Enterprise Fund Entries and Statements

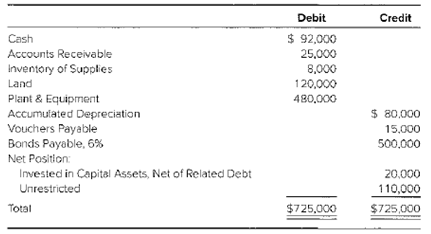

Augusta has a municipal water and gas utility district (MUD). The trail balance on January 1, 20X1, follows:

Additional Information for 20X1

- Charges to customers for water and gas were $420,000; collections were $432,000.

- A loan of $30,000 for two years was received from the general fund.

- The water and gas lines extended to a new development at a cost of $75,000. The contractor was paid.

- Supplies were acquired from central stores (internal service fund) for $12,400. Operating expenses were $328,000, and interest expense was $30,000. Payment was made for the interest and the payable to central stores, and $325,000 of the vouchers were paid.

Adjusting entries were as follows: estimated uncollectibleaccounts receivable , $6,300;depreciation expense, $32,000; and supplies expense, $15,200.

Required

- Prepare entries for the MUD enterprise fund for 20X1 and closing entries.

- Prepare a statement of net position for the fund for December 31, 20X1.

- Prepare a statement of revenues, expenses, and changes in fund net position for 20X1. Assume that the $500,000 of the 6 percent bonds is related to the net capital assets of land and of plant and equipment.

- Prepare a statement of cash flows for 20X1.

a

Introduction: An enterprise fund is one of two proprietary funds. It is the amounts charged to the general public, to recover all or most of the cost of goods and services provided by the government to the general public. An enterprise fund is one of two proprietary funds.

The entries for the enterprise fund for 20X1 and closing entries.

Explanation of Solution

| Particulars | Debit $ | Credit $ |

| 1. Accounts receivable | 420,000 | |

| Revenue | 420,000 | |

| (Recognition of receivable from customers) | ||

| 2. Cash | 432,000 | |

| Accounts receivable | 432,000 | |

| (Received cash on account of accounts receivable) | ||

| Cash | 30,000 | |

| Due to general fund | 30,000 | |

| (Received loan from general fund) | ||

| 3. Plant and equipment | 75,000 | |

| Contracts payable | 75,000 | |

| (Extension of water and gas lines recognized) | ||

| Contract payable | 75,000 | |

| Cash | 75,000 | |

| (Record payment of extended lines) | ||

| 4. Inventory of supplies | 12,400 | |

| Operating expenses | 328,000 | |

| Interest expense | 30,000 | |

| Due to central stores fund | 12,400 | |

| Vouchers payable | 328,000 | |

| Interest payable | 30,000 | |

| (Expenses incurred are recognized) | ||

| Due to central stores fund | 12,400 | |

| Vouchers payable | 325,000 | |

| Interest payable | 30,000 | |

| Cash | 367,400 | |

| (Paid cash for dues to central fund vouchers and interest) | ||

| 5. Revenue | 6,300 | |

| Allowance for uncollectible | 6,300 | |

| (Reduction of revenue for uncollectible accounts) | ||

| Depreciation expense | 32,000 | |

| Accumulated depreciation | 32,000 | |

| (Adjustment for depreciation for the period) | ||

| Supplies expense | 15,200 | |

| Inventory of supplies | 15,200 | |

| (Adjustment for supplies on hand) | ||

| Closing entries: | ||

| Revenue | 413,700 | |

| Operating expenses | 328,000 | |

| Interest expense | 30,000 | |

| Depreciation expense | 32,000 | |

| Supplies expense | 15,200 | |

| Profit and loss summary | 8,500 | |

| (Closing of nominal accounts) | ||

| Profit and loss summary | 8,500 | |

| Net assets − unrestricted | 8,500 | |

| (Profit and loss summary account closed and amount transferred to net assets unrestricted) | ||

| Net Assets − unrestricted | 43,000 | |

| Net assets − invested in capital | 43,000 | |

| (Recognition of increase in net asset invested) |

Calculation of increase in net assets invested:

| Ending balance of net capital assets | $563,000 |

| Less: Related debt | (500,000) |

| Beginning balance in net assets − invested in capital assets | (20,000) |

| Increase in net assets invested | $43,000 |

b

Introduction: An enterprise fund is one of two proprietary funds. It is the amounts charged to the general public, to recover all or most of the cost of goods and services provided by the government to the general public. An enterprise fund is one of two proprietary funds.

The statement of net position for the fund for December 31, 20X1.

Answer to Problem 18.8E

Total assets as per statement of net assets $686,500

Explanation of Solution

A MUD Enterprise Fund

Statement of Net Assets

December 31, 20X1

| $ | $ | |

| Assets: | ||

| Cash | 111,600 | |

| Accounts receivable | 13,000 | |

| Less: Allowance for uncollectible | (6,300) | 6,700 |

| Inventory of supplies | 5,200 | |

| Land | 120,000 | |

| Plant and equipment | 555,000 | |

| Less: Accumulated depreciation | (112,000) | 443,000 |

| Total Assets | 686,500 | |

| Liabilities: | ||

| Vouchers payable | 18,000 | |

| Due to general fund | 30,000 | |

| Bonds payable | 500,000 | |

| Total Liabilities | 548,000 | |

| Net Assets: | ||

| Invested in capital assets, net of related debt | 63,000 | |

| Unrestricted | 75,500 | |

| Total Net Assets | 138,500 | |

| 686,500 |

c

Introduction: An enterprise fund is one of two proprietary funds. It is the amounts charged to the general public, to recover all or most of the cost of goods and services provided by the government to the general public. An enterprise fund is one of two proprietary funds.

The statement of revenues, expenses and changes in fund net position for 20X1. Assuming $500,000 of the 6 percent bonds is related to the net capital assets of land and of plant and equipment.

Answer to Problem 18.8E

Change in net assets $8,500

Explanation of Solution

A MUD Enterprise fund

Statement of Revenues, Expenses and

Changes in Fund Net Assets

For the year ended December 31, 20X1

| $ | $ | |

| Revenues: | ||

| Revenue from services | 413,700 | |

| Expenses: | ||

| Operating expense | 328,000 | |

| Depreciation | 32,000 | |

| Supplies | 15,200 | |

| Total expenses | 375,200 | |

| Operating income | 38,500 | |

| Non-operating expenses | ||

| Interest on capital − related debt | 30,000 | |

| Change in net assets | 8,500 | |

| Net assets, January 1 | 130,000 | |

| Net assets, December 31 | 138,500 |

d

Introduction: An enterprise fund is one of two proprietary funds. It is the amounts charged to the general public, to recover all or most of the cost of goods and services provided by the government to the general public. An enterprise fund is one of two proprietary funds.

The statement of cash flows 20X1.

Answer to Problem 18.8E

Net increase in cash $19,600

Explanation of Solution

A MUD Enterprise Fund

Statement of Cash Flows

December 31, 20X1

| $ | $ | |

| Cash flows from operating activities: | ||

| Cash received from customers | 432,000 | |

| Cash payments for goods and services | (325,000) | |

| Cash paid to internal service fund for supplies | (12,400) | |

| Net cash provided by operating activities | 94,600 | |

| Cash flows from non-capital financing activities: | ||

| Cash received from general fund for non-capital loan | 30,000 | |

| Net cash provided by non-capital financing activities | 30,000 | |

| Cash flow from capital and related financing activities | ||

| Interest on capital related debts | (30,000) | |

| Extension of service lines | (75,000) | |

| Net cash used for capital and related financing activities | (105,000) | |

| Cash flow from investing activities | 0 | |

| Net increase in cash | 19,600 | |

| Cash at the beginning of the year | 92,000 | |

| Cash at the end of the year | 111,600 |

Want to see more full solutions like this?

Chapter 18 Solutions

ADVANCED FINANCIAL ACCT.-W/ACCESS

Additional Business Textbook Solutions

Financial Accounting: Tools for Business Decision Making, 8th Edition

Financial Accounting, Student Value Edition (4th Edition)

Introduction To Managerial Accounting

Intermediate Accounting

Financial Accounting, Student Value Edition (5th Edition)

- [The following information applies to the questions displayed below.]The Township of Thomasville’s General Fund has the following net resources at year end: $69,000 of prepaid insurance $410,000 rainy day fund approved by the township governing board with specific conditions for its use $1,800 of supplies inventory $60,000 state grant for snow removal $150,000 contractual obligations for the purchase of equipment Outstanding encumbrance of $105,000 for the purchase of furniture & fixtures (assume no contractual obligation) Total Fund Balance is $1,010,500 What would be the total Committed fund balance? Multiple Choice $410,000 $210,000 $560,000 $562,500 What would be the total Assigned fund balance? Multiple Choice $129,000 $165,000 $315,000 $105,000arrow_forwardPrepare journal entries to record the following events in the city of Rosewood’sWater Commission enterprise fund: a. From its general fund revenues, the city transferred $300,000, which is restricted for the drilling of additional wells. b. Billings for water consumption for the month totaled $287,000, including $67,000 billed to other funds within the city. c. TheWater Commission collected $42,000 from other funds and $190,000 from other users on billings in item (b). d. To raise additional funds, the utility issued $700,000 of 5%, 10-year revenue bonds at face value. Proceeds are restricted to the development of wells. e. The contract with the well driller showed an estimated cost of $930,000. f. The well driller bills $360,000 at year-end. g. The utility pays a $300,000 bill from the well driller.arrow_forwardPrepare journal entries for a local government to record the following transactions, first for fund financial statements and then for government-wide financial statements.a. The government sells $900,000 in bonds at face value to finance construction of a warehouse.b. A $1.1 million contract is signed for construction of the warehouse. The commitment is required, if allowed.c. A $130,000 transfer of unrestricted funds was made for the eventual payment of the debt in (a).d. Equipment for the fire department is received with a cost of $12,000. When it was ordered, an anticipated cost of $11,800 had been recorded.e. Supplies to be used in the schools are bought for $2,000 cash. The consumption method is used.f. A state grant of $90,000 is awarded to supplement police salaries. The money will be paid to reimburse the government after the supplement payments have been made to the police officers.g. Property tax assessments are mailed to citizens of the government. The total assessment is…arrow_forward

- The City of Oxbow General Fund has the following net resources at year-end: $260,000 unexpended proceeds of a state grant required by law to be used for health education. $20,000 of prepaid insurance. $609,000 rainy day fund approved by city council for use under specified circumstances. $210,000 budget stabilization fund to be used in the event of revenue shortfall. $285,000 provided for contractual obligations for capital projects. $41,000 unexpended proceeds of a tax required by law to be used for emergency 911 services. $1,636,000 total fund balance. Required:Prepare the fund balance section of the Balance Sheet. City of Oxbow Partial Balance sheet-General Fund Fund Balances Nonspendable $ Restricted $ $ Committed $ $ Assigned Unassigned Total Fund Balancearrow_forwardA $40 million contract is awarded by a county for construction of a building. Bonds are issued to finance construction, in the amount of $40 million. During the first year, $10 million is paid in cash to contractors for work done. At year-end, the capital projects fund reports the following fund balances: Question 43 options: a) Unavailable: $40 million b) Restricted $20 million, Committed: $10 million c) Restricted: $40 million d) Restricted: $30 millionarrow_forwardPrepare journal entries for a local government to record the following transactions, first for fund financial statements and then for government-wide financial statements. The government sells $900,000 in bonds at face value to finance construction of a warehouse. A $1.1 million contract is signed for construction of the warehouse. The commitment is required, if allowed. A $130,000 transfer of unrestricted funds was made for the eventual payment of the debt in (a). Equipment for the fire department is received with a cost of $12,000. When it was ordered, an anticipated cost of $11,800 had been recorded. Supplies to be used in the schools are bought for $2,000 cash. The consumption method is used. A state grant of $90,000 is awarded to supplement police salaries. The money will be paid to reimburse the government after the supplement payments have been made to the police officers. Property tax assessments are mailed to citizens of the government. The total assessment is $600,000,…arrow_forward

- Vacation City was awarded a $500,000 federal operating grant for use in Year 2. On December 1 of year 1, half of the grant money was received by the City. The journal entry to record receipt of the grant funds will include: Multiple Choice A. A credit to Revenues in the amount of $250,000. B. A credit to Deferred Inflow of Resources- Grant Proceeds in the amount of $250,000. C. A debit to Grant Expenditures in the amount of $250,000. D. No journal entry will be made until expenditures are made in Year 2.arrow_forwardA capital projects fund for a new state legislative chamber building received $600,000 from a state grant and $900,000 from a transfer from the general fund. What amount should be reported, by the capital projects fund, as revenue? Multiple Choice $900,000 $0 $600,000 $1,500,000arrow_forwardThe following items were included in Simple City's General Fund expenditures for the year ended June 30: Computer for the city treasurer's office $ 6,000 Furniture for the mayor’s office $ 20,000 How much should be classified as capital assets in Simple City's government-wide statement of net position at June 30? Multiple Choice $26,000 $0 $20,000 $6,000arrow_forward

- The City of Galena General Fund has the following net resources at year-end: $1,634,000 total fund balance. $259,000 unexpended proceeds of a state grant required by law to be used for health education. $19,000 of prepaid insurance. $608,000 rainy day fund approved by the city council for use under specified circumstances. $209,000 budget stabilization fund to be used in the event of a revenue shortfall. $284,000 provided for contractual obligations for capital projects. $39,000 unexpended proceeds of a tax required by law to be used for emergency 911 services. Required: Prepare the fund balance section of the Balance Sheet as of December 31, 2024.arrow_forwardThe County of Maxnell decides to create a waste management department and offer its services to the public for a fee. As a result, county officials plan to account for this activity as an enterprise fund. Assume the information is gathered so that the county can prepare fund financial statements. Only entries for the waste management department are required here: January 1 Receive unrestricted funds of $248,000 from the general fund as permanent financing. Febrauary 1 Borrow an additional $224,000 from a local bank at a 12 percent annual interest rate. March 1 Order a truck at an expected cost of $140,000. April 1 Receive the truck and make full payment. The actual cost including transportation was $143,000. The truck has a 10-year life and no residual value. The county uses straight-line depreciation. May 1 Receive a $23,600 cash grant from the state to help supplement the pay of the department workers. According to the grant, the money must be used for that…arrow_forwardCentral City was awarded two state grants during its fiscal year ending September 30, 20X1: a $2 million block grant that can be used to cover any operating expenses incurred during fiscal 20X2, and a $1 million grant that can be used any time to acquire equipment for its police department. For the year ending September 30, 20X1, Central City should recognize in grant revenue in its fund financial statements (in millions): $0 $1 $2 $3 Assume the same facts as in the previous example. How much should the city recognize in grant revenue in its government‐wide statements? $0 $1 $2 $3 For its fiscal year ending September 30, 20X2, Twin City levied $500 million in property taxes. It collected taxes applicable to fiscal 20X2 as follows (in millions): June 1, 20X1, through September 30, 20X1 $ 20 October 1, 20X1, through September 30, 20X2 $440 October 1, 20X2, through November 30, 20X2 $ 15 December 20X2 $ 4 The city estimates that $10 million of the outstanding balance…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education