Waseca Company had 5 convertible securities outstanding during all of 2019. It paid the appropriate interest (and amortized any related premium or discount using the

Additional data:

Net income for 2019 totaled $119,460. The weighted average number of common shares outstanding during 2019 was 40,000 shares. No share options or warrants arc outstanding. The effective corporate income tax rate is 30%.

Required:

- 1. Prepare a schedule that lists the impact of the assumed conversion of each convertible security on diluted earnings per share.

- 2. Prepare a ranking of the order in which each of the convertible securities should be included in diluted earnings per share.

- 3. Compute basic earnings per share.

- 4. Compute diluted earnings per share.

- 5. Indicate the amount(s) of the earnings per share that Waseca would report on its 2019 income statement.

1. and 2.

Prepare a schedule to show the impact of the assumed conversion of each convertible security on diluted earnings per share and also show the manner by which the securities that are included in the diluted earnings per share are ranked.

Explanation of Solution

Earnings per share (EPS):

The amount of net income available to each shareholder per common share outstanding is referred to as earnings per share (EPS).

Prepare a schedule to show the impact of the assumed conversion of each convertible security on diluted earnings per share.

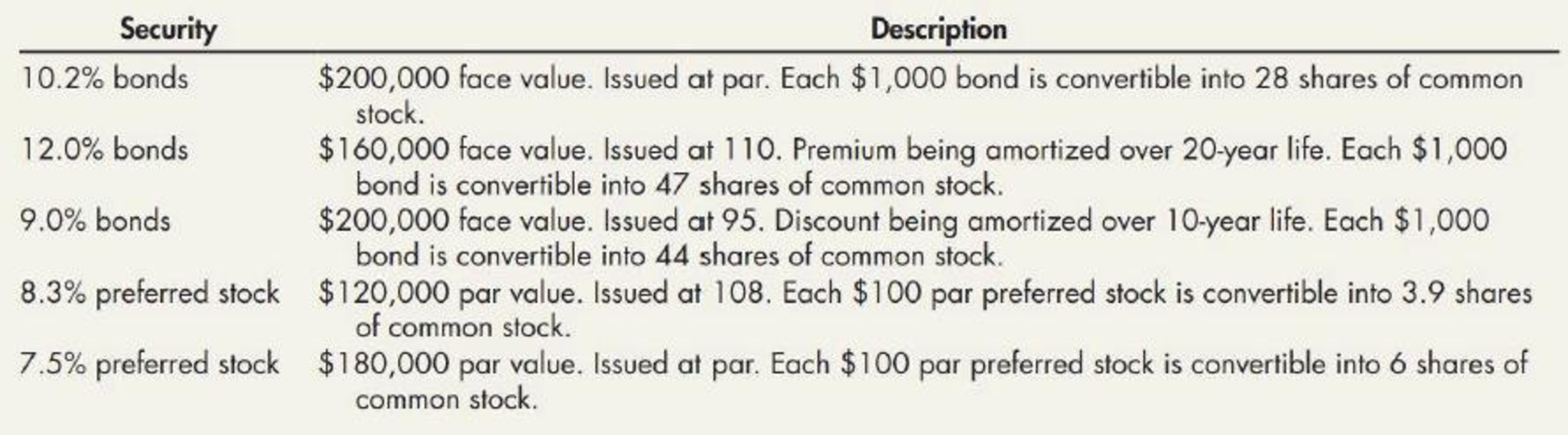

| Convertible security | Impact in $ | Ranking |

| 10.2% bonds (1) | $2.55 | 5 |

| 12.0% bonds (3) | $1.71 | 3 |

| 9.0% bonds (5) | $1.51 | 2 |

| 8.3% preferred stock (6) | $2.13 | 4 |

| 7.5% preferred stock (7) | $1.25 | 1 |

(Table 1)

Working notes:

(1) Calculate the impact of the 10.2% bonds on diluted earnings per share.

(2) Calculate the Premium on amortized bond for 20 year life:

(3) Calculate the impact of the 12.0% bonds on diluted earnings per share.

(4) Calculate the discount on amortized bond for 10 year life:

(5) Calculate the impact of the 9.0% bonds on diluted earnings per share.

(6) Calculate the impact of the 8.3% preferred stock on diluted earnings per share.

(7) Calculate the impact of the 7.5% preferred stock on diluted earnings per share.

3. and 4.

Calculate the basic earnings per share and diluted earnings per share.

Explanation of Solution

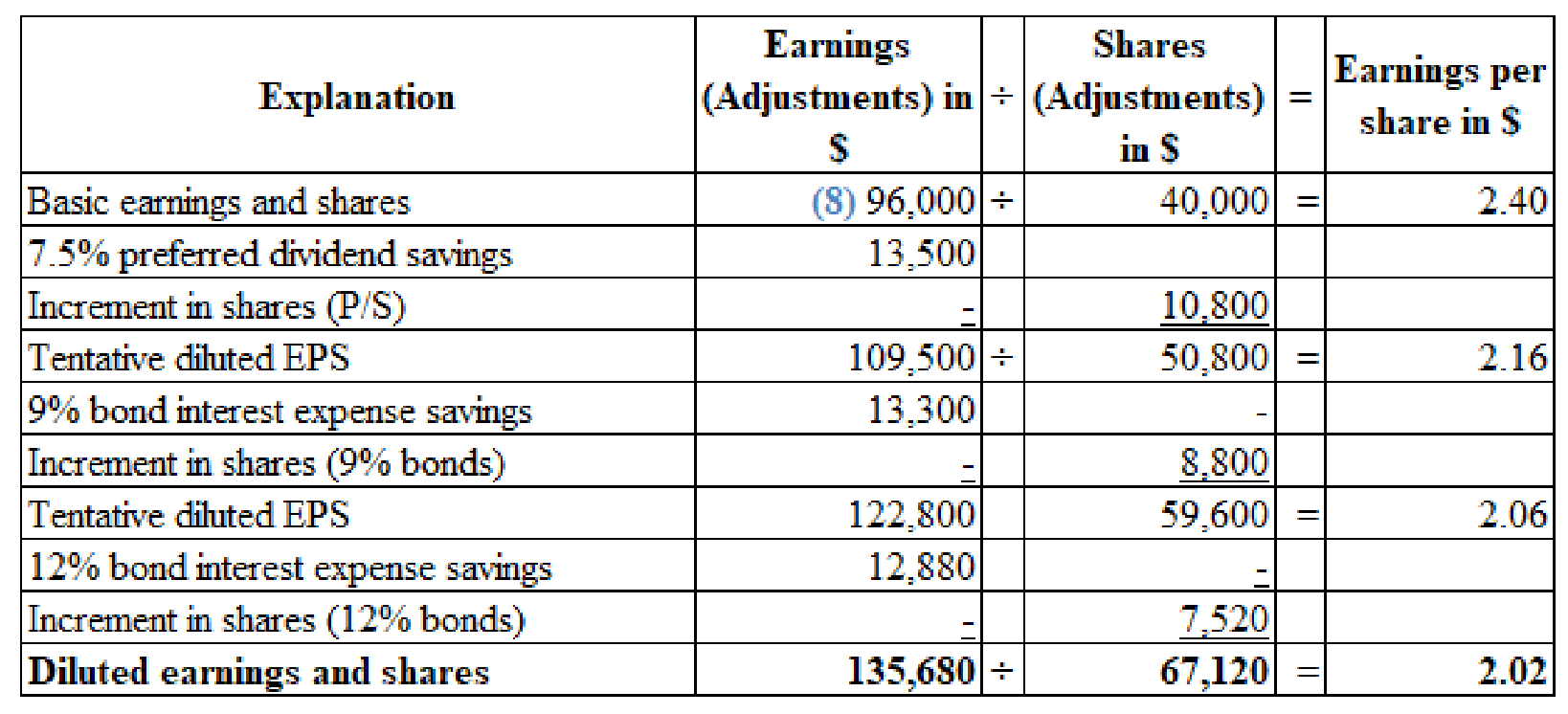

(Figure 1)

Working notes:

(8) Calculate the numerator for the basic earnings per share:

5.

Identify the amount that will be reported as basic and diluted earnings per share for the year 2019.

Explanation of Solution

The Company W must report an amount of $2.40 as basic earnings per share and $2.20 as diluted earnings per share in its 2019 income statement.

Want to see more full solutions like this?

Chapter 16 Solutions

INTERM.ACCT.:REPORTING...-CENGAGENOWV2

- Mills Company had five convertible securities outstanding during all of 2019. It paid the appropriate interest (and amortized any related premium or discount using the straight-line method) and dividends on each security during 2019. Each convertible security is described in the following table. The corporate income tax rate is 30%. Required: 1. Prepare a schedule that lists the impact of the assumed conversion of each convertible security on diluted earnings per share. 2. Prepare a ranking of the order in which the securities would be included in the diluted earnings per share computations.arrow_forwardTama Companys capital structure consists of common stock and convertible bonds. At the beginning of 2019, Tama had 15,000 shares of common stock outstanding; an additional 4,500 shares were issued on May 4. The 7% convertible bonds have a face value of 80,000 and were issued in 2016 at par. Each 1,000 bond is convertible into 25 shares of common stock; to date, none of the bonds have been converted. During 2019, the company earned net income of 79,200 and was subject to an income tax rate of 30%. Required: Compute the 2019 diluted earnings per share.arrow_forwardFrost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.arrow_forward

- Percy Company has 15,000 shares of common stock outstanding during all of 2019. It also has 2 convertible securities outstanding at the end of 2019. These are: 1. Convertible preferred stock: 1,000 shares of 9%, 100 par, preferred stock were issued in 2015 for 140 per share. Each share of preferred stock is convertible into 3.5 shares of common stock. The current dividends have been paid. To date, no preferred stock has been converted. 2. Convertible bonds: Bonds with a face value of 100,000 and an interest rate of 10% were issued at par on July 1, 2019. Each 1,000 bond is convertible into 35 shares of common stock. To date, no bonds have been converted. Percy earned net income of 54,000 during 2019. Its income tax rate is 30%. Required: Compute the 2019 diluted earnings per share. What earnings per share amount(s) would Percy report on its 2019 income statement?arrow_forwardOn January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.arrow_forwardOn July 2, 2018, McGraw Corporation issued 500,000 of convertible bonds. Each 1,000 bond could be converted into 20 shares of the companys 5 par value stock. On July 3, 2020, when the bonds had an unamortized discount of 7,400 and the market value of the McGraw shares was 52 per share, all the bonds were converted into common stock. Required: 1. Prepare the journal entry to record the conversion of the bonds under (a) the book value method and (b) the market value method. 2. Compute the companys debt-to-equity ratio (total liabilities divided by total shareholders equity, as described in Chapter 6) under each alternative. Assume the companys other liabilities are 2 million and shareholders equity before the conversion is 3 million. 3. Assume the company uses IFRS and issued the bonds for 487,500 on July 2, 2018. On this date, it determined that the fair value of each bond was 930 and the fair value of the conversion option was 45 per bond. Prepare the journal entry to record the issuance of the bonds.arrow_forward

- Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares of 10%, 100 par, nonconvertible preferred stock outstanding, on which the years dividends had been paid. At the beginning of 2019, the company had 7,000 shares of common stock outstanding. On April 2, 2019, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2019. Common dividends of 17,000 had been paid during 2019. At the end of 2019, the market price per share of common stock was 17.50. Required: 1. Compute Mononas basic earnings per share for 2019. 2. Compute the price/earnings ratio for 2019.arrow_forwardHyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73arrow_forwardAnoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?arrow_forward

- During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 lossarrow_forwardLyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning