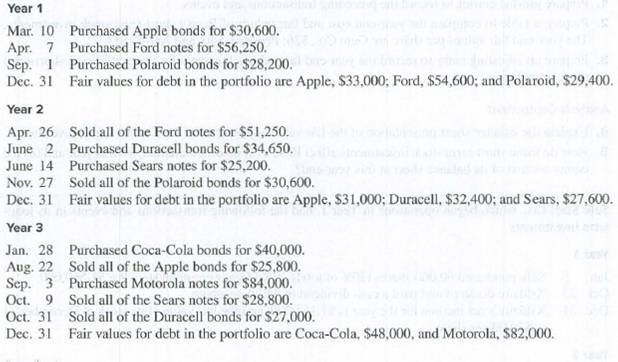

Paris Inc. began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities.

Required

- 1. Prepare

journal entries to record these transactions and events and any year-end fair value adjustments to the portfolio of long-term available-for-sale debt securities. - 2. Prepare a table that summarizes the (a) total cost, (b) total fair value adjustment, and (c) total fair value for the portfolio of long-term available-for-sale debt securities at each year-end.

- 3. Prepare a table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the portfolio of long-term available-for-sale debt securities at each year-end.

1.

Prepare journal entries to record the given transaction.

Explanation of Solution

Journal entry:

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Prepare the journal entries to record the given transactions as follows:

| Journal | ||||

| Date | Account Title and Explanation | Post | Debit | Credit |

| Ref. | ($) | ($) | ||

| March 10, Year 1 | Debt Investments -AFS (Company A) | 30,600 | ||

| Cash | 30,600 | |||

| (To record the purchase of bonds) | ||||

| April 7, Year 1 | Debt Investments—AFS (Company F) | 56,250 | ||

| Cash | 56,250 | |||

| (To record the purchase of F notes) | ||||

| September, 1 Year 1 | Debt Investments —AFS (Company P) | 28,200 | ||

| Cash | 28,200 | |||

| (To record the purchase of bonds) | ||||

| December 31, Year 1 | Fair Value Adjustment—AFS | 1,950 | ||

| Unrealized Gain—Equity (LT) (2) | 1,950 | |||

| (To record the annual adjustment to fair value of securities) | ||||

| April 26, Year 2 | Cash | 51,250 | ||

| Loss on sale of debt investments (3) | 5,000 | |||

| Debt investment—AFS (Company F) | 56,250 | |||

| (To record the gain on sale of bond) | ||||

| June 2, Year 2 | Debt Investments—AFS (Company D) | 34,650 | ||

| Cash | 34,650 | |||

| (To record the purchase of bond) | ||||

| June 14, Year 2 | Debt Investments —AFS (Company S) | 25,200 | ||

| Cash | 25,200 | |||

| (To record the purchase of bond) | ||||

| November, 27 Year 2 | Cash | 30,600 | ||

| Gain on Sale of Investments (4) | 2,400 | |||

| Debt Investments—AFS (Company P) | 28,200 | |||

| (To record the loss on sale of bond) | ||||

| December 31, Year 2 | Fair Value Adjustment—AFS | 1,400 | ||

| Unrealized Gain—Equity (LT) (6) | 1,400 | |||

| (To record the Annual adjustment to fair value of securities) | ||||

| January 28, Year 3 | Debt Investments—AFS (Company C) | 40,000 | ||

| Cash | 40,000 | |||

| (To record the purchase of bonds) | ||||

| August 22, Year 3 | Cash | 25,800 | ||

| Loss on Sale of Investments (7) | 4,800 | |||

| Debt Investments—AFS (Company A) | 30,600 | |||

| (To record the sale of bond) | ||||

| September 3, Year 3 | Debt Investments—AFS (Company M) | 84,000 | ||

| Cash | 84,000 | |||

| (To record the purchase of bonds) | ||||

| October 9, Year 3 | Cash | 28,800 | ||

| Gain on Sale of Investments (8) | 3,600 | |||

| Debt Investments—AFS (Company S) | 25,200 | |||

| (To record the sale of bonds) | ||||

| October 31, Year 3 | Cash | 27,000 | ||

| Loss on Sale of Investments (9) | 7,650 | |||

| Debt Investments—AFS (Company D) | 34,650 | |||

| (To record the sale of bond) | ||||

| December 31, Year 3 | Fair Value Adjustment—AFS | 5,450 | ||

| Unrealized Gain—Equity (LT) (11) | 5,450 | |||

| (To record the Annual adjustment to fair value of securities) | ||||

Table (1)

Working note:

Calculate the total cost and fair value of the bonds for Year 1:

| Name of the company | Cost of debt investment | Fair value of debt investment |

| Company A | $30,600 | $33,000 |

| Company F | $56,250 | $54,600 |

| Company P | $28,200 | $29,400 |

| Total | $115,050 | $117,000 |

Table (2)

…… (1)

Calculate the unrealized gain or loss for year 1:

Calculate the value of cash received from the sale of stock investment (Company F stocks)

Calculate the value of cash received from the sale of stock investment (Company P stocks)

Calculate the total cost and fair value of the bonds for Year 2:

| Name of the company | Cost of debt investment | Fair value of debt investment |

| Company A | S30,600 | $31,200 |

| Company F | $34,650 | $32,400 |

| Company S | $25,200 | $27,600 |

| Total | $90,450 | $91,000 |

Table (3)

…… (5)

Calculate the unrealized gain or loss for year 2:

Calculate the value of cash received from the sale of stock investment (Company A stocks)

Calculate the value of cash received from the sale of stock investment (Company S stocks)

Calculate the value of cash received from the sale of stock investment (Company D stocks)

Calculate the total cost and fair value of the bonds for Year 3:

| Name of the company | Cost of debt investment | Fair value of debt investment |

| Company C | $40,000 | $48,000 |

| Company M | $84,000 | $82,000 |

| Total | $124,000 | $130,000 |

Table (4)

…… (10)

Calculate the unrealized gain or loss for year 3:

2.

Prepare a table that summarizes the following

- a. Total cost,

- b. Total fair value adjustments,

- c. Total fair value of the portfolio of long-term available-for-sale securities at year-end.

Explanation of Solution

Prepare a table that summarizes the total cost, total fair value adjustments, and the total fair value as follows:

| Particulars | December 31, Year 1 | December 31, Year 2 | December 31, Year 3 |

| a. Long-term AFS Securities (cost) | $115,050 | $90,450 | $124,000 |

| b. Fair Value Adjustment | 1,950 | 550 | 6,000 |

| c. Long-term AFS Securities (fair value) | $117,000 | $91,000 | $130,000 |

Table (5)

3.

Prepare a table that summarizes the following

- a. The realized gains and losses,

- b. The unrealized gains and losses for the portfolio of long-term available-for-sale securities at year-end.

Explanation of Solution

- a. Prepare a table that summarizes the realized gains and losses as follows:

| Particulars | Year 1 | Year 2 | Year 3 |

| Realized gains (losses) | |||

| Sale of F shares | $(5,000 ) | ||

| Sale of P shares | 2,400 | ||

| Sale of A shares | $(4,800) | ||

| Sale of S shares | $3,600 | ||

| Sale of D shares | $(7,650) | ||

| Total realized gain (loss) | $0 | $ (2,600) | $(8,850) |

Table (6)

- b. Prepare a table that summarizes the Unrealized gains and losses as follows

| Particulars | Year 1 | Year 2 | Year 3 |

| Unrealized gains (losses) at year-end | $1,950 | $ 550 | $ 6,000 |

Table (7)

Want to see more full solutions like this?

Chapter 15 Solutions

Principles of Financial Accounting.

- Victoria Company has investments in marketable securities classified as trading and available-for-sale. At the beginning of the year, the aggregate market value of each portfolio exceeded its amortized cost. During the year, Victoria sold some securities from each portfolio. At the end of the year, the aggregate amortized cost of each portfolio exceeded its market value. Victoria also has investments in bonds classified as held-to-maturity, all of which were purchased for face value. During the year, some of these bonds held by Victoria were called prior to their maturity by the bond issuer. Three months before the end of the year, additional similar bonds were purchased for face value plus 2 months accrued interest. Required: 1. Explain how Victoria accounts for: a. sale of securities from each portfolio b. each equity securities portfolio at year-end 2. Explain how Victoria accounts for the disposition prior to their maturity of the long-term bonds called by their issuer. 3. Explain how Victoria reports the purchase of the additional similar bonds at the date of the acquisition.arrow_forwardSoto Industries Inc. is an athletic footware company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Soto Industries Inc., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement disclosure?arrow_forwardRefer to the information in RE13-5. Assume that on December 31, 2019, the investment in Smith Corporation bonds has a market value of 12,500. Prepare the year-end journal entry to record the unrealized gain or loss.arrow_forward

- Rekya Mart Inc. is a general merchandise retail company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Rekya Mart Inc., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement disclosure?arrow_forwardDuring 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 lossarrow_forwardRios Financial Co. is a regional insurance company that began operations on January 1, Year 1. The following transactions relate to trading securities acquired by Rios Financial Co., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. Prepare the investment-related current asset balance sheet presentation for Rios Financial Co. on December 31, Year 2. 3. How are unrealized gains or losses on trading investments presented in the financial statements of Rios Financial Co.?arrow_forward

- Refer to the information in RE13-11. Assume that on December 31, 2019, the investment in Cornett Company stock has a market value of 10,500. Prepare the year-end journal entry to record the unrealized gain or loss.arrow_forwardOn September 30, Franz Corporation notices a decline in value of its investment in held-to-maturity bonds. On that date, the carrying value of the bonds is 38,500 and the fair value is 22,980. Franz evaluation of this investment reveals that expected credit losses are 10,000. Prepare the journal entry to record the impairment.arrow_forwardMarigold Company in its first year of operations provides the following information related to one of its available-for-sale debt securities at December 31, 2020. Amortized cost $51,100 Fair value 42,200 Expected credit losses 12,600 A. What is the amount of credit loss that marigold should report on this available-for-sale security at december 31, 2020? Amount of the credit loss $ 8,900 B. Prepare the journal entry to record the credit loss, if any ( and other adjustments needed), at December 31, 2020? date account titles and explanations debit credit 12/31/20 8,900 8,900 Please note that the answer is NOT Debit Loss on available for sale debt securities and Credit avilable for sale debt securities. These are the account titles I can choose from... Accumulated Other…arrow_forward

- Presented below is selected information related to the financial instruments of Pronghorn Company at December 31, 2020. This is Pronghorn Company’s first year of operations. CarryingAmount Fair Value(at December 31) Investment in debt securities (intent is to hold to maturity) $42,700 $43,600 Investment in Chen Company stock 848,500 952,100 Bonds payable 237,600 213,400 (a) Pronghorn elects to use the fair value option for these investments. Assuming that Pronghorn’s net income is $106,200 in 2020 before reporting any securities gains or losses, determine Pronghorn’s net income for 2020. Assume that the difference between the carrying value and fair value is due to credit deterioration. Pronghorn’s net income for 2020 $ (b) Record the journal entry, if any, necessary at December 31, 2020, to record the fair value option for the bonds payable. (Credit account titles are automatically indented when amount is entered. Do not indent manually.…arrow_forwardThe Carrefour Group reported the following description of its available-for-sale investments. Assets available for sale are . . . valued at fair value. Unrealized . . . gains or losses are recorded as shareholders’ equity until they are sold. In a recent year, Carrefour’s financial statements reported €18 million in net unrealized losses (net of unrealized gains), which are included in the fair value of its available-for-sale securities reported on the balance sheet. 1. What amount of the €18 million net unrealized losses, if any, is reported in the income statement? Explain. 2. If the €18 million net unrealized losses are not reported in the income statement, in which statement are they reported, if any? Explain.arrow_forwardTamarisk Company in its first year of operations provides the following information related to one of its available-for-sale debt securities at December 31, 2020. Amoortization cost $52,100 Fair Value 44,200 Expected credit losses 12,850 What is the amount of the credit loss that Tamarisk should report on this available-for-sale security at December 31, 2020? Prepare the journal entry to record the credit loss, if any (and any other adjustment needed), at December 31, 2020. Assume that the fair value of the available-for-sale security is $57,200 at December 31, 2020, instead of $44,200. What is the amount of the credit loss that Tamarisk should report at December 31, 2020? Assume the same information as for part (c). Prepare the journal entry to record the credit loss, if necessary (and any other adjustment needed), at December 31, 2020.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning