Concept explainers

Transferred-in costs, FIFO method. Refer to the information in Problem 17-43. Suppose that Spelling Sports uses the FIFO method instead of the weighted-average method. Assume that all other information, including the cost of beginning WIP, is unchanged.

- 1. Using the FIFO process-costing method, complete Problem 17-43.

Required

- 2. If you did Problem 17-43, explain any difference between the cost of work completed and transferred out and the cost of ending work in process in the stitching department under the weighted-average method and the FIFO method.

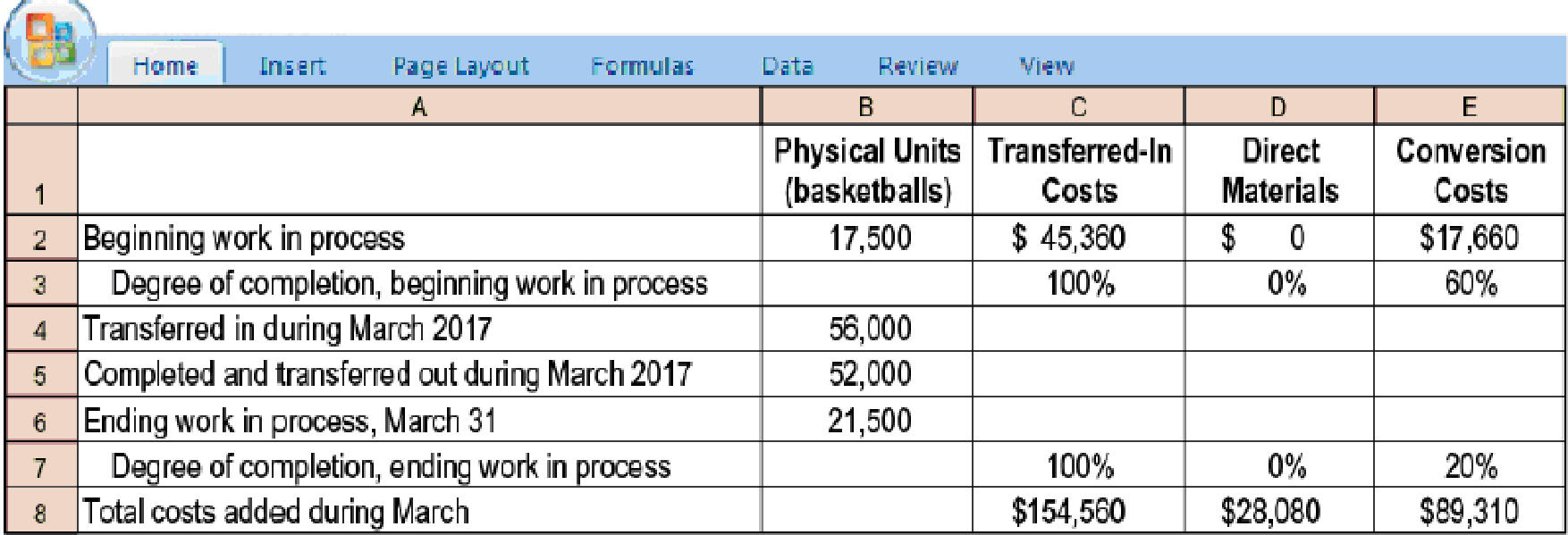

17-43 Transferred-in costs, weighted-average method. Spelling Sports, which produces basketballs, has two departments: cutting and stitching. Each department has one direct-cost category (direct materials) and one indirect-cost category (conversion costs). This problem focuses on the stitching department.

Basketballs that have undergone the cutting process are immediately transferred to the stitching department. Direct material is added when the stitching process is 70% complete. Conversion costs are added evenly during stitching operations. When those operations are done, the basketballs are immediately transferred to Finished Goods.

Spelling Sports uses the weighted-average method of

- 1. Summarize total stitching department costs for March 2017, and assign these costs to units completed (and transferred out) and to units in ending work in process.

Required

- 2. Prepare

journal entries for March transfers from the cutting department to the stitching department and from the stitching department to Finished Goods.

Trending nowThis is a popular solution!

Chapter 17 Solutions

HORNGREN COST ACCT NON-MAJORS W/ACCESS

- Carltons Kitchens three cost pools and overhead estimates are as follows: Compare the overhead allocation using: A. The traditional allocation method B. The activity-based costing method (Hint: the traditional method uses machine hours as the allocation base.)arrow_forwardWhich is not a step In activity-based costing? A. identify the activities performed by the organization B. identify the cost driver(s) associated with each activity C. compute a cost rate per production D. assign costs to products by multiplying the cost driver rate by the volume of the cost driver units consumed by the productarrow_forwardRefer to the data given in Problem 4.36 and suppose that the expected activity costs are reported as follows (all other data remain the same): The per unit overhead cost using the 14 activity-based drivers is 1,108 and 779 for Cylinder A and Cylinder B, respectively. Required: 1. Determine the percentage of total costs represented by the three most expensive activities. 2. Allocate the costs of all other activities to the three activities identified in Requirement 1. Allocate the other activity costs to the three activities in proportion to their individual activity costs. Now assign these total costs to the products using the drivers of the three chosen activities. 3. Using the costs assigned in Requirement 2, calculate the percentage error using the ABC costs as a benchmark. Comment on the value and advantages of this ABC simplification.arrow_forward

- Activity-based costing systems: A. use a single predetermined overhead rate based on machine hours instead of on direct labor B. frequently increase the overhead allocation to at least one product while decreasing the overhead allocation to at least one other product C. limit the number of cost pools D. always result in an increase of at least one products selling pricearrow_forwardHappy Trails has this information for its manufacturing: Â Its income statement under absorption costing is: Prepare an income statement with variable costing and a reconciliation statement between both methods.arrow_forwardRoberts Company produces two weed eaters: basic and advanced. The company has four activities: machining, engineering, receiving, and inspection. Information on these activities and their drivers is given below. Overhead costs: Required: 1. Calculate the four activity rates. 2. Calculate the unit costs using activity rates. Also, calculate the overhead cost per unit. 3. What if consumption ratios instead of activity rates were used to assign costs instead of activity rates? Show the cost assignment for the inspection activity.arrow_forward

- Which of the following statements regarding activity-based costing (ABC) is NOT correct? a. Under ABC cost centres are replaced by cost pools b. Blanket overhead recovery rates (OAR) are replaced with cost driver rates c. ABC uses one common overhead recovery rate, such as labour hours. d. ABC tackles the problems of absorption costing by adopting a much more accurate way of charging overhead to cost units.arrow_forwardThe company is considering using a two-stage cost allocation system and wants to assess the effects on reported product profits. The company is considering using Engineering Hours and Users as the allocation base. Additional information follows. Toot! TiX Total Engineering hours 7,650 5,650 13,300 Users 9,500 17,100 26,600 Engineering – hour related administrative cost $ 114,380 User-related administrative cost $…arrow_forwardThe FIFO method of process costing will produce the same cost of goods transferred out amount as the weighted average method when a. the goods produced are homogeneous b. there is no beginning Work in Process Inventory. c. there is no ending Work in Process Inventory. d. beginning and ending Work in Process Inventories are each 50 percent complete.arrow_forward

- In a process costing system, how is the unit cost affected in a production cost report when materials are added in a department subsequent to the first department and the added materials result in additional units? a. the first departments unit cost is increased, which necessitates an adjustment of the transferred-in unit cost b. the first department’s unit cost is decreased, which necessitates an adjustment of the transferred-in unit cost c. the first department’s unit cost is increased, but it does not necessitate an adjustment of the transferred-in unit cost d. the first department’s unit cost is decreased, but it does not necessitate an adjustment of the transferred-in unit costarrow_forwardThe following statements are correct except?A. ABC eliminates issues of over or under absorptionB. CDR is calculated as total cost pool of the activity cost center divided by total cost driver of the activityC. ABC method and traditional method are used to apportion overhead costD. ABC method is a replacement for a company’s usual traditional methodarrow_forwardThat which determine(s) whether the costs assigned to units transferred out and to units in ending work in process are equal to the costs in beginning work in process, plus the manufacturing costs incurred in the current period is(are) called: a.Cost reconciliation b.Transferred-in costs c.Batch production process d.Equivalent unit of outputarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,