a)

To determine: The effects on using leverage on the firm’s value

a)

Explanation of Solution

Compute the Original value of the firm:

Compute the original cost of capital:

With financial leverage (wd=30%):

Increasing the financial leverage by adding debt of $900,000 results in an growth in the value of the firm’s from $3,000,000 to $3,348,214.286.

b)

To determine: The price of Company R’s stock.

b)

Explanation of Solution

Compute price of stock:

Value of equity:

Price of stock:

Hence, price of the stock is $16.741.

c)

To determine: The effects EPS of the firm after recapitalization.

c)

Explanation of Solution

Compute number of shares:

Initial position:

Financial leverage:

EPS:

Hence, change in EPS is $0.342.

d)

To determine: The times-interest-earned ratio and the probability of not covering the interest payment at 30% debt level.

d)

Explanation of Solution

Compute price of stock:

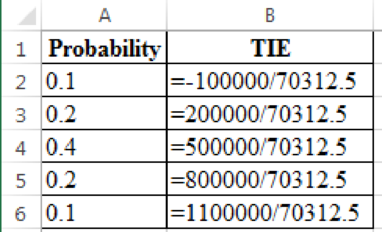

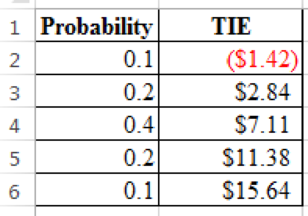

Excel workings:

Excel spread sheet:

- The interest payment is not covered if TIE < 1.0.

- The probability of this occurring is 10%.

Want to see more full solutions like this?

Chapter 15 Solutions

Mindtap Finance, 1 Term (6 Months) Printed Access Card For Brigham/ehrhardt's Financial Management: Theory & Practice, 15th

- The Rivoli Company has no debt outstanding, and its financial position is given by the following data: What is Rivoli’s intrinsic value of operations (i.e., its unlevered value)? What is its intrinsic stock price? Its earnings per share? Rivoli is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 12% to reflect the increased risk. Bonds can be sold at a cost, rd, of 7%. Based on the new capital structure, what is the new weighted average cost of capital? What is the levered value of the firm? What is the amount of debt? Based on the new capital structure, what is the new stock price? What is the remaining number of shares? What is the new earnings per share?arrow_forwardA company had WACC (weighted average cost of capital) equal to 8. % If the company pays off mortgage bonds with an interest rate of 4% and issues an equal amount of new stock considered to be relatively risky by the market, which of the following is true? a. residual income will increase. b. ROI will decrease. c. WACC will increase. d. WACC will decrease.arrow_forwardFujita, Incorporated, has no debt outstanding and a total market value of $422,400. Earnings before interest and taxes, EBIT, are projected to be $55,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 14 percent higher. If there is a recession, then EBIT will be 20 percent lower. The company is considering a $205,000 debt issue with an interest rate of 6 percent. The proceeds will be used to repurchase shares of stock. There are currently 8,800 shares outstanding. The company has a tax rate of 23 percent, a market-to-book ratio of 1.0 before recapitalization, and the stock price changes according to M&M. a-1. a-2. b-1. Calculate earnings per share (EPS) under each of the three economic scenarios assuming the company goes through with recapitalization. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b-2. Given the recapitalization, calculate the percentage changes…arrow_forward

- Gator Fabrics Inc. currently has zero debt (i.e., wd = 0). It is a zero growth company, and additional firm data are shown below. Now the company is considering using some debt, moving to the new capital structure indicated below. The money raised would be used to repurchase stock at the current price. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below. If this plan were carried out, by how much would the WACC change, i.e., what is WACCOld − WACCNew?arrow_forwardFowler, Inc., has no debt outstanding and a total market value of $240,000. Earnings before interest and taxes, EBIT, are projected to be $26,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 18 percent higher. If there is a recession, then EBIT will be 20 percent lower. The firm is considering a debt issue of $150,000 with an interest rate of 8 percent. The proceeds will be used to repurchase shares of stock. There are currently 15,000 shares outstanding. The firm has a tax rate 24 percent. Assume the stock price is constant under all scenarios. a-1. Calculate earnings per share (EPS) under each of the three economic scenarios before any debt is issued. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a-2. Calculate the percentage changes in EPS when the economy expands or enters a recession. (A negative answer should be indicated by a minus sign. Do not round intermediate…arrow_forwardMinion, Inc., has no debt outstanding and a total market value of $284,900. Earnings before interest and taxes, EBIT, are projected to be $44,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 18 percent higher. If there is a recession, then EBIT will be 29 percent lower. The company is considering a $150,000 debt issue with an interest rate of 7 percent. The proceeds will be used to repurchase shares of stock. There are currently 7,700 shares outstanding. The company has a tax rate of 22 percent, a market-to-book ratio of 1.0, and the stock price remains constant. a-1. Calculate earnings per share (EPS) under each of the three economic scenarios before any debt is issued. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)b-1. Calculate earnings per share (EPS) under each of the three economic scenarios assuming the company goes through with recapitalization. (Do not round…arrow_forward

- You were hired as a consultant to XYZ Company, whose target capital structure is 32% debt, 10% preferred, and 58% common equity. The interest rate on new debt is 8.40%, the yield on the preferred is 5.85%, the cost of common from retained earnings is 13.20%, and the tax rate is 33.00%. The firm will not be issuing any new common stock. What is XYZ's WACC?arrow_forwardMinion, Inc., has no debt outstanding and a total market value of $332,100. Earnings before interest and taxes, EBIT, are projected to be $48,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 18 percent higher. If there is a recession, then EBIT will be 29 percent lower. The company is considering a $170,000 debt issue with an interest rate of 7 percent. The proceeds will be used to repurchase shares of stock. There are currently 8,100 shares outstanding. Ignore taxes for questions a) and b). Assume the company has a market-to-book ratio of 1.0 and the stock price remains constant. a-1. Calculate return on equity, ROE, under each of the three economic scenarios before any debt is issued. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)a-2. Calculate the percentage changes in ROE when the economy expands or enters a recession. (A negative answer should be…arrow_forwardFowler, Inc., has no debt outstanding and a total market value of $150,000. Earnings before interest and taxes, EBIT, are projected to be $28,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 20 percent higher. If there is a recession, then EBIT will be 25 percent lower. The firm is considering a debt issue of $60,000 with an interest rate of 7 percent. The proceeds will be used to repurchase shares of stock. There are currently 10,000 shares outstanding. The firm has a tax rate 25 percent. Assume the stock price is constant under all scenarios. a-1. Calculate earnings per share (EPS) under each of the three economic scenarios before any debt is issued. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a-2. Calculate the percentage changes in EPS when the economy expands or enters a recession. (A negative answer should be indicated by a minus sign. Do not round intermediate…arrow_forward

- Vafeas Inc.'s capital structure consists of 80% debt and 20% common equity, it has a beta of 1.60, and its tax rate is 35%. However, the CFO thinks the company has too much debt, and he is considering moving to a capital structure with 40% debt and 60% equity. The risk - free rate is 5.0% and the market risk premium is 6.0%. By how much would the firm's cost of equity change as a result of altering its capital structure?arrow_forwardFujita, Incorporated, has no debt outstanding and a total market value of $220,000. Earnings before interest and taxes, EBIT, are projected to be $36,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 18 percent higher. If there is a recession, then EBIT will be 25 percent lower. The company is considering a $125,000 debt issue with an interest rate of 8 percent. The proceeds will be used to repurchase shares of stock. There are currently 11,000 shares outstanding. Ignore taxes for this problem. a-1. Calculate earnings per share (EPS) under each of the three economic scenarios before any debt is issued. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a-2. Calculate the percentage changes in EPS when the economy expands or enters a recession. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent…arrow_forwardDye Industries currently uses no debt, but its new CFO is considering changing the capital structure to 51.5% debt (wd) by issuing bonds and using the proceeds to repurchase and retire some common shares so the percentage of common equity in the capital structure (wc) = 1 – wd. Given the data shown below, by how much would this recapitalization change the firm's cost of equity, i.e., what is rL - rU? Do not round your intermediate calculations. Risk-free rate, rRF 5.00% Tax rate, T 25% Market risk prem, RPM 4.00% Current wd 0% Current beta, bU 1.20 Target wd 51.5% 4.78% 3.06% 4.40% 3.63% 3.82%arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning