ECONOMICS:PRIN.+POLICY-MINDTAP (1 TERM)

14th Edition

ISBN: 9781337912396

Author: Baumol

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Chapter 17, Problem 1DQ

To determine

Comment the statement regarding federal government tax.

Expert Solution & Answer

Explanation of Solution

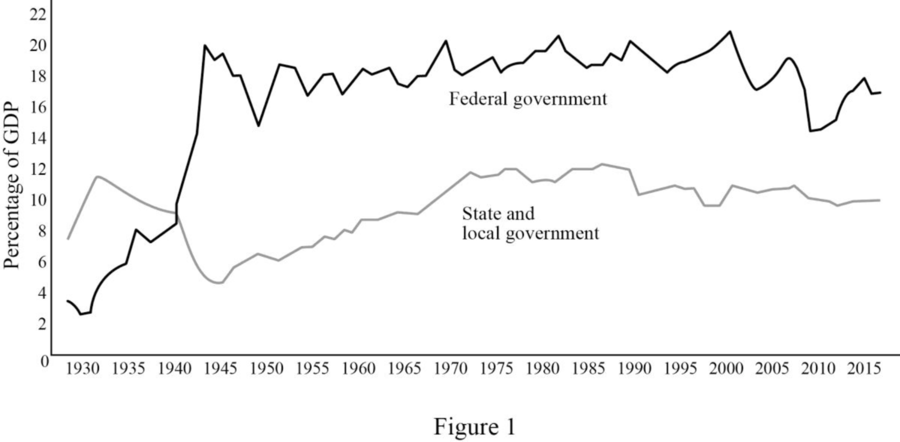

The tax as a percentage of

The federal government tax increases according to the proportion of

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

What would happen if Texas collects less taxes and generates less revenue?

Differentiate Tax from Taxation.

(Thank you)

A new elected government want to reform its tax system. As an economist you are hired to advise the government how to design a better tax system. Give your recommendation on factors that government need to consider if they want to implement the better tax system. Add specific example or case for each factor you recommend to government

Chapter 17 Solutions

ECONOMICS:PRIN.+POLICY-MINDTAP (1 TERM)

Knowledge Booster

Similar questions

- Revenue from tax is always greater than government spending in SouthAfrica;arrow_forwardWhat can you say about Tax incidence in our country, who carries the burden more? Give examples and explain your answerarrow_forwardRefusing to pay taxes because you disapprove of how the money is being used by the government is an example of whatarrow_forward

- What is the tax burden on the buyer and seller?arrow_forwardTrue or False: "A progressive tax system imposes higher tax rates on higher income earners." Don't use Aiarrow_forwardWhat can you say about Tax incidence in the Philippines, who carries the burden more? Give examples and explain your answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Macroeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning