Concept explainers

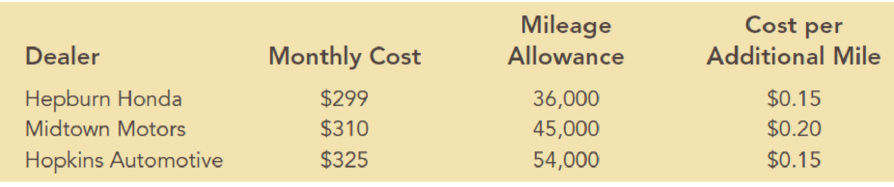

Amy Lloyd is interested in leasing a new Honda and has contacted three automobile dealers for pricing information. Each dealer offered Amy a closed-end 36-month lease with no down payment due at the time of signing. Each lease includes a monthly charge and a mileage allowance. Additional miles receive a surcharge on a per-mile basis. The monthly lease cost, the mileage allowance, and the cost for additional miles follow:

Amy decided to choose the lease option that will minimize her total 36-month cost. The difficulty is that Amy is not sure how many miles she will drive over the next three years. For purposes of this decision, she believes it is reasonable to assume that she will drive 12,000 miles per year, 15,000 miles per year, or 18,000 miles per year. With this assumption Amy estimated her total costs for the three lease options. For example, she figures that the Hepburn Honda lease will cost her 36($299) + $0.15(36,000 – 36,000) = $10,764 if she drives 12,000 miles per year, 36($299) + $0.15(45,000 – 36,000) = $12,114 if she drives 15,000 miles per year, or 36($299) + $0.15(54.000 – 36,000) = $13,464 if she drives 18,000 miles per year.

- a. What is the decision, and what is the chance

event ? - b. Construct a payoff table for Amy’s problem.

- c. If Amy has no idea which of the three mileage assumptions is most appropriate, what is the recommended decision (leasing option) using the optimistic, conservative, and minimax regret approaches?

- d. Suppose that the probabilities that Amy drives 12,000, 15,000, and 18,000 miles per year are 0.5, 0.4, and 0.1, respectively. What option should Amy choose using the

expected value approach? - e. Develop a risk profile for the decision selected in part (d). What is the most likely cost, and what is its probability?

- f. Suppose that, after further consideration, Amy concludes that the probabilities that she will drive 12,000, 15,000, and 18,000 miles per year are 0.3, 0.4, and 0.3, respectively. What decision should Amy make using the expected value approach?

a.

Find the decision and the chance event faced by Amy.

Explanation of Solution

Here, the decision is based on selecting the best lease option. Thus the least option has three alternatives that are Hepburn Honda, Midtown Motors and Hopkins Automotive.

Here, the chance event is the number of miles Amy will drive.

b.

Find the payoff table for Amy’s problem.

Answer to Problem 3P

Thus, the payoff table for Amy’s problem is given as:

| Actual Miles Driven Annually | |||

| Decision | 12000 | 15000 | 18000 |

| Hepburn Honda | $10,764 | $12,114 | $13,464 |

| Midtown Motors | $11,160 | $11,160 | $12,960 |

| Hopkins Automotive | $11,700 | $11,700 | $11,700 |

Explanation of Solution

The payoff for any combination of alternative and the chance event is the sum of the total monthly charges and total additional mileage cost that is given as follows:

For the Hepburn Honda lease option:

For the Midtown Motors lease option:

For the Hopkins Automotive lease option:

Thus, the payoff table for Amy’s problem is given as:

| Actual Miles Driven Annually | |||

| Decision | 12000 | 15000 | 18000 |

| Hepburn Honda | $10,764 | $12,114 | $13,464 |

| Midtown Motors | $11,160 | $11,160 | $12,960 |

| Hopkins Automotive | $11,700 | $11,700 | $11,700 |

c.

Find the decision using the optimistic, conservative and minimax regret approaches.

Answer to Problem 3P

The Hepburn Honda lease option gives the optimistic approach because it has the smallest minimum profit.

The Hopkins Automotive lease option gives the conservative approach because it has the smallest maximum profit.

The minimax regret is the Hopkins Automotive lease option because it minimizes the maximum regret.

Explanation of Solution

By using the decision tree in Part (a), the maximum and minimum profit based on the decisions Hepburn Honda, Midtown Motors and Hopkins Automotive.

| Decision | Maximum Profit | Minimum Profit |

| Hepburn Honda | $10,764 | $13,464 |

| Midtown Motors | $11,160 | $12,960 |

| Hopkins Automotive | $11,700 | $11,700 |

Optimistic approach:

The optimistic approach evaluates each decision alternative in terms of best payoff that can occur.

The Hepburn Honda lease option gives the optimistic approach because it has the smallest minimum profit (from the above table).

Conservative approach:

The conservative approach evaluates each decision alternative in terms of worst payoff that can occur.

The Hopkins Automotive lease option gives the conservative approach because it has the smallest maximum profit (from the above table).

Minimax Regret approach:

The minimax regret approach is the difference between the payoff associated with a particular alternative and payoff associated with the most decision that would yield the most desirable payoff for a given state of nature.

Regret or opportunity loss table:

| Decision | 12000 | 15000 | 18000 | Maximum Regret |

| Hepburn Honda | $0 | $954 | $1,764 | $1,764 |

| Midtown Motors | $396 | $0 | $1,260 | $1,260 |

| Hopkins Automotive | $936 | $540 | $0 | $936 |

The maximum regret for the decision Hepburn Honda is $1,764, Midtown Motors is $1,260 and Hopkins Automotive is $936.

Here, the Hopkins Automotive lease option has been selected because it minimizes the maximum regret.

d.

Find the expected value approach for the probabilities of 0.5, 0.4 and 0.1.

Answer to Problem 3P

The expected value approach results in Midtown Motors lease option.

Explanation of Solution

The formula to find expected value (EV) of decision alternative di is given as follows:

Here, the expected value for the payoffs associated with each of Amy’s three alternatives:

The expected value approach results in Midtown Motors lease option because it has the minimum expected value of the three alternatives.

e.

Find the most likely cost and its probability using risk analysis.

Answer to Problem 3P

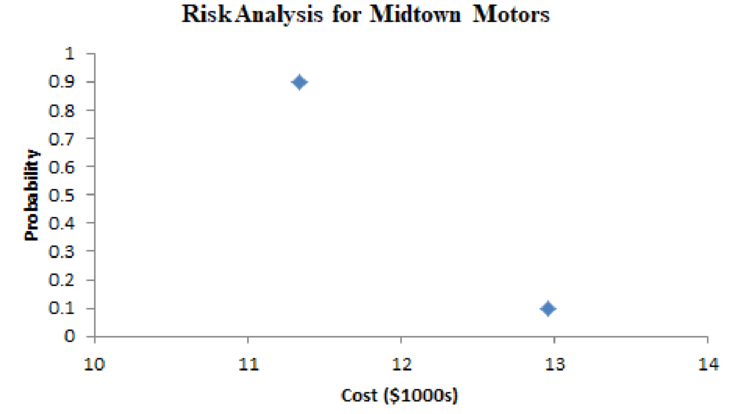

The risk analysis for midtown motors, the most likely cost is $11,160 with the probability of 0.9.

Explanation of Solution

From the data in part (d).

The risk profile for the decision to lease from Midtown Motors is:

From the above risk analysis for midtown motors, the most likely cost is $11,160 with the probability of 0.9.

Here, there are only two unique costs on this graph because for the decision alternative (midtown motors) have two unique payoffs. The payoffs are associated with the three chance outcomes- the payoff (cost) associated with midtown motors lease is same for the two of the chance outcomes.

f.

Find the expected value approach for the probabilities of 0.3, 0.4 and 0.3.

Answer to Problem 3P

The expected value approach results in either Midtown Motors lease option or Hopkins Automotive lease option.

Explanation of Solution

The formula to find expected value (EV) of decision alternative di is given as follows:

Here, the expected value for the payoffs associated with each of Amy’s three alternatives:

The expected value approach results in either Midtown Motors lease option or Hopkins Automotive lease option because both have the same minimum expected value of the three alternatives.

Want to see more full solutions like this?

Chapter 12 Solutions

Essentials Of Business Analytics

- At the Pizza Dude restaurant, a 12-in. pizza costs 5.40 to make, and the manager wants to make at least 4.80 from the sale of each pizza. If the pizza will be sold by the slice and each pizza is cut into 6 pieces, what is the minimum charge per slice?arrow_forwardIf during the following year it is predicted that each comedy skit will generate 30 thousand and each musical number 20 thousand, find the maximum income for the year. A television program director must schedule comedy skits and musical numbers for prime-time variety shows. Each comedy skit requires 2 hours of rehearsal time, costs 3000, and brings in 20,000 from the shows sponsors. Each musical number requires 1 hour of rehearsal time, costs 6000, and generates 12,000. If 250 hours are available for rehearsal and 600,000 is budgeted for comedy and music, how many segments of each type should be produced to maximize income? Find the maximum income.arrow_forwardWhat is the total effect on the economy of a government tax rebate of $1,000 to each household in order to stimulate the economy if each household will spend 90% of the rebate in goods and services?arrow_forward

- A manufacturer of lightweight mountain tents makes a standard model and an expeditionmodel for national distribution. Each standard tent requires 1 labour hour from the cuttingdepartment and 3 labour hours from the assembly department. Each expedition tent requires 2labour hours from the cutting department and 4 labour hours from the assembly department.The maximum labour hours available per day in the cutting department and the assemblydepartment are 32 and 84 respectively. If the company makes a profit of E50 on each standardtent and E80 on each expedition tent, use the graphical method to determine how many tentsof each type should be manufactured each day to maximize the total daily profit?arrow_forwardSuppose the chamber of commerce in Pinehurst, North Carolina decided to hold a professional golf tournament at the famous Pinehurst Country Club. They would probably be able to get a TV contract from a major network. The TV revenue would be about $4 million, and they would sell 60,000 tickets at $8 apiece. The fund for prizes would be 20% of their total revenue (TV plus tickets) rounded to the nearest $10,000. The prizes would be as follows (all prizes are rounded to the nearest dollar): First prize: 18% of the total prize money Second prize: 60% of the first prize Third prize: 65% of the second prize Fourth prize: 70% of the third prize Fifth prize: 75% of the fourth prize Sixth prize: 6% of the remaining prize money Seventh prize: $900 less than sixth prize Eighth prize: $900 less than seventh prize And so on, with each subsequent prize $900 less than the previous prize. The final prize would be whatever was left over, even if it…arrow_forwardA publisher for a promising new novel figures fixed costs (overhead, advances, promotion, copyediting, typesetting, and so on) at $87,000 and variable costs (printing, paperm bilding, shipping) at $4.50 for each book produced. If the book is sold to distributors for $28 each, how many must be produced and sold for the publisher to break even?arrow_forward

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning Elementary Geometry For College Students, 7eGeometryISBN:9781337614085Author:Alexander, Daniel C.; Koeberlein, Geralyn M.Publisher:Cengage,

Elementary Geometry For College Students, 7eGeometryISBN:9781337614085Author:Alexander, Daniel C.; Koeberlein, Geralyn M.Publisher:Cengage,

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL