Foundations of Financial Management

16th Edition

ISBN: 9781259277160

Author: Stanley B. Block, Geoffrey A. Hirt, Bartley Danielsen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 5P

Assume the par

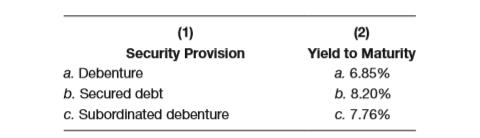

Match the yield to maturity in column 2 with the security provisions (or lack thereof) in column 1. Higher returns tend to go with greater risk.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

(a) Do you agree with the following statement, and explain why?

“If two bonds have the same duration, then the percentage change in price of the two bonds will be the same for a given change in interest rates.”

(b) Discuss the problems with the traditional bond pricing approach by using the yield to maturity. (300 words)

You are given the following prices and cash flows associated with bonds. CF stands for cash flow.

Bond

Price Today

CF Year 1

CF Year 2

CF Year 3

A

105.185

10

10

110

B

90.371

100

0

0

C

91.784

5

105

0

D

X

15

15

115

What is the current price of Bond D as per the no-arbitrage principle? In other words, what is the value of X?

Based on the graph, which of the following statements is true?

Neither bond has any interest rate risk.

The 1-year bond has more interest rate risk.

Both bonds have equal interest rate risk.

The 10-year bond has more interest rate risk.

Which type of bonds offer a higher yield, noncallable bonds or callable bonds?

Answer the following question based on your understanding of interest rate risk and reinvestment risk. True or False: Assuming all else is equal, short-term securities are exposed to higher reinvestment risk than long-term securities.

Chapter 16 Solutions

Foundations of Financial Management

Ch. 16 - Prob. 1DQCh. 16 - What are some specific features of bond...Ch. 16 - What is the difference between a bond agreement...Ch. 16 - Discuss the relationship between the coupon rate...Ch. 16 - Prob. 5DQCh. 16 - What method of “bond repayment� reduces debt...Ch. 16 - What is the purpose of serial repayments and...Ch. 16 - Under what circumstances would a call on a bond be...Ch. 16 - Discuss the relationship between bond prices and...Ch. 16 - Prob. 10DQ

Ch. 16 - Prob. 11DQCh. 16 - Bonds of different risk classes will have a spread...Ch. 16 - Prob. 13DQCh. 16 - Prob. 14DQCh. 16 - Explain how the zero-coupon rate bond provides...Ch. 16 - Prob. 16DQCh. 16 - Prob. 17DQCh. 16 - Prob. 18DQCh. 16 - Prob. 19DQCh. 16 - Prob. 20DQCh. 16 - Prob. 1PCh. 16 - Prob. 2PCh. 16 - Assume the par value of the bonds in the following...Ch. 16 - Assume the par value of the bonds in the following...Ch. 16 - Assume the par value of the bonds in the following...Ch. 16 - Assume the par value of the bonds in the following...Ch. 16 - Prob. 7PCh. 16 - Assume the par value of the bonds in the following...Ch. 16 - Assume the par value of the bonds in the following...Ch. 16 - Prob. 10PCh. 16 - Prob. 11PCh. 16 - Prob. 12PCh. 16 - Prob. 13PCh. 16 - Prob. 14PCh. 16 - Prob. 15PCh. 16 - Prob. 16PCh. 16 - Prob. 17PCh. 16 - Prob. 18PCh. 16 - Prob. 19PCh. 16 - Prob. 20PCh. 16 - Prob. 21PCh. 16 - Prob. 22PCh. 16 - Prob. 2WECh. 16 - Go back to the summary page and follow the same...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following statements is false? A. Other things being equal, an increase in a bond’s maturity will increase its interest rate risk. B. Other things being equal, an increase in the coupon rate of a bond will decrease its interest rate risk. C. Other things being equal, an increase in a bond’s YTM will decrease its interest rate risk. D. Effective duration is calculated as Macaulay duration divided by one plus the bond’s yield to maturity.arrow_forwardWhich of the following statements is correct assuming same market rates for all maturities (flat yield curve)? e a Extendible bonds allow bond issuer to extend the maturity date. O b. Callable bonds give the bond issuer an option to call the bond back before the maturity date at a predetermined price. Oc. When the market yield is equal to a bond's stated coupon rate, the bond's current yield is greater than its coupon yield. Od. The cash price plus the accrued interest on the bond is the quoted price of the bond. Current yield is the ratio of annual coupon payment divided by the par value. o e.arrow_forwardThe following information about bonds A, B, C, and D are given. Assume that bond prices admit noarbitrage opportunities. What is the convexity of Bond D?Cash Flow at the end ofBond Price Year 1 Year 2 Year 3A 91 100 0 0B 86 0 100 0C 78 0 0 100D ? 5 5 105arrow_forward

- If the pure expectations theory of the term structure is correct, which of the following statements would be CORRECT? a. If a 1-year Treasury bill has a yield to maturity of 7% and a 2-year Treasury bill has a yield to maturity of 8%, this would imply the market believes that 1-year rates will be 7.5% one year from now. b. The yield on a 5-year corporate bond should always exceed the yield on a 3-year Treasury bond. c. Interest rate (price) risk is higher on long-term bonds, but reinvestment rate risk is higher on short-term bonds. d. An upward-sloping yield curve would imply that interest rates are expected to be lower in the future. e. Interest rate (price) risk is higher on short-term bonds, but reinvestment rate risk is higher on long-term bondsarrow_forwardBond X has a 10% annual coupon, while Bond Y has a 8% annual coupon. Both bonds have the same maturity, a face value of $1,000, an 9% yield to maturity, and are noncallable. Which of the following statements is CORRECT? options: a) Bond X's capital gains yield is greater than Bond Y's capital gains yield. b) Bond X trades at a discount, whereas Bond Y trades at a premium. c) If the yield to maturity for both bonds immediately decreases to 7%, Bond X's bond will have a larger percentage increase in value. d) Bond X's current yield is greater than that of Bond Y. e) If the yield to maturity for both bonds remains at 9%, Bond X's price one year from now will be higher than it is today, but Bond Y's price one year from now will be lower than it is today.arrow_forwardAssume the following facts: a 10-yr bond, callable at 980 after 2 yrs, face value of 1000, priced to sell at 11% required rate of return, and pays a coupon of 10% (paid semiannually). The bond is valued today at 940.25. The problem with this valuation is that A. it assumes all cash flows are known with certainty B. it assumes all cash flows are not known with certainty C. it does not assume any reinvestment rate D. the bond should be selling at a premiumarrow_forward

- The method used to value a default-free zero coupon bonds (such as T-bills) requires that the interest is deducted from the face value of the bonds in advance. a.rediscounting b.market price c.forward price d.discount interestarrow_forwardWhich of the following statements is correct? Group of answer choices The actual capital gains yield for a one-year holding period on a bond can never be greater than the current yield on the bond. All of these statements are false. The price of a coupon bond is determined primarily by the number of years to maturity. The discount or premium on a bond can be expressed as the difference between the coupon payment on an old bond which originally sold at par and the coupon payment on a new bond, selling at par, where the difference in payments is discounted at the new market rate. On a coupon paying bond, the final interest payment is made one period before maturity and then, at maturity, the bond's face value is paid as the final payment.arrow_forwardWhich of the following statements correctly describes the relationship between a long-term bond’s market value, its coupon rate and the relevant yield to maturity? A. When bonds are initially issued, the coupon rate is generally set equal to the required yield to maturity so that the company can issue the bonds at their face value. B. If at any point in the bond’s life its coupon rate is less than the market determined yield to maturity, its market value at that time will be less than the face value of the bond. C. More than one of the other statements are correct D. A government bond with a fixed coupon rate may be valued below its’ face value even though the promised cash flows are effectively riskless. E. None of the other statements are correct Is "B" is the correct answer?arrow_forward

- Please solve for all parts and questions (a-e) being asked in the problem. For example the question being asked in Part A is: What is the value of the bond if the market's required yield to maturity on a comparable-risk bond is 8 percent? Also, please show all work and steps.arrow_forwardThe respective maturities of these newly issued debt instruments are approximately equivalent. Which one of the investments in the portfolio would be subject to the greatest relative amount of price volatility if interest rates were to change quickly a. Treasury bond.b. Zero-coupon bond.c. Corporate bond.d. Municipal bond.arrow_forwardConsider the following pure discount bonds with face value $1,000: Maturity Price 1 952.38 2 898.47 3 847.62 4 799.64 5 754.38 a). Find the spot rates and draw a yield curve.b). Assume that there is a constant liquidty premium that is equal to 1% across all maturities. Find the forward rates and the expected one period future interest rates.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

What is modified duration? | Dejargoned; Author: Mint;https://www.youtube.com/watch?v=5yLIybzb_OQ;License: Standard YouTube License, CC-BY