Concept explainers

Initial direct costs; sales-type lease

• LO15–2, LO15–7

Bidwell Leasing purchased a single-engine plane for its fair value of $645,526 and leased it to Red Baron Flying Club on January 1, 2018.

Terms of the lease agreement and related facts were:

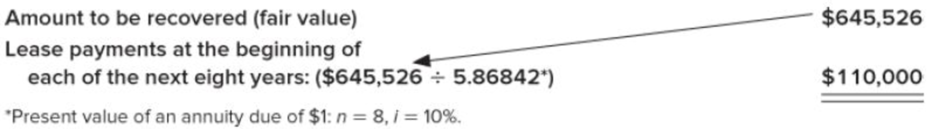

- a. Eight annual payments of $110,000 beginning January 1, 2018, the beginning of the lease, and at each December 31 through 2024. Bidwell Leasing’s implicit interest rate was 10%. The estimated useful life of the plane is eight years. Payments were calculated as follows:

- b. Red Baron’s incremental borrowing rate is 11%.

- c. Incremental costs of negotiating and consummating the completed lease transaction incurred by Bidwell Leasing were $18,099.

Required:

- 1. How should this lease be classified (a) by Bidwell Leasing (the lessor) and (b) by Red Baron (the lessee)?

- 2. Prepare the appropriate entries for both Red Baron Flying Club and Bidwell Leasing on January 1, 2018.

- 3. Prepare an amortization schedule that describes the pattern of interest expense over the lease term for Red Baron Flying Club.

- 4. Determine the effective rate of interest for Bidwell Leasing for the purpose of recognizing interest revenue over the lease term.

- 5. Prepare an amortization schedule that describes the pattern of interest revenue over the lease term for Bidwell Leasing.

- 6. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2018 (the second lease payment). Both companies use straight-line

depreciation. - 7. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2024 (the final lease payment).

(1)

Sales-type lease

Sales type is a parallel type of direct financing whereby the owner (lessor) purchases the equipment to lease it and received the interest revenue over the period of lease for equipment, apart from the recognition of profit from sale of equipment.

The criteria for defining the lease as finance lease or operating lease

As per the notes issued by Financial Accounting Standard Board (FASB), the following are four criteria to determine is a lease is a capital lease or an operating lease:

- Transfer of title: The asset is transferred to lessee at the end of the lease period concerned.

- Purchase option: The purchase option is exercisable when the purchase price is sufficiently lower than expected fair value.

- Economic life: The economic life of the lease period is 75% or more than the useful life of the asset.

- Value recovery: Present value of lease payments is greater or equal to 90% of the fair value.

If a particular lease fulfils any one of the above four criteria, then it is considered as finance lease. If a lease does not fulfil any of the above four criteria, it would be considered as operating lease.

Initial direct cost

Initial direct cost refers to the cost that

- (a) Related directly with the completing a lease agreement

- (b) Important for acquiring a lease

- (c) Would not have been incurred had the lease agreement not occurred.

To Classify: the type of lease by BL company (Lessor) and by RB Company (Lessee)

Explanation of Solution

BL Company (Lessor)

Here at least one (Two in this scenario) classification criterion are met, this is a finance lease. As the fair value is the lessor’s cost, also no selling profit, in this sales type lease.

RB Company (Lessee)

Since at least one (Two in this scenario) criteria are met, this is finance lease to the lessee. The lessee records the present value of lease payments as right-of-use asset and lease payable.

| S.No | Classification criteria | Does it satisfy? | |

| 1 | Does the lease agreement specify about ownership transfer? | No | |

| 2 | Does the lease agreement state about bargain purchase option? | No | |

| 3 | Does the term of lease constitute major part of the expected economic life of the asset? | Yes | Lease term = 8 years Useful life = 8 years |

| 4 | Is the present value of lease payments greater than or equal to substantially (90%) all of the market/fair value of the asset? | Yes | Present value (1) = $645,526 Fair value = $645,526 |

| 5 | Is the asset is of such a specialized nature which is expected to have an alternative use to lessor at the end of the term of lease? | No |

Table (1)

Working note:

The present value of lease payments is calculated as below:

(2)

To Prepare: the appropriate entries for RB Company (Lessee) and BL Company (Lessor) on January 01, 2018.

Explanation of Solution

Prepare journal entries for RB Company (Lessee)

| Date | Account Title and Explanation | Post Ref | Debit ($) | Credit ($) |

| 2018 | ||||

| January 01 | Right-of-use asset (1) | 645,526 | ||

| Lease Payable | 26,427 | |||

| (To record the lease payable) | ||||

| January 01 | Lease payable | 110,000 | ||

| Cash | 110,000 | |||

| (To record the quarterly lease payments) |

Table (2)

Prepare journal entries for BL Company (Lessor)

| Date | Account Title and Explanation | Post Ref | Debit ($) | Credit ($) |

| 2018 | ||||

| January 01 | Lease Receivable | 645,526 | ||

| Equipment | 645,526 | |||

| (To record the lease receivable) | ||||

| January 01 | Lease receivable | 18,099 | ||

| Cash | 18,099 | |||

| (To record the initial direct cost) | ||||

| January 01 | Cash | 110,000 | ||

| Lease receivable | 110,000 | |||

| (To record the lease payments received) |

Table (3)

(3)

To Prepare: amortization schedule for RB Company (Lessee)

Explanation of Solution

Prepare amortization schedule as follows:

| Lease Amortization Schedule | ||||

| A | B | C | D | E |

| Date | Lease Payment($) | Effective Interest (10% × Outstanding balance) ($) | Payment Reduction ($) (B –C) |

Outstanding Balance($) (E –D) |

| 645,526 | ||||

| 1/1/2018 | 110,000 | 110,000 | 535,526 | |

| 12/31/2018 | 110,000 | 53,553 | 56,447 | 479,079 |

| 12/31/2019 | 110,000 | 47,908 | 62,092 | 416,986 |

| 12/31/2020 | 110,000 | 41,699 | 68,301 | 348,685 |

| 12/31/2021 | 110,000 | 34,869 | 75,131 | 273,554 |

| 12/31/2022 | 110,000 | 27,355 | 82,645 | 190,909 |

| 12/31/2023 | 110,000 | 19,091 | 90,909 | 100,000 |

| 12/31/2024 | 110,000 | 10,000 | 100,000 | 0 |

| 880,000 | 234,474 | 645,526 | ||

Table (4)

The amortization table is prepared to present the pattern of interest expenses throughout the period. The schedule shows the lease balance and effective interest change over the 8- term period of lease using effective interest rate of 10%. Each lease payment after the first payment includes both the interest and amount that represents the reduction of outstanding balance. At the end of the lease period, the outstanding balance becomes zero.

(4)

the effective rate of interest for BL Company (Lessor) for the purpose of recognizing interest revenue over the lease term.

Explanation of Solution

First, calculate the net investment.

The net investment is higher: $645,526 + $18,099 = $663,625

Then, calculate the present value table amount from the given data:

Now, match the present value annuity with the rates of interest in the present value annuity table to ascertain the applied rate of interest.

When matching the present value annuity amount (6.03295) with the annuity table, we could find that the value 6.03295 falls in 8 years column under 9% rate of interest.

Therefore, effective rate of interest is 9%

(5)

To Prepare: amortization schedule for BL Company (Lessor)

Explanation of Solution

Prepare amortization schedule as follows:

| Lease Amortization Schedule | ||||

| A | B | C | D | E |

| Date | Lease Payment($) | Effective Interest (9% × Outstanding balance) ($) | Payment Reduction ($) (B –C) |

Outstanding Balance($) (E –D) |

| 663,625 | ||||

| 1/1/2018 | 110,000 | 110,000 | 553,625 | |

| 12/31/2018 | 110,000 | 49,826 | 60,174 | 493,451 |

| 12/31/2019 | 110,000 | 44,411 | 65,589 | 427,862 |

| 12/31/2020 | 110,000 | 38,508 | 71,492 | 356,369 |

| 12/31/2021 | 110,000 | 32,073 | 77,927 | 278,443 |

| 12/31/2022 | 110,000 | 25,060 | 84,940 | 193,503 |

| 12/31/2023 | 110,000 | 17,415 | 92,585 | 100,918 |

| 12/31/2024 | 110,000 | 9,083 | 100,917 | 0 |

| 880,000 | 216,375 | 663,625 | ||

Table (5)

The amortization table is prepared to present the pattern of interest expenses throughout the period. The schedule shows the lease balance and effective interest change over the 8- term period of lease using effective interest rate of 9%. Each lease payment after the first payment includes both the interest and amount that represents the reduction of outstanding balance. At the end of the lease period, the outstanding balance becomes zero.

(6)

To Prepare: appropriate entries for RB Company (Lessee) and BL Company (Lessor) as on December 31, 2018. (Second lease payments)

Explanation of Solution

Prepare journal entries for RB Company (Lessee)

| Date | Account Title and Explanation | Post Ref | Debit ($) | Credit ($) |

| 2018 | ||||

| December 31 | Amortization expense (2) | 80,691 | ||

| Right-of-use asset | 80,691 | |||

| (To record amortization expense.) | ||||

| December 31 | Interest expense (From table 4) | 53,553 | ||

| Lease payable | 56,447 | |||

| Cash | 110,000 | |||

| (To record the lease payments and interest expense) |

Table (6)

Working note:

Calculate the amortization expense for the asset

Prepare journal entries for BL Company (Lessor)

| Date | Account Title and Explanation | Post Ref | Debit ($) | Credit ($) |

| 2018 | ||||

| December 31 | Cash | 110,000 | ||

| Lease receivable | 60,174 | |||

| Interest revenue (From table 5) | 49,826 | |||

| (To record interest revenue.) |

Table (7)

(7)

To Prepare: appropriate entries for RB Company (Lessee) and BL Company (Lessor) as on December 31, 2024. (Final lease payments)

Explanation of Solution

Prepare journal entries for RB Company (Lessee)

| Date | Account Title and Explanation | Post Ref | Debit ($) | Credit ($) |

| 2024 | ||||

| December 31 | Amortization expense (2) | 80,691 | ||

| Right-of-use asset | 80,691 | |||

| (To record amortization expense.) | ||||

| December 31 | Interest expense (From table 4) | 10,000 | ||

| Lease payable | 100,000 | |||

| Cash | 110,000 | |||

| (To record the lease payments and interest expense) |

Table (8)

Prepare journal entries for BL Company (Lessor)

| Date | Account Title and Explanation | Post Ref | Debit ($) | Credit ($) |

| 2024 | ||||

| December 31 | Cash | 110,000 | ||

| Lease receivable | 100,918 | |||

| Interest revenue (From table 5) | 9,082 | |||

| (To record interest revenue.) |

Table (9)

Want to see more full solutions like this?

Chapter 15 Solutions

Intermediate Accounting

- Exercise 15-27 (Algo) Lessee; lessee guaranteed residual value [LO15-2, 15-6] On January 1, 2021, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year period ending December 31, 2024, at which time possession of the leased asset will revert back to Aqua. The equipment cost Aqua $429,029 and has an expected economic life of five years. Aqua and Maywood expect the residual value at December 31, 2024, to be $65,000. Negotiations led to Maywood guaranteeing a $92,500 residual value. Equal payments under the lease are $130,000 and are due on December 31 of each year with the first payment being made on December 31, 2021. Maywood is aware that Aqua used a 6% interest rate when calculating lease payments. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required:1. & 2. Prepare the appropriate entries for Maywood on January 1, 2021 and December 31, 2021, related to the lease. (If no entry…arrow_forwardP17–4 LEASE VERSUS PURCHASE JLB Corporation is attempting to determine whether to lease or purchase research equipment. The firm is in the 21% tax bracket, and its after-tax cost of debt is currently 8%. The terms of the lease and of the purchase are as follows: LEASE Annual end-of-year lease payments of $25,200 are required over the three-year life of the lease. All maintenance costs will be paid by the lessor; insurance and other costs will be borne by the lessee. The lessee will exercise its option to purchase the asset for $5,000 at termination of the lease. PURCHASE The equipment costs $60,000 and can be financed with a 14% loan requiring annual end-of-year payments of $25,844 for three years. JLB will depreciate the equipment under MACRS using a three-year recovery period. (See Table 4.2 for the applicable depreciation percentages.) JLB will pay $1,800 per year for a service contract that covers all maintenance costs; insurance and other costs will be borne by the JLB, who plans…arrow_forwardExercise 15-27 (Algo) Lessee; lessee guaranteed residual value [LO15-2, 15-6] On January 1, 2021, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year period ending December 31, 2024, at which time possession of the leased asset will revert back to Aqua. The equipment costs Aqua $421,168 and has an expected economic life of five years. Aqua and Maywood expect the residual value at December 31, 2024, to be $58,000. Negotiations led to Maywood guaranteeing a $82,000 residual value. Equal payments under the lease are $116,000 and are due on December 31 of each year with the first payment being made on December 31, 2021. Maywood is aware that Aqua used a 5% interest rate when calculating lease payments. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required:1. & 2. Prepare the appropriate entries for Maywood on January 1, 2021, and December 31, 2021, related to the lease. (If no…arrow_forward

- 7..new.continue..c-d Sage Industries and Pronghorn Inc. enter into an agreement that requires Pronghorn Inc. to build three diesel-electric engines to Sage’s specifications. Upon completion of the engines, Sage has agreed to lease them for a period of 10 years and to assume all costs and risks of ownership. The lease is non-cancelable, becomes effective on January 1, 2020, and requires annual rental payments of $405,443 each January 1, starting January 1, 2020.Sage’s incremental borrowing rate is 8%. The implicit interest rate used by Pronghorn and known to Sage is 7%. The total cost of building the three engines is $2,685,000. The economic life of the engines is estimated to be 10 years, with residual value set at zero. Sage depreciates similar equipment on a straight-line basis. At the end of the lease, Sage assumes title to the engines. Collectibility of the lease payments is probable. (c) Prepare the journal entry to record the transaction on January 1, 2020, on the books of…arrow_forward7...new...continue b Sage Industries and Pronghorn Inc. enter into an agreement that requires Pronghorn Inc. to build three diesel-electric engines to Sage’s specifications. Upon completion of the engines, Sage has agreed to lease them for a period of 10 years and to assume all costs and risks of ownership. The lease is non-cancelable, becomes effective on January 1, 2020, and requires annual rental payments of $405,443 each January 1, starting January 1, 2020.Sage’s incremental borrowing rate is 8%. The implicit interest rate used by Pronghorn and known to Sage is 7%. The total cost of building the three engines is $2,685,000. The economic life of the engines is estimated to be 10 years, with residual value set at zero. Sage depreciates similar equipment on a straight-line basis. At the end of the lease, Sage assumes title to the engines. Collectibility of the lease payments is probable. (b) Prepare the journal entry to record the transaction on January 1, 2020, on the books of…arrow_forward31.. continue Marin, Inc. leases a piece of equipment to Bucks Company on January 1, 2020. The contract stipulates a lease term of 5 years, with equal annual rental payments of $7,367 at the end of each year. Ownership does not transfer at the end of the lease term, there is no bargain purchase option, and the asset is not of a specialized nature. The asset has a fair value of $40,000, a book value of $38,000, and a useful life of 8 years. At the end of the lease term, Marin expects the residual value of the asset to be $12,000, and this amount is guaranteed by a third party. Marin wants to earn a 6% return on the lease and collectibility of the lease payments is probable. Assume that the lease receivable is $40,000, deferred gross profit is $2,000, and the rate of return to amortize the net lease receivable to zero is 7.64%.Prepare Marin’ journal entry at the end of the first year of the lease to record the receipt of the first lease payment. (Credit account titles are automatically…arrow_forward

- Kk.194. Jeff owns a new company that is considering either leasing or buying a $100,000 piece of equipment. The lease-buy analysis indicates that buying is better than leasing in Jeff's situation. What factors other than those considered in the lease-buy analysis might lead Jeff to lease rather than buy, in contradiction to the analysis results?arrow_forward4... continues Sunland Leasing Company agrees to lease equipment to Coronado Corporation on January 1, 2020. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2. The cost of the machinery is $489,000, and the fair value of the asset on January 1, 2020, is $699,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $60,000. Coronado estimates that the expected residual value at the end of the lease term will be 60,000. Coronado amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2020. 5. The collectibility of the lease payments is probable. 6. Sunland desires a 9% rate of return on its investments. Coronado’s incremental borrowing rate is 10%, and the lessor’s implicit rate is unknown.…arrow_forward4...continue Sunland Leasing Company agrees to lease equipment to Coronado Corporation on January 1, 2020. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2. The cost of the machinery is $489,000, and the fair value of the asset on January 1, 2020, is $699,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $60,000. Coronado estimates that the expected residual value at the end of the lease term will be 60,000. Coronado amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2020. 5. The collectibility of the lease payments is probable. 6. Sunland desires a 9% rate of return on its investments. Coronado’s incremental borrowing rate is 10%, and the lessor’s implicit rate is…arrow_forward

- 4...continue Sunland Leasing Company agrees to lease equipment to Coronado Corporation on January 1, 2020. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2. The cost of the machinery is $489,000, and the fair value of the asset on January 1, 2020, is $699,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $60,000. Coronado estimates that the expected residual value at the end of the lease term will be 60,000. Coronado amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2020. 5. The collectibility of the lease payments is probable. 6. Sunland desires a 9% rate of return on its investments. Coronado’s incremental borrowing rate is 10%, and the lessor’s implicit rate is…arrow_forward7...new.e1..... Sage Industries and Pronghorn Inc. enter into an agreement that requires Pronghorn Inc. to build three diesel-electric engines to Sage’s specifications. Upon completion of the engines, Sage has agreed to lease them for a period of 10 years and to assume all costs and risks of ownership. The lease is non-cancelable, becomes effective on January 1, 2020, and requires annual rental payments of $405,443 each January 1, starting January 1, 2020.Sage’s incremental borrowing rate is 8%. The implicit interest rate used by Pronghorn and known to Sage is 7%. The total cost of building the three engines is $2,685,000. The economic life of the engines is estimated to be 10 years, with residual value set at zero. Sage depreciates similar equipment on a straight-line basis. At the end of the lease, Sage assumes title to the engines. Collectibility of the lease payments is probable. (e1) Prepare a lease amortization schedule for 2 years. (Round answers to 0 decimal…arrow_forward16... Partially correct answer icon Your answer is partially correct. Grouper Corporation leases equipment from Falls Company on January 1, 2020. The lease agreement does not transfer ownership, contain a bargain purchase option, and is not a specialized asset. It covers 3 years of the equipment’s 8-year useful life, and the present value of the lease payments is less than 90% of the fair value of the asset leased.Prepare Grouper’s journal entries on January 1, 2020, and December 31, 2020. Assume the annual lease payment is $30,000 at the beginning of each year, and Grouper’s incremental borrowing rate is 8%, which is the same as the lessor’s implicit rate. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to 0 decimal places, e.g. 5,265. Record journal entries in the order presented in the problem.)Click here to…arrow_forward