Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 26P

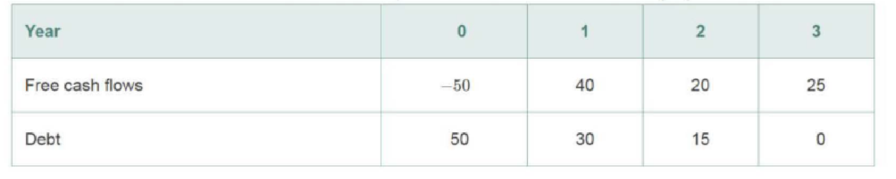

Propel Corporation plans to make a $50 million investment, initially funded completely with debt. The

Propel’s incremental debt for the project will be paid off according to the predetermined schedule shown. Propel’s debt cost of capital is 8%, and its tax rate is 40%. Propel also estimates an unlevered cost of capital for the project of 12%.

- a. Use the APV method to determine the levered value of the project at each date and its initial

NPV . - b. Calculate the WACC for this project at each date. How does the WACC change over time? Why?

- c. Compute the project’s NPV using the WACC method.

- d. Compute the equity cost of capital for this project at each date. How does the equity cost of capital change over time? Why?

- e. Compute the project’s equity value using the FTE method. How does the initial equity value compare with the NPV calculated in parts a and c?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

BASF will invest $14 million this year to upgrade its ethylene glycol processes. This chemical is used to produce polyester resins to manufacture products varying from construction materials to aircraft, and from luggage to home appliances. Equity capital costs 14.5% per year and will supply 65% of the capital funds. Debt capital costs 10% per year before taxes. The effective tax rate for BASF is 36%. (a) Determine the amount of annual revenue after taxes that is consumed in covering the interest on the project’s initial cost. (b) If the corporation does not want to use 65% of its own funds, the financing plan may include 75% debt capital. Determine the amount of annual revenue needed to cover the interest with this plan, and explain the effect it may have on the corporation’s ability to borrow in the future.

Amalgamated Industries is considering a 4- year project. The project is expected to generate operating cash flows of $3 million, $16 million, $18 million, and $14 million over the four years, respectively. It will require initial capital expenditures of $35 million dollars and an initial investment in NWC of $6 million. The firm expects to generate a $6 million after tax salvage value from the sale of equipment when the project ends, and it expects to recover 100% of its nw investments. Assuming the firm requires a return of 15% for projects of this risk level, what is the project's IRR?

A. 16.16%

B. 16.47%

C. 15.39%

D. 16.00%

E. 15.70%

Western Wear is considering a project that requires an initial investment of $602,000. The firm maintains a debt-equity ratio of .55 and has a flotation cost of debt of 4.9 percent and a flotation cost of equity of 10.2 percent. The firm has sufficient internally generated equity to cover the equity portion of this project. What is the initial cost of the project including the flotation costs?

Chapter 18 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 18.1 - What are the three methods we can use to include...Ch. 18.1 - Prob. 2CCCh. 18.2 - Prob. 1CCCh. 18.2 - Prob. 2CCCh. 18.3 - Prob. 1CCCh. 18.3 - Prob. 2CCCh. 18.4 - Prob. 1CCCh. 18.4 - Prob. 2CCCh. 18.5 - How do we estimate a projects unlevered cost of...Ch. 18.5 - What is the incremental debt associated with a...

Ch. 18.6 - Prob. 1CCCh. 18.6 - Prob. 2CCCh. 18.7 - How do we deal with issuance costs and security...Ch. 18.7 - Prob. 2CCCh. 18.8 - When a firm has pre-determined tax shields, how do...Ch. 18.8 - Prob. 2CCCh. 18 - Prob. 1PCh. 18 - Prob. 2PCh. 18 - In 2015, Intel Corporation had a market...Ch. 18 - Prob. 4PCh. 18 - Suppose Goodyear Tire and Rubber Company is...Ch. 18 - Suppose Alcatel-Lucent has an equity cost of...Ch. 18 - Acort Industries has 10 million shares outstanding...Ch. 18 - Prob. 8PCh. 18 - Prob. 9PCh. 18 - Consider Alcatel-Lucents project in Problem 6. a....Ch. 18 - Consider Alcatel-Lucents project in Problem 6. a....Ch. 18 - In year 1, AMC will earn 2000 before interest and...Ch. 18 - Prokter and Gramble (PKGR) has historically...Ch. 18 - Amarindo, Inc. (AMR), is a newly public firm with...Ch. 18 - Remex (RMX) currently has no debt in its capital...Ch. 18 - You are evaluating a project that requires an...Ch. 18 - Prob. 17PCh. 18 - You are on your way to an important budget...Ch. 18 - Your firm is considering building a 600 million...Ch. 18 - Prob. 20PCh. 18 - DFS Corporation is currently an all-equity firm,...Ch. 18 - Prob. 22PCh. 18 - Prob. 23PCh. 18 - Prob. 24PCh. 18 - XL Sports is expected to generate free cash flows...Ch. 18 - Propel Corporation plans to make a 50 million...Ch. 18 - Gartner Systems has no debt and an equity cost of...Ch. 18 - Revtek, Inc., has an equity cost of capital of 12%...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your division is considering two investment projects, each of which requires an up-front expenditure of 25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars): a. What is the regular payback period for each of the projects? b. What is the discounted payback period for each of the projects? c. If the two projects are independent and the cost of capital is 10%, which project or projects should the firm undertake? d. If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake? e. If the two projects are mutually exclusive and the cost of capital is 15%, which project should the firm undertake? f. What is the crossover rate? g. If the cost of capital is 10%, what is the modified IRR (MIRR) of each project?arrow_forwardEdelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year’s capital budget. The projects are independent. The cash outlay for the truck is $17,100, and that for the pulley system is $22,430. The firm’s cost of capital is 14%. After-tax cash flows, including depreciation, are as follows: Calculate the IRR, the NPV, and the MIRR for each project, and indicate the correct accept/reject decision for each.arrow_forwardPostman Company is considering two independent projects. One project involves a new product line, and the other involves the acquisition of forklifts for the Materials Handling Department. The projected annual operating revenues and expenses are as follows: Required: Compute the after-tax cash flows of each project. The tax rate is 40 percent and includes federal and state assessments.arrow_forward

- Wansley Lumber is considering the purchase of a paper company, which would require an initial investment of $300 million. Wansley estimates that the paper company would provide net cash flows of $40 million at the end of each of the next 20 years. The cost of capital for the paper company is 13%. Should Wansley purchase the paper company? Wansley realizes that the cash flows in Years 1 to 20 might be $30 million per year or $50 million per year, with a 50% probability of each outcome. Because of the nature of the purchase contract, Wansley can sell the company 2 years after purchase (at Year 2 in this case) for $280 million if it no longer wants to own it. Given this additional information, does decision-tree analysis indicate that it makes sense to purchase the paper company? Again, assume that all cash flows are discounted at 13%. Wansley can wait for 1 year and find out whether the cash flows will be $30 million per year or $50 million per year before deciding to purchase the company. Because of the nature of the purchase contract, if it waits to purchase, Wansley can no longer sell the company 2 years after purchase. Given this additional information, does decision-tree analysis indicate that it makes sense to purchase the paper company? If so, when? Again, assume that all cash flows are discounted at 13%.arrow_forwardStaten Corporation is considering two mutually exclusive projects. Both require an initial outlay of 150,000 and will operate for five years. The cash flows associated with these projects are as follows: Statens required rate of return is 10%. Using the net present value method and the present value table provided in Appendix A, which of the following actions would you recommend to Staten? a. Accept Project X and reject Project Y. b. Accept Project Y and reject Project X. c. Accept Projects X and Y. d. Reject Projects X and Y.arrow_forwardThe Rodriguez Company is considering an average-risk investment in a mineral water spring project that has an initial after-tax cost of 170,000. The project will produce 1,000 cases of mineral water per year indefinitely, starting at Year 1. The Year-1 sales price will be 138 per case, and the Year-1 cost per case will be 105. The firm is taxed at a rate of 25%. Both prices and costs are expected to rise after Year 1 at a rate of 6% per year due to inflation. The firm uses only equity, and it has a cost of capital of 15%. Assume that cash flows consist only of after-tax profits because the spring has an indefinite life and will not be depreciated. a. What is the present value of future cash flows? (Hint: The project is a growing perpetuity, so you must use the constant growth formula to find its NPV.) What is the NPV? b. Suppose that the company had forgotten to include future inflation. What would they have incorrectly calculated as the projects NPV?arrow_forward

- Clearcast Communications Inc. is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated operating income, and net cash flow for each proposal are as follows: The companys capital rationing policy requires a maximum cash payback period of three years. In addition, a minimum average rate of return of 12% is required on all projects. If the preceding standards are met, the net present value method and present value indexes are used to rank the remaining proposals. Instructions 1. Compute the cash payback period for each of the four proposals. 2. Giving effect to straight-line depreciation on the investments and assuming no estimated residual value, compute the average rate of return for each of the four proposals. Round to one decimal place. 3. Using the following format, summarize the results of your computations in parts (1) and (2). By placing the computed amounts in the first two columns on the left and by placing a check mark in the appropriate column to the right, indicate which proposals should be accepted for further analysis and which should be rejected. 4. For the proposals accepted for further analysis in part (3), compute the net present value. Use a rate of 12% and the present value table appearing in Exhibit 2 of this chapter. 5. Compute the present value index for each of the proposals in part (4). Round to two decimal places. 6. Rank the proposals from most attractive to least attractive, based on the present values of net cash flows computed in part (4). 7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5). 8. Based on the analyses, comment on the relative attractiveness of the proposals ranked in parts (6) and (7).arrow_forwardThe Pinkerton Publishing Company is considering two mutually exclusive expansion plans. Plan A calls for the expenditure of 50 million on a large-scale, integrated plant that will provide an expected cash flow stream of 8 million per year for 20 years. Plan B calls for the expenditure of 15 million to build a somewhat less efficient, more labor-intensive plant that has an expected cash flow stream of 3.4 million per year for 20 years. The firms cost of capital is 10%. a. Calculate each projects NPV and IRR. b. Set up a Project by showing the cash flows that will exist if the firm goes with the large plant rather than the smaller plant. What are the NPV and the IRR for this Project ? c. Graph the NPV profiles for Plan A, Plan B, and Project .arrow_forwardesfandairi enterprises is considering a new three year expansion project that requires an initial fixed asset investment of 2.3 million. The fixed assets falls into the 3 year MARCS class The project is estimated to generate $1,7200, 000 in annual sales with costs of $628,000. The project requires an initial investment in net working capital of $270, 000 and the fixed assett will have a market value of $210,000 at the end of the project. If the tax rate is 22% what is the projects 0 net cash flow? Year 1? Year 2 Year 3? If the required return is 10% what is the projects NPV? MARCs schedule 33.33%, 44.45%, 14.81%, and 7.41%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Discounted cash flow model; Author: Edspira;https://www.youtube.com/watch?v=7PpWneOBJls;License: Standard YouTube License, CC-BY