a.

To determine: The Maximum Price per Share.

Introduction: The

The cost of debt is the effective interest rate of cost which a business earns on their current debts. Debt involves in the formation of capital structure. As the debt is considered as a deduction expenditure, the cost of debt is usually determined as after-tax cost in order to formulate similar to the cost of equity.

a.

Answer to Problem 21QP

The Maximum Price per Share is $62.17

Explanation of Solution

Determine the Total Market Value

Therefore the Total Market Value is $52,000,000

Determine the Weight of Debt and Equity

Therefore the Weight of Debt is 26.92% and Equity is 73.08%

Determine the WACC of the Company

Therefore the WACC of the Company is 9.04%

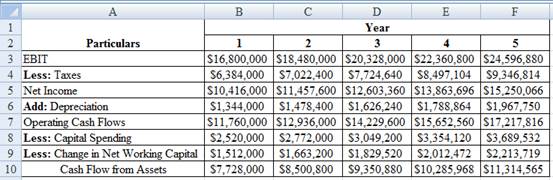

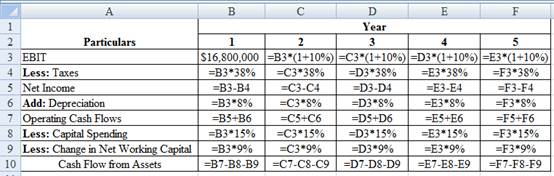

Determine the Cash Flow from Assets

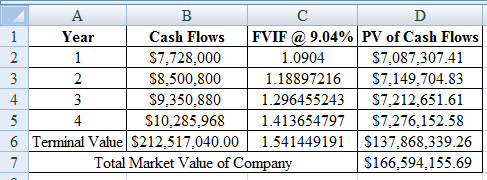

Using a excel spreadsheet we compute the cash flow from assets as,

Excel Spreadsheet:

Excel Workings:

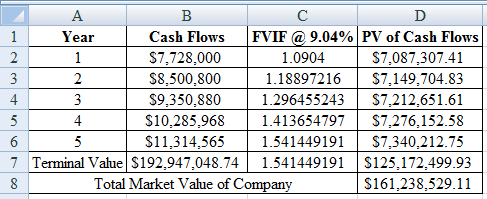

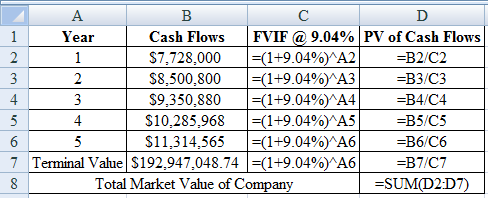

Determine the Terminal Value at the end of Year 5

Therefore the Terminal Value at the end of Year 5 is $192,947,048.74

Determine the Total Market Value of the Company

Using a excel spreadsheet we calculate the total value of company as,

Excel Spreadsheet:

Excel Workings:

Therefore the Total Market Value of the Company is $161,238,529.11

Determine the Total Market Value of Equity

Therefore the Total Market Value of Equity is $121,238,529.11

Determine the Maximum Price per Share

Therefore the Maximum Price per Share is $62.17

b.

To determine: The New Estimate of Maximum Price per Share.

b.

Answer to Problem 21QP

The Maximum Price per Share is $64.92

Explanation of Solution

Determine the Earnings Before Interest on Taxes,

Therefore the Earnings Before Interest on Taxes, Depreciation and Amortization (EBITDA) is $26,564,630

Determine the Terminal Value at the end of Year 5

Therefore the Terminal Value at the end of Year 5 is $212,517,040

Determine the Total Market Value of Company

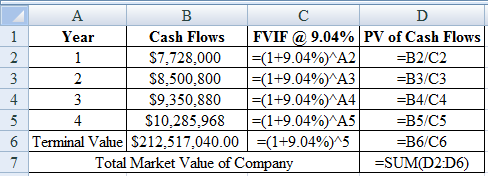

Using a excel spreadsheet we calculate the total value of company as,

Excel Spreadsheet:

Excel Workings:

Therefore the Total Market Value of Company is $166,594,155.69

Determine the Total Market Value of Equity

Therefore the Total Market Value of Equity is $126,594,155.69

Determine the New Estimate of Maximum Price per Share

Therefore the New Estimate of Maximum Price per Share is $64.92

Want to see more full solutions like this?

Chapter 13 Solutions

CORPORATE FIN.(LL)-W/ACCESS >CUSTOM<

- Happy Times, Incorporated, wants to expand its party stores into the Southeast. In order to establish an immediate presence in the area, the company is considering the purchase of the privately held Joe’s Party Supply. Happy Times currently has debt outstanding with a market value of $200 million and a YTM of 5.8 percent. The company’s market capitalization is $440 million and the required return on equity is 11 percent. Joe’s currently has debt outstanding with a market value of $33.5 million. The EBIT for Joe’s next year is projected to be $13 million. EBIT is expected to grow at 8 percent per year for the next five years before slowing to 3 percent in perpetuity. Net working capital, capital spending, and depreciation as a percentage of EBIT are expected to be 7 percent, 13 percent, and 6 percent, respectively. Joe’s has 2.15 million shares outstanding and the tax rate for both companies is 21 percent. a. What is the maximum share price that Happy Times should be willing to pay for…arrow_forwardHappy Times, Incorporated, wants to expand its party stores into the Southeast. In order to establish an immediate presence in the area, the company is considering the purchase of the privately held Joe’s Party Supply. Happy Times currently has debt outstanding with a market value of $200 million and a YTM of 5.8 percent. The company’s market capitalization is $440 million and the required return on equity is 11 percent. Joe’s currently has debt outstanding with a market value of $33.5 million. The EBIT for Joe’s next year is projected to be $13 million. EBIT is expected to grow at 8 percent per year for the next five years before slowing to 3 percent in perpetuity. Net working capital, capital spending, and depreciation as a percentage of EBIT are expected to be 7 percent, 13 percent, and 6 percent, respectively. Joe’s has 2.15 million shares outstanding and the tax rate for both companies is 21 percent. a.What is the maximum share price that Happy Times should be willing to pay for…arrow_forwardHappy Times, Incorporated, wants to expand its party stores into the Southeast. In order to establish an immediate presence in the area, the company is considering the purchase of the privately held Joe's Party Supply. Happy Times currently has debt outstanding with a market value of $220 million and a YTM of 5.8 percent. The company's market capitalization is $460 million and the required return on equity is 12 percent. Joe's currently has debt outstanding with a market value of $34.5 million. The EBIT for Joe's next year is projected to be $14 million. EBIT is expected to grow at 10 percent per year for the next five years before slowing to 3 percent in perpetuity. Net working capital, capital spending, and depreciation as a percentage of EBIT are expected to be 9 percent, 15 percent, and 8 percent, respectively. Joe's has 2.25 million shares outstanding and the tax rate for both companies is 23 percent. a. What is the maximum share price that Happy Times should be willing to pay for…arrow_forward

- Tesla, Inc., wants to expand its infrastucture into the Midwest. In order to establish an immediate an immediate presence in the area, the company is considering the aquisition of the privately held Rob Allen's Used Car Dealership. Tesla currently has debt outstanding with a market value of $325 million and a yield to maturity of 7.25%. The company's market capitalization is $450 million and the required return on equity is 10.25%. Rob's currently has debt outstanding with a market value of $73.5 million.The EBIT for Rob's next year is projected to be $20.35 million. EBIT is expected to grow at 9.75% per year for the next six years before slowing to 4.50% in perpetuity. Net working capital, capital spending, and depreciation as a percentage of EBIT are expected to be 8.5%, 15.20%, and 6.85% respectively. Rob's has 575,000 shares outstanding and the tax rate for both companies is 21%. Based on these estimates, what is the maximum share price that Tesla should be willing to pay…arrow_forwardEnergy Plus Limited (EP) is operating in the booming energy sector. The company recognized that to stay competitive it must implement projects which would reduce the cost of products to its customers. EP’s board of directors approved the recommendation to finance the project by issuing new debt. On January 1, 2014, EP issued new bonds which will mature on December 31, 2038. The bonds have a par value of $1,000 and a coupon rate of 12%. Coupon payments are made semi-annually. a) What would be the value of the bonds on December 31, 2018, if the interest rates had risen to 16%? Based on the price of the bond, how would you classify the bond? b) What would be their value on June 30, 2026, if interest rates had fallen to 8%? Based on the price of the bond, how would you classify the bond? c) If the bonds had a value of $860.00 on June 30, 2024, what would be their yield to maturity on that date?arrow_forwardThe company wants to take a $500.0 mil loan to rebuild its position and expand its line of business to heavy equipment. Should the company take the loan or seek other forms of investment? notes -Business overseas- 40% of company revenues -Domestic market- 60% of company revenues -Increase in competition -The company has over the years relied mainly on issuing long-term bonds to finance its capital projects. -As of today, the firm has 50.0 million shares of common stock outstanding. Ratio Analysis 2021 Est. 2020 2019 Industry Average Liquidity Ratios Current Ratio (times) 2.34 3.22 3.68 4.2 Quick Ratio (times) 0.91 1.24 1.79 2.1 Asset Management Ratios Average sales/day 10.96 8.22 7.81 9 Inventory Turnover Ratio (times) 4.43 3.74 5.06 9 Days Sales Outstanding (days) 38.32 45.62 40.34 36 Fixed Assets Turnover…arrow_forward

- Boxer & Company are planning to enter export market. The Company needs to spend around $300 million to balance and upgrade manufacturing facilities to cater for new markets. The firm’s present optimal capital structure is as under. Long-term debt $180,000,000 Common equity 170,000,000 Total liabilities and equity $ 350,000,000 New bonds will have a 12 percent coupon rate and will be sold at par. Common stock, currently selling at $80 a share, can be sold to net the company $76 a share. Stockholders’ required rate of return is estimated to be 15 percent comprising of 9% dividend yield and 6% growth. Retained earnings are estimated to be $ 100 million. The marginal tax rate is 35%. Required: (a.) To maintain the present capital structure, how much of the capital budget can be financed by debt and equity? (b.) How much of the needed funds will be generated internally and externally? (c.) Calculate the cost of each of the equity components? (d.) At what level of the capital expenditure…arrow_forwarduppose a firm follows a moderate current asset investment policy, but it is now considering a change, perhaps to a restricted or maybe to a relaxed policy. The firm's annual sales are €300,000; its fixed assets are €100,000; its target capital structure calls for 50% debt and 50% equity; its EBIT is €35,000; the interest rate on its debt is 10%; and its tax rate is 35%. With a restricted policy, current assets will be 10% of sales, while under a relaxed policy they will be 20% of sales. What is the difference in the projected ROEs between the restricted and relaxed policies?arrow_forwardAtlas Corporation wants to determine the optimal level of current assets that should be kept in the next year. The company is currently undergoing expansion, after which sales are expected to increase approximately by PKR 1 million. The company wants to maintain a 40% equity ratio and its total fixed assets are of PKR 1 million. Atlas’s interest rate is currently 8% on both short-term and longer-term debt (which the firm uses in its permanent structure). The company must choose between three strategies and decide which one is better. (1) a lean and mean policy where current assets would be only 35% of projected sales, (2) a moderate policy where current assets would be 40% of sales, and (3) a lenient policy where current assets would be 50% of sales. Earnings before interest and taxes should be 10% of total sales, and the federal-plus-state tax rate is 35%. a. What is the expected return on equity under each current asset level? (show all your workings)arrow_forward

- Atlas Corporation wants to determine the optimal level of current assets that should be kept in the next year. The company is currently undergoing expansion, after which sales are expected to increase approximately by PKR 1 million. The company wants to maintain a 40% equity ratio and its total fixed assets are of PKR 1 million. Atlas’s interest rate is currently 8% on both short-term and longer-term debt (which the firm uses in its permanent structure). The company must choose between three strategies and decide which one is better. (1) a lean and mean policy where current assets would be only 35% of projected sales, (2) a moderate policy where current assets would be 40% of sales, and (3) a lenient policy where current assets would be 50% of sales. Earnings before interest and taxes should be 10% of total sales, and the federal-plus-state tax rate is 35%. What is the expected return on equity under each current asset level? (Solved) In this problem, we assume that expected sales are…arrow_forwardAtlas Corporation wants to determine the optimal level of current assets that should be kept in the next year. The company is currently undergoing expansion, after which sales are expected to increase approximately by PKR 1 million. The company wants to maintain a 40% equity ratio and its total fixed assets are of PKR 1 million. Atlas’s interest rate is currently 8% on both short-term and longer-term debt (which the firm uses in its permanent structure). The company must choose between three strategies and decide which one is better. (1) a lean and mean policy where current assets would be only 35% of projected sales, (2) a moderate policy where current assets would be 40% of sales, and (3) a lenient policy where current assets would be 50% of sales. Earnings before interest and taxes should be 10% of total sales, and the federal-plus-state tax rate is 35%. What is the expected return on equity under each current asset level? In this problem, we assume that expected sales are…arrow_forwardCompany X is considering an expansion. The project has an estimated internal rate of return equal to 8%. The company has a debt to equity ratio equal to one. The yield to maturity on its bonds is 5%, while the cost of the company’s equity is estimated to be 15%. The company’s CEO, who is keen on the expansion project, argues that the project would be profitable if the company were to entirely finance it by issuing debt. The CFO, however, is sceptical and believes there is a logical flaw in the CEO’s argument. Who do you think is right? In no more than 200 words, give reasons for your answer by referencing relevant corporate finance theories.arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning