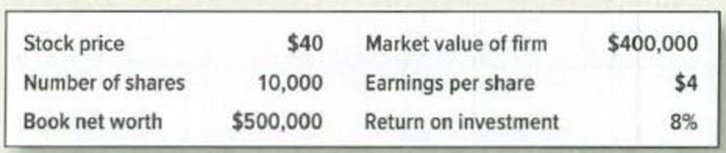

Dilution Here is recent financial data on Pisa Construction Inc.

Pisa has not performed spectacularly to date. However, it wishes to issue new shares to obtain $80,000 to finance expansion into a promising market. Pisa’s financial advisers think a stock issue is a poor choice because, among other reasons, “sale of stock at a price below book value per share can only depress the stock price and decrease shareholders’ wealth.” To prove the point they construct the following example: “Suppose 2,000 new shares are issued at $40 and the proceeds are invested. (Neglect issue costs.) Suppose

Thus, EPS declines, book value per share declines, and share price will decline proportionately to $38.70.”

Evaluate this argument with particular attention to the assumptions implicit in the numerical example.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- The Rivoli Company has no debt outstanding, and its financial position is given by the following data: What is Rivoli’s intrinsic value of operations (i.e., its unlevered value)? What is its intrinsic stock price? Its earnings per share? Rivoli is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 12% to reflect the increased risk. Bonds can be sold at a cost, rd, of 7%. Based on the new capital structure, what is the new weighted average cost of capital? What is the levered value of the firm? What is the amount of debt? Based on the new capital structure, what is the new stock price? What is the remaining number of shares? What is the new earnings per share?arrow_forwardWhich of the following statements is true? a. High liquidity means a company is short on cash and may be unable to pay its debts.b. When a company decides to go public through an IPO, it is typically targeting to sell its shares to only a handful of shareholders. c. If the company has a higher than expected extremely high profit this year, equity holders will benefit more than debt holders as debtholders are the residual claimers for the cash flows of the company.d. In the extreme case, the debt holders take legal ownership of the firm's assets through a process called bankruptcy.e. Equity holders expect to receive dividends and the firm is always legally obligated to pay them.arrow_forwardSchalheim Sisters Inc. has always paid out all of its earnings as dividends; hence, the firm has no retained earnings. This same situation is expected to persist in the future. The company uses the CAPM to calculate its cost of equity, and its target capital structure consists of common stock, preferred stock, and debt. Which of the following events would REDUCE its WACC? A. The flotation costs associated with issuing preferred stock increase. B. The company's beta increases. C. The flotation costs associated with issuing new common stock increase. D. The market risk premium declines. E. Expected inflation increases.arrow_forward

- If payout policy is irrelevant or has no effect on firm value, then why do individuals have a preference on payout policy? Shefrin and Statman (1984) provide a really interesting illustration of why payout policy may be important to individual investors by highlighting a particular case of a dividend omission by Consolidated Edison in the 70s, which occurred after 89 years of uninterrupted dividends. One of the shareholder's statements concerning the missed dividend payment during the 1974 annual meeting was as follows: What are we to do? You give us shorthand answers. You don't know when the dividend is coming back. Who is going to pay my rent? I had a husband. Now Con Ed has to be my husband. (Shefrin et al., 1984, p. 276) An excellent and very readable summary questioning the dividend's relevance is provided by Black (1976) and a summary of the current state of the literature is found in Baker and Weigand (2015). The questions that you should consider for this discussion response…arrow_forwardBurnham Brothers Inc. has no retained earnings since it has always paid out all of its earnings as dividends. This same situation is expected to persist in the future. The company uses the CAPM to calculate its cost of equity, and its target capital structure consists of common stock, preferred stock, and debt. Which of the following events would REDUCE its WACC? The market risk premium declines. The flotation costs associated with issuing new common stock increase. The company's beta increases. Expected inflation increases. The flotation costs associated with issuing preferred stock increase.arrow_forwardTrue or False: The following statement accurately describes how firms make decisions related to issuing new common stock. Taking flotation costs into account will reduce the cost of new common stock. False: Flotation costs are additional costs associated with raising new common stock. True: Taking flotation costs into account will reduce the cost of new common stock, because you will multiply the cost of new common stock by 1 minus the flotation cost—similar to how the after-tax cost of debt is calculated. Alpha Moose Transporters is considering investing in a one-year project that requires an initial investment of $475,000. To do so, it will have to issue new common stock and will incur a flotation cost of 2.00%. At the end of the year, the project is expected to produce a cash inflow of $595,000. The rate of return that Alpha Moose expects to earn on its project (net of its flotation costs) is (18.25, 20.53, 22.81, 14.83) (rounded to two decimal…arrow_forward

- The Fourth Corp. is evaluating extra cash dividends versus share repurchases. In either case, $6,675 will be spent. Current earnings are $2.8 per share and the stock currently sells for $67 per share. There are 1,500 shares outstanding. Ignore taxes and any information asymmetry in the financial market. Which of the following is correct? Group of answer choices Shareholder wealth is the same regardless of which payout policy is chosen. Shareholder wealth will be lower if the firm repurchases shares because shares outstanding is reduced as a result of the repurchase. Shareholder wealth will be lower if the firm pays extra cash dividends because share price is lower. Shareholder wealth will be higher if the firm repurchases shares because repurchases can boost share price.arrow_forwardA privately held corporation, is making plans for future investments that can increase growth. The company’s manager has recommended that the company “go public” by issuing common stock to raise the funds needed to support the growth. The current owners, who founded the firm, are worried that control of the firm will be diluted by this strategy. If the company undertakes an IPO, it is estimated that each share of stock will sell for $6.25, the investment banking fee will be 22 percent of the total value of the issue. The founders now hold all of the company’s stock: 8 million shares. If the company issues 8 million shares, what proportion of the stock will the founders own after the IPO?arrow_forwardTaggart Technologies is considering issuing new common stock and using the proceeds to reduce its outstanding debt. The stock issue would have no effect on total assets, the interest rate Taggart pays, EBIT, or the tax rate. Which of the following is likely to occur if the company goes ahead with the stock issue? a. The times-interest-earned ratio will decrease. b. Net income will decrease. c. Taxable income will decline. d. The ROA will decline. e. The tax bill will increase.arrow_forward

- Ewing Corporation is evaluating an extra dividend versus a share repurchase. In either case, $10,000 would be spent. Current earnings are $3 per share, and the stock currently sells for $50 per share. There are 5,000 shares outstanding. Ignore taxes and other market imperfections (e.g. transaction cost) in answering the questions. a) Evaluate the two alternatives in terms of the effect on the price per share of the stock and shareholder wealth. b) What will be the effect on Ewing’s EPS and PE ratio under the two different scenarios?arrow_forwardWorldTrans is a family owned concern. It has been using the residual dividend model, but family members who hold a majority of the stock want more cash dividends, even if that means a slower future growth rate. Neither the net income nor the capital structure will change during the coming year as a result of a dividend policy change to the indicated target payout ratio. By how much would the capital budget have to be cut to enable the firm to achieve the new target dividend payout ratio? Do not round intermediate calculations. % Debt 45% % Equity = 1.0 – % Debt 55% Capital budget under the residual dividend model $5,000,000 Net income; it will not change this year even if dividends increase $3,500,000 Equity to support the capital budget = % Equity × Capital budget $2,750,000 Dividends paid = NI – Equity needed $750,000 Currently projected dividend payout ratio 21.4% Target dividend payout ratio 43% Group of answer choices -$1,249,182…arrow_forwardBluesky.com, which currently is a privately held corporation, is making plans for future growth. The company’s financial manager has recommended that Bluesky“go public” by issuing common stock to raise the funds needed to support thegrowth. The current owners, who are the founders of the company, are concernedthat control of the firm will be diluted by this strategy. If Bluesky undertakes anIPO, it is estimated that each share of stock will sell for $5, the investment bankingfee will be 15 percent of the total value of the issue, and the costs to the companyfor items such as lawyer fees, printing stock certificates, SEC registration, and so onwill be approximately 1 percent of the total value of the issue.a. If the market value of the stock issue is $42 million, how much will Blueskybe able to use for growth?b. How many shares of stock will Bluesky have to issue if it needs to net$42 million for growth?c. The founders now hold all of the company’s stock—10 million shares. If thecompany…arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT