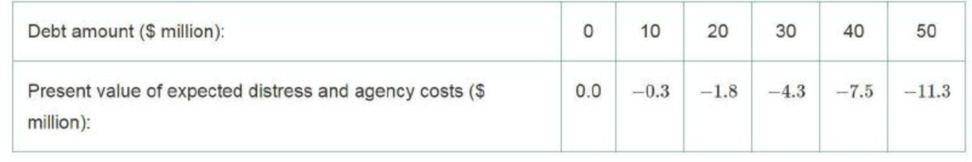

DFS Corporation is currently an all-equity firm, with assets with a market value of $100 million and 4 million shares outstanding. DFS is considering a leveraged recapitalization to boost its share price. The firm plans to raise a fixed amount of permanent debt (i.e., the outstanding principal will remain constant) and use the proceeds to repurchase shares. DFS pays a 35% corporate tax rate, so one motivation for taking on the debt is to reduce the firm’s tax liability. However, the upfront investment banking fees associated with the recapitalization will be 5% of the amount of debt raised. Adding leverage will also create the possibility of future financial distress or agency costs; shown below are DFS’s estimates for different levels of debt:

- a. Based on this information, which level of debt is the best choice for DFS?

- b. Estimate the stock price once this transaction is announced.

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Additional Business Textbook Solutions

Corporate Finance

Foundations Of Finance

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Accounting Volume 1

- The Rivoli Company has no debt outstanding, and its financial position is given by the following data: What is Rivoli’s intrinsic value of operations (i.e., its unlevered value)? What is its intrinsic stock price? Its earnings per share? Rivoli is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 12% to reflect the increased risk. Bonds can be sold at a cost, rd, of 7%. Based on the new capital structure, what is the new weighted average cost of capital? What is the levered value of the firm? What is the amount of debt? Based on the new capital structure, what is the new stock price? What is the remaining number of shares? What is the new earnings per share?arrow_forwardBayani Bakerys most recent FCF was 48 million; the FCF is expected to grow at a constant rate of 6%. The firms WACC is 12%, and it has 15 million shares of common stock outstanding. The firm has 30 million in short-term investments, which it plans to liquidate and distribute to common shareholders via a stock repurchase; the firm has no other nonoperating assets. It has 368 million in debt and 60 million in preferred stock. a. What is the value of operations? b. Immediately prior to the repurchase, what is the intrinsic value of equity? c. Immediately prior to the repurchase, what is the intrinsic stock price? d. How many shares will be repurchased? How many shares will remain after the repurchase? e. Immediately after the repurchase, what is the intrinsic value of equity? The intrinsic stock price?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning