Managerial Accounting - With Helios Access

5th Edition

ISBN: 9780134493916

Author: Braun

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 14.48ACT

Using financial statement ratios to analyze Coca-Cola and PepsiCo (Learning Objectives 1, 2, 3, & 4)

REAL LIFE

The Coca-Cola Company and PepsiCo, Inc., are fierce competitors in the beverage and snack markets. A perennial question among consumers is “Coke or Pepsi”? In this case, we will be looking at the financial positions of both companies to answer the question of which company is in a stronger financial position, Coke or Pepsi.

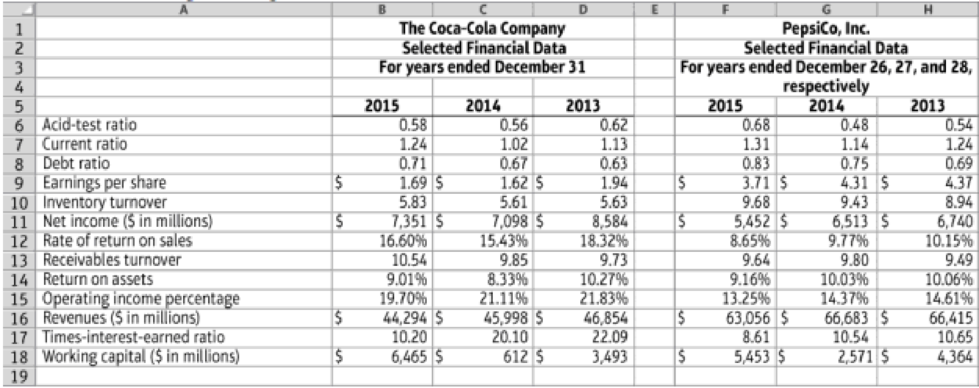

Following is a table of various financial data and ratios for both Coca-Cola and PepsiCo. The data are arranged in alphabetic order.

14.7-99 Full Alternative Text

Requirements

- 1. Rearrange the data and ratios into a report format that groups similar data and ratios together, to make it easier to analyze the data.

- 2. Using the given financial data for The Coca-Cola Company, discuss the company’s:

- a. Ability to pay current liabilities;

- b. Ability to sell inventory and collect receivables;

- c. Ability to pay long-term debt; and

- d. Profitability.

- 3. Using the given financial data for PepsiCo, Inc., discuss the company’s:

- e. Ability to pay current liabilities;

- f. Ability to sell inventory and collect receivables;

- g. Ability to pay long-term debt; and

- h. Profitability.

- 4. Now compare Coca-Cola’s financial position to PepsiCo’s financial position. How do the two companies compare in the following areas?

- i. Ability to pay current liabilities

- j. Ability to sell inventory and collect receivables

- k. Ability to pay long-term debt

- l. Profitability

- 5. What conclusions can you draw from your analysis of the two companies? Which company do you think is in a stronger financial position?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

(Learning Objective 5: Differentiate financing with debt vs. equity) OrchardMedical Goods is embarking on a massive expansion. Assume the plans call for opening20 new stores during the next two years. Each store is scheduled to be 30% larger than thecompany’s existing locations, offering more items of inventory and with more elaborate displays. Management estimates that company operations will provide $1.0 million of the cashneeded for expansion. Orchard Medical must raise the remaining $4.75 million from outsiders.The board of directors is considering obtaining the $4.75 million either by borrowing at 4%or by issuing an additional 200,000 shares of common stock. This year the company has earned$5 million before interest and taxes and has 200,000 shares of $1-par common stock outstanding. The market price of the company’s stock is $23.75 per share. Assume that income beforeinterest and taxes is expected to grow by 30% each year for the next two years. The company’smarginal income tax…

Please help, we have this example out of our textbook tthat we have to do for preperation for our test next week. Due to online learning I don not understand the steps or formulas needed to complete this question

You are an investment analyst at FI Investments tasked to value FBC firm a Southern Agricultural Conglomerate. The following financial information was recently released for FBC. The company’s 2015 and 2014 annual financial reports are contained in the tables below, along with important additional information:

FBC statement of financial position (R millions)

2015

2014

Cash and equivalents

R149

R83

Accounts receivable

295

265

Inventory

275

285

Total current assets

R719

R633

Total fixed assets

3 909

3 856

Accounts payable

228

220

Notes payable

0

0

Total current liabilities

228

220

Long term debt

1 800

1 650

Total liabilities and…

Please help, we have this example out of our textbook tthat we have to do for preperation for our test next week. Due to online learning I don not understand the steps or formulas needed to complete this question

You are an investment analyst at FI Investments tasked to value FBC firm a Southern Agricultural Conglomerate. The following financial information was recently released for FBC. The company’s 2015 and 2014 annual financial reports are contained in the tables below, along with important additional information:

FBC statement of financial position (R millions)

2015

2014

Cash and equivalents

R149

R83

Accounts receivable

295

265

Inventory

275

285

Total current assets

R719

R633

Total fixed assets

3 909

3 856

Accounts payable

228

220

Notes payable

0

0

Total current liabilities

228

220

Long term debt

1 800

1 650

Total liabilities and…

Chapter 14 Solutions

Managerial Accounting - With Helios Access

Ch. 14 - (Learning Objective 1) Which of the following...Ch. 14 - Prob. 2QCCh. 14 - Prob. 3QCCh. 14 - Prob. 4QCCh. 14 - (Learning Objective 3) Which of the following is...Ch. 14 - (Learning Objective 4) Working capital is defined...Ch. 14 - Prob. 7QCCh. 14 - Prob. 8QCCh. 14 - Prob. 9QCCh. 14 - Prob. 10QC

Ch. 14 - Prob. 14.1SECh. 14 - Find trend percentages (Learning Objective 1)...Ch. 14 - Prob. 14.3SECh. 14 - Prepare common-size income statements (Learning...Ch. 14 - Analyze common-size income statements (Learning...Ch. 14 - Cartwrights Data Set used for S14-6 through...Ch. 14 - Cartwrights Data Set used for S14-6 through...Ch. 14 - Cartwrights Data Set used for S14-6 through...Ch. 14 - Prob. 14.9SECh. 14 - Prob. 14.10SECh. 14 - Prob. 14.11SECh. 14 - Prob. 14.12AECh. 14 - Prob. 14.13AECh. 14 - Prob. 14.14AECh. 14 - Prob. 14.15AECh. 14 - Prob. 14.16AECh. 14 - Calculate ratios (Learning Objective 4) Kelleher...Ch. 14 - Prob. 14.18AECh. 14 - Prob. 14.19AECh. 14 - Prob. 14.20AECh. 14 - Prob. 14.21AECh. 14 - Classify company sustainability measurements into...Ch. 14 - Prob. 14.23BECh. 14 - Prob. 14.24BECh. 14 - Prob. 14.25BECh. 14 - Prob. 14.26BECh. 14 - Prob. 14.27BECh. 14 - Calculate ratios (Learning Objective 4) Ponderosa...Ch. 14 - Prob. 14.29BECh. 14 - Prob. 14.30BECh. 14 - Prob. 14.31BECh. 14 - Calculate ratios (Learning Objective 4) Thornton...Ch. 14 - Prob. 14.33BECh. 14 - Prob. 14.34APCh. 14 - Comprehensive analysis (Learning Objectives 2, 3, ...Ch. 14 - Prob. 14.36APCh. 14 - Ratio analysis over two years (Learning Objective...Ch. 14 - Prob. 14.38APCh. 14 - Prob. 14.39BPCh. 14 - Prob. 14.40BPCh. 14 - Prob. 14.41BPCh. 14 - Ratio analysis over two years (Learning Objective...Ch. 14 - Make an investment decision (Learning Objective 4)...Ch. 14 - Prob. 14.44SCCh. 14 - Discussion Questions 1. Describe horizontal...Ch. 14 - Prob. 14.47ACTCh. 14 - Using financial statement ratios to analyze...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Two classes used the same accounting textbooks, had the same arrangements, and showed equal intellectual ability and scores on a science pre-test. Why did one class score much higher on the final achievement test?A. Environmental factors in the classroom of the successful group were more conducive to learningB.The accounting teacher of the successful group explained the materials in more detailC. The parents of the successful group exerted severed pressure on these studentsD. The successful group had class-supervised study periodsE. The successful group had more students who liked the subjectarrow_forwardPlease help, this is an example out of our textbook that needs to be done in preperation for our test later this week. Due to online learning I have fallen behind and don't know what steps to follow or what formulas to use. You are an investment analyst at FI Investments tasked to value FBC firm a Southern Agricultural Conglomerate. The following financial information was recently released for FBC. The company’s 2018 and 2017 annual financial reports are contained in tables 1 and 2 below, along with important additional information: Table 1: FBC statement of financial position (R millions) 2018 2017 Cash and equivalents R149 R83 Accounts receivable 295 265 Inventory 275 285 Total current assets R719 R633 Total fixed assets 3 909 3 856 Accounts payable 228 220 Notes payable 0 0 Total current liabilities 228 220 Long term debt 1 800 1 650 Total…arrow_forwardCompare and contrast the four categories of financial ratios we discussed in class. Discuss how the business owners and potential investors could benefit from these ratios. What are clear indicators of success vs. poor operations?arrow_forward

- Profit Planning and Control This case is a manufacturer and could make specialty bikes, ski or outdoor equipment, computers, food like chocolates, saltwater taffy, cookies, or donuts, etc. Create the balance sheet, income statement, and statement of the cash flow from the following information. Use the following information for the learning experiences Sales volume units = 11,000 Sales price/unit = $100 Variable manufacturing costs/unit = $60 Fixed manufacturing costs = $210,000 Fixed sales & administration costs = $190,000 Business income tax rate = 25% Current assets = $250,000 (Cash $50,000, Accounts Receivables $100,000, Inventory $100,000) Fixed assets = $750,000 Current liabilities = $200,000 (Accounts Payable $100,000, Short Term Debt $100,000) Long Term Debt = $300,000 Owners' Equity = $500,000arrow_forwardA) Good decision making in business goes a long way to ensure long term success andsurvival amidst the cutthroat competition that one faces. Do an analysis of the three mostimportant financing decisions that are taken – examine the main features of such decisionsand also evaluate the factors that affect the respective decisions. 4 B) Let’s say you are considering investing in a popcorn business. The popcorn machinecosts $1000. The Cash flows for 5 years are given below: CF0 -$1000CF1 $100CF2 $500CF3 $200CF4 $400CF5 $300 Given rate of interest at 9%, calculate the Net present Value of the above business.arrow_forwardPlease review the rubric prior to beginning the assignment to become familiar with the expectations for successful completion.You are required to submit this assignment to LopesWrite. Please refer to the directions in the Student Success Center.Paul Duncan, financial manager of EduSoft Inc., is facing a dilemma. The firm was founded 5 years ago to provide educational software for the rapidly expanding primary and secondary school markets. Although EduSoft has done well, the firm's founder believes an industry shakeout is imminent. To survive, EduSoft must grab market share now, and this will require a large infusion of new capital.Because he expects earnings to continue rising sharply and looks for the stock price to follow suit, Mr. Duncan does not think it would be wise to issue new common stock at this time. On the other hand, interest rates are currently high by historical standards, and the firm's B rating means that interest payments on a new debt issue would be prohibitive.…arrow_forward

- After illustrating how to account for investments if the investor has significant influence over the investee’s financial and operating policies, the students were given the opportunity to confirm if they correctly understood the lesson on the equity method. Several transactions of the same nature were given a number of times to increase the likelihood of retention. The teacher is applying the internal mental process of *A. Responding to questions to enhance encoding and verificationB. Reinforcement and assessment of correct performance.C. Creating a level of expectation for learningD. Activating stimuli/receptorsarrow_forwardQuestion: XYZ Company, a retail business, wants to evaluate its financial performance for the current fiscal year. As a financial analyst, you have been tasked with conducting a comprehensive financial analysis. Develop a detailed set of questions that cover various aspects of the company's financial health, including profitability, liquidity, solvency, efficiency, and market performance. Additionally, explain the importance of each question in assessing the company's financial position and making informed business decisions. Your analysis will consider key financial ratios, trend analysis, and comparisons with industry benchmarks to provide a holistic evaluation of XYZ Company's financial performance.arrow_forward1. Compute for the profitability ratios of both Elen and Melanie. Which of the two companies do you believe is more profitable? 2. Compute for the operational efficiency ratios of both Elen and Melanie. Which of the two companies do you believe is more efficient? 3. Compute for the financial health ratios of both Elen and Melanie. Which of the two companies do you believe is more financially healthy?arrow_forward

- Finance professionals make decisions that fall into three distinctive areas: corporate finance, capital markets, and investments. Below is a set of decisions made by finance professionals. Categorize the decisions according to the area of finance to which they belong. Decision Corporate Finance Capital Markets Investments Ethan must make a decision on how to cut costs so that his company can generate extra cash flow to acquire assets. Radford works for an investment bank and makes decisions about the sale of new common stock by ABCL Inc. Aakash works for a financial advising firm. He must create a financial plan and come up with a list of securities in which his client can invest. Aakash must make decisions regarding the investments that he should recommend to his clients to include in their portfolio.arrow_forward8.-Relate the local business examples, to each of the Financial Manager's objectives. Instructions:Choose Profit or Wealth A) A congal, profit or wealth? B) Christmas gift wrapping, profit or wealth? C) El rosal flour mill - profit or wealth? D) Merendero Manuets, utility or wealth? E) Sakura Restaurant, profit or wealth? (This is a class exercise)arrow_forwardYou are a financial consultant. You are hired by a manufacturing company to assess its performance Based on financial ratios. Your task is to come up with the following: (1) financial analysis using financial ratios on liquidity, solvency or stability, and profitability; (2) trend analysis, both vertical and horizontal; and (3) comparative financial statements. The analysis should be benchmarked with competitors. Prepare a report indicating your comments on the financial health and performance of the company (as benchmarked with competitors) using the following liquidity ratios: (1) current ratio, (2) receivable turnover, (3) inventory turnover, and (4) quick ratio. Give your insights into the relative solvency or stability of the company (as benchmarked with the competitors) using the following ratios: (1) debt ratio, (2) times interest earned ratio, and (3) debt - equity ratio, Also, assess the relative profitability of the company (as benchmarked with competitors) using the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Topic 6 - Financial statement analysis; Author: drdavebond;https://www.youtube.com/watch?v=uUnP5qkbQ20;License: Standard Youtube License