Concept explainers

Cost allocation to divisions. Forber Bakery makes baked goods for grocery stores and has three divisions: bread, cake, and doughnuts. Each division is run and evaluated separately, but the main headquarters incurs costs that are indirect costs for the divisions. Costs incurred in the main headquarters are as follows:

| Human resources (HR) costs | $1,900,000 |

| Accounting department costs | 1,400,000 |

| Rent and |

1,200,000 |

| Other | 600,000 |

| Total costs | $5,100,000 |

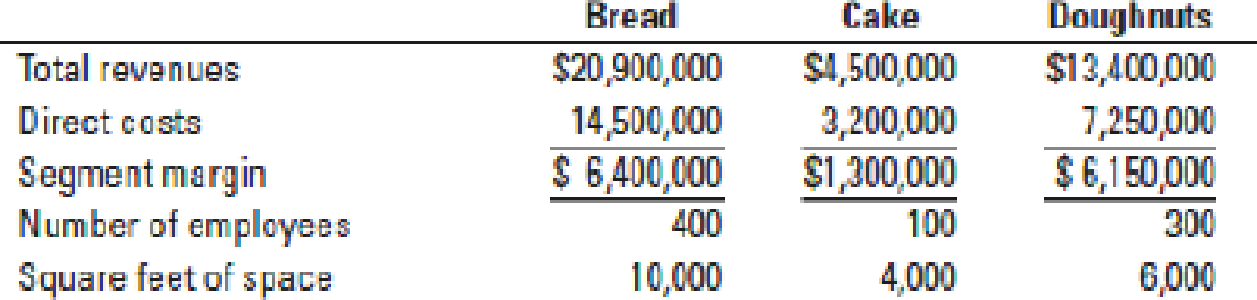

The Forber upper management currently allocates this cost to the divisions equally. One of the division managers has done some research on activity-based costing and proposes the use of different allocation bases for the different indirect costs—number of employees for HR costs, total revenues for accounting department costs, square feet of space for rent and depreciation costs, and equal allocation among the divisions of “other” costs. Information about the three divisions follows:

- 1. Allocate the indirect costs of Forber to each division equally. Calculate division operating income after allocation of headquarter costs.

- 2. Allocate headquarter costs to the individual divisions using the proposed allocation bases. Calculate the division operating income after allocation. Comment on the allocation bases used to allocate headquarter costs.

- 3. Which division manager do you think suggested this new allocation. Explain briefly. Which allocation do you think is “better?”

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Horngren's Cost Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (16th Edition)

- A manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardA manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardCost allocation to divisions. Forber Bakery makes baked goods for grocery stores and has three divisions: bread, cake, and doughnuts. Each division is run and evaluated separately, but the main headquarters incurs costs that are indirect costs for the divisions. Costs incurred in the main headquarters are as follows: The Forber upper management currently allocates this cost to the divisions equally. One of the division managers has done some research on activity-based costing and proposes the use of different allocation bases for the different indirect costs—number of employees for HR costs, total revenues for accounting department costs, square feet of space for rent and depreciation costs, and equal allocation among the divisions of “other” costs. Information about the three divisions follows: Allocate the indirect costs of Forber to each division equally. Calculate division operating income after allocation of headquarter costs. Allocate headquarter costs to the individual…arrow_forward

- Baldwin Enterprises has two service departments, Personnel and Legal, and two operating divisions, Eastern and Western. Personnel costs are allocated on the basis of employees and Legal costs are allocated on the basis of hours. A summary of Baldwin operations follows: Personnel 120 10,800 $ 300,000 5,400 $ 1,200,000 $ 160,000 Baldwin Enterprises estimates that the cost structure in its operations is as follows: Employees Hours Department direct costs Variable costs Fixed costs Total costs Avoidable fixed costs Personnel $200,000 250,000 $ 450,000 $ 65,000 Required A Required B Required C Legal Maximum amount 40 0 Legal $ 56,000 134,000 $ 190,000 $ 35,000 Eastern Complete this question by entering your answers in the tabs below. Western $575,000 245,000 $ 820,000 $300,000arrow_forwardSpirits and More operates two departments, Cutting and Fabrication. Two service departments, maintenance and purchasing, are also included within the company. The operating costs and distribution of each service department's efforts to the other departments is as follows: Maintenance Purchasing Operating Costs Maintenance 0% 25% $87,000 Purchasing 35% 0% 16,000 Cutting 15% 60% 80,000 Fabrication 50% 15% 56,000 Using the direct method of allocating support costs, what is the total cost accumulated in the fabrication department? Question options: a) $56,000.00 b) Maintenance Purchasing Costs c) $70,123.00 d) $77,750.00 e) $126,123.00arrow_forwardThe Riverbed Brokerage firm is organized into two major sales divisions: institutional clients and retail clients. The firm also has two support departments: research and administration. The research department’s costs are allocated to the other departments based on a log of hours spent on tasks for each user. The administration department’s costs are allocated based on the number of employees in each department. Records are available for last period as follows: Support departments Operating departments Research Administration Institutional RetailPayroll costs $ 338,400 $ 289,700 $ 366,600 $ 585,200Other costs $ 231,370 $ 163,800 $ 112,830 $ 238,870Research hours 100 200 500 300Number of employees 7 10…arrow_forward

- Ford Bakery makes baked goods for grocery stores, and has three divisions: bread, cake, and doughnuts. Each division is run and evaluated separatelv. but the main headquarters incurs costs that are indirect costs for the divisions. E (Click to view information for each division and the main headquarters.) Data table Read the requirements. Costs incurred in the main headquarters are as follows: Requirement 1. Allocate the indirect costs of Ford to each division equally. Calculate div or parentheses.) Human resources (HR) costs $ 2,300,000 Bread Cake Dough Accounting department costs 1,800,000 Segment margin $ 7,200,000 $ 1,400,000 $ 6 Rent and depreciation 640,000 Allocated headquarter costs Other 660,000 2$ 5,400,000 Operating income (loss) Total costs The Ford upper management currently allocates this cost to the divisions equally. One of the division managers has done some research on activity-based costing and proposes the use of different allocation bases for the different indirect…arrow_forwardFlamingos, Inc. has two service departments and two operating (production) departments. Administrative Department costs are allocated to the Assembly and Packaging departments based on the number of employees, and Maintenance Department costs are allocated to the Assembly and Packaging departments based on square feet occupied. Data for these departments follows: Department Direct Expenses No. of Employees Square Feet Administrative $ 30,000 Maintenance 15,000 Assembly 70,000 6 2,000 Packaging 45,000 4 3,000 The total amount of service department costs (Administrative and Maintenance) that would be allocated to the Packaging Department is:arrow_forwardDepartmental information for the four departments at Samoa Industries is provided below. Total Cost Cost Driver Square Feet Number of Employees Janitorial $150,000 Square footage serviced 200 40 Cafeteria 50,000 Number of employees 20,000 12 Cutting 1,125,000 4,000 120 Assembly 1,100,000 16,000 40 The Janitorial and Cafeteria departments are support departments. Samoa uses the sequential method to allocate support department costs, first allocating the costs from the Janitorial Department to the Cafeteria, Cutting, and Assembly departments. i need help determining the dollar amount of the cafetria costs to be allocated to the: cutting department assembly departmentarrow_forward

- Cost allocation and decision making. Reidland Manufacturing has four divisions: Acme, Dune, Stark, and Brothers. Corporate headquarters is in Minnesota. Reidland corporate headquarters incurs costs of $16,800,000 per period, which is an indirect cost of the divisions. Corporate headquarters currently allocates this cost to the divisions based on the revenues of each division. The CEO has asked each division manager to suggest an allocation base for the indirect headquarters costs from among revenues, segment margin, direct costs, and number of employees. The following is relevant information about each division:arrow_forwardDirect Method of Support Department Cost Allocation Chekov Company has two support departments, Human Resources and General Factory, and two producing departments, Fabricating and Assembly. Direct costs Normal activity: Number of employees Square footage Support Departments Producing Departments Human Resources $160,000 General Factory $360,000 Fabricating Assembly $114,200 $95,000 60 45 80 1,500 6,000 14,000 The costs of the Human Resources Department are allocated on the basis of number of employees, and the costs of General Factory are allocated on the basis of square footage. Chekov Company uses the direct method of support department cost allocation. Required: 1. Calculate the allocation ratios for the four departments using the direct method. If an amount is zero, enter "0". Round your answer to the nearest cent. Proportion of Driver Used by Human Resources Human Resources General Factory General Factory Fabricating Assembly 2. Using the direct method, allocate the costs of the…arrow_forward(Appendix 48) Direct Method of Support Department Cost Allocation Stevenson Company is divided into two operating divisions: Battery and Small Motors. The company allocates power and general factory costs to each operating division using the direct method. Power costs are allocated on the basis of the number of machine hours and general factory costs on the basis of square footage. Support department cost allocations using the direct method are based on the following data: Support Departments Operating Divisions General Small Power Factory Battery Motors Overhead costs $160,000 $430,000 $163,000 $84,600 Machine hours 2,000 2,000 7,500 2,000 Square footage 1,000 1,500 10,000 20,000 Direct labor hours 18,000 60,000 Required: 1. Calculate the allocation ratios for Power and General Factory. (Note: Carry these calculations out to four decimal places, if necessary.) Power General Factory 0.8750 X Battery 0.8750 X Small Motors 2. Allocate the support service costs to the operating divisions.…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub