College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 11SPB

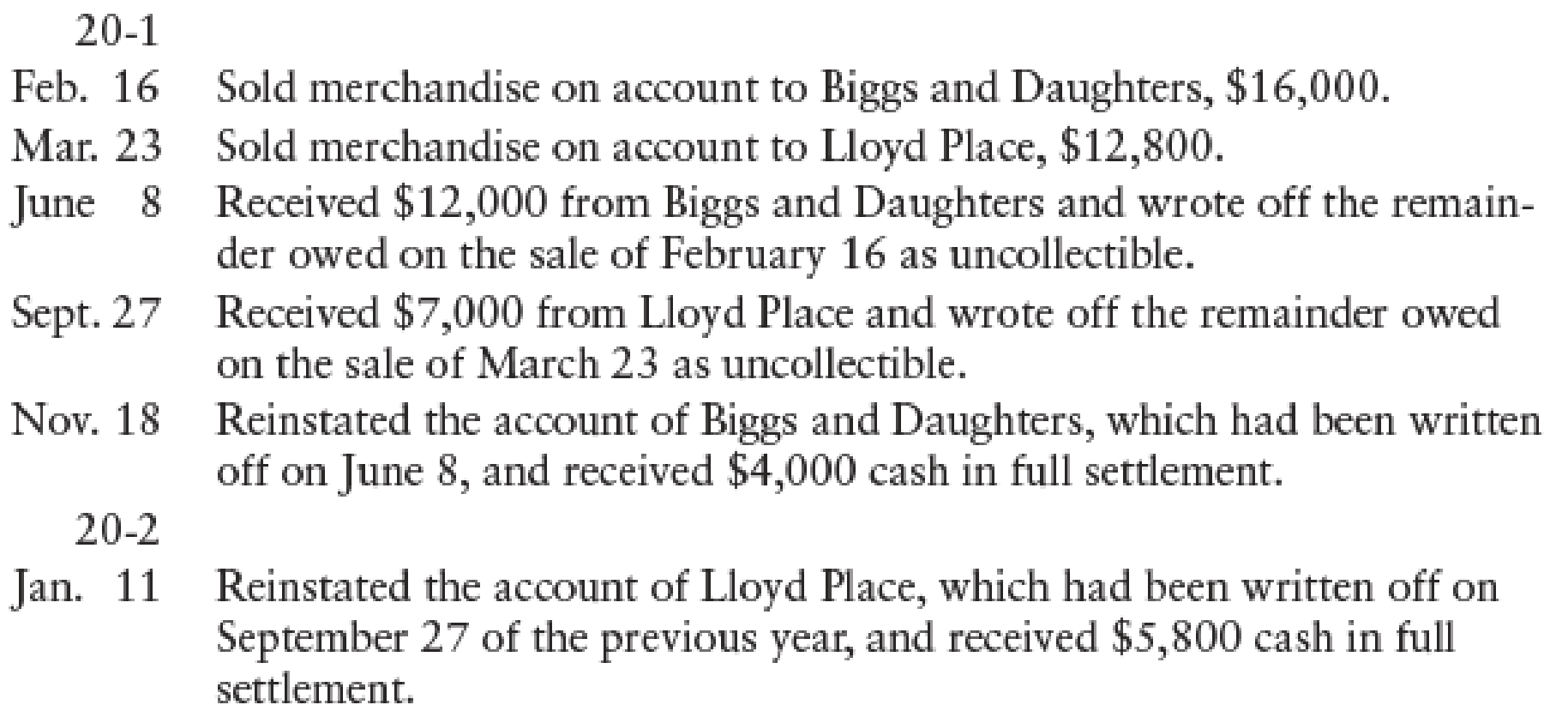

DIRECT WRITE-OFF METHOD Lee and Chen Distributors uses the direct write-off method in accounting for uncollectible accounts.

REQUIRED

Record these transactions in general journal form.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Nash's Trading Post, LLC uses the allowance method for estimating uncollectible accounts. Prepare journal entries to record the following transactions: (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record jour entries in the order presented in the problem.)

Do not give answer in image

When a customer returns a product to Hartville Equipment that the customer purchasedon account, Hartville will issue a to authorize a credit to the customer’saccount receivable on Hartville’s books:a. return authorizationb. refund notec. credit memod. manager approval

The entry to record the granting of credit to a customer for a sales return is posted to

the accounts receivable subsidiary ledger only.

the general ledger only.

both the accounts receivable subsidiary ledger and the general ledger.

both the accounts payable subsidiary ledger and the general ledger.

Chapter 16 Solutions

College Accounting, Chapters 1-27

Ch. 16 - There are two methods of accounting for...Ch. 16 - The matching principle states that debits should...Ch. 16 - Using the percentage of sales method, the balance...Ch. 16 - When an account is written off under the allowance...Ch. 16 - Each time an account is written off under the...Ch. 16 - The dollar difference between Accounts Receivable...Ch. 16 - A business has an ending balance in Accounts...Ch. 16 - A business has an ending balance in Accounts...Ch. 16 - Prob. 4MCCh. 16 - Under the allowance method, when an account is...

Ch. 16 - Prob. 1CECh. 16 - Tonis Tech Shop has total credit sales for the...Ch. 16 - Fionas Pharmacy uses the direct write-off method...Ch. 16 - Prob. 1RQCh. 16 - Prob. 2RQCh. 16 - Prob. 3RQCh. 16 - Prob. 4RQCh. 16 - Prob. 5RQCh. 16 - Prob. 6RQCh. 16 - Prob. 7RQCh. 16 - Under the allowance method, what journal entries...Ch. 16 - Prob. 9RQCh. 16 - Prob. 10RQCh. 16 - CALCULATION OF NET REALIZABLE VALUE L. R. Updike...Ch. 16 - UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES Rossins...Ch. 16 - UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF RECEIVABLES...Ch. 16 - COLLECTION OF ACCOUNTS WRITTEN OFFALLOWANCE METHOD...Ch. 16 - UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND...Ch. 16 - DIRECT WRITE-OFF METHOD Maria Rivera, owner of...Ch. 16 - COLLECTION OF ACCOUNT WRITTEN OFFDIRECT WRITE-OFF...Ch. 16 - UNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Pyle...Ch. 16 - UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND...Ch. 16 - AGING ACCOUNTS RECEIVABLE An analysis of the...Ch. 16 - DIRECT WRITE-OFF METHOD Williams Hendricks...Ch. 16 - CALCULATION OF NET REALIZABLE VALUE Mary Martin...Ch. 16 - UNCOLLECTIBLE ACCOUNTS-PERCENTAGE OF SALES Nicoles...Ch. 16 - UNCOLLECTIBLE ACCOUNTS-PERCENTAGE OF RECEIVABLES...Ch. 16 - COLLECTION OF ACCOUNT WRITTEN OFFALLOWANCE METHOD...Ch. 16 - UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND...Ch. 16 - DIRECT WRITE-OFF METHOD Brent Mussellman, owner of...Ch. 16 - COLLECTION OF ACCOUNT WRITTEN OFFDIRECT WRITE-OFF...Ch. 16 - UNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Lewis...Ch. 16 - UNCOLLECTIBLE ACCOUNTSPERCENTAGE OF SALES AND...Ch. 16 - AGING ACCOUNTS RECEIVABLE An analysis of the...Ch. 16 - DIRECT WRITE-OFF METHOD Lee and Chen Distributors...Ch. 16 - Sam and Robert are identical twins. They opened...Ch. 16 - Martel Co. has 320,000 in Accounts Receivable on...Ch. 16 - Prob. 2CPCh. 16 - At the end of 20-3, Martel Co. had 410,000 in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- DIRECT WRITE-OFF METHOD Williams Hendricks Distributors uses the direct write-off method in accounting for uncollectible accounts. REQUIRED Record these transactions in general journal form.arrow_forwardDIRECT WRITE-OFF METHOD Brent Mussellman, owner of Brents Barbells, uses the direct write-off method in accounting for uncollectible accounts. Record the following transactions in general journal form:arrow_forwardCOLLECTION OF ACCOUNT WRITTEN OFFDIRECT WRITE-OFF METHOD Comos Music Store uses the direct write-off method in accounting for uncollectible accounts. Record the following transactions in general journal form:arrow_forward

- COLLECTION OF ACCOUNT WRITTEN OFFDIRECT WRITE-OFF METHOD Madonnas Music Store uses the direct write-off method in accounting for uncollectible accounts. Record the following transactions in general journal form:arrow_forwardDIRECT WRITE-OFF METHOD Maria Rivera, owner of Rivera Pharmacy, uses the direct write-off method in accounting for uncollectible accounts. Record the following transactions in general journal form:arrow_forwardCOLLECTION OF ACCOUNT WRITTEN OFFALLOWANCE METHOD Raynette Ramos, owner of Ramos Rentals, uses the allowance method in accounting for uncollectible accounts. Record the following transactions in general journal form:arrow_forward

- COLLECTION OF ACCOUNTS WRITTEN OFFALLOWANCE METHOD Julia Alvarez, owner of Alvarez Rentals, uses the allowance method in accounting for uncollectible accounts. Record the following transactions in general journal form:arrow_forwardAllowance method Journalize the following transactions, using the allowance method of accounting for uncollectible receivables:arrow_forwardJournal Entry to Separate Receivables An examination of Hutton Corporations accounting records indicates that all receivables are being recorded in a single account entitled Receivables. An analysis of the account reveals the following: Required: 1. Prepare a journal entry to separate the preceding items into their proper accounts. 2. How would each of the preceding items normally be reflected (current or noncurrent; trade or nontrade receivable) on Huttons balance sheet?arrow_forward

- JOURNALIZING SALES RETURNS AND ALLOWANCES Enter the following transactions starting on page 60 of a general journal and post them to the appropriate general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter. Beginning balance in Accounts Receivable is 3,900. Beginning balances in selected customer accounts are Adams, 850; Greene, 428; and Phillips, 1,018.arrow_forwardUNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Lewis Warehouse used the allowance method to record the following transactions, adjusting entries, and closing entries during the year ended December 31, 20--: Selected accounts and beginning balances on January 1, 20--, are as follows: REQUIRED 1. Open the three selected general ledger accounts. 2. Enter the transactions and the adjusting and closing entries in a general journal (page 6). After each entry, post to the appropriate selected accounts. 3. Determine the net realizable value as of December 31, 20--.arrow_forwardUNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Pyle Nurseries used the allowance method to record the following transactions, adjusting entries, and closing entries during the year ended December 31, 20--. REQUIRED 1. Open the three selected general ledger accounts. 2. Enter the transactions and the adjusting and closing entries in a general journal (page 6). After each entry, post to the appropriate selected accounts. 3. Determine the net realizable value as of December 31.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License