Concept explainers

1)

Case summary:

Person X is graduated from large university. He desired to become an entrepreneur. After death of his grandfather he got a business worth of $1million. Then he decided to buy minimum one franchise in the area of fast foods.an issue behind is that he will sell off investment after 3 years and go on to something else.

Person X has two alternatives franchise L and franchise S. Franchise L providing breakfast and lunch while franchise S is providing only dinner. Person X made evaluation of each franchise and find out that both have characteristics of risk and needs

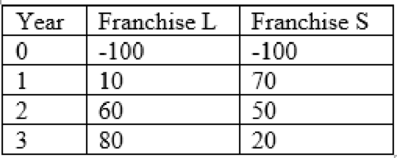

Here are the net cash flows (in thousand $)

To determine: The payback period and its meaning.

2)

To determine: The rationale for the payback period technique and the franchise or franchises must be accepted if the company’s supreme acceptable payback is 2 years and is both franchises are independent or mutually exclusive.

3)

To determine: The variance among the regular and discounted payback periods.

4)

To determine: The main demerit of discounted payback and the payback method of real usefulness in capital budgeting decisions.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Intermediate Financial Management (MindTap Course List)

- A fixed-price-incentive -- firm target (FPIF) contract has a target cost of $100,000, a target profit of $15,000, a target price of $115,000, a ceiling price of $132,000, and a share arrangement of 80/20. If the seller does the work for $80,000 actual cost, how much profit does the buyer pay to the seller?arrow_forwardYou are asked to evaluate ergonomic interventions for your company based on the following projections: Decreased annual Workers' Compensation costs: $13, 060 Increased annual production: $17,501 Initial purchase costs: $4, 561 If you have an expectation of 3.75% interest over a 6-year period, what would you calculate the multiplier for the Worker's Comp equivalence calculation to be if you're asked to evaluate the future worth over the life of the project?arrow_forwardFountain Corporation’s economists estimate that a good business environment and a bad business environment are equally likely for the coming year. The managers of the company must choose between two mutually exclusive projects. Assume that the project the company chooses will be the firm’s only activity and that the firm will close one year from today. The company is obligated to make a $4,100 payment to bondholders at the end of the year. The projects have the same systematic risk but different volatilities. Consider the following information pertaining to the two projects: Economy Probability Low-Volatility Project Payoff High-Volatility Project Payoff Bad .50 $ 4,100 $ 3,500 Good .50 4,600 5,200 a. What is the expected value of the company if the low-volatility project is undertaken? The high-volatility project? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) b. What is the expected value of the…arrow_forward

- ABC Company has the following mutually exclusive projects. Year Project A Project B 0 -$19,520 -$16,800 1 11,500 9,500 2 8,750 7,100 3 2,500 3,500 If the company uses the Profitability Index to rank these two projects, which project should be chosen if the appropriate discount rate is 15 percent?arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $5.00 million per year. Your upfront setup costs to be ready to produce the part would be $8.00 million. Your discount rate for this contract is 8.0%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? Question content area bottom Part 1 a. What does the NPV rule say you should do? The NPV of the project is $ enter your response here XX million. (Round to two decimal places.)arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.17 million per year. Your upfront setup costs to be ready to produce the part would be $8.17 million. Your discount rate for this contract is 8.3% a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm?arrow_forward

- You have estimated the current-year EBITDA of Mallock Transportation for a potential buyer of the firm, and you have discovered that the CEO of Mallock, who owns 90% of the firm, is taking a salary that is at least $100,000 higher than the cost of an outsider that could be hired to run the firm. The CEO will retire upon the sale, and the firm expects no loss in revenue since clients have signed long-term contracts that will be difficult to cancel. You adjust EBITDA to account for the CEOs replacement. The adjustment is called: a. Fraud b. Business judgment c. Accounting under GAAP d. Normalizing EBITDA e. None of the abovearrow_forwardFountain Corporation’s economists estimate that a good business environment and a bad business environment are equally likely for the coming year. The managers of the company must choose between two mutually exclusive projects. Assume that the project the company chooses will be the firm’s only activity and that the firm will close one year from today. The company is obligated to make a $4,200 payment to bondholders at the end of the year. The projects have the same systematic risk but different volatilities. Consider the following information pertaining to the two projects: Economy Probability Low-Volatility Project Payoff High-Volatility Project Payoff Bad .50 $ 4,200 $ 3,400 Good .50 4,600 4,900 a. What is the expected value of the company if the low-volatility project is undertaken? What if the high-volatility project is undertaken? (Do not round intermediate calculations.) b. What is the expected value of the company’s equity if the low-volatility…arrow_forwardSheaves Corporation economists estimate that a good business environment and a bad business environment are equally likely for the coming year. Management must choose between two mutually exclusive projects. Assume that the project chosen will be the firm’s only activity and that the firm will close one year from today. The firm is obligated to make a $5,400 payment to bondholders at the end of the year. The projects have the same systematic risk, but different volatilities. Consider the following information pertaining to the two projects: Economy Probability Low-VolatilityProject Payoff High-VolatilityProject Payoff Bad .50 $5,400 $4,800 Good .50 6,550 7,150 a. What is the expected value of the firm if the low-volatility project is undertaken? What if the high-volatility project is undertaken? (Do not round intermediate calculations and round your answers to the nearest whole dollar, e.g., 32.) b. What is the…arrow_forward

- Sheaves Corporation economists estimate that a good business environment and a bad business environment are equally likely for the coming year. Management must choose between two mutually exclusive projects. Assume that the project chosen will be the firm’s only activity and that the firm will close one year from today. The firm is obligated to make a $4,400 payment to bondholders at the end of the year. The projects have the same systematic risk, but different volatilities. Consider the following information pertaining to the two projects: Economy Probability Low-VolatilityProject Payoff High-VolatilityProject Payoff Bad .50 $4,400 $3,800 Good .50 5,050 5,650 a. What is the expected value of the firm if the low-volatility project is undertaken? What if the high-volatility project is undertaken? (Do not round intermediate calculations and round your answers to the nearest whole dollar, e.g., 32.) b. What is the…arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.83 million per year. Your upfront setup costs to be ready to produce the part would be $8.13 million. Your discount rate for this contract is 7.9%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm?arrow_forwardPele Corp. is a professional leasing company. The leasing manager has to evaluate some lease agreements under the following conditions: • The company’s marginal federal-plus-state income tax rate is 30%. • The company has alternative investment options of similar risk that yield 5.50%. Assuming all other factors and values are constant among these leases, from the lessor’s perspective, which of the following is the best lease? A lease that generates an after-tax rate of return of 2.75%. A lease that has an NPV of –$120,000. A lease that has an IRR of 3.05%. A lease that has an MIRR of 4.45%.arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning