a)

Case summary:

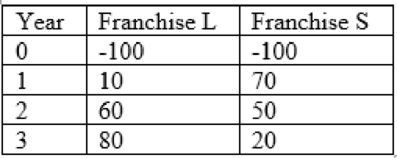

Person X is graduated from large university. He desired to become an entrepreneur. After death of his grandfather he got a business worth of $1million. Then he decided to buy minimum one franchise in the area of fast foods.an issue behind is that he will sell off investment after 3 years and go on to something else.

Person X has two alternatives franchise L and franchise S. Franchise L providing breakfast and lunch while franchise S is providing only dinner. Person X made evaluation of each franchise and find out that both have characteristics of risk and needs

Here are the net cash flows (in thousand $)

To determine: The definition of

b)

To determine: The relationship between IRR and YTM and IRR if equal

c)

To determine: The logic behind the IRR method and the franchises must be accepted if they are independent and equally exclusive.

d)

To determine: Whether IRR changes with respect to change in cost of capital.

Trending nowThis is a popular solution!

Chapter 12 Solutions

Intermediate Financial Management (MindTap Course List)

- Define the term “net present value (NPV).” What is each franchise’s NPV? What is the rationale behind the NPV method? According to NPV, which franchise or franchises should be accepted if they are independent? Mutually exclusive? Would the NPVs change if the cost of capital changed?arrow_forwardc. (1) Define the term net present value (NPV). What is each franchises NPV? (2) What is the rationale behind the NPV method? According to NPV, which franchise or franchises should be accepted if they are independent? Mutually exclusive? (3) Would the NPVs change if the cost of capital changed?arrow_forwardThe principle device used by the corporation to force conversion A. is a call provision. B. is setting the conversion price above the current market price. C. is reducing the amount of interest payments. D. is buying bonds back at below par value.arrow_forward

- Which of the following is not a determinant of investment? a) The efficiency of capital equipment b) The level of consumer demand c) Interest rates d) The willingness of investors to buy new share issuesarrow_forwardThe relationship between WACC and investors' required rates of return The required rate of return of an investor is the rate of return that an investor demands to purchase a firm’s stocks or bonds and thus provide funds for capital investment. Therefore, required returns from the investors’ point of view correspond to the required returns or the weighted average cost of capital (WACC) from the firm’s point of view. Indicate in the following table whether each of the statements about WACC and the required rates of return of investors is true or false. Statement True False Flotation costs increase the cost of newly issued stock compared to the cost of the firm’s existing, or already outstanding, common stock or retained earnings. The firm’s cost of debt is what an investor is willing to pay for the firm’s stock before considering flotation costs. The amount that an investor is willing to pay for a firm’s bonds is inversely related to the…arrow_forwardHow does the WACC DCF methodology mechanically incorporate interest tax shields (select the best answer)? Group of answer choices By estimating free cash flows that incorporate the tax benefits of debt. By adding the tax benefits of interest payments to the value of the firm. By adding the PV of the interest tax shields to the value of the firm. By estimating a discount rate that incorporates the tax benefits of debt.arrow_forward

- Among the following choices, which would be the best way to estimate the cost of capital (discount rate) for a project within a diversified firm? Group of answer choices The firm's WACC The firm's cost of equity A discount rate that reflects the systematic risk of the project under consideration A discount rate that reflects the systematic risk of other diversified firmsarrow_forwardWhat does the Trade-off Theory say about the corporate's financing choices?Briefly explain.arrow_forwardIn the equities capital markets, participants play key roles to support primary and secondary capital markets. Participants include investors, speculators, market makers, underwriters, and brokers. how would participants interact to facilitate capital market activities? For example, when there is a Federal Reserve action that affects interest rates, how might the various participants interact with a company going through an acquisition?arrow_forward

- For a firm that has adequate access to capital markets, is it more reasonable toassume reinvestment at the WACC or the IRR? Explain.arrow_forwardWhen a corporation invests borrowed money in assets that generate profits greater than the after-tax cost of the debt, it increases the return on equity for common shareholders. creates financial leverage. has a mix of debt and equity in its capital structure. does all of these options. If the effective rate of interest is greater than the contract rate, the bonds will sell at par. a premium. a discount. any of these choices, depending on other circumstances.arrow_forward(a) – Explain the concept of Tax Deduction in WACC. Does this tax deduction make debt finance Cheaper Then Equity Finance? (b) – Compare Dividend Valuation Model with Capital Asset Pricing Model in the context of calculating cost of equity? Can use of these two methods result in differing values of business?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning