Concept explainers

To compute: Beta and construct a tabulated summary.

Introduction: The model that shows the relation between systematic risk and expected

Explanation of Solution

Security market line: SML refers to a line that represents CAPM (capital asset pricing model), which further shows the level of systematic, or market, risks for various securities against the expected return of the market at a stated point of time.

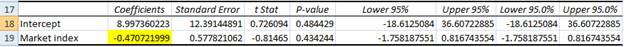

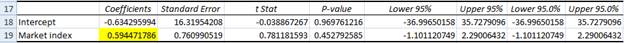

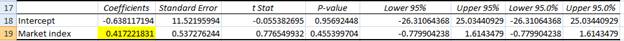

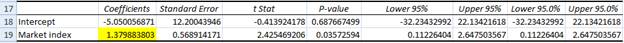

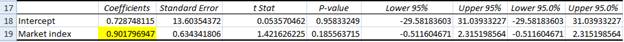

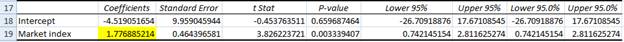

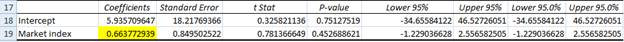

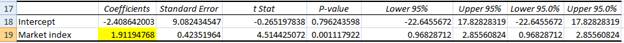

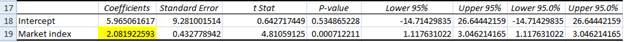

Regression can be applied to excess return to evaluate beta for each portfolio. It has been shown below:

Beta of Stock A: -0.4707

Beta of Stock B: 0.5945

Beta of Stock C: 0.4172

Beta of Stock D: 1.3799

Beta of Stock E: 0.9018

Beta of Stock F: 1.7769

Beta of Stock G: 0.6638

Beta of Stock H: 1.9119

Beta of Stock I: 2.0819

Tabulated summary has been constructed below:

| Stock | Beta |

| A | -0.47072 |

| B | 0.59447 |

| C | 0.41722 |

| D | 1.37988 |

| E | 0.90179 |

| F | 1.77688 |

| G | 0.66377 |

| H | 1.91194 |

| I | 2.08192 |

Want to see more full solutions like this?

Chapter 13 Solutions

INVESTMENTS (LOOSELEAF) W/CONNECT

- Consider the following time series data: Construct a time series plot. What type of pattern exists in the data? Use a multiple regression model with dummy variables as follows to develop an equation to account for seasonal effects in the data: Qtr1 = 1 if quarter 1, 0 otherwise; Qtr2 = 1 if quarter 2. 0 otherwise; Qtr3 = 1 if quarter 3, 0 otherwise. Compute the quarterly forecasts for next year based on the model you developed in part (b). Use a multiple regression model to develop an equation to account for trend and seasonal effects in the data. Use the dummy variables you developed in part (b) to capture seasonal effects and create a variable t such that t = 1 for quarter 1 in year 1, t = 2 for quarter 2 in year 1, … t = 12 for quarter 4 in year 3. Compute the quarterly forecasts for next year based on the model you developed in part (d). Is the model you developed in part (b) or the model you developed in part (d) more effective? Justify your answer.arrow_forwardIn a simple linear regression based on 20 observations, it is found b1 = 3.05 and se(b1) = 1.30. Consider the hypothesis : H0 : β1 = 0 and HA : β1 ≠ 0 . Calculate the value of the test statistic.arrow_forwardAssuming that the rates of return associated with a given asset investment are normally distributed; that the expected return, r, is 18.7%; and that the coefficient of variation, CV, is 1.88, answer the following questions: a. Find the standard deviation of returns, sigma Subscript rσr. b. Calculate the range of expected return outcomes associated with the following probabilities of occurrence: (1) 68%, (2) 95%, (3) 99%.arrow_forward

- In creating the T2 measure one mixes P* and T-bills to match the _____ of the market and in creating the M2 measure one mixes P* and T-bills to match the _____ of the market. Group of answer choices beta, alpha alpha, beta standard deviation, beta beta, standard deviationarrow_forwardThe standard deviation of return on investment a is 0.10, while the standard deviation of return on investment b is 0.04. If the correlation coefficient between the returns on A and B is_____________. A. -0.0447 B. -0.0020 C. 0.0020 D. 0.0447arrow_forwardUse the following information to answer the question. Based on above data, determine the expected return? Select one: a. 12.06% b. 19% c. 17.35% d. 16.72%arrow_forward

- Please fill out the parts in the above table that are shaded in yellow. You will notice that there are nine line items Please answer : Covariance with MP Correlation with Market Index Beta CAPM Req. Returnarrow_forwardSuppose the average return on Asset A is 6.6 percent and the standard deviation is 8.6 percent and the average return and standard deviation on Asset B are 3.8 percent and 3.2 percent, respectively. Further assume that the returns are normally distributed. Use the NORMDIST function in Excel® to answer the following questions. a. What is the probability that in any given year, the return on Asset A will be greater than 11 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on Asset B will be greater than 11 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-1. In a particular year, the return on Asset A was −4.25 percent. How likely is it that such a low return will recur at some point in the future? (Do…arrow_forwarduppose the average return on Asset A is 7.1 percent and the standard deviation is 8.3 percent, and the average return and standard deviation on Asset B are 4.2 percent and 3.6 percent, respectively. Further assume that the returns are normally distributed. Use the NORMDIST function in Excel® to answer the following questions. a. What is the probability that in any given year, the return on Asset A will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on Asset B will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-1. In a particular year, the return on Asset A was −4.38 percent. How likely is it that such a low return will recur at some point in the future? (Do not round…arrow_forward

- The following results were obtained in a decision problem where payoffs are profits: EVSI EVwithPI 612 4300 If the efficiency of sample information is 30%, what is the maximum expected monetary value? Maximum EMV =arrow_forwardConsider the information below, compute the expected return, variance, and standard deviation. Show the solution. Probability Return of Assets 25% .30 25% .050 25% .100 25% .280arrow_forwardAccessibility tab summary: Given information for this question is presented in rows 2 through 10. Requirement information is presented in rows 12 through 20. Market Data Return Standard Deviation Beta Market Data 0.120 0.200 1.000 Risk-Free Rate 0.025 0.000 0.000 Company Data A B C Alpha 0.015 0.020 -0.005 Beta 1.200 0.800 1.250 Residual standard deviation, σ(e) 0.105 0.195 0.067 Standard Deviation of Excess Return 0.245 0.235 0.210 Required: Using the data above, please solve for the Sharpe Ratio, Treynor's Measure, and Information Ratio. (Use cells A3 to D10 from the given information to complete this question. Negative answers should be input and displayed as a negative values. All other answers should be input and displayed as positive values.) Risk-Adjusted Performance Measures A B C Market Sharpe Ratio Treynor's…arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning