PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 14PS

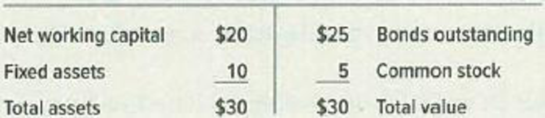

Agency costs* Let us go back to Circular File’s market value balance sheet:

Who gains and who loses from the following maneuvers?

- a. Circular scrapes up $5 in cash and pays a cash dividend.

- b. Circular halts operations, sells its fixed assets, and converts net working capital into $20 cash. Unfortunately the fixed assets fetch only $6 on the secondhand market. The $26 cash is invested in Treasury bills.

- c. Circular encounters an acceptable investment opportunity,

NPV = 0, requiring an investment of $10. The firm borrows to finance the project. The new debt has the same security, seniority, etc., as the old. - d. Suppose that the new project has NPV = +$2 and is financed by an issue of

preferred stock . - e. The lenders agree to extend the maturity of their loan from two years to three in order to give Circular a chance to recover.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

PROBLEM

The management of the Book Warehouse Company wishes to apply the Miller-Orr model to manage its cash investment. They have determined that the cost of either investing in or selling marketable securities is $100. By looking at Book Warehouse’s past cash needs, they have determined that the variance of daily cash flows is $20,000. Book Warehouse’s opportunity cost of cash, per day, is estimated to be 0.03%. Based on experience, management has determined that the cash balance should never fall below $10,000.

4. How much is the variance of daily cash flows?(Use a number, no decimal value, no commas, no currency, no space) *

5. How much is the lower limit based on the Miller-Orr model of cash management? (Use a number, no decimal value, no commas, no currency, no space) *

6. How much is the opportunity cost of cash, per day? (Use a number, must be in decimal form. eg. 6.3%/100, encode 0.063 , no commas, no currency, no space) *

PLEASE ANSWER ALL QUESTIONS. THANKS!

Baumol Model and Miller-Orr Model

1. The management of the Book Warehouse Company wishes to apply the Miller-Orr model to manage its cash investment. They have determined that the cost of either investing in or selling marketable securities is $100. By looking at Book Warehouse’s past cash needs, they have determined that the variance of daily cash flows is $20,000. Book Warehouse’s opportunity cost of cash, per day, is estimated to be 0.03%. Based on experience, management has determined that the cash balance should never fall below $10,000. Calculate the lower limit, the return point, and the upper limit based on the Miller-Orr model of cash management.

The management of the Keribels Company wishes to apply the Miller-Orr model to manage its cash investments. They have determined that the cost of either investing in or selling marketable securities is P 100. By looking at the Keribels Company’s past cash needs, they have determined that the variance of daily cash flow is P 75,000. Keribels Company’s opportunity cost of cash per day is 0.05%. Based on their experience the cash balance should not fall below P 50,000. WHAT IS THE LOWER LIMIT? (Use a number, no decimal value, no currency, no space, no commas) *

Chapter 18 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 18 - Prob. 1PSCh. 18 - Tax shields Compute the present value of interest...Ch. 18 - Tax shields Here are book and market value balance...Ch. 18 - Tax shields Look back at the Johnson Johnson...Ch. 18 - Prob. 5PSCh. 18 - Tax shields The firm cant use interest tax shields...Ch. 18 - Prob. 7PSCh. 18 - Tax shields The trouble with MMs argument is that...Ch. 18 - Bankruptcy costs On February 29, 2019, when PDQ...Ch. 18 - Financial distress This question tests your...

Ch. 18 - Prob. 12PSCh. 18 - Agency costs Let us go back to Circular Files...Ch. 18 - Agency costs The Salad Oil Storage (SOS) Company...Ch. 18 - Agency costs The possible payoffs from Ms....Ch. 18 - Prob. 17PSCh. 18 - Prob. 18PSCh. 18 - Prob. 20PSCh. 18 - Pecking-order theory Fill in the blanks: According...Ch. 18 - Financial slack For what kinds of companies is...Ch. 18 - Financial slack True or false? a. Financial slack...Ch. 18 - Debt ratios Rajan and Zingales identified four...Ch. 18 - Leverage targets Some corporations debtequity...Ch. 18 - Prob. 26PSCh. 18 - Trade-off theory The trade-off theory relies on...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The management of the Keribels Company wishes to apply the Miller-Orr model to manage its cash investments. They have determined that the cost of either investing in or selling marketable securities is P 100. By looking at the Keribels Company’s past cash needs, they have determined that the variance of daily cash flow is P 75,000. Keribels Company’s opportunity cost of cash per day is 0.05%. Based on their experience the cash balance should not fall below P 50,000. WHAT IS THE UPPER LIMIT?arrow_forwardThe A Company wishes to apply the Miller-Orr model to manage its cash investment. A's management has determined that the cost of either investing in or selling marketable securities is $200. By looking at A Company’s past cash needs, they have determined that the variance of daily cash flows is $10,000. A Company’s opportunity cost of cash, per day, is estimated to be 0.05%. A management has figured, based on their experience dealing with the cash flows of the company, that there should be a cushion— a safety stock—of cash of $20,000. Calculate the lower limit, the return point, and the upper limit based on the Miller-Orr model of cash management.arrow_forwardPROBLEM The Seminole Company wishes to apply the Miller-Orr model to manage its cash investment. Seminole’s management has determined that the cost of either investing in or selling marketable securities is $200. By looking at Seminole Company’s past cash needs, they have determined that the variance of daily cash flows is $10,000. Seminole Company’s opportunity cost of cash, per day, is estimated to be 0.05%. Seminole management has figured, based on their experience dealing with the cash flows of the company, that there should be a cushion— a safety stock—of cash of $20,000. 4. How much is the lower limit based on the Miller-Orr model of cash management?(Use a number, no decimal value, no commas, no currency, no space) * 5. How much is the upper limit based on the Miller-Orr model of cash management? (Use a number, no decimal value, no commas, no currency, no space) * 6.How much is the return point based on the Miller-Orr model of cash management? (Use a number, no decimal value, no…arrow_forward

- All parts are under one questions and per your policy can be answered. 3. Understanding the IRR and NPV The net present value (NPV) and internal rate of return (IRR) methods of investment analysis are interrelated and are sometimes used together to make capital budgeting decisions. Consider the case of Green Caterpillar Garden Supplies Inc.: Last Tuesday, Green Caterpillar Garden Supplies Inc. lost a portion of its planning and financial data when both its main and its backup servers crashed. The company’s CFO remembers that the internal rate of return (IRR) of Project Gamma is 13.2%, but he can’t recall how much Green Caterpillar originally invested in the project nor the project’s net present value (NPV). However, he found a note that detailed the annual net cash flows expected to be generated by Project Gamma. They are: Year Cash Flow Year 1 $2,400,000 Year 2 $4,500,000 Year 3 $4,500,000 Year 4 $4,500,000 The CFO has asked you to compute Project…arrow_forwardWhich of the following decreases the cash holding A.The rising commodity prices increases the value of law material inventoriesby 10% B.A manufacturer decreases production in anticipation of a decrease in demand C.THe frim repurchases its own stocks D.THe corporation has decided to give their customer less time in paying their purchasesarrow_forwardBulldogs inc. will least likely experience which of the following if the firm shifts its credit terms from n/25 to 3/10, n/25 the computed days sales outstanding will decrease the percentage of credit sales from the total sales revenue will increase decrease in short-term borrowings cash conversion cycle will tend to increase The company’s usage of the Baumol model in cash management involves trade-off. A decrease in the optimal transaction size would more likely result from Decrease of debt to asset ratio Increase of return on marketable securities None of the choices is correct Increase in the annual demand for casharrow_forward

- 1) When investors disregard their own information which is incomplete and follow the momentum activities of other market participants, they could inadvertently cause a financial bubble by transmitting inaccurate information with each additional trade. This phenomenon is called ______________. Multiple Choice Asymmetric information. Attribution bias. Systematic bias. Overconfidence. Information cascade. 2) Canada Revenue Agency requires firms to claim only one-half of the incremental capital cost of a new project in its first year for tax purposes. This rule is called the _________. Multiple Choice CCA rule. Half-CCA rule. Two-year rule. Half-year rule. Incomplete CCA rule. 3)Alternative ways of calculating operating cash flows are the bottom-up approach, the top-down approach, and the tax shield approach. True/False?arrow_forwardThe company’s usage of the Baumol model in cash management involves trade-off. A decrease in the optimal transaction size would more likely result from Decrease of debt to asset ratio Increase of return on marketable securities None of the choices is correct Increase in the annual demand for casharrow_forwardThe company’s usage of the Baumol model in cash management involves trade-off. A decrease in the optimal transaction size would more likely result from a. Increase of return on marketable securities b. None of the choices is correct c. Increase in the annual demand for cash d. Decrease of debt to asset ratioarrow_forward

- JunJun & Co. has debt ratio of 0.50, a total asset turnover of 0.25 and a profit margin of 10%. The president is unhappy with the current return on equity, and he thinks it could be doubled. This could be accomplished (1) by increasing the profit margin to 14% and (2) by increasing debt utilization. Total assets turnover will not change. What new debt ratio, along with the 14% profit margin, is required to double the return on equity? (SHOW SOLUTION) a. 0.75 b. 0.70 c. 0.65 d. 0.55arrow_forwardVarious Contingency Issues Skinner Company has the following contingencies: 1. Potential costs due to the discovery of a possible defect related to one of its products. These costs are probable and can be reasonably estimated. 2. A potential claim for damages to be received from a lawsuit filed this year against another company. It is probable that proceeds from the claim will be received by Skinner next year. 3. Potential costs due to a promotional campaign in which a cash refund is sent to customers when coupons are redeemed. Skinner estimated, based on past experience, that 70% of the coupons would be redeemed. Forty percent of the coupons were actually redeemed and the cash refunds sent this year. The remaining 30% of the coupons are expected to be redeemed next year. Required: 1. How should Skinner report the potential costs due to the discovery of a possible product defect? Explain why. 2. How should Skinner report this year the potential claim for damages that may be received next year? Explain why. 3. This year, how should Skinner account for the potential costs and obligations due to the promotional campaign?arrow_forwardWhich of the following actions should Reece Windows take if it wants to reduce its cash conversion cycle? a. Take steps to reduce the DSO. b. Sell an issue of long-term bonds and use the proceeds to buy back some of its common stock. c. Increase average inventory without increasing sales. d. Sell common stock to retire long-term bonds. e. Start paying its bills sooner, which would reduce the average accounts payable but not affect sales.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Why do we need accounting?; Author: EconClips;https://www.youtube.com/watch?v=weCXE2wIl90;License: Standard Youtube License