method:

Modified Accelerated Cost Recovery System (MACRS) is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with predetermined depreciation periods.

Depreciation tax shield:

It is a particular kind of a tax shield provided to an individual or corporation in which depreciation as an expense is deducted from taxable income.

h.

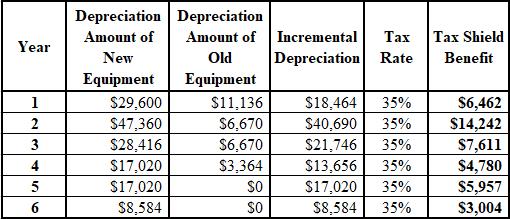

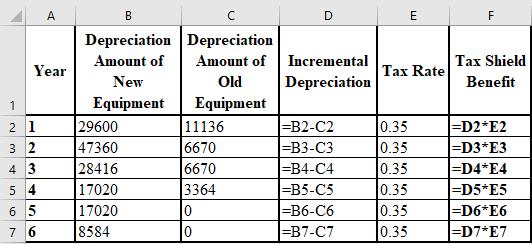

Answer to Problem 33P

The calculation of the incremental depreciation of the old and new equipment and the tax shield benefit are shown below.

Explanation of Solution

The formulae used for the calculation of the incremental depreciation of the old and new equipment and the tax shield benefit are shown below.

i.

To calculate: The after-tax benefits of cost savings.

Introduction:

After-tax benefits:

After-tax benefits are deductions that individuals are eligible for after the calculation of income tax calculated.

i.

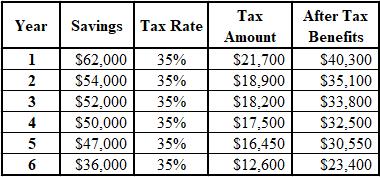

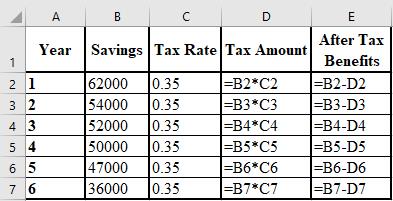

Answer to Problem 33P

The calculation of the after-tax benefits of cost savings is shown below.

Explanation of Solution

The formulae used for the calculation of the after-tax benefits of cost savings are shown below.

j.

To calculate: The PV of the total cash inflow (sum of depreciation tax shield and after tax benefits).

Introduction:

Present value (PV):

The current value of an investment or asset is termed as its present value. It is calculated by discounting the

Cash inflow:

It is the money received by the firm as the result of its operating, investing and financing activities and is recorded in the cash flow statement.

j.

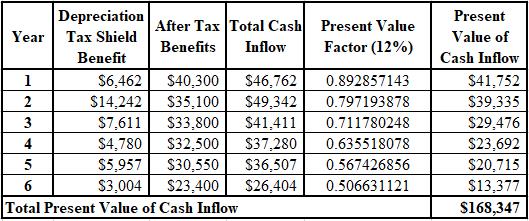

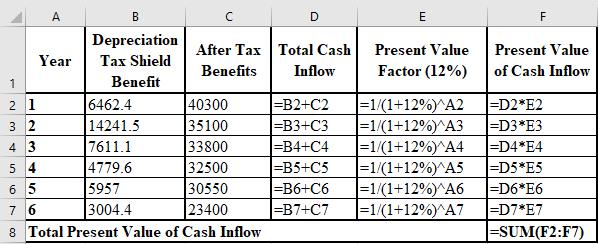

Answer to Problem 33P

The calculation of the PV of the total cash inflow is shown below.

Explanation of Solution

The formulae used for the calculation of the present value of the total cash inflow are shown below.

k.

To determine: Whether the replacement should be done or not.

Introduction:

It is the difference between the PV (present value) of cash inflows and that of

k.

Answer to Problem 33P

The replacement should be done because the NPV of the project is $46,211, and a positive NPV indicates that the replacement is beneficial for the corporation.

Explanation of Solution

The calculation of the NPV of the replacement is as follows.

Want to see more full solutions like this?

Chapter 12 Solutions

Foundations of Financial Management

- The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500, and it is expected to generate net after-tax operating cash flows, including depreciation, of $6,250 per year. The truck has a 5-year expected life. The expected salvage values after tax adjustments for the truck are given here. The company’s cost of capital is 10%. Should the firm operate the truck until the end of its 5-year physical life? If not, then what is its optimal economic life? Would the introduction of salvage values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project?arrow_forwardAlfredo Company purchased a new 3-D printer for $900,000. Although this printer is expected to last for ten years, Alfredo knows the technology will become old quickly, and so they plan to replace this printer in three years. At that point, Alfredo believes it will be able to sell the printer for $15,000. Calculate yearly depreciation using the double-declining-balance method.arrow_forwardUrquhart Global purchases a building to house its administrative offices for $500,000. The best estimate of the salvage value at the time of purchase was $45,000, and it is expected to be used for forty years. Urquhart uses the straight-line depreciation method for all buildings. After ten years of recording depreciation, Urquhart determines that the building will be useful for a total of fifty years instead of forty. Calculate annual depreciation expense for the first ten years. Determine the depreciation expense for the final forty years of the assets life, and create the journal entry for year eleven.arrow_forward

- Consolidated Aluminum is considering the purchase of a new machine that will cost $308,000 and provide the following cash flows over the next five years: $88,000, 92,000, $91,000, $72,000, and $71,000. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forwardFor each of the following unrelated situations, calculate the annual amortization expense and prepare a journal entry to record the expense: A. A patent with a ten-year remaining legal life was purchased for $300,000. The patent will be usable for another eight years. B. A patent was acquired on a new smartphone. The cost of the patent itself was only $24,000, but the market value of the patent is $600,000. The company expects to be able to use this patent for all twenty years of its life.arrow_forwardGardner Denver Company is considering the purchase of a new piece of factory equipment that will cost $420,000 and will generate $95,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further Instructions on internal rate of return in Excel, see Appendix C.arrow_forward

- Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one it expects to use the truck for 26,000 miles. Calculate the annual depreciation expense.arrow_forwardColquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value at the time of purchase was $15,000, and it is expected to be used for twenty-five years. Colquhoun uses the straight-line depreciation method for all warehouse buildings. After four years of recording depreciation, Colquhoun determines that the warehouse will be useful for only another fifteen years. Calculate annual depreciation expense for the first four years. Determine the depreciation expense for the final fifteen years of the assets life, and create the journal entry for year five.arrow_forwardDepreciation Jensen Inc., a graphic arts studio, is considering the purchase of computer equipment and software for a total cost of $18,000. Jensen can pay for the equipment and software over three years at the rate of $6,000 per year. The equipment is expected to last 10 to 20 years, but because of changing technology, Jensen believes it may need to replace the system in as soon as three to five years. A three-year lease of similar equipment and software is available for $6,000 per year. Jensens accountant has asked you to recommend whether the company should purchase or lease the equipment and software and to suggest the length of time over which to depreciate the software and equipment if the company makes the purchase. Required Ignoring the effect of taxes, would you recommend the purchase or the lease? Why or why not? Referring to the definition of depreciation, what appropriate useful life should be used for the equipment and software?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning