(a)

Effects of higher interest rate on households and firm behavior.

(a)

Explanation of Solution

If the Federal Reserve System rises the interest rates, then the borrowing of items become more costly. Therefore, households will reduce the purchase of durable goods such as auto mobiles and houses. So when the rate of interest rises, consumers spending on durable goods reduce.

In the case of firms, when the rate of interest rises, cost of capital becomes higher. Therefore firms will reduce the spending on investment. So when the rate of interest rises, investment will reduce.

Rate of interest: The rate of interest refers to that percentage at which the money is borrowed or is taken as a loan. The amount to be paid as interest is calculated on this given percentage.

(b)

Effects of higher interest rate on bonds.

(b)

Explanation of Solution

When the rate of interest rises by the Federal Reserve, will fall the existing values of fixed rate bonds. Because, in the case of fixed rate bonds, if the holder paying 7% for the next 10 years is become simply worth less if the potential buyers can now earn 8% by buying a new bond. That’s why, the higher interest rate would decrease the value of existing fixed rate bonds held by the public.

Bonds: Bond refers to the securities, which are traded in the public to raise the capital when needed. It is an investment with a fixed income, where an investor gives money to an entity or individual for a specified period of time at a fixed rate.

(c)

Wealth effect of higher interest rate on consumption.

(c)

Explanation of Solution

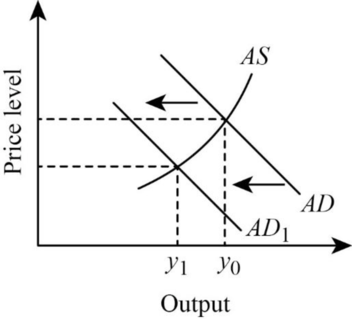

The below figure illustrates the changes in aggregative demand

In the figure, vertical axis shows the output and the horizontal axis shows the price level. When the consumption falls the AD curve will shift from AD to AD1. As a result, price level falls and the quantity reduces from Y0 to Y1.

When the rate of interest rises, the cost of borrowing become higher. And also, the investment rate reduces because of the higher rate of capitals. These factors will reduce the wealth of an economy. When wealth reduces, consumers will spend less and they become worse off. In short, higher interest rate will reduce the spending of consumers. Therefore, the aggregative demand curve will shift the left wards. This is higher than the direct effect on investment.

Wealth effect: Wealth effect refers to the effect of a change in the price that has on the wealth of the individual.

Want to see more full solutions like this?

Chapter 15 Solutions

PRIN OF MACRO W/MYLAB ACCESS COMBOCARD

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education