Concept explainers

a.

To calculate: The probability that the outcome will be between $16,800 and $31,200.

Introduction:

Probability:

The likelihood of the occurrence of an event or of a proposition to be true, when expressed numerically or quantitatively, is termed as probability.

a.

Answer to Problem 20P

The probability that the outcome will be between $16,800 and $31,200 is 0.8664.

Explanation of Solution

The calculation of the expected value (Z) for the outcome being equal to or greater than $16,800 is shown below.

The calculation of the expected value (Z) for the outcome being equal to or lower than $31,200 is shown below.

The Z values are positive as well as negative 1.5. Hence, the probability of the outcome being between $16,800 and $31,200 is 0.8664.

b.

To calculate: The probability that the outcome will be between $14,400 and $33,600.

Introduction:

Probability:

The likelihood of the occurrence of an event or of a proposition to be true, when expressed numerically or quantitatively, is termed as probability.

b.

Answer to Problem 20P

The probability that the outcome will be between $14,400 and $33,600 is 0.9544.

Explanation of Solution

The calculation of the expected value (Z) for the outcome being equal to or greater than $14,400 is shown below.

The calculation of the expected value (Z) for the outcome being equal to or lower than $33,600 is shown below.

The Z values are positive as well as negative 2. Hence, the probability of the outcome being between $14,400 and $33,600 is 0.9544.

c.

To calculate: The probability that the outcome will be at least $14,400.

Introduction:

Probability:

The likelihood of the occurrence of an event or of a proposition to be true, when expressed numerically or quantitatively, is termed as probability.

c.

Answer to Problem 20P

The probability that the outcome will be at least $14,400 is 0.9544.

Explanation of Solution

The calculation of the expected value (Z) for the outcome being at least $14,400 is shown below.

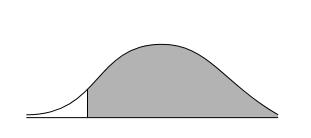

The expected value is 0.4772 when Z is (+ or -) 2 and 0.5000 when Z is 0. So, the probability of the outcome being at least $14,400 is 0.9772. The graph of this probability is shown below.

d.

To calculate: The probability that the outcome will be less than $31,900.

Introduction:

Probability:

The likelihood of the occurrence of an event or of a proposition to be true, when expressed numerically or quantitatively, is termed as probability.

d.

Answer to Problem 20P

The probability that the outcome will be less than $31,900 is 0.9544.

Explanation of Solution

The calculation of the expected value (Z) for the outcome being at least $14,400 is shown below.

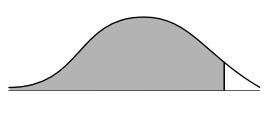

The expected value is 0.4505 when Z is (+ or -) 1.65 and 0.5000 when Z is 0. So, the probability of the outcome being at least $14,400 is 0.9505. The graph of this probability is shown below.

e.

To calculate: The probability that the outcome will be less than $19,200 or greater than $26,400.

Introduction:

Probability:

The likelihood of the occurrence of an event or of a proposition to be true, when expressed numerically or quantitatively, is termed as probability.

e.

Answer to Problem 20P

The probability that the outcome will be less than $19,200 or greater than $26,400 is 0.4672.

Explanation of Solution

The calculation of the expected value (Z) for the outcome being less than $19,200 is shown below.

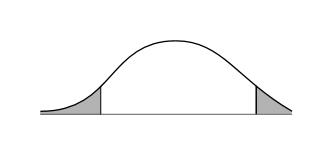

The expected value is 0.3413 when Z is (+ or -) 1 and 0.5000 when Z is 0. So, the probability of the outcome being less than $19,200 is 0.1587 (0.5000 – 0.3413).

The calculation of the expected value (Z) for the outcome being greater than $26,400 is shown below.

The expected value is 0.1915 when Z is (+ or -) 1 and 0.5000 when Z is 0. So, the probability of the outcome being at least $14,400 is 0.3085 (0.5000 – 0.1915).

Hence, the probability that the outcome will be less than $19,200 or greater than $26,400 is 0.4672. The graph of this probability is shown below.

Want to see more full solutions like this?

Chapter 13 Solutions

Foundations Of Financial Management

- uppose the average return on Asset A is 7.1 percent and the standard deviation is 8.3 percent, and the average return and standard deviation on Asset B are 4.2 percent and 3.6 percent, respectively. Further assume that the returns are normally distributed. Use the NORMDIST function in Excel® to answer the following questions. a. What is the probability that in any given year, the return on Asset A will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on Asset B will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-1. In a particular year, the return on Asset A was −4.38 percent. How likely is it that such a low return will recur at some point in the future? (Do not round…arrow_forwarda risk manager gathers the following sample data to analyze annual returns for an asset: 12%, 25% and -1%. he wants to compute the best unbiased estimator of the true population mean and standard deviation. the manager's estimate of the standard deviation for this asset should be closest to a. 0.0111 b. 0.0113 c. 0.1054 d. 0.1204.arrow_forwardSuppose that the returns on an investment are normally distributed with an expected return of 16% and standard deviation of 3%. What is the likelihood of receiving a return that is equal to or less than 19%? (Hint: the area under a curve for 1 std dev is 34.13%, 2 std dev is 47.73% and 3 std dev is 49.87%.).arrow_forward

- Calculate the (a) expected return, (b) standard deviation, and (c) coefficient of variation for an investment with the following probability distribution: Probability Payoff 0.45 32.0% 0.35 -4.0% 0.20 -20.0%arrow_forwardCalculate the range, the expected rate of return, the variance, and the standard deviation for the problem below: Economic Condition Probability Expected Return Better than expected 0.15 0.65 Good 0.25 0.3 Average 0.45 0.15 Poor 0.1 -0.15 Terrible 0.05 -0.35arrow_forwardThe standard deviation of return on investment a is 0.10, while the standard deviation of return on investment b is 0.04. If the correlation coefficient between the returns on A and B is_____________. A. -0.0447 B. -0.0020 C. 0.0020 D. 0.0447arrow_forward

- The return expected from the project no. 542 is 22 percent. The standard deviation of these return is 11 percent. If returns from the project are normally distributed. What is the chance that the project will result in a rate of return above 33 percent?arrow_forwardGiven the data here, Compute the average return for each of the assets from 1929 to 1940 (the Great Depression) (Round to five decimalplaces.) Compute the variance and standard deviation for each of the assets from 1929 to 1940. (Round to five decimalplaces.) Which asset was riskiest during the Great Depression? How does that fit with your intuition? (Round to five decimalplaces.) Note: Notice that the answers for average return, variance and standard deviation must be entered in decimal format.arrow_forwardSuppose the net present values of projects A and B show a distribution as follows. a) Compare the projects by expected value criteria?b) Compare the projects by standard deviation criteria?c) Evaluate A and B projects according to the coefficient of variation criterion?Calculate on paper.arrow_forward

- Four assets have the following distribution of returns. Probability Rate of return (%)Occurrence A B C D0.1 10.0 6.0 14.0 2.00.2 10.0 8.0 12.0 6.00.4 10.0 10.0 10.0 9.00.2 10.0 12.0 8.0 15.00.1 10.0 14.0 6.0 20.0 In each asset alculate The expected rate of return, standard deviation, variance coefficient of variationarrow_forwardAssume that Allied’s average project has a coefficient of variation (CV) in the range of 1.25 to 1.75.Would the lemon juice project be classified as high risk, average risk, or low risk? What type of risk isbeing measured here?arrow_forwardI asked this question before, and got an answer, but I have a question about the response that was given. The original question was: For an initial investment of 100, an investment yields returns of X1 and X2, where X1 and X2 are independent normal random variables with mean 60 and variance 25. What is the probability that the rate of return of this investment is greater than 10%? In the answer that was given it says that the gain of the investment is X1+X2. My question is why can we just group those together as one amount? I was given a formula in my class that says the return on the investment would be the solution to the equation: -100+ X1/(1+r) + X2/(1+r)2=0. If this formula is used, a different solution would result for this problem.arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT