1.

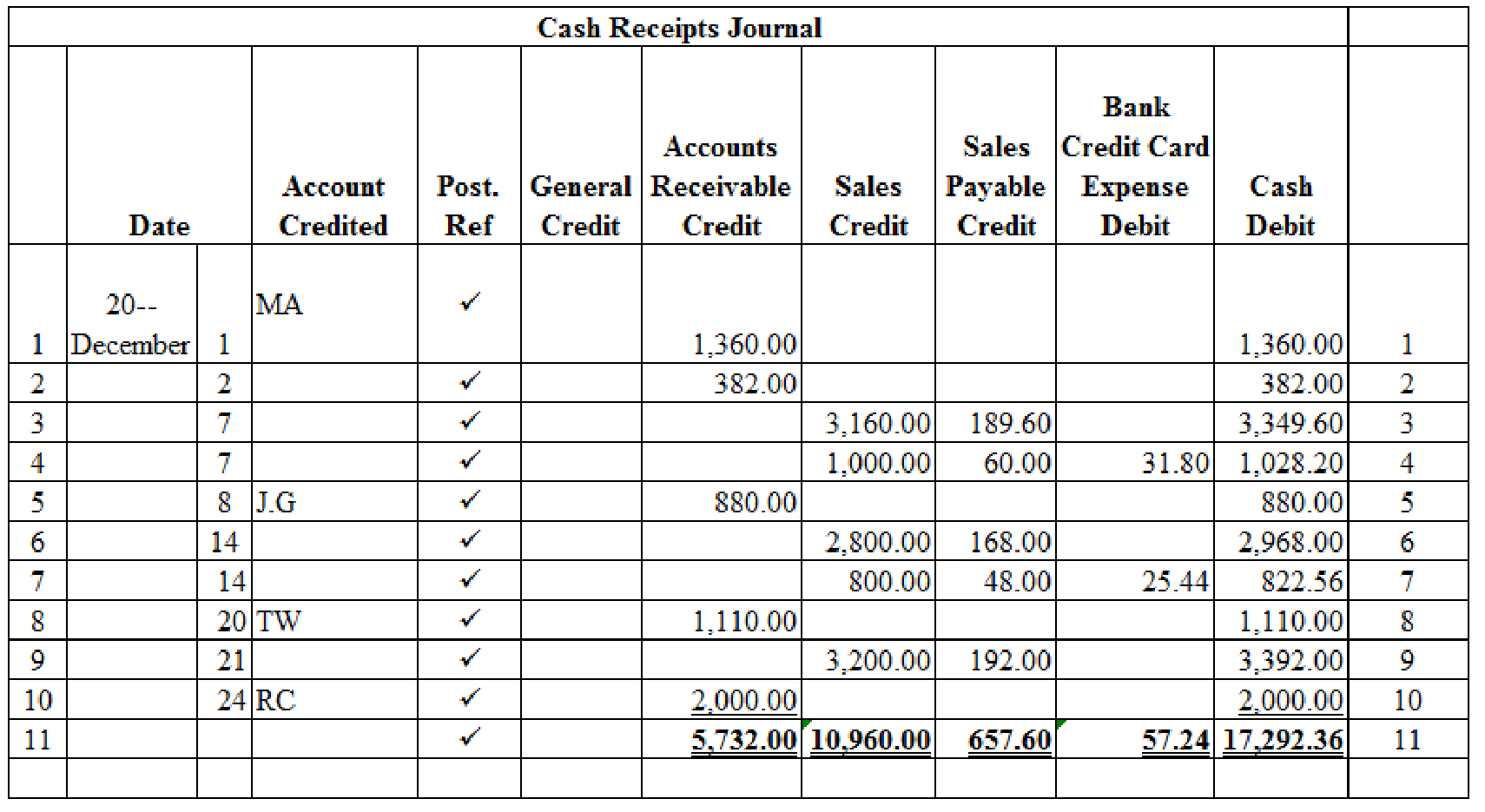

Prepare the given transactions in the cash receipts journal and verify the total column and rule the column and use the general journal to record the sales returns and allowances.

1.

Explanation of Solution

Cash Receipts Journal: It is a special book where only cash receipts transactions that are received from customers, merchandise sales and service made in cash and collection of

The following are the some examples of transactions that would be recorded in the Other Accounts credit column of the cash receipts journal:

- • Cash received as interest on notes payable

- • Interest revenue received from debtors

- • Cash receipts from bank loans

- • Cash receipts for capital investments

Prepare the given transactions in the cash receipts journal and verify the total column and rule the column and use the general journal to record the sales returns and allowances:

Table (1)

Verification of total debit and credit column:

Working note 1:

Calculate the amount of cash on dated 7th December:

Working note 2:

Calculate the amount of bank credit card expense on dated 7th December:

Working note 3:

Calculate the amount of cash on dated 7th December:

Working note 4:

Calculate the amount of cash on dated 14th December:

Working note 5:

Calculate the amount of bank credit card expense on dated 14th December:

Working note 6:

Calculate the amount of cash on dated 14th December:

Working note 7:

Calculate the amount of cash on dated 21st December:

Use the general journal to record the sales returns and allowances:

General Journal: It is a book where all the monetary transactions are recorded in the form of journal entries on the date of their occurrence in a chronological order.

Transaction on December 11:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| December | 11 | Sales Returns and Allowances | 401.1 | 60.00 | ||

| Sales Tax Payable | 231 | 3.60 | ||||

| Accounts Receivable, MA | 122/✓ | 63.60 | ||||

| (To record the merchandise returned) | ||||||

Table (2)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, MA is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working note 1:

Compute the sales tax payable amount.

Working note 2:

Compute the accounts receivable amount.

Transaction on December 21:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| December | 21 | Sales Returns and Allowances | 401.1 | 22.00 | ||

| Sales Tax Payable | 231 | 1.32 | ||||

| Accounts Receivable, A Manufacturing | 122/✓ | 23.32 | ||||

| (To record the merchandise returned) | ||||||

Table (3)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, A Manufacturing is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working note 1:

Compute the sales tax payable amount.

Working note 2:

Compute the accounts receivable amount;

2.

Post the prepared journal to the general ledger, and to the accounts receivable ledger.

2.

Explanation of Solution

Posting transactions: The process of transferring the journalized transactions into the accounts of the ledger is known as posting the transactions.

Post the prepared journals to the general ledger:

| ACCOUNT Cash ACCOUNT NO. 101 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 1 | Balance | ✓ | 9,862.00 | |||

| 31 | CR10 | 17,292.36 | 27,154.36 | ||||

Table (4)

| ACCOUNT Accounts Receivable ACCOUNT NO. 122 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 1 | Balance | ✓ | 9,352.00 | |||

| 11 | J8 | 63.60 | 9,288.40 | ||||

| 21 | J8 | 23.32 | 9,265.08 | ||||

| 31 | CR10 | 5,732.00 | 3,533.08 | ||||

Table (5)

| ACCOUNT Sales Tax Payable ACCOUNT NO. 231 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 11 | J8 | 3.60 | 3.60 | |||

| 21 | J8 | 1.32 | 4.92 | ||||

| 31 | CR10 | 657.60 | 652.68 | ||||

Table (6)

| ACCOUNT Sales ACCOUNT NO. 401 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 31 | CR10 | 10,960.00 | 10,960.00 | |||

Table (7)

| ACCOUNT Sales Returns and Allowances ACCOUNT NO. 401.1 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 11 | J8 | 60.00 | 60.00 | |||

| 21 | J8 | 22.00 | 82.00 | ||||

Table (8)

| ACCOUNT Bank Credit Card Expense ACCOUNT NO. 513 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 31 | CR10 | 57.24 | 57.24 | |||

Table (9)

Post the journals to the accounts receivable ledger.

| NAME MA | ||||||

| ADDRESS 233 W 11th Avenue, D, Mi 59500-1154 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 2,480.00 | ||

| 1 | CR10 | 1,360.00 | 1,120.00 | |||

| 11 | J8 | 63.60 | 1,056.40 | |||

Table (10)

| NAME A Manufacturing | ||||||

| ADDRESS 284 W 88 Street, D, Mi 59522-1168 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 982.00 | ||

| 2 | CR10 | 382.00 | 600.00 | |||

| 21 | J8 | 23.32 | 576.68 | |||

Table (11)

| NAME JG | ||||||

| ADDRESS P.O. Box 864, D, Mi 59552-0864 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 880.00 | ||

| 8 | CR10 | 880.00 | 0 | |||

Table (12)

| NAME TW | ||||||

| ADDRESS 100 N w S Street., D, Mi 59210-1337 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 1,810.00 | ||

| 20 | CR10 | 1,110.00 | 700.00 | |||

Table (13)

| NAME RC | ||||||

| ADDRESS 11312 Fourteenth Avenue South, D, Mi 59221-1142 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 3,200.00 | ||

| 24 | CR10 | 2,000.00 | 1,200.00 | |||

Table (14)

Want to see more full solutions like this?

Chapter 12 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- Accounts Receivable Balance XYZ Corp sells widgets to consumers for $20 each. Its beginning accounts receivable balance was $24,975, and it sold 12,376 widgets throughout the year. The total cash collections for the year amounted to $217,750. Required: Calculate the ending accounts receivable balance.arrow_forwardCASH RECEIPTS TRANSACTIONS Color Florists, a retail business, had the following cash receipts during January 20--. The sales tax is 5%. REQUIRED 1. Record the transactions starting on page 20 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardSALES AND CASH RECEIPTS TRANSACTIONS Paul Jackson owns a retail business. The following sales, returns, and cash receipts are for April 20--. There is a 7% sales tax. REQUIRED 1. Record the transactions starring on page 7 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forward

- SALES TRANSACTIONS J. K. Bijan owns a retail business and made the following sales on account during the month of August 20--. There is a 6% sales tax on all sales. REQUIRED 1. Record the transactions starting on page 15 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardKaseys Cake Shop made 20,000 in sales of wedding cakes in July. All of these sales were on bank credit cards. The credit card company charges a 3.5% collection fee. Prepare Kaseys journal entry to record the credit card sales.arrow_forwardAccounts Receivable Balance Hart Inc. began the year with $315,700 of accounts receivable. During the year, Hart sold a considerable amount of merchandise on credit and collected $2,427,000 of its credit sales. At the end of the year, the accounts receivable balance is $16,800 lower than the beginning balance. Required: Calculate the amount of credit sales during the period.arrow_forward

- C. R. McIntyre Company sells candy wholesale, primarily to vending machine operators. Terms of sales on account are 2/10, n/30, FOB shipping point. The following transactions involving cash receipts and sales of merchandise took place in May of this year: May 2Received 411.60 cash from N. Rojas in payment of April 23 invoice of 420, less cash discount. 5Received 2,085 cash in payment of 2,000 note receivable and interest of 85. 8Sold merchandise on account to G. Soto, invoice no. 862, 830. 9Received 11,838.40 cash from D. Maddox in payment of April 30 invoice of 12,080, less cash discount. 15Received cash from G. Soto in payment of invoice no. 862, less cash discount. 16Cash sales for first half of May, 3,259. 19Received 296 cash from R. O. Higgins in payment of April 14 invoice, no discount. 22Sold merchandise on account to N. T. Jennings, invoice no. 863, 753. 25Received 239 cash refund for return of defective equipment bought in April for cash. 28Sold merchandise on account to M. E. Mueller, invoice no. 864, 964. 31Cash sales for second half of May, 4,728. Required 1. Journalize the transactions for May in the cash receipts journal and the sales journal. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journals. Prove the equality of the debit and credit totals.arrow_forwardCASH PAYMENTS TRANSACTIONS Kay Zembrowski operates a retail variety store. The books include a general journal and an accounts payable ledger. Selected account balances on May 1 are as follows: The following transactions are related to cash payments for the month of May: May 1Issued Check No. 326 in payment of May rent (Rent Expense), 2,600. 4Issued Check No. 327 to Cortez Distributors in payment of merchandise purchased on account, 4,200, less a 3% discount. Check was written for 4,074. 7Issued Check No. 328 to Indra Velga in partial payment of merchandise purchased on account, 6,200. A cash discount was not allowed. 11Issued Check No. 329 to Toy Corner for merchandise purchased on account, 4,600, less a 1% discount. Check was written for 4,554. 15Issued Check No. 330 to County Power and Light (Utilities Expense), 1,500. 19Issued Check No. 331 to Builders Warehouse for a cash purchase of merchandise, 3,500. 25Issued Check No. 332 to Troutman Outlet for merchandise purchased on account, 4,400, less a 2% discount. Check was written for 4,312. May 30Issued Check No. 333 to Rapid Transit Company for freight charges on merchandise purchased (Freight-In), 800. 31Issued Check No. 334 to City Merchants for a cash purchase of merchandise, 2,350. Required 1. Enter the transactions starting with page 9 of a general journal. 2. Post from the general journal to the general ledger and the accounts payable ledger. Use general ledger account numbers as shown in the chapter.arrow_forwardScrepcap Co. had the following transactions during the first week of June: June 1Purchased merchandise on account from Acme Supply, 2,700, plus freight charges of 160. 1Issued Check No. 219 to Denver Wholesalers for merchandise purchased on account, 720, less 1% discount. 1Sold merchandise on account to F. Colby, 246, plus 5% state sales tax plus 2% city sales tax. June 2Received cash on account from N. Dunlop, 315. 2Made cash sale of 413 plus 5% state sales tax plus 2% city sales tax. 2Purchased merchandise on account from Permon Co., 3,200, plus freight charges of 190. 3Sold merchandise on account to F. Ayres, 211, plus 5% state sales tax plus 2% city sales tax. 3Issued Check No. 220 to Ellis Co. for merchandise purchased on account, 847, less 1% discount. 3Received cash on account from F. Graves, 463. 4Issued Check No. 221 to Penguin Warehouse for merchandise purchased on account, 950, less 1% discount. 4Sold merchandise on account to K. Stanga, 318, plus 5% state sales tax plus 2% city sales tax. 4Purchased merchandise on account from Mason Milling, 1,630, plus freight charges of 90. 4Received cash on account from O. Alston, 381. 5Made cash sale of 319 plus 5% state sales tax plus 2% city sales tax. 5Issued Check No. 222 to Acme Supply for merchandise purchased on account, 980, less 1% discount. Required 1. Record the transactions in a general journal. 2. Assuming these are the types of transactions Screpcap Co. experiences on a regular basis, design the following special journals for Screpcap: (a) Sales journal (b) Cash receipts journal (c) Purchases journal (d) Cash payments journalarrow_forward

- SALES TRANSACTIONS T. M. Maxwell owns a retail business and made the following sales on account during the month of July 20--. There is a 5% sales tax on all sales. REQUIRED 1. Record the transactions starting on page 15 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardOn March 24, MS Companys Accounts Receivable consisted of the following customer balances: S. Burton 310 A. Tangier 240 J. Holmes 504 F. Fullman 110 P. Molty 90 During the following week, MS made a sale of 104 to Molty and collected cash on account of 207 from Burton and 360 from Holmes. Prepare a schedule of accounts receivable for MS at March 31, 20--.arrow_forwardMonitoring of Receivables The Russ Fogler Company, a small manufacturer of cordless telephones, began operations on January 1. Its credit sales for the first 6 months of operations were as follows: Throughout this entire period, the firm’s credit customers maintained a constant payments pattern: 209b paid in the month of sale, 309b paid in the first month following the sale, and 509b paid in the second month following the sale. What was Fogler’s receivables balance at the end of March and at the end of June? Assume 90 days per calendar quarter. What were the average daily sales (ADS) and days sales outstanding (DSO) for the first quarter and for the second quarter? What were the cumulative ADS and DSO for the first half-year? Construct an aging schedule as of June 30. Use account ages of 0-30, 31-60, and 61-90 days. Construct the uncollected balances schedule for the second quarter as of June 30.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub