EBK CORNERSTONES OF COST MANAGEMENT

3rd Edition

ISBN: 9781305147102

Author: MOWEN

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem 16E

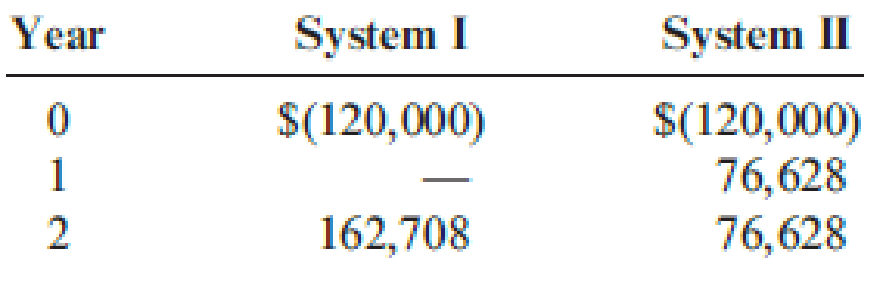

Covington Pharmacies has decided to automate its insurance claims process. Two networked computer systems are being considered. The systems have an expected life of two years. The net

The company’s cost of capital is 10 percent.

Required:

- 1. Compute the

NPV and theIRR for each investment. - 2. Show that the project with the larger NPV is the correct choice for the company.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

A clinic is considering the possibility of two new purchases: new MRI equipment and new biopsy equipment. Each project requires an investment of $425,000. The expected life for each is five years with no expected salvage value. The net cash inflows associated with the two independent projects are as follows:

1. Compute the payback period for each project.

2. Compute the accounting rate of return for each project.

Alfredo Auto Parts is considering investing in a new forming line for grille assemblies. For a five-year study period, the cash flows for two separate designs are shown below. Create a spreadsheet that will calculate the present worths for each project for a variable ALARR. Through trial and error, establish the ALARR at which the present worths of the two projects are exactly the same. Cash Flows for Grille Assembly Project Automated Line Manual Line Disburse- Net Cash | Disburse- Net Cash Year | ments | Receipts | Flow ments | Receipts Flow 0 [e1 500000 [€ 0 [-€1 500 000 [€1 000 000 | € o[ -€1 000 000 1 50 000 | 300 000 250000 [ 20000 [ 200 000 180 000 2 60 000 | 300 000 240000 [ 25000 [ 200 000 175 000 3 70 000 | 300 000 230 000 30 000 | 200 000 170 000 4 80000 [ 300 000 220 000 35000 | 200 000 165 000 5 90 000 [ 800 000 710000 40000 [ 200 000 160 000

The production department is proposing the purchase of an automatic insertion machine. It has identified 3

machines, each with an estimated life of 10 years. Which machine offers the best internal rate of return?

Annual net cash flows

Average investment

Machine A only

Machine B only

Machine C only

O Machines A and B

Machine A

$ 50,000

250,000

Machine B

$ 40,000

300,000

Machine

$ 75,000

500,000

Chapter 19 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

Ch. 19 - Explain the difference between independent...Ch. 19 - Explain why the timing and quantity of cash flows...Ch. 19 - Prob. 3DQCh. 19 - Prob. 4DQCh. 19 - What is the accounting rate of return?Ch. 19 - What is the cost of capital? What role does it...Ch. 19 - Prob. 7DQCh. 19 - Explain how the NPV is used to determine whether a...Ch. 19 - Explain why NPV is generally preferred over IRR...Ch. 19 - Prob. 10DQ

Ch. 19 - Prob. 11DQCh. 19 - Prob. 12DQCh. 19 - Prob. 13DQCh. 19 - Prob. 14DQCh. 19 - Prob. 15DQCh. 19 - Jan Booth is considering investing in either a...Ch. 19 - Prob. 2CECh. 19 - Carsen Sorensen, controller of Thayn Company, just...Ch. 19 - Manzer Enterprises is considering two independent...Ch. 19 - Keating Hospital is considering two different...Ch. 19 - Prob. 6CECh. 19 - Prob. 7ECh. 19 - Prob. 8ECh. 19 - Each of the following scenarios is independent....Ch. 19 - Roberts Company is considering an investment in...Ch. 19 - NPV A clinic is considering the possibility of two...Ch. 19 - Refer to Exercise 19.11. 1. Compute the payback...Ch. 19 - Buena Vision Clinic is considering an investment...Ch. 19 - Consider each of the following independent cases....Ch. 19 - Gina Ripley, president of Dearing Company, is...Ch. 19 - Covington Pharmacies has decided to automate its...Ch. 19 - Postman Company is considering two independent...Ch. 19 - Prob. 18ECh. 19 - Prob. 19ECh. 19 - Prob. 20ECh. 19 - Prob. 21ECh. 19 - Prob. 22ECh. 19 - Prob. 23ECh. 19 - Prob. 24PCh. 19 - Prob. 25PCh. 19 - Prob. 26PCh. 19 - Kent Tessman, manager of a Dairy Products...Ch. 19 - Friedman Company is considering installing a new...Ch. 19 - Okmulgee Hospital (a large metropolitan for-profit...Ch. 19 - Mallette Manufacturing, Inc., produces washing...Ch. 19 - Prob. 31PCh. 19 - Prob. 32P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose that you have just completed the mechanical design of a high-speed automated palletizer that has an investment cost of $3,000,000. The existing palletizer is quite old and has no salvage value. The market value for the new palletizer is estimated to be $300,000 after seven years. One million pallets will be handled by the palletizer each year during the seven-year expected project life. What net savings per pallet (i.e., total savings less expenses) will have to be generated by the palletizer to justify this purchase in view of a MARR of 20% per year?arrow_forwardA computer call center is going to replace all of its incandescent lamps with more energy efficient fluorescent lighting fixtures. The total energy savings are estimated to be $1,875 per year, and the cost of purchasing and installing the fluorescent fixtures is $4,900. The study period is five years, and terminal values for the fixtures are negligible.a. What is the IRR of this investment?b. What is the simple payback period of the investment?arrow_forwardThe Dental Clinic, Inc. is contemplating replacing an obsolete word processing system with one of two innovative lines of equipment. Alternative 1 requires a current investment layout of $26,022, whereas alternative 2 requires an outlay of $31,048. The following cash flows (cost savings) will be generated each year over the five-year useful lives of the new systems. Probability Cash Flow $7,000 10,000 13,000 $7,500 10,000 12,500 Alternative 1 0.32 0.36 0.32 Alternative 2 0.18 0.64 0.18 6a) Calculate the expected cash flow for each investment alternative.arrow_forward

- Your venture has signed a new consulting contract that will require you to invest in new analytical software and a new computer. The contract will generate the following periodic cash flows. You have used bank credit to finance the cost of the software and hardware. The financing rate is 6%. Cash flows generated from the project will be reinvested at 4%. The MIRR of the project is between 6% and 7%. time cash flow 0 -$200,000 1 $20,000 2 $30,000 3 $50,000 4 $65,000 5 $80,000 True Falsearrow_forwardA pharmacy has decided to automate its insurance claims process. Two networked computer systems are being considered. The systems have an expected life of 3 years. Herewith is the cash flows related to the project, the cash benefits represent the savings created by switching from manual to automated. Question: Which system would you choose and why? (Limit 5 sentences) System 1 P 200,000 75,000 75,000 75,000 The company's cost of capital is 10%. Year Investment System 2 P 215,000 1 2 3 420,000 Your answerarrow_forwardGina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?arrow_forward

- If a copy center is considering the purchase of a new copy machine with an initial investment cost of $150,000 and the center expects an annual net cash flow of $20,000 per year, what is the payback period?arrow_forwardManzer Enterprises is considering two independent investments: A new automated materials handling system that costs 900,000 and will produce net cash inflows of 300,000 at the end of each year for the next four years. A computer-aided manufacturing system that costs 775,000 and will produce labor savings of 400,000 and 500,000 at the end of the first year and second year, respectively. Manzer has a cost of capital of 8 percent. Required: 1. Calculate the IRR for the first investment and determine if it is acceptable or not. 2. Calculate the IRR of the second investment and comment on its acceptability. Use 12 percent as the first guess. 3. What if the cash flows for the first investment are 250,000 instead of 300,000?arrow_forwardYour company is planning to purchase a new log splitter for is lawn and garden business. The new splitter has an initial investment of $180,000. It is expected to generate $25,000 of annual cash flows, provide incremental cash revenues of $150,000, and incur incremental cash expenses of $100,000 annually. What is the payback period and accounting rate of return (ARR)?arrow_forward

- Rambus Inc. would like to purchase a production machine for $325,000. The machine is expected to have a life of three years, and a salvage value of $50,000. Annual maintenance costs will total $12,500. Annual savings are predicted to be $112,500. The company's required rate of return is 12%. Required: Ignoring the time value of money, calculate the net cash inflow or outflow resulting from this investment opportunity.arrow_forwardSuppose Kyler Valley is deciding whether to purchase new accounting software. The payback for the $30,050 software package is five years, and the software's expected life is nine years. Kyler Valley's required rate of return for this type of project is 11.0%. Assuming equal yearly cash flows, what are the expected annual net cash savings from the new software? (1) ÷ (2) = Expected annual net cash inflow ÷ = (1) Amount invested Average amount invested Expected useful life Payback Required rate of return (2) Amount invested Average amount invested Expected useful life Payback Required rate of returnarrow_forwardA computer call center is going to replace all of its incandescent lamps with more energy-efficient fluorescent lighting fixtures. The total energy saving are estimated to be $2,033 per year, and the cost of purchasing and installing the fluorescent fixtures is $5,400. The study period is five years, and terminal market values for the fixtures are negligible. a. What is the IRR of this investment? b. What is the simple payback period of the investment? c. Is there a conflict in the answers Parts (a) and (b)? List your assumptions. d. The simple payback "rate of return" is 1/θ. How close does this metric come to matching your answer in Part(a)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License