Concept explainers

a.

To calculate: The PV of annual lease obligations of Ellis Corporation, if discount rate is 10%.

Introduction:

Lease:

It refers to the contract between two parties, that is, lessee(user) and lessor (owner) defining the terms in which one party agrees to pay rent in exchange of usage of property, that is, owned by another party.

Present value (PV):

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the

a.

Answer to Problem 21P

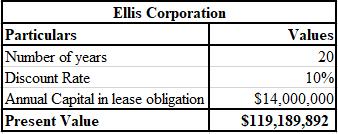

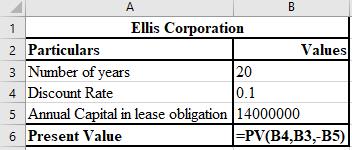

The calculation of the PV of annual lease obligations at the rate of 10% is shown below.

Thus, the PV of annual lease obligations at the rate of 10%, after rounding off, is $119 million.

Explanation of Solution

The formula used for the calculation of the PV of annual lease obligations at the rate of 10% is shown below.

b.

To construct: The revised

Introduction:

Balance Sheet:

It refers to the financial statement that displays the company's liabilities and assets. Through this, one can evaluate the financial position of a company.

b.

Answer to Problem 21P

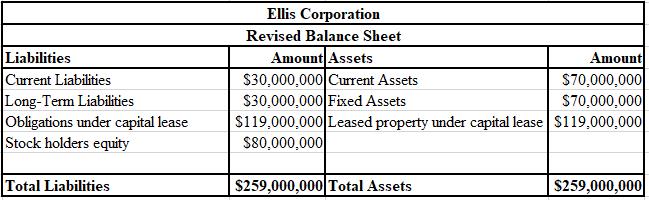

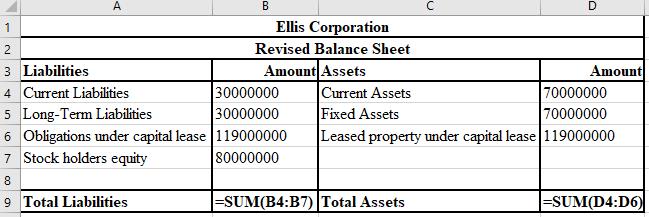

The revised balance sheet is shown below:

Explanation of Solution

The formulae used for the calculation of revised balance sheet are shown below.

c.

To calculate: The ratio of total debt to total assets on the original and revised balance sheet of Ellis Corporation.

Introduction:

Balance sheet:

It refers to the financial statement that displays the company's liabilities and assets. Through this, one can evaluate the financial position of a company.

c.

Answer to Problem 21P

The ratio of total debt to total asset on the original and revised balance sheet of Ellis Corporation is 42.9% and 69.1%, respectively.

Explanation of Solution

Calculation of the ratio of total debt to the total assets on the original balance sheet:

Calculation of the ratio of total debt to the total assets on the revised balance sheet:

d.

To calculate: The ratio of total debt to total equity on the original and revised balance sheet of Ellis Corporation.

Introduction:

Balance sheet:

It refers to the financial statement that displays the company's liabilities and assets. Through this, one can evaluate the financial position of a company.

d.

Answer to Problem 21P

The ratio of total debt to total equity on the original and revised balance sheet of Ellis Corporation is 75% and 223.8%, respectively.

Explanation of Solution

Calculation of the total debt to equity on the original balance sheet:

Calculation of the total debt to equity on the revised balance sheet:

e.

To determine: Whether the consequences of SFAS No. 13 will be viewed in the calculation of part (c) and part (d) to make changes in the stock price and credit ratings in an efficient capital market.

Introduction:

Capital Market:

It refers to the market place where trading of financial securities like stocks and bonds are undertaken by the sellers and buyers. This market usually trades in long term securities.

e.

Answer to Problem 21P

No, the consequences of SFAS No. 13 will not be viewed in the calculation of part (c) and part (d) for making changes to the stock price and credit ratings in an efficient capital market.

Explanation of Solution

In the efficient capital

f.

To explain: The management's perception of

Introduction:

Market Efficiency:

It refers to the degree at which prices circulated in the market portray the relevant information to the investors.

f.

Answer to Problem 21P

According to the financial officer, the performance may not be reliable enough as it has been presented for the first time.

Explanation of Solution

The concern of the company’s management is if the market is as efficient as it is believed to be. As per the management’s perception, the performance may appear questionable if the information is newly presented.

Want to see more full solutions like this?

Chapter 16 Solutions

Foundations of Financial Management

- Issue Price The following terms relate to independent bond issues: 500 bonds; $1,000 face value; 8% stated rate; 5 years; annual interest payments 500 bonds; $1,000 face value; 8% stated rate; 5 years; semiannual interest payments 800 bonds; $1,000 face value; 8% stated rate; 10 years; semiannual interest payments 2,000 bonds; $500 face value; 12% stated rate; 15 years; semiannual interest payments Required Assuming the market rate of interest is 10%, calculate the selling price for each bond issue.arrow_forwardOShea Inc. issued bonds at a face value of $100,000, a rate of 6%, and a 5-year term for $98,000. From this information, we know that the market rate of interest was ________. A. more than 6% B. less than 6% C. equal to 6% D. cannot be determined from the information given.arrow_forwardOn July 1, Somerset Inc. issued $200,000 of 10%, 10-year bonds when the market rate was 12%. The bonds paid interest semi-annually. Assuming the bonds sold at 58.55, what was the selling price of the bonds? Explain why the cash received from selling this bond is different from the $200,000 face value of the bond.arrow_forward

- Charleston Inc. issued $200,000 bonds with a stated rate of 10%. The bonds had a 10-year maturity date. Interest is to be paid semi-annually and the market rate of interest is 8%. If the bonds sold at 113.55, what amount was received upon issuance?arrow_forwardKrystian Inc. issued 10-year bonds with a face value of $100,000 and a stated rate of 4% when the market rate was 6%. Interest was paid semi-annually. Calculate and explain the timing of the cash flows the purchaser of the bonds (the investor) will receive throughout the bond term. Would an investor be willing to pay more or less than face value for this bond?arrow_forwardAn insurance company has liabilities of £15 million due in 11 years' time and £6 million due in 15 years' time.The assets of the company consist of two zero-coupon bonds, one paying million in 7 years' time and the other paying million in 19 years' time.The current interest rate is 7% per annum effective.Find the nominal value of Y (i.e. the amount, IN MILLIONS, that bond Y pays in 19 year's time) such that the first two conditions for Redington’s theory of immunisation are satisfied.Express your answer to THREE DECIMAL PLACES.arrow_forward

- The investment manager for Draxler Co. pays $988,472 to purchase a $1,000,000 face-value bond maturing in five years and paying interest semiannually at an annual rate of 2.75 percent. The annual market rate for comparable bonds at the time of issuance is 3.00 percent. With two years remaining, the manager determines that the bond will pay the full $1,000,000 at maturity but will pay $3,000 less in interest than planned every six months for the remainder of the bond’s life. The relevant present value factors for $1 and a $1 ordinary annuity are 0.9422 and 3.8544, respectively. If the bond’s current fair value with two years remaining is $994,800 and the amortized cost of the bond is $995,182, the current expected credit loss, assuming that the bond is classified as held-to-maturity, is closest to: A. $4,835 B. $6,710 C. $11,165 D. $11,545arrow_forwardThe following terms relate to independent bond issues: 460 bonds; $1,000 face value; 8% stated rate; 5 years; annual interest payments 460 bonds; $1,000 face value; 8% stated rate; 5 years; semiannual interest payments 830 bonds; $1,000 face value; 8% stated rate; 10 years; semiannual interest payments 1,890 bonds; $500 face value; 12% stated rate; 15 years; semiannual interest payments Use the appropriate present value table: PV of $1 and PV of Annuity of $1 Required: Assuming the market rate of interest is 10%, calculate the selling price for each bond issue. If required, round your intermediate calculations and final answers to the nearest dollar.arrow_forwardAn insurance company has liabilities of £5 million due in 11 years' time and £13 million due in 17 years' time. The assets of the company consist of two zero-coupon bonds, one paying £X million in 7 years' time and the other paying £Y million in 22 years' time. The current interest rate is 7% per annum effective. Find the nominal value of Y (i.e. the amount, IN MILLIONS, that bond Y pays in 22 year's time) such that the first two conditions for Redington's theory of immunisation are satisfied. Express your answer to THREE DECIMAL PLACES.arrow_forward

- On January 1, 2024, Ithaca Corporation purchases Cortland Incorporated bonds that have a face value of $210,000. The Cortland bonds have a stated interest rate of 10%. Interest is paid semiannually on June 30 and December 31, and the bonds mature in 10 years. For bonds of similar risk and maturity, the market yield on particular dates is as follows: Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) January 1, 2024 11.0% June 30, 2024 12.0% December 31, 2024 14.0%arrow_forwardOn January 1, 2024, Ithaca Corporation purchases Cortland Incorporated bonds that have a face value of $210,000. The Cortland bonds have a stated interest rate of 10%. Interest is paid semiannually on June 30 and December 31, and the bonds mature in 10 years. For bonds of similar risk and maturity, the market yield on particular dates is as follows: Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) January 1, 2024 11.0% June 30, 2024 12.0% December 31, 2024 14.0% Prepare all appropriate journal entries related to the bond investment during 2024, assuming that Ithaca chose the fair value option when the bonds were purchased, and that Ithaca determines fair value of the bonds semiannually. Ithaca calculates interest revenue at the effective interest rate as of the date it purchased the bonds. 1. Record the investment in bonds with a face value of $210,000, a stated interest rate of 10% and a market…arrow_forwardABC Corporation plans to issue an 8%, 15-year, P5,000,000 face value bonds. It will incur P300,000 as underwriting fee. What is the cost of the bond based on the following methods? 1. Yield-to-maturity formula 2. Trial and error method (closest percent, 5 decimal places)arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College