Construction Accounting And Financial Management (4th Edition)

4th Edition

ISBN: 9780135232873

Author: Steven J. Peterson MBA PE

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 13P

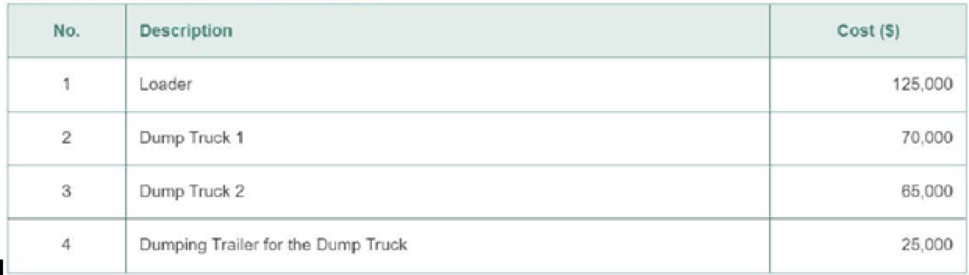

A manager has up to $190.000 available to invest in new construction equipment for the company. The manager must purchase a new dump truck and does not have a need for a second dump truck. The dumping trailer can only be purchased along with a dump truck. From the list of possible equipment in Table 17-11, identify all of the mutually exclusive alternatives and identify which of the alternatives are not acceptable.

Table 17-11 Alternatives for Problem 13

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Dwight Donvan, the president of Munoz enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only 1 of them. Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of four years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for project A are $114, 000 and for project, B is $43,000. The annual expected cash inflows are $44,037 for project A and $13,565 for project B. Both investments are expected to provide cash flow benefits for the next four years. Munoz Enterprises' desired rate is 8 percent.

A. Commute the net present value of each project.

B. Commute the approximate internal rate of each project.

Dwight Donovan, the president of Fanning Enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of four years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for Project A are $116,000 and for Project B are $36,000. The annual expected cash inflows are $44,810 for Project A and $12,355 for Project B. Both investments are expected to provide cash flow benefits for the next four years. Fanning Enterprises’ desired rate of return is 8 percent.

wight Donovan, the president of Donovan Enterprises, is considering 2 investment opportunities. Because of limited resources, he will be able to invest in only 1 of them.

Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of 4 years and no salvage value.

Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for Project A are $400,000 and for Project B are $160,000. The annual expected cash inflows are $126,000 for Project A and $52,800 for Project B.

Both investments are expected to provide cash flow benefits for the next 4 years. Donovan Enterprises’ desired rate of return is 8%. Your task as Senior Accountant is to use your knowledge of net present value and internal rate of return to identify the preferred method and best investment opportunity for the company and present your results to Dwight Donovan.

Use Excel®—showing all work…

Chapter 17 Solutions

Construction Accounting And Financial Management (4th Edition)

Ch. 17 - What is the do nothing alternative?Ch. 17 - Why is it important to compare all possible...Ch. 17 - What is a sunk cost? How should sunk costs be...Ch. 17 - Prob. 4DQCh. 17 - Prob. 5DQCh. 17 - What is a study period? Why must all of the...Ch. 17 - Why do the NPV, the future worth, and the annual...Ch. 17 - Why must you use mutually exclusive alternatives...Ch. 17 - Why would one use the capital recovery with return...Ch. 17 - What are the weaknesses of the payback period...

Ch. 17 - What types of investments does the payback period...Ch. 17 - What is the advantage of using the project balance...Ch. 17 - A manager has up to 190.000 available to invest in...Ch. 17 - A manager has up to 200,000 available to invest in...Ch. 17 - Determine the MARR for a company that can borrow...Ch. 17 - Determine the MARR for a company that can invest...Ch. 17 - Your company is looking at purchasing a dump truck...Ch. 17 - Your company is looking at purchasing a loader at...Ch. 17 - Your company needs to purchase a new track hoe and...Ch. 17 - Your company needs to purchase a new track hoe and...Ch. 17 - Your company needs to purchase a track hoe and has...Ch. 17 - Your company needs to purchase a truck and has...Ch. 17 - Prob. 23PCh. 17 - Determine the incremental net present value for...Ch. 17 - Determine the future worth for Problem 17. Should...Ch. 17 - Determine the future worth for Problem 18. Should...Ch. 17 - Prob. 27PCh. 17 - Determine the annual equivalent for Problem 18....Ch. 17 - Determine the rate of return for Problem 17....Ch. 17 - Determine the rate of return for Problem 18....Ch. 17 - Your company has 100,000 to invest and has...Ch. 17 - Your company has 200,000 to invest and has...Ch. 17 - Determine the incremental rate of return for...Ch. 17 - Prob. 34PCh. 17 - Your company has purchased a new track hoe for...Ch. 17 - Your company has purchased a new excavator for...Ch. 17 - Determine the payback period without interest for...Ch. 17 - Determine the payback period without interest for...Ch. 17 - Prob. 39PCh. 17 - Determine the payback period with interest for...Ch. 17 - Draw a project balance chart for Problem 17.Ch. 17 - Draw a project balance chart for Problem 18.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Aubey Coffee Company is evaluating the within-plant distribution system for its new roasting, grinding, and packing plant. The two alternatives are (1) a conveyor system with a high initial cost but low annual operating costs and (2) several forklift trucks, which cost less but have considerably higher operating costs. The decision to construct the plant has already been made, and the choice here will have no effect on the overall revenues of the project. The cost of capital for the plant is 8%, and the projects’ expected net costs are listed in the following table: What is the IRR of each alternative? What is the present value of the costs of each alternative? Which method should be chosen?arrow_forwardNewmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new design will eliminate the production of a toxic solid residue. The initial cost of the system is estimated at 860,000 and includes computerized equipment, software, and installation. There is no expected salvage value. The new system has a useful life of 8 years and is projected to produce cash operating savings of 225,000 per year over the old system (reducing labor costs and costs of processing and disposing of toxic waste). The cost of capital is 16%. Required: 1. Compute the NPV of the new system. 2. One year after implementation, the internal audit staff noted the following about the new system: (1) the cost of acquiring the system was 60,000 more than expected due to higher installation costs, and (2) the annual cost savings were 20,000 less than expected because more labor cost was needed than anticipated. Using the changes in expected costs and benefits, compute the NPV as if this information had been available one year ago. Did the company make the right decision? 3. CONCEPTUAL CONNECTION Upon reporting the results mentioned in the postaudit, the marketing manager responded in a memo to the internal audit department indicating that cash inflows also had increased by a net of 60,000 per year because of increased purchases by environmentally sensitive customers. Describe the effect that this has on the analysis in Requirement 2. 4. CONCEPTUAL CONNECTION Why is a postaudit beneficial to a firm?arrow_forwardAlexander Industries is considering purchasing an insurance policy for its new office building in St. Louis, Missouri. The policy has an annual cost of $10,000. If Alexander Industries doesn’t purchase the insurance and minor fire damage occurs, a cost of $100,000 is anticipated; the cost if major or total destruction occurs is $200,000. The costs, including the state-of-nature probabilities, are as follows: Using the expected value approach, what decision do you recommend? What lottery would you use to assess utilities? (Note: Because the data are costs, the best payoff is $0.) Assume that you found the following indifference probabilities for the lottery defined in part (b). What decision would you recommend? Do you favor using expected value or expected utility for this decision problem? Why?arrow_forward

- Dwight Donovan, the president of Perez Enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of five years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for Project A are $103,000 and for Project B are $48,000. The annual expected cash inflows are $26,481 for Project A and $13,982 for Project B. Both investments are expected to provide cash flow benefits for the next five years. Perez Enterprises’ desired rate of return is 8 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.)Required Compute the net present value of each project. Which project should be adopted based on the net present value approach? Compute the approximate internal rate…arrow_forwardDwight Donovan, the president of Stuart Enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of four years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for Project A are $103,000 and for Project B are $40,000. The annual expected cash inflows are $31,793 for Project A and $14,295 for Project B. Both investments are expected to provide cash flow benefits for the next four years. Stuart Enterprises’ desired rate of return is 8 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.)Required Compute the net present value of each project. Which project should be adopted based on the net present value approach? Compute the approximate internal…arrow_forwardA company is trying to decide between two different conveyor belt systems. System A costs $300,000, has a 4-year life, and requires $101,000 in pretax annual operating costs. System B costs $380,000, has a 6-year life, and requires $95,000 in pretax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value. Whichever project is chosen, it will not be replaced when it wears out. The tax rate is 22 percent and the discount rate is 10 percent. A. Calculate the NPV for both conveyor belt systems. (Do not round intermediate calculations ) B. Which conveyor belt system should the firm choose? Please use excel and show equations used.arrow_forward

- The production manager on the Ofon Phase 2 offshore platform operated by Total S.A. must purchase specialized environmental equipment or an equivalent service. The first cost is $250,000 with an AOC of $66,000. The manager has let it be known that he does not care about the salvage value because he thinks it will make no difference in the decision-making process. His supervisor estimates the salvage might be as high as $100,000 or as low as $10,000 in 3 years, at which time the equipment will be unnecessary. Alternatively, a subcontractor can provide the service for $165,000 per year. The total offshore project MARR is 13% per year. Determine if the decision to buy the equipment is sensitive to the salvage value. The annual worth of high salvage value is $______________ 142,525 incorrect.. The annual worth of low salvage value is $_______________ 168,940 incorrect.. Decision is sensitive…arrow_forward#3 Dwight Donovan, the president of Benson Enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of four years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for Project A are $103,000 and for Project B are $34,000. The annual expected cash inflows are $35,350 for Project A and $12,151 for Project B. Both investments are expected to provide cash flow benefits for the next four years. Benson Enterprises’ desired rate of return is 6 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.)Required Compute the net present value of each project. Which project should be adopted based on the net present value approach? Compute the approximate internal…arrow_forwardAerotron Electronics is considering purchasing a water filtration system to assist in circuit board manufacturing. The system costs $40,000. It has an expected life of 7 years at which time its salvage value will be $7,500. Operating and maintenance expenses are estimated to be $2,000 per year. If the filtration system is not purchased, Aerotron Electronics will have to pay Bay City $12,000 per year for water purification. If the system is purchased, no water purification from Bay City will be needed. Aerotron Electronics must borrow half of the purchase price, but they cannot start repaying the loan for 2 years. The bank has agreed to three equal annual payments, with the first payment due at the end of year 2. The loan interest rate is 8% compounded annually. Aerotron Electronics’ MARR is 10% compounded annually. a. What is the present worth of this investment? b. What is the decision rule for judging the attractiveness of investmentsbased on present worth? c. Should Aerotron…arrow_forward

- In a cost center, the manager has responsibility and authority for making decisions that affect a. costs b. investments in assets c. both costs and revenues d. revenues Keating Co. is considering disposing of equipment with a cost of $68,000 and accumulated depreciation of $47,600. Keating Co. can sell the equipment through a broker for $27,000 less 8% commission. Alternatively, Gunner Co. has offered to lease the equipment for five years for a total of $46,000. Keating will incur repair, insurance, and property tax expenses estimated at $10,000 over the five-year period. At lease-end, the equipment is expected to have no residual value. The net differential income from the lease alternative is a. $11,160 b. $7,812 c. $16,740 d. $13,392 If sales are $828,000, variable costs are 68% of sales, and operating income is $278,000, what is the contribution margin ratio? a. 64% b. 36% c. 68% d. 32%arrow_forwardAerotron Electronics is considering the purchase of a water filtration system to assist in circuit board manufacturing. The system costs $40,000. It has an expected life of 7 years at which time its salvage value will be $7,500. Operating and maintenance expenses are estimated to be $2,000 per year. If the filtration system is not purchased, Aerotron Electronics will have to pay Bay City $12,000 per year for water purification. If the system is purchased, no water purification from Bay City will be needed. Aerotron Electronics must borrow half of the purchase price, but they cannot start repaying the loan for 2 years. The bank has agreed to three equal annual payments, with the first payment due at end of year 2. The loan interest rate is 8% compounded annually. Aerotron Electronics’ MARR is 10% compounded annually. Solve, a. What is the internal rate of return of this investment? b. What is the decision rule for judging the attractiveness of investments based on internal rate of…arrow_forwardAerotron Electronics is considering the purchase of a water filtration system to assist in circuit board manufacturing. The system costs $40,000. It has an expected life of 7 years at which time its salvage value will be $7,500. Operating and maintenance expenses are estimated to be $2,000 per year. If the filtration system is not purchased, Aerotron Electronics will have to pay Bay City $12,000 per year for water purification. If the system is purchased, no water purification from Bay City will be needed. Aerotron Electronics must borrow half of the purchase price, but it cannot start repaying the loan for 2 years. The bank has agreed to three equal annual payments, with the first payment due at the end of year 2. The loan interest rate is 8% compounded annually. Aerotron Electronics’ MARR is 10% compounded annually. Solve, a. What is the annual worth of this investment? b. What is the decision rule for judging the attractiveness of investments based on annual worth? c. Should…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License