PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 20PS

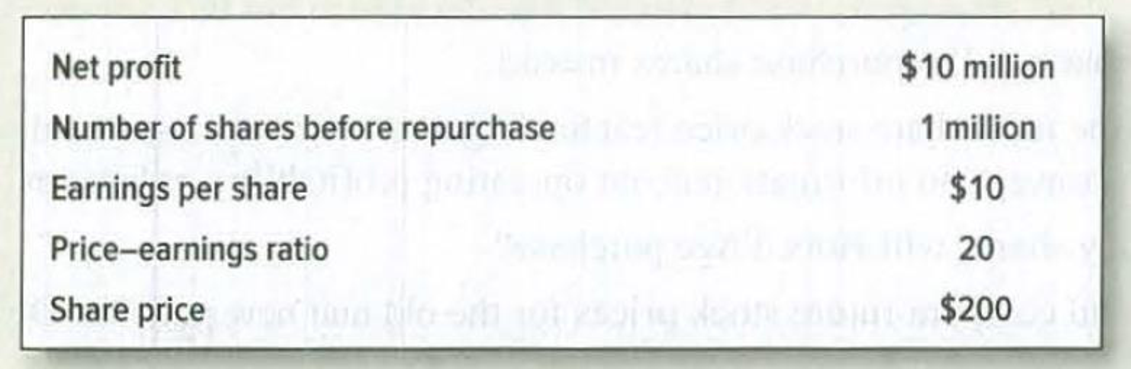

Repurchases and EPS Many companies use stock repurchases to increase earnings per share. For example, suppose that a company is in the following position:

The company now repurchases 200,000 shares at $200 a share. The number of shares declines to 800,000 shares and earnings per share increase to $12.50. Assuming the price–earnings ratio stays at 20, the share price must rise to $250. Discuss.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

“Many companies use stock repurchases to increase earnings per share. For example, supposethat a company is in the following position:Net profit $10 millionNumber of shares before repurchase 1 millionEarnings per share $10Price–earnings ratio 20Share price $200The company now repurchases 200,000 shares at $200 a share. The number of sharesdeclines to 800,000 shares and earnings per share increase to $12.50. Assuming the price–earnings ratio stays at 20, the share price must rise to $250.”Discuss.

A firm has a market value equal to its book value. Currently, the firm has excess cash of $1,800 and other assets of $5,700. Equity is worth $7,500. The firm has 750 shares of stock outstanding and net income of $1,500. The firm has decided to spend all of its excess cash on a share repurchase program. How many shares of stock will be outstanding after the stock repurchase is completed?

The dividend discount model assumes the value of a share of common stock is the present value of all future dividends. One year holding period Assume an investor wants to buy a stock, hold it for one year, and then sell it. The company earned $2.50 a share last year and paid a dividend of $1 a share. The company maintains a 40% payout ratio over time. Financial analysts suggest the firm will earn about $2.75 per share during the coming year and will raise its dividend to $1.10 per share. The risk free rate is 10% and the market risk premium is currently 4%. You project the sale price of this stock a year from now to be $22. ? Estimate the value of this stock. ? Would you buy this stock? Multiple holding period Assume the expected holding period is three years and you estimate the following dividend payments at the end of each year. Year 1 - $1.10 per share The Business School BUACC3701: Financial Management Year 2 - $1.20 per share Year 3 - $1/35 per share The risk free rate is 10% and…

Chapter 16 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 16 - Dividend payments In 2017, Entergy paid a regular...Ch. 16 - Dividend payments Seashore Salt Co. has surplus...Ch. 16 - Repurchases Look again at Problem 2. Assume...Ch. 16 - Repurchases An article on stock repurchase in the...Ch. 16 - Company dividend policy Here are several facts...Ch. 16 - Prob. 7PSCh. 16 - Information content of dividends What is meant by...Ch. 16 - Information content of dividends Does the good...Ch. 16 - Information content of dividends Generous dividend...Ch. 16 - Prob. 11PS

Ch. 16 - Payout policy in perfect capital markets Go back...Ch. 16 - Payout policy in perfect capital markets Go back...Ch. 16 - Payout policy in perfect capital markets Respond...Ch. 16 - Prob. 15PSCh. 16 - Repurchases and the DCF model Hors dAge...Ch. 16 - Repurchases and the DCF model Surf Turf Hotels is...Ch. 16 - Repurchases and the DCF model House of Haddock has...Ch. 16 - Repurchases and the DCF model Little Oil has 1...Ch. 16 - Repurchases and EPS Many companies use stock...Ch. 16 - Dividends and value We stated in Section 16-3 that...Ch. 16 - Payout and valuation Look back one last time at...Ch. 16 - Dividend clienteles Mr. Milquetoast admires Warren...Ch. 16 - Prob. 24PSCh. 16 - Payout and taxes Which of the following U.S....Ch. 16 - Prob. 26PSCh. 16 - Prob. 27PSCh. 16 - Prob. 28PSCh. 16 - Dividend policy and the dividend discount model...Ch. 16 - Prob. 30PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Stock Price after Recapitalization Lee Manufacturings value of operations is equal to 900 million after a recapitalization. (The firm had no debt before the recap.) Lee raised 300 million in new debt and used this to buy back stock. Lee had no short-term investments before or after the recap. After the recap, wd = 1/3. The firm had 30 million shares before the recap. What is P (the stock price after the recap)?arrow_forwardThe shares of a company trade today for $37. The company is fairly valued at this current price. There are 39 million shares outstanding prior to the repurchase. The company has announced that it intends to spend $265 million on an open market repurchase. Assume that the company is able to repurchase shares at a price of $39.00. Assume that the company is all-equity financed. What fraction of shares does the company repurchase? What is the share price after the repurchase?arrow_forwardPayout Policy. House of Haddock has 5,000 shares outstanding and the stock price is $100. The company is expected to pay a dividend of $20 per share next year, and thereafter, the dividend is expected to grow indefinitely by 5% a year. The president, George Mullet, now makes a surprise announcement: He says that the company will henceforth distribute half the cash in the form of dividends and the remainder will be used to repurchase stock. a. what should be the total value of the company before the announcement? b. what should be the total value after the announcement? c. what must be the expected rate of return on equity? d. what is the new growth rate in the dividend stream? (check your estimate of share value by discounting this stream of dividends per share)arrow_forward

- A firm has a market value equal to its book value. Currently, the firm has $500,000 of excess cash, $4,500,000 in other assets, $1,000,000 in liabilities, $40,000 in common stock at $1 par, $0 in retained earnings, and $30,000 in net income. Assume that the firm uses all of its excess cash to repurchase some of its shares outstanding. How many shares will be outstanding after the repurchases are completed? (Round, if necessary, your final answer to the whole number).arrow_forwardA firm has 7,000 outstanding shares with current value of 10£ per share. Planned dividend is £5 per share. What is the ex-dividend share price? How much is the share price if the company decides to use the cash it had originally earmarked for dividend for a share repurchase instead? A. £5, £10 B. £10, £5 C. £8, £10 D. £2, £12 ( explain well with step by step answer ).arrow_forwardShare repurchase proposal: Currently, the firm has available capital (cash and net income) of approximately $7,000,000. There is a large block of stock available at $35 a share. For the sake of this exercise let us disregard tax implications and effects. If the firm decides to spend this amount of excess cash on a share repurchase program, how many shares will be repurchased?? What are the benefits of repurchasing shares? How will this affect the capital structure of the company? How can this be interpreted in the marketplace? Suppose the market price of the shares is $35.75 a share. Why do you think the seller of the large block would agree to see at $35 a share? Suppose the assumptions of MM are true, then what would happen to the market price of shares once the purchase of the large block at $35 a share is completed? Would it rise above $35.75, remain unchanged or fall? Would a dividend be better? Please discuss the pros and cons of dividends and share buybacks. Make a…arrow_forward

- The stock of Payout Inc. will go ex-dividend tomorrow. The dividend will be $1 per share. There are 20,000 shares of stock outstanding. The market value balance sheet for Payout is below: Assets Liabilities and equity Cash $100,000 Equity $1,000,000 Fixed Assets $900,000 a) What price is Payout selling for today? Explain your answer. b) What price will it sell for tomorrow? Explain your answer. Now suppose that Payout announces its intention to repurchase $20,000 worth of stock instead of paying out the dividend. c) What effect will the repurchase have on an investor who currently holds 10 shares and sells 2 of those shares back to the company in the repurchase? d) Compare the effects of the repurchase to the effects of the cash dividend that worked out in (a). Show all of your working. Do not use Excel.arrow_forwardStock repurchase Harte Textiles, Inc., a maker of custom upholstery fabrics, is concerned about preserving the wealth of its stockholders during a cyclic down- turn in the home furnishings business. The company has maintained a constant dividend payout of $2.00 tied to a target payout ratio of 40%. Management is preparing a share repurchase recommendation to present to the firm❝s board of directors. The following data have been gathered from the last two years: 2014 2015 Earnings available for common stockholders $1,260,000 $1,200,000 Number of shares outstanding 300,000 300,000 Earnings per share $4.20 $4.00 Market price per share $23.50 $20.00 Price/earnings ratio 5.6 5.0 a. How many shares should the company have outstanding in order to combine the earnings available for common stockholders of $1,200,000 in the year 2003 and a dividend of $2.00 to produce the desired payout ratio of 40%? b. How many shares would Harte have to repurchase to have the level of shares outstanding…arrow_forwardShares repurchase and the previous problem? Suppose the company had. Announce is going to repurchase $21,850 worth of stock instead of repairing a dividend. What effects would the transaction have on the equity of the firm? How many shares will be outstanding? What will the price per share before the repurchase? Ignoring tax effects, shows how the share repurchase is affectively the same as a cash dividend.arrow_forward

- The Dunn Corporation is planning to pay dividends of $540000. There are 270000 shares outstanding, and earnings per share are $4. The stock should sell for $48 after the ex-dividend date. If, instead of paying a dividend, the firm decides to repurchase stock,a. What should be the repurchase price? b. How many shares should be repurchased? c. What if the repurchase price is set below or above your suggested price in part a? d. If you own 100 shares, would you prefer that the company pay the dividend or repurchase stock? a. 3/10, net 45 b. 3/15 net 30 c. 3/15 net 60 d.2/10 net 45arrow_forward#2: XYZ Corporation is evaluating an extra dividend versus a share repurchase. In either case, $14,500 would be spent. Current earnings are $1.65 per share, and the stock currently sells for $58 per share. There are 2,000 shares outstanding. a) Evaluate the two alternatives in terms of the effect on the price per share of the stock and shareholder wealth per share. b) What will the company's EPS and P/E ratio be under the two different scenarios?arrow_forwardA company is considering the following two dividend policies for the next five years. Year Policy #1 Policy #2 1 $4.00 $6.00 2 $4.00 $2.70 3 $4.00 $5.00 4 $4.00 $3.10 5 $4.00 $3.20 Required: Part 1: How much total dividends per share will the stockholders receive over the five year period under each policy? Part 2: If investors see no difference in risk between the two policies, and therefore apply a 9.4% discount rate to both, what is the present value of each dividend stream? Part 3: Suppose investors see Policy #2 as the riskier of the two. And they therefore apply a 9.4% discount rate to Policy #1 but a 14% discount rate to Policy #2. Under this scenario, what is the present value of each dividend stream? Part 4: What conclusions can be drawn from this exercise?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

What Are Stock Buybacks and Why Are They Controversial?; Author: TD Ameritrade;https://www.youtube.com/watch?v=2O4bmcliaog;License: Standard youtube license