CORPORATE FIN.(LL)-W/ACCESS >CUSTOM<

11th Edition

ISBN: 9781260269901

Author: Ross

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 4QP

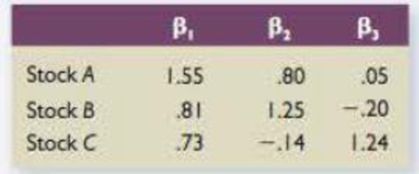

Multifactor Models Suppose stock returns can be explained by the following three-factor model:

Ri = RF + β1F1 + β2F2 – β3F3

Assume there is no firm-specific risk. The information for each stock is presented here:

The risk premiums for the factors are 4.9 percent 3.8 percent and 5.3 percent, respectively. If you create a portfolio with 20 percent invested in Stock A, 20 percent invested in Stock 8, and the remainder in Stock C, what is the expression for the return on your portfolio? If the risk-free rate is 3.2 percent, what is the expected return on your portfolio?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

CORPORATE FIN.(LL)-W/ACCESS >CUSTOM<

Ch. 12 - Prob. 1CQCh. 12 - Prob. 2CQCh. 12 - Prob. 3CQCh. 12 - Prob. 4CQCh. 12 - Market Model versus APT What are the differences...Ch. 12 - APT In contrast to the CAPM, the APT does not...Ch. 12 - CAPM versus APT What is the relationship between...Ch. 12 - Prob. 8CQCh. 12 - Data Mining What is data mining? Why might it...Ch. 12 - Prob. 10CQ

Ch. 12 - Prob. 1QPCh. 12 - Factor Models Suppose a three-factor model is...Ch. 12 - Prob. 3QPCh. 12 - Multifactor Models Suppose stock returns can be...Ch. 12 - Prob. 5QPCh. 12 - Market Model The following three stocks are...Ch. 12 - Prob. 7QPCh. 12 - Prob. 8QPCh. 12 - APT Assume that the following market model...Ch. 12 - Prob. 10QP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An analyst has modeled the stock of a company using the Fama-French three-factor model. The market return is 10%, the return on the SMB portfolio (rSMB) is 3.2%, and the return on the HML portfolio (rHML) is 4.8%. If ai = 0, bi = 1.2, ci = 20.4, and di = 1.3, what is the stock’s predicted return?arrow_forwardMarket equity beta measures the covariability of a firms returns with all shares traded on the market (in excess of the risk-free interest rate). We refer to the degree of covariability as systematic risk. The market prices securities so that the expected returns should compensate the investor for the systematic risk of a particular stock. Stocks carrying a market equity beta of 1.20 should generate a higher return than stocks carrying a market equity beta of 0.90. Nonsystematic risk is any source of risk that does not affect the covariability of a firms returns with the market. Some writers refer to nonsystematic risk as firm-specific risk. Why is the characterization of nonsystematic risk as firm-specific risk a misnomer?arrow_forwardAPT An analyst has modeled the stock of Crisp Trucking using a two-factor APT model. The risk-free rate is 6%, the expected return on the first factor (r1) is 12%, and the expected return on the second factor (r2) is 8%. If bi1 = 0.7 and bi2 = 0.9, what is Crisp’s required return?arrow_forward

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY