CengageNOWv2, 1 term Printed Access Card for Hoffman/Young/Raabe/Maloney/Nellen's South-Western Federal Taxation 2018: Individual Income Taxes, 41st

41st Edition

ISBN: 9781337389518

Author: William H. Hoffman, James C. Young, William A. Raabe, David M. Maloney, Annette Nellen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 17, Problem 7CPA

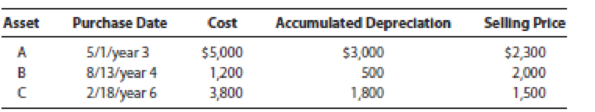

Wally, Inc., sold the following three personal property assets in year 6:

What is Wally’s Section 1245 recapture in year 6?

- a. $500 loss

- b. $300 gain

- c. $800 gain

- d. $1,600 gain

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Jacob purchased business equipment for $144,900 in 2018 and has taken $86,940 of regular MACRS

depreciation. Jacob sells the equipment in 2021 for $65,205.

What is the amount and character of Jacob's gain or loss?

If an amount is zero, enter "0".

Jacob has § 1245 gain of $fill in the blank 1 and § 1231 gain of Sfill in the blank 2.

Mike sold the following personal use property during the current year:

Painting

Stamp collection

Outboard motor

Antique desk

Sales Price

Cost

$2,500

$ 800

600

1,200

900

100

1,300

1,950

What is his taxable capital gain, net of allowable capital losses, for the current year?

$625.

$650.

$325.

$750.

13

Jason sold various business-use assets in Year 10 resulting in a net Section 1231 gain of $8,100. Jason had the following net Section

1231 gains and losses in the previous years:

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

($4,000)

($2,900)

$5,100

Year 10

$1,100

($5,400)

$4,400

How is the Year 10 net Section 1231 gain of $8,100 treated? (Do not leave any field blank. If answer is zero, please enter O for the amount.)

$

Ordinary Loss

$

Ordinary Income

$

LTCG Gain

Chapter 17 Solutions

CengageNOWv2, 1 term Printed Access Card for Hoffman/Young/Raabe/Maloney/Nellen's South-Western Federal Taxation 2018: Individual Income Taxes, 41st

Ch. 17 - Prob. 1DQCh. 17 - Prob. 2DQCh. 17 - Prob. 3DQCh. 17 - Prob. 4DQCh. 17 - Prob. 5DQCh. 17 - A depreciable business dump truck has been owned...Ch. 17 - Prob. 10DQCh. 17 - Prob. 11DQCh. 17 - Prob. 12DQCh. 17 - Prob. 13DQ

Ch. 17 - Prob. 15DQCh. 17 - Prob. 16DQCh. 17 - Prob. 17DQCh. 17 - Prob. 18DQCh. 17 - Prob. 19DQCh. 17 - Prob. 20DQCh. 17 - Prob. 21CECh. 17 - Prob. 22CECh. 17 - Prob. 23CECh. 17 - Prob. 24CECh. 17 - Prob. 25CECh. 17 - Prob. 26CECh. 17 - Prob. 27CECh. 17 - Prob. 28CECh. 17 - Prob. 29CECh. 17 - Prob. 30CECh. 17 - Prob. 31PCh. 17 - Prob. 32PCh. 17 - LO.2 A sculpture that Korliss Kane held for...Ch. 17 - Prob. 34PCh. 17 - Prob. 35PCh. 17 - Prob. 36PCh. 17 - Prob. 37PCh. 17 - Prob. 38PCh. 17 - Prob. 39PCh. 17 - Prob. 40PCh. 17 - Prob. 41PCh. 17 - Prob. 43PCh. 17 - Joanne is in the 24% tax bracket and owns...Ch. 17 - Prob. 45PCh. 17 - Prob. 46PCh. 17 - Prob. 47PCh. 17 - Prob. 48PCh. 17 - Prob. 49PCh. 17 - Prob. 50PCh. 17 - Prob. 51PCh. 17 - Prob. 52PCh. 17 - Prob. 53PCh. 17 - Prob. 54PCh. 17 - Jay sold three items of business equipment for a...Ch. 17 - Prob. 1RPCh. 17 - Prob. 2RPCh. 17 - Prob. 3RPCh. 17 - Prob. 4RPCh. 17 - Prob. 1CPACh. 17 - Prob. 2CPACh. 17 - Jerry uses a building for business purposes. The...Ch. 17 - Prob. 4CPACh. 17 - Prob. 5CPACh. 17 - Prob. 6CPACh. 17 - Wally, Inc., sold the following three personal...Ch. 17 - Net Section 1231 losses are: a. Deducted as a...Ch. 17 - Prob. 9CPACh. 17 - Prob. 10CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Alma sells the following depreciable assets from her sole proprietorship: Asset Cost Office furniture $10,000 Age Gain/Loss 4 years ($2,400) Truck $2,000 5 years 3,100 Bakery equipment $25,000 9 months (4,500) What should Alma report on her income tax return relative to these property transactions? a. $3,800 capital loss b. $3,100 Section 1245 recapture; $2,400 Section 1231 loss; $4,500 ordinary loss c. $3,800 ordinary loss d. $700 Section 1231 gain; $4,500 ordinary loss e. None of the abovearrow_forwardJacob purchased business equipment for $144,900 in 2018 and has taken $86,940 of regular MACRS depreciation. Jacob sells the equipment in 2021 for $65,205. What is the amount and character of Jacob's gain or loss? If an amount is zero, enter "0". Jacob has § 1245 gain of $fill in the blank 1 and § 1231 gain of $fill in the blank 2.arrow_forwardAngelina gave a parcel of realty to Julie valued at $167,500 (Angelina purchased the property five years ago for $71,000). Required: a. Compute the amount of the taxable gift on the transfer, if any. b. Suppose several years later Julie sold the property for $174,000. What is the amount of her gain or loss, if any, on the sale? a. Amount of taxable gift b. Amount of gainarrow_forward

- In the current year, Madison inherited investment property from a parent's estate with a fair market value of $200,000. The parent had a basis in the asset of $100,000. Madison sold the property for $150,000 in the year the parent died. What is Madison's gain or loss on the sale? $50,000 short-term loss. O $50,000 long-term gain. о $50,000 long-term loss. O $50,000 short-term gain.arrow_forwardRequired information [The following information applies to the questions displayed below.] Moran owns a building he bought during year 0 for $221,000. He sold the building in year 6. During the time he held the building, he depreciated it by $36,250. What are the amount and character of the gain or loss Moran will recognize on the sale in each of the following alternative situations? Note: Loss amounts should be indicated by a minus sign. Enter NA if a situation is not applicable. Leave no answers blank. Enter zero if applicable. c. Moran received $177,000. Answer is complete but not entirely correct. Required information [The following information applies to the questions displayed below.] loss) J Moran owns a building he bought during year 0 for $221,000. He sold the building in year 6. During the time he held the building, he depreciated it by $36,250. c. Moran received $177,000. What are the amount and character of the gain or loss Moran will recognize on the sale in each of the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License