Corporate Financial Accounting

14th Edition

ISBN: 9781305653535

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 14.2ADM

Deere: Profitability analysis

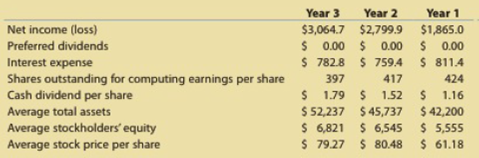

Deere & Company manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deere's credit division loans money to customers to finance the purchase of their farm and construction equipment.

The following information is available for three recent years (in millions except per-share amounts):

- 1. Calculate the following ratios for each year (round ratios and percentages to one decimal place, except for per-share amounts):

- A. Return on total assets

- B. Return on stockholders’ equity

- C. Earnings per share

- D. Dividend yield

- E. Price-earnings ratio

- 2. Based on these data, evaluate Deere s profitability.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Deere & Company manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deere’s credit division loans money to customers to finance the purchase of their farm and construction equipment.The following information is available for three recent years (in millions except pershare amounts):

Please see the attachment for details:

1. Calculate the following ratios for each year, rounding ratios and percentages to one decimal place, except for per-share amounts:a. Return on total assetsb. Return on stockholders’ equityc. Earnings per shared. Dividend yielde. Price-earnings ratio2. Based on these data, evaluate Deere’s profitability.

Rotorua Products, Ltd., of New Zealand markets agricultural products for the burgeoning Asian consumer market. The company’s current assets, current liabilities, and sales have been reported as follows over the last five years (Year 5 is the most recent year):

image

$NZ stands for New Zealand dollars.

Required:

Express all of the asset, liability, and sales data in trend percentages. (Show percentages for each item.) Use Year I as the base year and carry computations to one decimal place.

Comment on the results of your analysis.

A firm reported the following income statement (all figures are in thousands of dollars):

Net Sales

1,105

-

operating costs

200

-

depreciation & amortization

245

=

Operating Income (EBIT)

?

-

interest

19

=

Earnings Before Taxes (EBT)

?

-

taxes

?

=

Net Income

?

What is the amount of taxes the firm is charged, given that the tax rate is 25%?

answer using one decimal figure.

Chapter 14 Solutions

Corporate Financial Accounting

Ch. 14 - Briefly explain the difference between liquidity,...Ch. 14 - What is the advantage of using comparative...Ch. 14 - Prob. 3DQCh. 14 - How would the current and quick ratios of a...Ch. 14 - Prob. 5DQCh. 14 - What do the following data, taken from a...Ch. 14 - A. How does the rate earned on total assets differ...Ch. 14 - Kroger, a grocery store, recently had a...Ch. 14 - Prob. 9DQCh. 14 - Prob. 10DQ

Ch. 14 - Horizontal analysis The comparative accounts...Ch. 14 - Vertical analysis Income statement information for...Ch. 14 - Current position analysis The following items are...Ch. 14 - Accounts receivable analysis A company reports the...Ch. 14 - Inventory analysis A company reports the...Ch. 14 - Prob. 14.6BECh. 14 - Prob. 14.7BECh. 14 - Asset turnover A company reports the following:...Ch. 14 - Prob. 14.9BECh. 14 - Common stockholders' profitability analysis A...Ch. 14 - Earnings per share and price-earnings ratio A...Ch. 14 - Vertical analysis of income statement Revenue and...Ch. 14 - Prob. 14.2EXCh. 14 - Common-sized income statement Revenue and expense...Ch. 14 - Vertical analysis of balance sheet Balance shed...Ch. 14 - Horizontal analysis of the income statement Income...Ch. 14 - Current position analysis The following data were...Ch. 14 - Prob. 14.7EXCh. 14 - Current position analysis The bond indenture for...Ch. 14 - Accounts receivable analysis The following data...Ch. 14 - Accounts receivable analysis Xavier Stores Company...Ch. 14 - Inventory analysis The following data were...Ch. 14 - Inventory analysis QT, Inc. and Elppa Computers,...Ch. 14 - Ratio of liabilities to stockholders' equity and...Ch. 14 - Prob. 14.14EXCh. 14 - Ratio of liabilities to stockholders' equity and...Ch. 14 - Prob. 14.16EXCh. 14 - Profitability ratios The following selected data...Ch. 14 - Profitability ratios Ralph Lauren Corporation...Ch. 14 - Six measures of solvency or profitability The...Ch. 14 - Five measures of solvency or profitability The...Ch. 14 - Earnings per share, price-earnings ratio, dividend...Ch. 14 - Prob. 14.22EXCh. 14 - Earnings per share, discontinued operations The...Ch. 14 - Prob. 14.24EXCh. 14 - Unusual items Explain whether Colston Company...Ch. 14 - Comprehensive Income Anson Industries, Inc....Ch. 14 - Horizontal analysis of income statement For 20V2,...Ch. 14 - Prob. 14.2APRCh. 14 - Prob. 14.3APRCh. 14 - Measures of liquidity, solvency, and profitability...Ch. 14 - Solvency and profitability trend analysis Addai...Ch. 14 - Horizontal analysis of income statement For 20Y2,...Ch. 14 - Prob. 14.2BPRCh. 14 - Effect of transactions on current position...Ch. 14 - Measures of liquidity, solvency and profitability...Ch. 14 - Solvency and profitability trend analysis Crosby...Ch. 14 - Financial Statement Analysis The financial...Ch. 14 - Prob. 14.1ADMCh. 14 - Deere: Profitability analysis Deere Company...Ch. 14 - Marriott and Hyatt: Solvency and profitability...Ch. 14 - Prob. 14.1TIFCh. 14 - Prob. 14.3TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Deere Company (DE) manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deeres credit division loans money to customers to finance the purchase of their farm and construction equipment. The following information is available for three recent years (in millions except per-share amounts): 1. Calculate the following ratios for each year. Round ratios and percentages to one decimal place, except for per-share amounts, which should be rounded to the nearest cent. a. Return on total assets b. Return on stockholders' equity c. Earnings per share d. Dividend yield e. Price-earnings ratio 2. Based on these data, evaluate Deeres profitability.arrow_forwardNeiman Marcus Group (NMG) is one of the largest luxury fashion retailers in the world. Kohls Corporation (KSS) sells moderately priced private and national branded products through more than 1,100 department stores located throughout the United States. The current assets and current liabilities at the end of a recent year for both companies are as follows (in millions): a. Would an analysis of working capital between the two companies be meaningful? Explain. b. Compute the quick ratio for both companies. Round to one decimal place. c. Interpret your results.arrow_forwardMike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture of office supplies. To be able to assess the financial capabilities of the company, Mike has been given the companys financial statements for the 2 most recent years. Required: Note: Round all answers to two decimal places. 1. Compute the following for each year: (a) return on assets, (b) return on stockholders equity, (c) earnings per share, (d) price-earnings ratio, (e) dividend yield, and (f ) dividend payout ratio. 2. CONCEPTUAL CONNECTION Based on the analysis in Requirement 1, would you invest in the common stock of Kepler?arrow_forward

- Grammatico Company has just completed its third year of operations. The income statement is as follows: Selected information from the balance sheet is as follows: Required: Note: Round answers to two decimal places. 1. Compute the times-interest-earned ratio. 2. Compute the debt ratio. 3. CONCEPTUAL CONNECTION Assume that the lower quartile, median, and upper quartile values for debt and times-interest-earned ratios in Grammaticos industry are as follows: How does Grammatico compare with the industrial norms? Does it have too much debt?arrow_forwardReturn on assets The following data (in millions) were adapted from recent financial statements of Tootsie Roll Industries Inc. (TR): The percent a company adds to its cost of sales to determine selling price is called a markup. What is Tootsie Roll’s markup percent? Round to one decimal place.arrow_forwardAnalyze and compare Zynga, Electronic Arts, and Take-Two Data (in millions) from recent financial statements of Zynga Inc. (ZNGA), Electronic Arts Inc. (EA), and Take-Two Interactive Software, Inc. (TTWO) are as follows: a. Compute the working capital for Year 2 and Year 1 for each company. b. Which company has the largest working capital? c. Compute the current ratio for Year 2 and Year 1 for each company. Round to one decimal place. d. For Year 2, rank the companies from most liquid to least liquid based upon the current ratio.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License