CengageNOWv2, 1 term Printed Access Card for Hoffman/Young/Raabe/Maloney/Nellen's South-Western Federal Taxation 2018: Individual Income Taxes, 41st

41st Edition

ISBN: 9781337389518

Author: William H. Hoffman, James C. Young, William A. Raabe, David M. Maloney, Annette Nellen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 55P

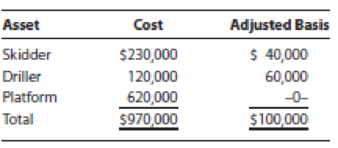

Jay sold three items of business equipment for a total of $300,000. None of the equipment was appraised to determine its value. Jay’s cost and adjusted basis for the assets are as follows:

Jay has been unable to establish the fair market values of the three assets. All he can determine is that combined they were worth $300,000 to the buyer in this arm’s length transaction. How should Jay allocate the sales price and figure the gain or loss on the sale of the three assets?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Dial Co. and Safeguard Inc. engage in an exchange of nonmonetary assets that LACKS commercial substance. Dial gives up an asset with a book value of $20,000

and a fair market value of $19,000.

Safeguard gives up an asset with a book value of $12,000 and a fair market value of $15,000. Safeguard also paid $4,000 cash boot.

What amount should SAFEGUARD record for the asset received and for the gain or loss?

O $16,000 and $3,000 gain

O $16,000 and $0 gain/loss

O $15,000 and $0 gain/loss

O $19,000 and $3,000 gain

Jay sold three items of business equipment for a total of $300,000. None of the equipment was appraised to determine its value. Jay's cost and adjusted basis for the assets are shown below.

Asset

Cost

AdjustedBasis

Skidder

$230,000

$40,000

Driller

120,000

60,000

Platform

620,000

−0−

Total

$970,000

$100,000

Jay has been unable to establish the fair market values of the three assets. All he can determine is that combined they were worth $300,000 to the buyer in this arm's length transaction.

b. If Jay treats the assets as a single group, determine the amount and nature of the gain or loss. There is an overall gain of $______ of which $________ is § 1245 gain.

Please avoid images in Solutions thanks

On April 30, White sold land with a book value of $600,000 to Black for its fair value of $800,000. Black gave White a 12 percent, $800,000 note secured only by the land. At the date of sale, Black was in a very poor financial position and its continuation as a going concern was very questionable. white should......

a. Use the cost recovery method of accounting

b. Record the note at its discounted value

c. Record a $200,000 gain on the sale of the land

d. Increase the allowance for uncollectibles for the full amount of the note

Chapter 17 Solutions

CengageNOWv2, 1 term Printed Access Card for Hoffman/Young/Raabe/Maloney/Nellen's South-Western Federal Taxation 2018: Individual Income Taxes, 41st

Ch. 17 - Prob. 1DQCh. 17 - Prob. 2DQCh. 17 - Prob. 3DQCh. 17 - Prob. 4DQCh. 17 - Prob. 5DQCh. 17 - A depreciable business dump truck has been owned...Ch. 17 - Prob. 10DQCh. 17 - Prob. 11DQCh. 17 - Prob. 12DQCh. 17 - Prob. 13DQ

Ch. 17 - Prob. 15DQCh. 17 - Prob. 16DQCh. 17 - Prob. 17DQCh. 17 - Prob. 18DQCh. 17 - Prob. 19DQCh. 17 - Prob. 20DQCh. 17 - Prob. 21CECh. 17 - Prob. 22CECh. 17 - Prob. 23CECh. 17 - Prob. 24CECh. 17 - Prob. 25CECh. 17 - Prob. 26CECh. 17 - Prob. 27CECh. 17 - Prob. 28CECh. 17 - Prob. 29CECh. 17 - Prob. 30CECh. 17 - Prob. 31PCh. 17 - Prob. 32PCh. 17 - LO.2 A sculpture that Korliss Kane held for...Ch. 17 - Prob. 34PCh. 17 - Prob. 35PCh. 17 - Prob. 36PCh. 17 - Prob. 37PCh. 17 - Prob. 38PCh. 17 - Prob. 39PCh. 17 - Prob. 40PCh. 17 - Prob. 41PCh. 17 - Prob. 43PCh. 17 - Joanne is in the 24% tax bracket and owns...Ch. 17 - Prob. 45PCh. 17 - Prob. 46PCh. 17 - Prob. 47PCh. 17 - Prob. 48PCh. 17 - Prob. 49PCh. 17 - Prob. 50PCh. 17 - Prob. 51PCh. 17 - Prob. 52PCh. 17 - Prob. 53PCh. 17 - Prob. 54PCh. 17 - Jay sold three items of business equipment for a...Ch. 17 - Prob. 1RPCh. 17 - Prob. 2RPCh. 17 - Prob. 3RPCh. 17 - Prob. 4RPCh. 17 - Prob. 1CPACh. 17 - Prob. 2CPACh. 17 - Jerry uses a building for business purposes. The...Ch. 17 - Prob. 4CPACh. 17 - Prob. 5CPACh. 17 - Prob. 6CPACh. 17 - Wally, Inc., sold the following three personal...Ch. 17 - Net Section 1231 losses are: a. Deducted as a...Ch. 17 - Prob. 9CPACh. 17 - Prob. 10CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Talbot purchases business machinery for a price of $100,000. Talbot pays the seller $20,000 in cash and finances the rest by giving the seller a note for $80,000. What is Talbot’s initial basis in this machinery? Refer to the facts of Question #1. Assume Talbot uses the machinery, depreciates $60,000 of the machinery’s cost, and sells the machinery for $50,000 after that time period. Talbot reduced the principal amount of the note to $40,000 during the period of use. The buyer assumes the balance of the note and gives Talbot $10,000 in cash to complete the sale. What is Talbot’s gain on the sale of this machinery?arrow_forwardElvera Easton traded in copying equipment with an adjusted basis of $10,000 for other copying equipment valued at $6,000. She also received $2,500 in cash, and her mortgage of $3,000 on the traded copying equipment was wiped out. What is her recognized gain on this exchange, if anyarrow_forwardCliff Company traded in an old truck for a new one. The old truck had a cost of $300,000 and accumulated depreciation of $60,000. The new truck had an invoice price of $311,000. Huffington was given a $237,000 trade-in allowance on the old truck, which meant they paid $74,000 in addition to the old truck to acquire the new truck. If this transaction has commercial substance, what is the recorded value of the new truck? Multiple Choice $240,000 $300,000 $74,000 $311,000 $314,000arrow_forward

- Dave Company sold assets to Frank Company with an alleged value of $2,800,000. Frank Company paid $2,100,000 for the assets. The actual value of the assets was $1,800,000. Using the "benefit-of-the-bargain" damage loss rule, the fraud damages would be: A. $300,000. B. $1,000,000. C. $1,800,000. D. $2,800,000.arrow_forwardDiaz Company owns a milling machine that cost $125,200 and has accumulated depreciation of $90,700. Prepare the entry to record the disposal of the milling machine on January 3 under each of the following independent situations. The machine needed extensive repairs, and it was not worth repairing. Diaz disposed of the machine, receiving nothing in return. Diaz sold the machine for $15,500 cash. Diaz sold the machine for $34,500 cash. Diaz sold the machine for $40,500 cash.arrow_forwardHot Company exchanges an automobile machine with a carrying amount of $135,000 ( original cost , $550,000) for a molding machine owned by Water Company. The molding machine is carried in Water's Company books at a cost of $240,000 with an accumulated depreciation of $83,000 at the time of exchange. Assume that no cash is involved in the transaction, and the fair value of the automobile is not readily determinable. The fair market value of the molding machine is $172,800. How much is the gain or loss on the exchange of Water Company?arrow_forward

- Dietz owned a delivery van with a Cost of $ 12,000 and Accumulated Depreciation of $10,000. It traded this old van for a new one that cost $16,000. The dealer allowed Dietz a trade-in allowance of $3,500 on the old van, and Dietz paid the remainder in cash. Compute the following: i) Gain on Disposal of Old Vanarrow_forwardCOPS Company exchanges an automobile machine with a carrying amount of $135,000 ( original cost , $550,000) for a molding machine owned by Water Company. The molding machine is carried in Water's Company books at a cost of $240,000 with an accumulated depreciation of $83,000 at the time of exchange. Assume that no cash is involved in the transaction, and the fair value of the automobile is not readily determinable. The fair market value of the molding machine is $172,800. How much is the gain or loss on the exchange of Cool Companyarrow_forwardFrank's Mini Mart sold a piece of equipment on an installment agreement, to a competitor on the other side of town. The other owner failed to make the payments and Frank had to repossess the equipment. What is Frank's gain or loss on repossessed personal property with a fair market value of $12,000 on the date of repossession, where the seller's basis in the installment obligation at the time of repossession is $7,500, and the costs of repossession were $500? (a) Loss of $500. (b) Gain of $4,000. (c) Gain of $4,500 (d) Gain of $5,000.arrow_forward

- Caleb Co. owns a machine that had cost $42,400 with accumulated depreciation of $18,400. Caleb exchanges the machine for a newer model that has a market value of $52,000. 1. Record the exchange assuming Caleb paid $30,000 cash and the exchange has commercial substance. 2. Record the exchange assuming Caleb paid $22,000 cash and the exchange has commercial substance.arrow_forwardMariot trades in its old equipment (with the following carrying values) for new equipment. Mariot received $4,000 cash on the exchange. The fair value of the new equipment is $14,000. Original cost of old equipment : $10,000 Accumulated Depreciation on old equipment: $6,000 If the transaction lacks commercial substance, what amount does Mariot assign to the new equipment?arrow_forwardCalaveras Tire exchanged equipment for two pickup trucks. The book value and fair value of the equipment given up were $34,000 (original cost of $86,000 less accumulated depreciation of $52,000) and $45,000, respectively. Assume Calaveras paid $6,000 in cash and the exchange lacks commercial substance. (1) At what amount will Calaveras value the pickup trucks? (2) How much gain or loss will the company recognize on the exchange? (1) Value of pickup trucks (2) Loss on exchange $ $ 39,000 13,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License