Concept explainers

Salem Electronics currently produces two products: a programmable calculator and a tape recorder. A recent marketing study indicated that consumers would react favorably to a radio with the Salem brand name. Owner Kenneth Booth was interested in the possibility. Before any commitment was made, however, Kenneth wanted to know what the incremental fixed costs would be and how many radios must be sold to cover these costs.

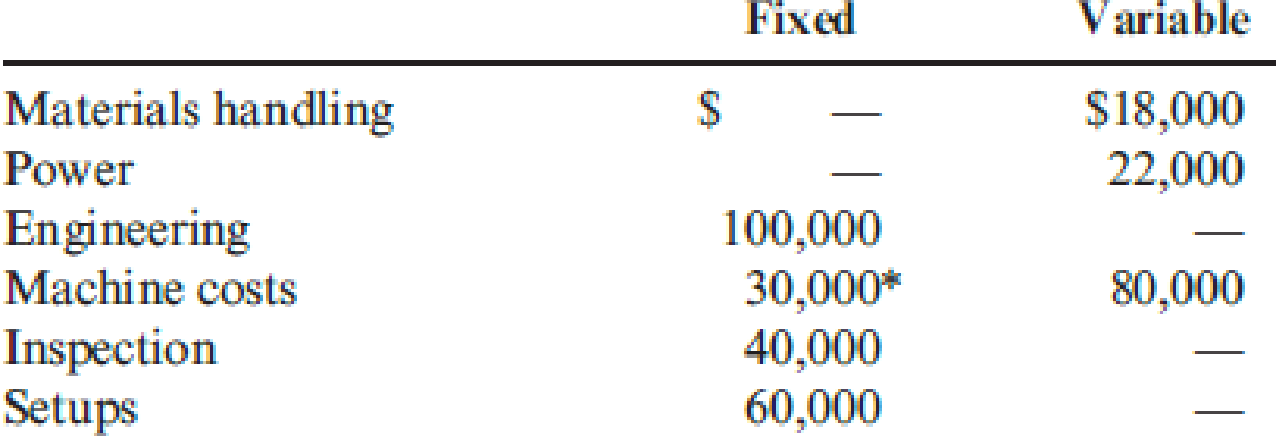

In response, Betty Johnson, the marketing manager, gathered data for the current products to help in projecting overhead costs for the new product. The overhead costs based on 30,000 direct labor hours follow. (The high-low method using direct labor hours as the independent variable was used to determine the fixed and variable costs.)

*All

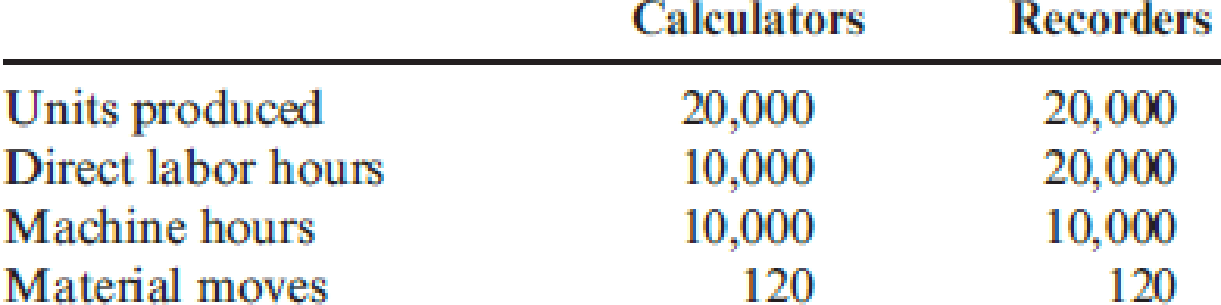

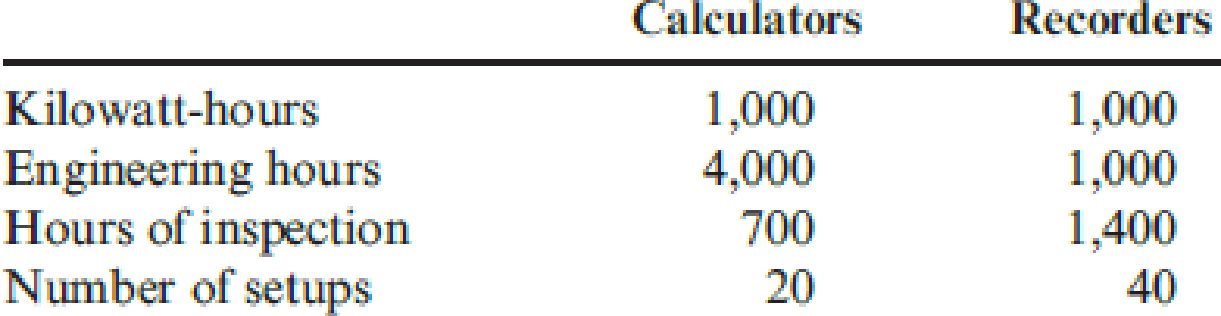

The following activity data were also gathered:

Betty was told that a plantwide overhead rate was used to assign overhead costs based on direct labor hours. She was also informed by engineering that if 20,000 radios were produced and sold (her projection based on her marketing study), they would have the same activity data as the recorders (use the same direct labor hours, machine hours, setups, and so on).

Engineering also provided the following additional estimates for the proposed product line:

Upon receiving these estimates, Betty did some quick calculations and became quite excited. With a selling price of $26 and just $18,000 of additional fixed costs, only 4,500 units had to be sold to break even. Since Betty was confident that 20,000 units could be sold, she was prepared to strongly recommend the new product line.

Required:

- 1. Reproduce Betty’s break-even calculation using conventional cost assignments. How much additional profit would be expected under this scenario, assuming that 20,000 radios are sold?

- 2. Use an activity-based costing approach, and calculate the break-even point and the incremental profit that would be earned on sales of 20,000 units.

- 3. Explain why the CVP analysis done in Requirement 2 is more accurate than the analysis done in Requirement 1. What recommendation would you make?

1.

Ascertain the break-even point and the additional profit for the given proposal.

Explanation of Solution

Contribution Margin Ratio: The contribution margin ratio shows the amount of difference in the actual sales value and the variable expenses in percentage. This margin indicates that percentage which is available for sale above the fixed costs and the profit. The formula for variable cost ratio is shown below:

Break-Even Point: The break-even point refers to the point of sales at which the firm neither earns a profit nor suffers a loss. It is also known as the point of sales or sales value at which the firm recovers the entire cost of fixed and variable nature.

Break-Even in sales revenue: The break-even in sales revenue refers to the sales volume required to cover the fixed and variable costs and left out with neither profit nor loss.

Compute the variable overhead rate:

The variable overhead rate per direct labor hour is $4.

Compute the unit variable cost:

The variable cost per unit is $22.

Compute the break-even units:

The break-even unit is 4,500 units.

Compute the additional profit:

The additional profit is $62,000.

2.

Compute the break-even point and the incremental profit using the activity based costing.

Explanation of Solution

Compute the unit-based variable overhead cost per unit:

| Particulars | Amount ($) |

| Unit-based variable costs: | |

| Materials handling | $18,000 |

| Power | $22,000 |

| Machine costs | $80,000 |

| Total | $120,000 |

| Machine hours | 20000 |

| Pool rate | $6 |

Table (1)

Compute the unit variable cost:

The unit-based variable overhead cost per unit is $21 (X1).

Compute the non-unit-based variable overhead cost per unit:

| Particulars | Calculations | Amount ($) |

| Non-unit-based variable costs: | ||

| Engineering (X2) | $20.00 | |

| Inspection (X3) | 19.05 | |

| Setups (X4) | $1,000 |

Table (2)

Compute the break-even units:

Substitute the values found in the below equation to compute the break-even point.

The break-even unit is 20,934 units.

The activity based costing is based on the assumptions that:

- The expected variable cost is realized.

- The depreciation is a fixed cost.

If the depreciation represents no salvage and the expected production is achieved, then the variable cost per unit will increase by $0.90

Compute the new break-even units:

The new break-even unit is 21,122 units.

3.

Describe the reasons for the greater accuracy of CVP analysis done in Requirement 2 than in the CVP analysis done in Requirement 1.

Explanation of Solution

Cost Volume Profit Analysis (CVP Analysis): The Cost volume profit (CVP) analysis is helpful in determining how any type of change in cost determines company’s income.

The reasons for differences in accuracy are:

- The Requirement 2 takes into consideration all the associated costs of the support activities which are ignored by the conventional method.

- The non-unit related costs are viewed as fixed costs in Requirement 1.

- Once these support activity costs are added the analysis tends to be more accurate.

Want to see more full solutions like this?

Chapter 16 Solutions

CengageNOWv2, 1 term Printed Access Card for Hansen/Mowen’s Cornerstones of Cost Management, 4th

- Hudson Corporation is considering three options for managing its data warehouse: continuing with its own staff, hiring an outside vendor to do the managing, or using a combination of its own staff and an outside vendor. The cost of the operation depends on future demand. The annual cost of each option (in thousands of dollars) depends on demand as follows: If the demand probabilities are 0.2, 0.5, and 0.3, which decision alternative will minimize the expected cost of the data warehouse? What is the expected annual cost associated with that recommendation? Construct a risk profile for the optimal decision in part (a). What is the probability of the cost exceeding $700,000?arrow_forwardSouthland Corporation’s decision to produce a new line of recreational products resulted in the need to construct either a small plant or a large plant. The best selection of plant size depends on how the marketplace reacts to the new product line. To conduct an analysis, marketing management has decided to view the possible long-run demand as low, medium, or high. The following payoff table shows the projected profit in millions of dollars: What is the decision to be made, and what is the chance event for Southland’s problem? Construct a decision tree. Recommend a decision based on the use of the optimistic, conservative, and minimax regret approaches.arrow_forwardKeith Golding has decided to purchase a personal computer. He has narrowed his choices to two: Brand A and Brand B. Both brands have the same processing speed, hard disk capacity, RAM, graphics card memory, and basic software support package. Both come from companies with good reputations. The selling price for each is identical. After some review, Keith discovers that the cost of operating and maintaining Brand A over a three-year period is estimated to be 200. For Brand B, the operating and maintenance cost is 600. The sales agent for Brand A emphasized the lower operating and maintenance cost. She claimed that it was lower than any other PC brand. The sales agent for Brand B, however, emphasized the service reputation of the product. She provided Keith with a copy of an article appearing in a PC magazine that rated service performance of various PC brands. Brand B was rated number one. Based on all the information, Keith decided to buy Brand B. Required: 1. What is the total product purchased by Keith? 2. Is the Brand A company pursuing a cost leadership or differentiation strategy? The Brand B company? Explain. 3. When asked why he purchased Brand B, Keith replied, I think Brand B offered more value than Brand A. What are the possible sources of this greater value? If Keiths reaction represents the majority opinion, what suggestions could you offer to help improve the strategic position of Brand A?arrow_forward

- Jim Salters, the COO of CryoDerm, has asked his cost management team for a product-line profitability analysis for his firm’s two products, Zderm and Bderm. The two skincare products require a large amount of research and development and advertising. After receiving the following statement fromCryoDerm’s costing team, Jim concludes that Zderm is the more profitable product and that perhaps cost-cutting measures should be applied to Bderm. Zderm Bderm Total Sales $3,000,000 $2,000,000 $5,000,000 Cost of Goods Sold ($1,900,000) ($1,600,000) ($3,500,000) Gross Profit $1,100,000 $ 400,000 $1,500,000 R&D (900,000) Selling expenses (100,000) Profit before taxes $ 500,000 Required:(i) Briefly explain why Jim may be wrong in his assessment of the relative performance of the twoproducts. (ii) Suppose that 80% of the R&D and selling expenses are traceable to Zderm. Prepare life-cycle income statements for each product. What does this indicate…arrow_forwardCompuware, Ltd., produces digital-to-analog converters for compact disk players used by radio stations and audio enthusiasts. It is contemplating an expansion into the moderately-priced home audio market by producing a CD player that would sell at a price of $360. The production of each CD player would require $100 in materials, and 3.75 hours of labor at the rate of $2 per hour for wages and fringe benefits plus variable overhead tied to labor. Energy, supervisory and other variable overhead costs would amount to $50 per unit. The accounting department has derived an allocated fixed overhead charge of $25 per CD player (at a projected volume of 14,000 units) to account for the expected increase in fixed costs. A. What is Compuware's breakeven sales volume (in units) for home audio CD players? B. Calculate the degree of operating leverage at a projected volume of 14,000 units and explain what the DOL means. What happens to the DOL as output approaches the breakeven level…arrow_forwardThe Monroe Forging Company sells a corrugated steel product to the Standard Manufacturing Company and is in competition on such sales with other suppliers of the Standard Manufacturing Co. The vice president of sales of Monroe Forging Co. believes that by reducing the price of the product, a 40% increase in the volume of units sold to the Standard Manufacturing Co. could be secured. As the manager of the cost and analysis department, you have been asked to analyze the proposal of the vice president and submit your recommendations as to whether it is financially beneficial to the Monroe Forging Co. You are specifically requested to determine the following: (a) Net profit or loss based on the pricing proposal. (b) Unit sales volume under the proposed price that is required to make the same $40,000 profit that is now earned at the current price and unit sales volume. Use the following data in your analysis:arrow_forward

- Suppose that FedEx Kinko’s has decided to install personal computers and printers in its Pittsburgh store that will be rented to customers on an hourly basis. FedEx Kinko’s management has called in consultants from a number of computer suppliers to assist it in designing a system. After considering a number of alternatives, FedEx Kinko’s decided that an Apple computer system consisting of eight iMac computers and two printers best meets its current and projected future needs. FedEx Kinko’s evaluated the desirability of the acquisition of the Apple computer system using its normal capital budgeting procedures. It found that the computer system has a large positive expected net present value. Jim Horn, a new management trainee in the financial planning office, has recently been reading about the boom in the leasing industry. He feels that if leasing is growing as rapidly as it seems, there must be some significant advantages to the leasing alternative compared to ownership. If purchased,…arrow_forwardAlameda Tile sells products to many people remodeling their homes and thinks that it could profitably offer courses on tile installation, which might also increase the demand for its products. The basic installation course has the following (tentative) price and cost characteristics.arrow_forwardLiquid Sleeve, Inc. is a company that makes a sealing solution for machine shaft surfaces that have been compromised by abrasion, high pressures,or inadequate lubrication. The manager is considering adding a metal-based nanoparticle (Type Al or Fe) to its solution to increase the product’s performance at high temperatures. The costs associated with each type are estimated. If the company’sMARRis 20% per year, which nanoparticle type should the company select? Utilize a rate of return analysis.arrow_forward

- Tennis Products, Inc., produces three models of high-quality tennis rackets. The following table contains recent information on the sales, costs, and profitability of thethree models: The company is considering lowering the price of Model A to $27 in an effort toincrease the number of units sold. Based on the results of price changes that havebeen instituted in the past, Tennis Products’ chief economist estimates the arc priceelasticity of demand to be 2.5. Furthermore, she estimates the arc cross elasticity ofdemand between Model A and Model B to be approximately 0.5 and between ModelA and Model C to be approximately 0.2. Variable costs per unit are not expected tochange over the anticipated changes in volume.a. Evaluate the impact of the price cut on the (i) total revenue and (ii) contributionmargin of Model A. Based on this analysis, should the firm lower the price ofModel A?b. Evaluate the impact of the price cut on the (i) total revenue and (ii) contributionmargin for the entire…arrow_forwardA manager must decide how many machines of a certain type to buy. The machines will be used to manufacture a new gear for which there is increased demand. The manager has narrowed the decision to two alternatives: buy one machine or buy two. If only one machine is purchased and demand is more than it can handle, a second machine can be purchased at a later time. However, the cost per machine would be lower if the two machines were purchased at the same time. The estimated probability of low demand is .30, and the estimated probability of high demand is .70. The net present value associated with the purchase of two machines initially is $79,200 if demand is low and $130,600 if demand is high. The net present value for one machine and low demand is $99,000. If demand is high, there are three options. One option is to do nothing, which would have a net present value of $124,680. A second option is to subcontract; that would have a net present value of $115,650. The third option is to…arrow_forwardTesla’s decision to produce a new line of compact and full sized cars resulted in the need to construct either a small plant or a large plant. The best selection of plant size depends on how the marketplace reacts to the new product line. To conduct an analysis, marketing management has decided to view the possible long-run demand as low, medium, or high. The following payoff table shows the projected profit in millions of dollars: Long Run Demand Plant size Low Medium High Small 80 200 350 Large 120 180 190 Construct an influence diagram. Construct a decision tree. Recommend a decision based on the use of the optimistic, conservative, and minimax regret approaches.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,