1.

Prepare the

1.

Explanation of Solution

Investment: It refers to the process of using the currently held excess cash to earn profitable returns in future. The investments can be made in equity securities such as shares or debt securities such as bonds.

Prepare the journal entries in the books of Company D for the year 2016.

| Date | Account Title and Explanation | Debit | Credit |

| February 3, 2016 | Investment in Available-for-sale Securities | $36,000 | |

| Cash | $36,000 | ||

| (To record the purchase of Company B's 3000 shares) | |||

| April 1, 2016 | Investment in Available-for-sale Securities | $20,000 | |

| Interest income (1) | $600 | ||

| Cash | $20,600 | ||

| (To record the purchase of Incorporation S's bonds) | |||

| June 30, 2016 | Cash | $1,950 | |

| Dividend income | $750 | ||

| Interest income (2) | $1,200 | ||

| (To record the interest and dividend received) | |||

| September 1, 2016 | Investment in Available-for-sale Securities | $88,000 | |

| Cash | $88,000 | ||

| (To record the purchase of Company W's 4000 shares) | |||

| November 1, 2016 | Investment in Available-for-sale Securities | $30,000 | |

| Interest income (3) | $1,375 | ||

| Cash | $31,375 | ||

| (To record the purchase of Incorporation W's bonds) | |||

| December 1, 2016 | Cash | $1,650 | |

| Interest income (4) | $1,650 | ||

| (To record the interest received from Company E's bond) | |||

| December 1, 2016 | Cash | $30,300 | |

| Investment in Available-for-sale Securities | $30,000 | ||

| Gain on sale of Available-for-sale Securities | $300 | ||

| (To record the sale of Company E's bond on profit) | |||

| December 30, 2016 | Cash | $750 | |

| Dividend income | $750 | ||

| (To record the dividend received for Company B's share) | |||

| December 30, 2016 | Cash | $35,300 | |

| Loss on sale of Available-for-sale Securities | $700 | ||

| Investment in Available-for-sale Securities | $36,000 | ||

| (To record the sale of Company B's share on loss) | |||

| December 31, 2016 | Cash | $1,200 | |

| Interest income (5) | $1,200 | ||

| (To record the interest received from Incorporation S's bond) | |||

| December 31, 2016 | Allowance for change in fair value of investment | $4,200 | |

| Unrealized holding gain/loss: Available-for-sale securities (7) | $4,200 | ||

| (To adjust the allowance and the unrealized gain on holding the Securities) |

Table (1)

Working note (1):

Determine the amount of interest income paid by Company D.

Working note (2):

Calculate the amount of interest income received from Incorporation S’s bond.

Working note (3):

Calculate the amount of interest income paid by Company D.

Working note (4):

Calculate the amount of interest income received from Company E’s bond.

Working note (5):

Calculate the amount of interest income.

Working note (6):

Determine the fair value of investment in Corporation W’s stock.

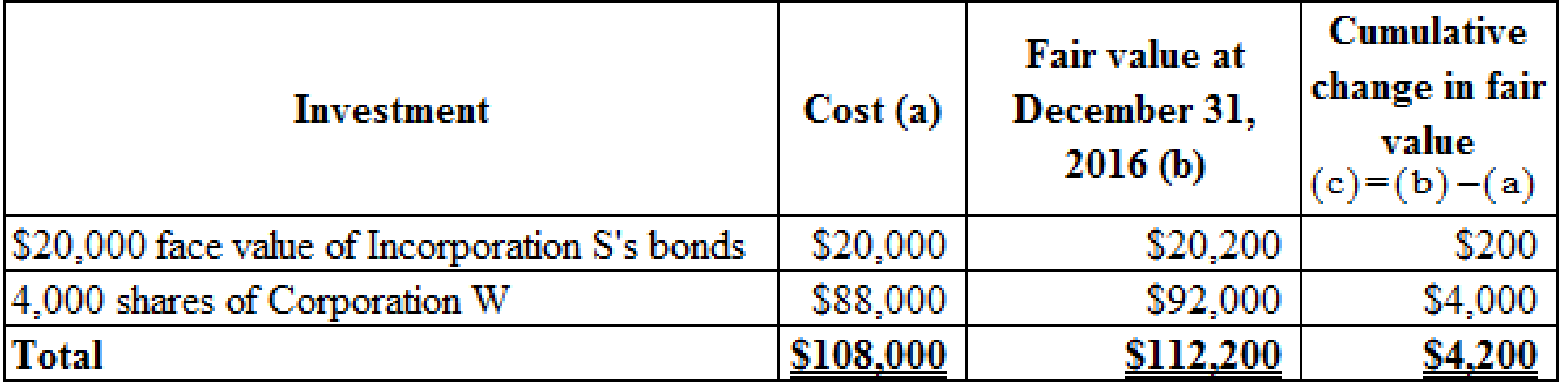

Working note (7):

Determine the net amount of unrealized gain or loss on available-for-sale securities as on December 31, 2016.

Table (2)

2.

Show the items of income or loss of Company D for the year ended December 31, 2016.

2.

Explanation of Solution

Show the items of income or loss of Company D for the year ended December 31, 2016.

| Particulars | Amount |

| Interest income (8) | $2,075 |

| Dividend income (9) | $1,500 |

| Loss on sale of available-for-sale securities | ($ 700) |

| Gain on sale of available-for-sale securities | $300 |

Table (3)

Working note (8):

Calculate the amount of interest income.

Working note (9):

Calculate the amount of dividend income.

3.

Show the carrying value of Company D’s investment in available-for-sale securities at its balance sheet at December 31, 2016.

3.

Explanation of Solution

Show the carrying value of Company D’s investment in available-for-sale securities at its balance sheet at December 31, 2016.

| Company D | |

| Balance sheet Statement (Partial) | |

| As at December 31, 2016 | |

| Assets | Amount |

| Current assets: | |

| Investment in available-for-sale securities (at cost) | $108,000 |

| Add : Allowance for change in fair value of investment | $4,200 |

| Investment in available-for-sale securities (at fair value) | $112,200 |

Table (4)

Want to see more full solutions like this?

Chapter 13 Solutions

Intermediate Accounting: Reporting and Analysis

- Dunn Company recognized a 5,000 unrealized holding gain on investment in Starbuckss long-term bonds during 2019. The company classified its investment as an available-for-sale security. How would this information be reported on a statement of cash flows prepared using the indirect method?arrow_forwardAmerican Surety and Fidelity buys and sells securities expecting to earn profits on short-term differences in price. For the first 11 months of 2016, gains from selling trading securities totaled $8 million, losses were $11 million, and the company had earned $5 million in investment revenue. The following selected transactions relate to American’s trading account during December 2016, and the first week of 2017. The company’s fiscal year ends on December 31. No trading securities were held by American on December 1, 2016. 2016 Dec. 12 Purchased FF&G Corporation bonds for $12 million. 13 Purchased 2 million Ferry Intercommunications common shares for $22 million. 15 Sold the FF&G Corporation bonds for $12.1 million. 22 Purchased U.S. Treasury bills for $56 million and Treasury bonds for $65 million. 23 Sold half the Ferry Intercommunications common shares for $10 million. 26 Sold the U.S. Treasury bills for $57 million. 27 Sold the Treasury bonds for $63 million. 28 Received…arrow_forwardAssume the following is a portion of the investment footnote from MetLife’s 2016 10-K report. Investment earnings are a crucial component of the financial performance of insurance companies such as MetLife, and investments comprise a large part of Metlife’s assets. MetLife accounts for its bond investments as available-for-sale securities. a. $223,926 million, $8,329 million gainb. $230,050 million, $6,124 million gainc. $223,926 million, $6,124 million gaind. $230,050 million, $2,205 million lossarrow_forward

- (Equity Securities Entries) On December 21, 2017, Bucky Katt Company provided you with the following information regarding its equity investments. Check below image for the investment information. During 2018, Colorado Co. stock was sold for $9,400. The fair value of the stock on December 31, 2018, was Clemson Corp. stock—$19,100; Buffaloes Co. stock—$20,500. None of the equity investments result in significant influence.Instructions(a) Prepare the adjusting journal entry needed on December 31, 2017.(b) Prepare the journal entry to record the sale of the Colorado Co. stock during 2018.(c) Prepare the adjusting journal entry needed on December 31, 2018.arrow_forwardDuring 2017, Latvia Company purchased trading securities with the following cost and market value on December 31, 2017. Security Cost Market Value A – 1 000 shares 200 000 300 000 B – 10 000 shares 1 700 000 1 600 000 C – 20 000 shares 3 100 000 2 900 000 5 000 000 4 800 000 The entity sold 10 000 shares of security B on January 15, 2018, for P 150 per share. 1. What amount of unrealized gain or loss should be reported in income statement for 2017? 2. What amount should be reported as loss on sale of trading investment of 2018?arrow_forward(a.) Prepare any journal entries you consider necessary, including year end entries (December 31), assuming these investments are managed to profit from changes in market interest rates (held for trading). Mayor Company doesn’t have debt investment before 2020. (b.) Prepare a partial statement of financial position showing the Investment account at December 31, 2020. (c.) If Mayor Company purchase the debt investment to collect the contractual cash flow (held the debt investment to maturity), explain how the journal entries would differ from those in part (a).arrow_forward

- Investments in Equity Securities Manson Incorporated reported investments in equity securities of 60,495 as a current asset on its December 31, 2018, balance sheet. An analysis of Mansons investments on December 31, 2018, reveals the following: During 2019, the following transactions related to Mansons investments occurred: Required: 1. Assuming Manson prepares quarterly financial statements, prepare journal entries to record the preceding information. 2. Show the items of income or loss from investment transactions that Manson reports for each quarter of 2019. 3. Show how Mansons investments are reported on the balance sheet on March 31, 2019; June 30, 2019; September 30, 2019; and December 31, 2019.arrow_forwardInvestments in Equity Securities Noonan Corporation prepares quarterly financial statements and invests its excess funds in marketable securities. At the end of 2018, Noonans portfolio of investments consisted of the following equity securities: Dunne the first half of 2019, Noonan engaged in the following investment transactions: Required: 1. Record Noonans investment transactions for January 6 through June 30, 2019. 2. Show the items of income or loss from investment transactions that Noonan reports for each of the first and second quarters of 2019. 3. Show how the preceding items are reported on the first and second quarter 2019 ending balance sheets, assuming that management expects to dispose of the Keene and Sachs securities within the next year.arrow_forwardOBrien Industries Inc. is a book publisher. The comparative unclassified balance sheets for December 31, 2017 and 2016 follow. Selected missing balances are shown by letters. Note 1. Investments are classified as available for sale. The investments at cost and fair value on December 31, 2016, are as follows: Note 2. The investment in Jolly Roger Co. stock is an equity method investment representing 30% of the outstanding shares of Jolly Roger Co. The following selected investment transactions occurred during 2017: May 5. Purchased 3,080 shares of Gozar Inc. at 30 per share including brokerage commission. Gozar Inc. is classified as an available-for-sale security. Oct. 1. Purchased 40,000 of Nightline Co. 6%, 10-year bonds at 100. The bonds are classified as available for sale. The bonds pay interest on October 1 and April 1. 9. Dividends of 12,500 are received on the Jolly Roger Co. investment. Dec. 31. Jolly Roger Co. reported a total net income of 112,000 for 2017. OBrien Industries Inc. recorded equity earnings for its share of Jolly Roger Co. net income. 31. Accrued three months of interest on the Nightline bonds. 31. Adjusted the available-for-sale investment portfolio to fair value, using the following fair value per-share amounts: 31. Closed the OBrien Industries Inc. net income of 146,230. OBrien Industries Inc. paid no dividends during the year. Instructions Determine the missing letters in the unclassified balance sheet. Provide appropriate supporting calculations.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning