Concept explainers

COST-BENEFIT ANALYSIS

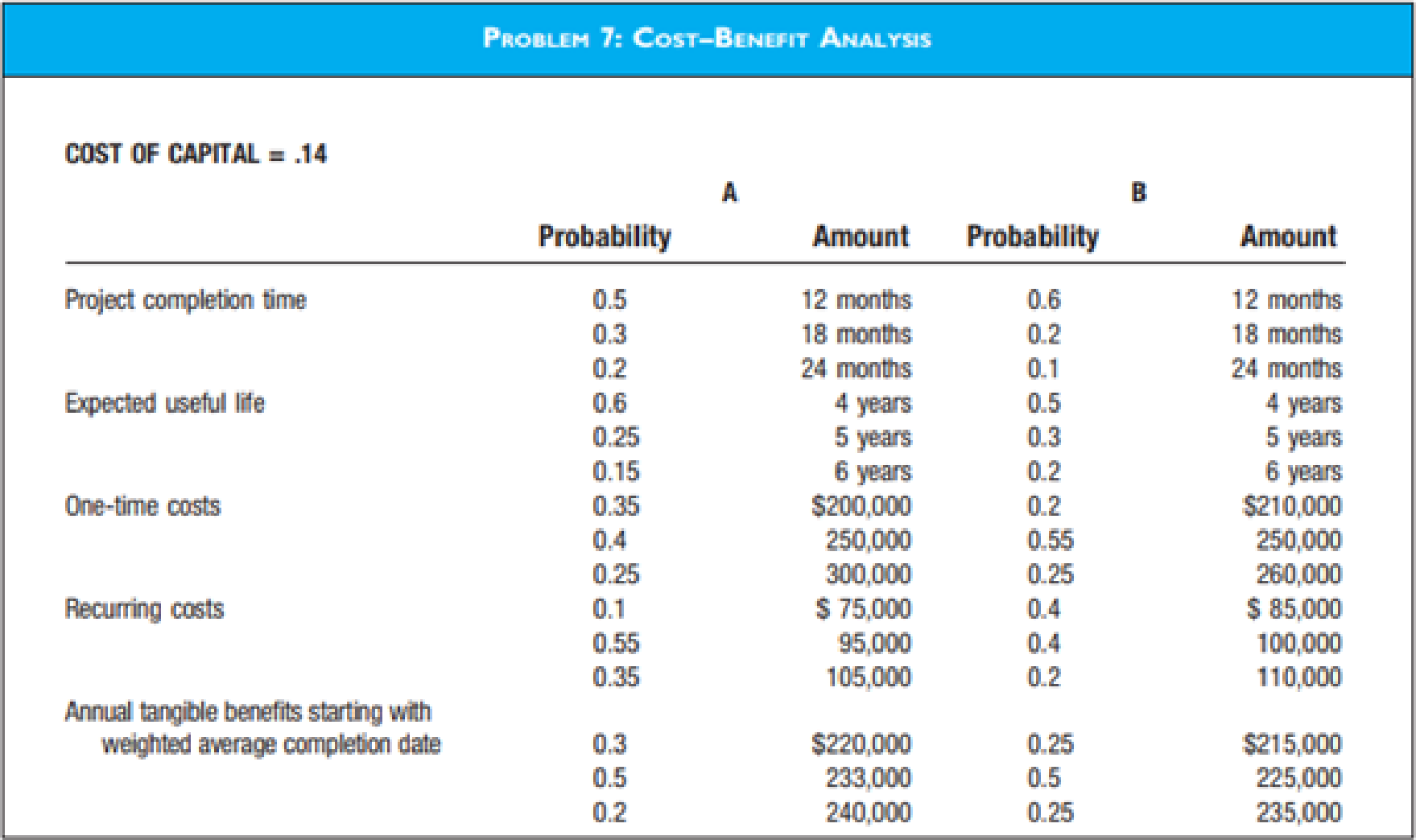

Listed in the diagram for Problem 7 are some probability estimates of the costs and benefits associated with two competing projects.

- a. Compute the

net present value of each alternative. Round the cost projections to the nearest month. - b. Repeat step (a) for the payback method.

- c. Which method do you think provides the best source of information? Why?

a.

Calculate the net present value of each alternative.

Explanation of Solution

Net Present Value:

Net present value (NPV) is defined as a method which is used in capital budgeting to compute the profitability of an investment. It can be calculated by subtracting the cash inflow of present value from cash outflow of a period of time.

Given information:

Average time period is 5 year.

Discount rate is 0.14.

Present value of annuity at discount rate of 0.14 and time 5 year is 3.433.

Calculation of Net present value of project A:

The formula to calculate net present value of project A is,

The table given below represents the annual cash flow of project A:

|

Probability (A) |

Recurring cost (B) |

Cash inflow |

Probability (C) |

Weighted average benefits (D) |

Cash outflow |

Cash Flow |

| 0.1 | $75,000 | $7,500 | 0.3 | $220,000 | $66,000 | $9,000 |

| 0.55 | $95,000 | $52,250 | 0.5 | $233,000 | $116,500 | $64,250 |

| 0.35 | 105,000 | $36,750 | 0.2 | $240,000 | $48,000 | $11,250 |

| Total | $96,500 | Total | $230,500 | $84,500 | ||

Table (1)

From Table (1), total cash inflow of project A is $84,500.

Substitute $84,500 for Cash flow and

Hence, net present value of project A is $290,088.50 per year.

Calculation of Net present value of project B:

The formula to calculate net present value of project B is given in equation (1)

The table given below represents the annual cash flow of project B:

|

Probability (A) |

Recurring cost (B) |

Cash inflow |

Probability (C) |

Weighted average benefits (D) |

Cash outflow |

Cash Flow |

| 0.4 | $85,000 | $34,000 | 0.25 | $215,000 | $53,750 | $1,750 |

| 0.4 | $100,000 | $40,000 | 0.5 | $225,000 | $112,500 | $72,500 |

| 0.2 | $110,000 | $22,000 | 0.25 | $235,000 | $58,750 | $36,750 |

| Total | $96,000 | Total | $225,000 | $111,000 | ||

Table (2)

From Table (2), total cash inflow of project B is $111,000.

Substitute $111,000 for Cash flow and

Hence, net present value of project B is $381,063.

b.

Compute payback method of each alternative.

Explanation of Solution

Payback Method:

Payback method is defined as the method of capital budgeting which is used to measure the length of time required to recover the cost of investment in a project.

Calculation of period using payback method of project A:

The formula to calculate payback period of project A is,

The table given below represents total initial investment of project A:

| Probability factor | One-time cost | Initial investment |

| 0.35 | $200,000 | $70,000 |

| 0.4 | $250,000 | $100,000 |

| 0.25 | $300,000 | $75,000 |

| Total | $245,000 | |

Table (3)

From Table (3), total initial investment of project A is $245,000.

Substitute $245,000 for initial investment and $84,500 Cash flow in the above formula.

Hence, the payback period of project A is 3 year.

Calculation of period using payback method of project B:

The formula to calculate payback period of project B is given in equation (2).

The table given below represents total initial investment of project B:

| Probability factor | One-time cost | Initial investment |

| 0.2 | $210,000 | $42,000 |

| 0.55 | $250,000 | $137,500 |

| 0.25 | $260,000 | $65,000 |

| Total | $244,500 | |

Table (4)

From Table (4), total initial investment of project B is $244,500.

Substitute $244,500 for initial investment and $111,000 Cash flow in the above formula.

Hence, the payback period of project B is 2 year.

c.

Explain which method net present value method or payback period method provides better information of investment.

Explanation of Solution

Net Present Value:

Net present value (NPV) is defined as a method which is used in capital budgeting to compute the profitability of an investment. It can be calculated by subtracting the cash inflow of present value from cash outflow of a period of time.

Net present value provides the information about the profitability of investment. On the other hand, payback period method gives the information about time required to recover the cost of investment.

Therefore, to analyse the budgeting of an investment both the methods are equally important.

Want to see more full solutions like this?

Chapter 13 Solutions

Accounting Information Systems (Looseleaf) - Text Only

- Refer to Exercise 19.11. 1. Compute the payback period for each project. Assume that the manager of the clinic accepts only projects with a payback period of three years or less. Offer some reasons why this may be a rational strategy even though the NPV computed in Exercise 19.11 may indicate otherwise. 2. Compute the accounting rate of return for each project.arrow_forwardYou have been assigned to perform a project selection based on profitability index. You have collected data on the three project alternatives A1, A2, and A3 and your team has calculated the following (table) present worth equivalent for the benefits, costs, and investments at a social discount rate of 10%. The service life of each alternative is identical. (a) Find the PI(i) for each project alternative (b) Find the best alternative based on incremental PI(i) analysis (c) Why is the profitability index referred to as a measure of capital efficiency?arrow_forwardIn a maximum of two lines, give an explanation to the following statements: While comparing projects with unequal time frames, evaluation via the equivalent annual net benefit method may be simpler than via the roll-over method.arrow_forward

- Assuming monetary benefits of a construction project at $50,000 per year, one-time costs (initial investment) of $15,000, recurring costs of $35,000 per year, a discount rate of 10 per cent, and a 4-year time horizon, calculate the net present value (NPV) of an information system's costs and benefits. Calculate the overall return on investment (ROI) of the project. During which year does break-even occur? Use the NPV template provided (modify to suit your answer) and clearly display the NPV, ROI, and year in which payback occurs. Write a paragraph explaining whether you would recommend investing in this project based on your financial analysis. Explain your answer referring to the NPV, ROI and payback for this project. Discount Rate (10%) Year 0 - 1.0000 Year 1 - .9091 Year 2 - .8264 Year 3 - .7513 Year 4 - .6830arrow_forwardFrom the following data, calculate the (a) conventional and (b) modified benefit/cost ratios using a discount rate of 6% per year and a very long (infinite) project life.arrow_forwardAssume a high demand for the product and by-products that all produced goods are sold each year within the studyperiod. Calculate the following: Internal Rate of Return Based on the computed values, decide whether the project is economically justifiable or not.arrow_forward

- Use the information contained below to compress one time unit per move using the leastcost method. Assume the total indirect cost for the project is $700 and there is a savingsof $50 per time unit reduced. Record the total direct, indirect, and project costs for eachduration. What is the optimum cost-time schedule for the project? What is the cost?arrow_forwardPlease solve both (a) and (b) in an Excel Spreadsheet and provide formulas you used. a) Use rate of return (ROR) analysis to determine which of the mutually exclusive projects listed below to select given a MARR of 12% per year. b) Confirm your answer to part (a) using Present Worth analysis.arrow_forwardA manufacturing firm is considering two mutually exclusive projects. Both projects have an economic service life of one year with no salvage value. The first cost or Project 1 is $1,000, and the first cost or Project 2 is $800. The net year-end revenue for each project is given as follows: Assume that both projects are statistically independent or each other.(a) If you make decisions by maximizing the expected NPW, which projectwould you select?(b) If you also consider the variance of the projects, which project would youselect?arrow_forward

- (a) Calculate the payback period for each project. (b) Calculate the net present value (NPV) for each project. (c) Calculate the profitability index of each project. (d) Explain to the company which project should be implemented. Support your answer.arrow_forwardPlease help to solve all the below :) What is the average return per year for a project that has an initial investment of $75,000 with an average return of $12,000 per year over 10 years? a) $1,080 b) $10,800 c) $4,500 d) $11,000 e) $3,200 Based on previous answer, what is the Return on investment (ROI) of this project? a) 8.5 b) 6 c) 4 d) 5.5 e) 3 Which of the following best describes a cost-bound project? a) A project that is constrained by a hard deadline in which the delivery timing is as important as the delivery itself b) A project that is constrained by safety standards in which the safety aspect of the project is as important as the delivery itself c) A project that is constrained by a hard budget in which the cost of the project is as important as the delivery itself d) A and C e) All of the above What would be the discount factor at year 3 of a 4-year project, if the discount rate is 6%? a) 0.78 b) 0.84 c) 0.89 d) 0.96 e) None of the abovearrow_forwardUse the information provided to answer the questions.Use the information provided below to calculate the following. Where applicable, use the presentvalue tables provided in APPENDICES 1 and 2 1. Calculate the Payback Period of Project A (expressed in years, months and days).2. Calculate the Accounting Rate of Return (on average investment) of Project B (expressed to twodecimal places).arrow_forward

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning