Calculate the present worth.

Explanation of Solution

The value of MARR is indicated by ‘i’ and the time period is indicated by ‘n’. The value of n1 is 4. The present worth (PW) of the defender can be calculated as follows:

The present worth of the defender is -$40,327.

Substitute the respective values in Equation (1) to calculate the depreciation in year 1 for the challenger.

Depreciation for year 1 is $8,000.

The taxable income (TI) can be calculated using the following formula:

Substitute the respective values in Equation (2) to calculate the taxable income in year 1 for the challenger.

The taxable income for year 1 is -$16,000.

The tax (T) can be calculated using the following formula:

Substitute the respective values in Equation (3) to calculate the tax in year 1 for the challenger.

The tax for year 1 is -$5,600.

The cash flow after tax (CFAT) can be calculated using the following formula:

Substitute the respective values in Equation (4) to calculate the CFAT in year 1 for the challenger.

CFAT for year 1 is -$2,400.

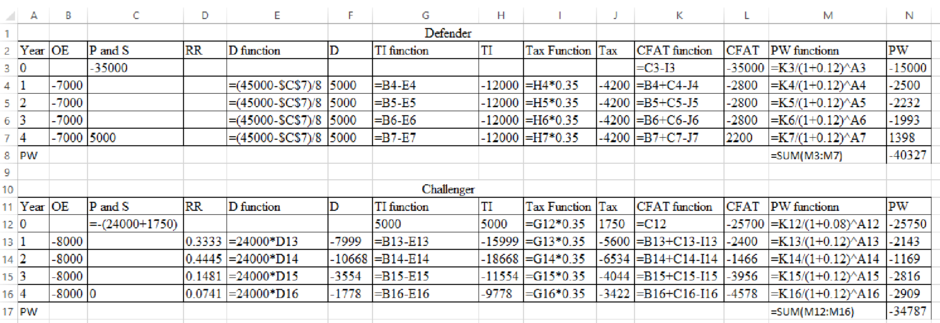

Table 1 shows the CFAT value for different years obtained using Equations (1), (2), (3), and (4). The carry forwarded tax is $1,750. This should include the first cost.

Table 1

| Year | OE | P and S | RR | D | TI | Tax | CFAT |

| 0 | 25,750 | -25,750 | |||||

| 1 | -8,000 | 0.3333 | 8,000 | -16,000 | -,5600 | -2,400 | |

| 2 | -8,000 | 0.4445 | 10,668 | -18,668 | -6,534 | -1,466 | |

| 3 | -8,000 | 0.1481 | 3,554 | -11,554 | -4,044 | -3,956 | |

| 4 | -8,000 | 0 | 0.0741 | 1,778 | -9,778 | -3,422 | -4,578 |

The present worth (PW) can be calculated as follows:

The present worth of the challenger is -$34,787. Since the present worth of the challenger is greater than the defender, select the challenger.

The present worth of defender and challenger can be calculated using spreadsheet as follows:

Since the present worth of the challenger is greater than the defender, select the challenger.

Want to see more full solutions like this?

Chapter 17 Solutions

Engineering Economy

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education