Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15.MJ, Problem 2IFRS

IFRS Activity 2

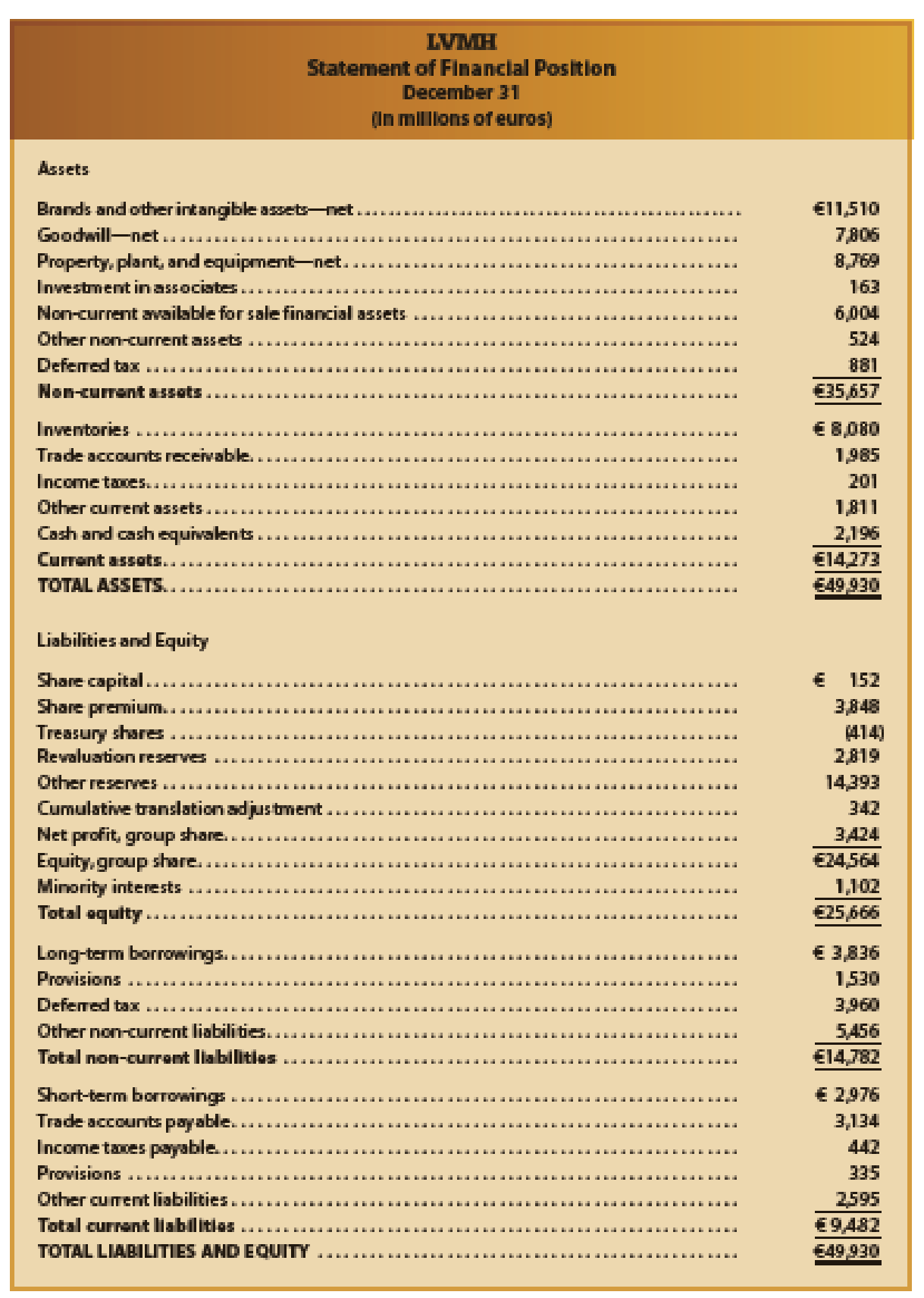

The following is a recent consolidated

- a. Identify presentation differences between the balance sheet of LVMH and a balance sheet prepared under U.S. GAAP. Use the Mornin’ Joe balance sheet (Exhibit 2) as an example of a U.S. GAAP balance sheet. (Ignore minority interests and cumulative translation adjustment.)

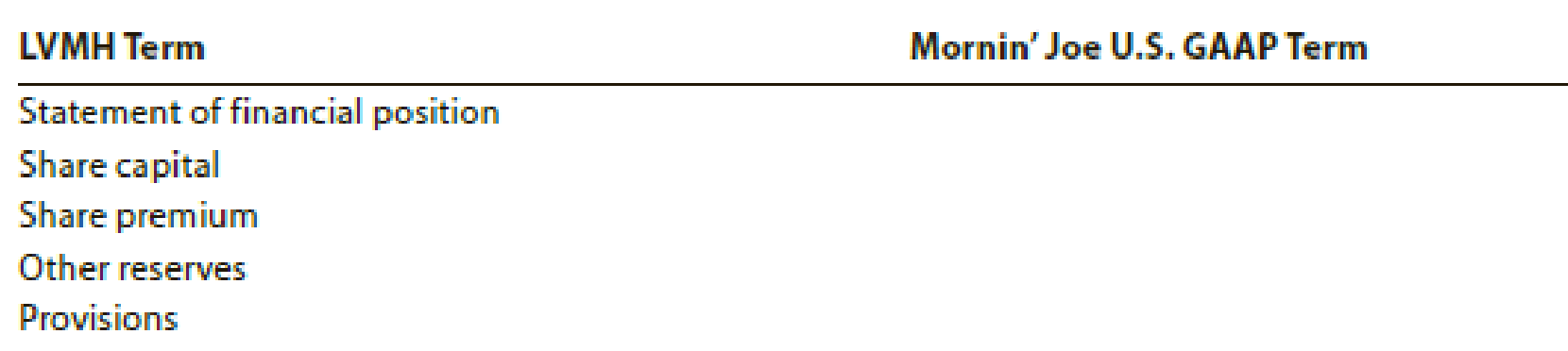

- b. Compare the terms used in this balance sheet with the terms used by Mornin’ Joe (Exhibit 2), using the table that follows:

- c. What does the “Revaluation reserves” in the Equity section of the balance sheet represent?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

QUESTION 1

Francis Limited is finalizing its accounts for the year ended December 31, 2017 before the finalization of account the following events came to the knowledge of the finance director.

1. The company owns a subsidiary in a foreign country. The government of that has communicated to the company on December 28, 2017 that it will expropriate assets of the subsidiary. The book value of the investment in the subsidiary at the year-end was GHS 50 million and fair market value GHS 75 million. The foreign government has indicated that they will compensate the company only to the extent of 25% of the fair value of the investment in the subsidiary.

2. A damages claim of GHS 2 million has been filled against the company for the breach of contract. The company’s lawyer is of the viewpoint that it is probable that the damages will be awarded to the plaintiff. It is not possible to reasonably estimate the amount of damages, at the year end. However, before the authorization of financial…

Produce a consolidated balance sheet for Johnston Group as at 30 September 20X6 consistent with international accounting standards.

A. Select a publicly-traded company that is traded on U.S. exchange. Locate the annual report for at least the last three fiscal years.

Analyze the financial statements for the company and review for large movements in specific accounts from one year to the next. In addition, review the notes to the financial statements as these are an integral part of the financial reporting package. Evaluate the balance sheet to determine if there are large changes in the company's assets, liabilities, or equity accounts. In addition, analyze the income statement and statement of cash flows.B. At a minimum, calculate the following ratios for two years, the debt-to-equity ratio, current ratio, quick ratio, return on equity, and net profit margin. For each ratio, explain what the ratio tells you about the company.

Chapter 15 Solutions

Financial Accounting

Ch. 15.MJ - Prob. 1DQCh. 15.MJ - What is the difference between classifying an...Ch. 15.MJ - If a functional expense classification is used for...Ch. 15.MJ - Prob. 4DQCh. 15.MJ - What are two main differences in inventory...Ch. 15.MJ - Prob. 6DQCh. 15.MJ - Prob. 7DQCh. 15.MJ - Prob. 8DQCh. 15.MJ - Prob. 9DQCh. 15.MJ - How is treasury stock reported under IFRS? How...

Ch. 15.MJ - IFRS Activity 1

Unilever Group is a global company...Ch. 15.MJ - IFRS Activity 2 The following is a recent...Ch. 15.MJ - Prob. 3IFRSCh. 15 - Why might a business invest cash in temporary...Ch. 15 - What causes a gain or loss on the sale of a bond...Ch. 15 - When is the equity method the appropriate...Ch. 15 - Prob. 4DQCh. 15 - Prob. 5DQCh. 15 - Prob. 6DQCh. 15 - Prob. 7DQCh. 15 - Prob. 8DQCh. 15 - Prob. 9DQCh. 15 - Prob. 10DQCh. 15 - Prob. 1PEACh. 15 - Prob. 1PEBCh. 15 - On February 10, 15,000 shares of Sting Company are...Ch. 15 - Prob. 2PEBCh. 15 - Prob. 3PEACh. 15 - Prob. 3PEBCh. 15 - Prob. 4PEACh. 15 - Prob. 4PEBCh. 15 - Prob. 5PEACh. 15 - On January 1, 2016, Valuation Allowance for...Ch. 15 - Prob. 6PEACh. 15 - Prob. 6PEBCh. 15 - Parilo Company acquired 170,000 of Makofske Co.,...Ch. 15 - Prob. 2ECh. 15 - Prob. 3ECh. 15 - Prob. 4ECh. 15 - Prob. 5ECh. 15 - On March 4, Breen Corporation acquired 7,500...Ch. 15 - Prob. 7ECh. 15 - Prob. 8ECh. 15 - Seamus Industries Inc. buys and sells investments...Ch. 15 - Prob. 10ECh. 15 - Prob. 11ECh. 15 - Prob. 12ECh. 15 - Prob. 13ECh. 15 - JED Capital Inc. makes investments in trading...Ch. 15 - Prob. 15ECh. 15 - Prob. 16ECh. 15 - Prob. 17ECh. 15 - Prob. 18ECh. 15 - Prob. 19ECh. 15 - The investments of Steelers Inc. include a single...Ch. 15 - Prob. 21ECh. 15 - Storm, Inc. purchased the following...Ch. 15 - Prob. 23ECh. 15 - Prob. 24ECh. 15 - Prob. 25ECh. 15 - Prob. 26ECh. 15 - Prob. 27ECh. 15 - Prob. 28ECh. 15 - Prob. 29ECh. 15 - Prob. 1PACh. 15 - Prob. 2PACh. 15 - Prob. 3PACh. 15 - OBrien Industries Inc. is a book publisher. The...Ch. 15 - Prob. 1PBCh. 15 - Prob. 2PBCh. 15 - Prob. 3PBCh. 15 - Prob. 4PBCh. 15 - Selected transactions completed by Equinox...Ch. 15 - On July 16, 1998, Wyatt Corp. purchased 40 acres...Ch. 15 - International Financial Reporting Standard No. 16...Ch. 15 - Prob. 3CPCh. 15 - Berkshire Hathaway, the investment holding company...Ch. 15 - Prob. 5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Jardine Matheson Group is a major conglomerate within the Asian region. The company uses IFRS in preparing its financial statements ad has done so for a number of years. Access Jardine Matheson’s most recent annual report on the company’s website. Review the company’s consolidated financial statements to evaluate whether the financial statements presented comply with the presentation requirements in IAS 1, Presentation of Financial Statements. Document your evaluation.arrow_forwardb) During the year ended 30 June 2014, Parent company guarantees borrowings of Subsidiary company which amounts to $1,000,000. At the time of the guarantee, Subsidiary’s’ financial position was sound. During the year ended 30 June 2015, the financial condition of Subsidiary company deteriorates and at 30 June 2015 Subsidiary company files for protection from its creditors. Requirements: 1) How should this be treated in Parent’s financial statements for the year ended i) 30 June 2014 and ii) 30 June 2015.arrow_forward24 Assume that the total assets, liabilities, equity of the company are OMR 60000, OMR 20000 and OMR 40000 respectively.The company received OMR10000 dividend income from foreign securities and the company spent OMR 7000 factory painting, cleaning and maintenance expenses. Identify the effect of income received and expenses done by the company on different elements of balance sheet. a. Assets will decrease by OMR 10000 and Capital will increase by OMR 10000 b. None of the given options c. Assets will increase by OMR 10000 and Capital will decrease by OMR 7000 d. Assets will increase by OMR 3000 and capital will increase by OMR 3000 Clear my choicearrow_forward

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Business Diversification; Author: GreggU;https://www.youtube.com/watch?v=50-d__Pn_Ac;License: Standard Youtube License