Fundamental Accounting Principles -Hardcover

22nd Edition

ISBN: 9780077862275

Author: John J Wild, Ken Shaw Accounting Professor, Barbara Chiappetta Fundamental Accounting Principles

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem 18E

Exercise 19-18

A1

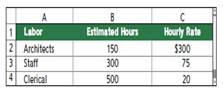

Hansel Corporation has requested bids from several architects to design its new corporate headquarters. Frey Architects is one of the firms bidding on the job. Frey estimates that the job will require the Mowing direct labor.

Frey apples overhead to jobs at 175% of direct labor cost, Frey would like to earn at least $80,000 profit on the architectural job. Based on past experience and

1. What is Frey;s estimated cost of the architectural job?

2. What bid would you suggest that Frey submit?

Check (1) $213,125

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Question No.4

The Jewell plant has two categories of overhead: maintenance and inspection. Costs expected for these categories for the coming year are as follows:

Maintenance Rs.360,000

Inspection 750,000

The plant currently applies overhead using direct labor hours and expected capacity of 100,000 direct labor hours. The following data has been assembled for use in developing a bid for a proposed job. Bid prices are calculated as full manufacturing cost plus a 20% mark-up.

Direct materials Rs.2,100

Direct labor 5,625

Machine hours 450

Number of inspections 4

Direct labor hours 550

Total expected machine hours for all jobs during the year are 60,000, and the total expected number of inspections is 4,000.

Required:

A: Compute the total cost of the potential job using direct labor hours to assign overhead.

Determine the bid price for the potential job.

B: Compute the total cost of the job using…

Review Question 1Manufacturing Overhead Allocation Base and Calculating the Cost of Jobs.Pyramid Company expects to incur $3,000,000 in manufacturing overhead costs this year. During theyear, it expects to use 40,000 direct labor hours at a cost of $600,000 and 80,000 machine hours.Required:a. Prepare a predetermined overhead rate based on direct labor hours, direct labor cost, andmachine hours.b. Why might Pyramid Company prefer to use machine hours to allocate manufacturing overhead?c. Using each of the predetermined overhead rates calculated in part a and the data that follows forjob 128, determine the cost of job128.Direct materials $6,000Direct labor $4,000 (200 hours at $15 per hour) + (100 hours at $10 per hour)Machine time 700 hours

JOB COSTING II

GLOBAL CAMPUS

Discussion Question

Miguel Manufacturing Company uses a predetermined manufacturing overhead rate based on direct

labor hours. At the beginning of 2023, they estimated total manufacturing overhead costs at

$2,352,000, and they estimated total direct labor hours at 7,000.

The administration and selling overheads are to be absorbed in each job cost at 15% of prime cost.

Distribution cost should be added to each job according to quotes from outside carriage companies.

The company wishes to quote for job # 222. Job stats are as follows:

Direct materials cost

Direct labour cost

Direct labour hours

$173,250

$240,000

500 hours

Special Design Cost

Distribution quote from haulage company

Units of product produced

$8,750

$21,700

400 cartons

a) Compute Miguel's Manufacturing Company predetermined manufacturing overhead rate for

2023.

b) How much manufacturing overhead was allocated to Job #222?

c) Calculate the total cost & quotation price of Job #222, given that a…

Chapter 19 Solutions

Fundamental Accounting Principles -Hardcover

Ch. 19 - Prob. 1DQCh. 19 - Prob. 2DQCh. 19 - Prob. 3DQCh. 19 - Prob. 4DQCh. 19 - Prob. 5DQCh. 19 - Prob. 6DQCh. 19 - Prob. 7DQCh. 19 - Prob. 8DQCh. 19 - Prob. 9DQCh. 19 - Prob. 10DQ

Ch. 19 - Prob. 11DQCh. 19 - Prob. 12DQCh. 19 - Prob. 13DQCh. 19 - Prob. 14DQCh. 19 - Prob. 1QSCh. 19 - Prob. 2QSCh. 19 - Prob. 3QSCh. 19 - Prob. 4QSCh. 19 - Prob. 5QSCh. 19 - Prob. 6QSCh. 19 - Prob. 7QSCh. 19 - Prob. 8QSCh. 19 - Prob. 9QSCh. 19 - Prob. 10QSCh. 19 - Prob. 11QSCh. 19 - Manufacturing cost flows P1 P2 P3 Refer to the...Ch. 19 - Prob. 13QSCh. 19 - Prob. 14QSCh. 19 - Prob. 1ECh. 19 - Prob. 2ECh. 19 - Prob. 3ECh. 19 - Prob. 4ECh. 19 - Prob. 5ECh. 19 - Prob. 6ECh. 19 - Prob. 7ECh. 19 - Prob. 8ECh. 19 - Prob. 9ECh. 19 - Prob. 10ECh. 19 - Prob. 11ECh. 19 - Prob. 12ECh. 19 - Prob. 13ECh. 19 - Prob. 14ECh. 19 - Prob. 15ECh. 19 - Prob. 16ECh. 19 - Prob. 17ECh. 19 - Exercise 19-18 Job order costing for services A1...Ch. 19 - A recent balance sheet for Porsche AG shows...Ch. 19 - Problem 19-1A

Production costs computed and...Ch. 19 - Prob. 2APSACh. 19 - Prob. 3APSACh. 19 - Prob. 4APSACh. 19 - Prob. 5APSACh. 19 - Prob. 1BPSBCh. 19 - Prob. 2BPSBCh. 19 - Problem 19-3B

Source documents, journal entries,...Ch. 19 - Prob. 4BPSBCh. 19 - Prob. 5BPSBCh. 19 - The computer workstation furniture manufacturing...Ch. 19 - Prob. 1GLPCh. 19 - Prob. 1BTNCh. 19 - Prob. 2BTNCh. 19 - Prob. 3BTNCh. 19 - Prob. 4BTNCh. 19 - Prob. 5BTNCh. 19 - Prob. 6BTNCh. 19 - Prob. 7BTNCh. 19 - Prob. 8BTNCh. 19 - Apple and Samsung are competitors in the global...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 3 The Fleming Company of Anguilla (FCA) designs and produces automotive parts. In 2019, actual variable manufacturing overhead is $280,000. FCA's simple costing system allocates variable manufacturing overhead to its three customers based on machine-hours and prices its contracts based on full costs. One of its customers has regularly complained of being charged noncompetitive prices, so FCA's controller Matthias Hodge realizes that it is time to examine the consumption of overhead resources more closely. He knows that there are three main departments that consume overhead resources: design, production, and engineering. Interviews with the department personnel and examination of time records yield the following detailed infomation: Usage of Cost of Drivers by Customer Contract Manufacturing Gumbs Connor Richardson Overhead in 2019 Motors Motors Auto Department Design Cost Driver CAD design hours $ 35,000 150 250 100 Engineering hours 25,000 220,000 $280,000 Production 130 100…arrow_forwardExercise 9 Engineer Co. is submitting a bid for a major job and estimates the following direct labor costs: Engineers Drafters Staff Hourly Rate Hours 60 $ 250.00 40 $ 120.00 100 $ 20.00 Engineer Co. has no direct material costs and applies overhead at a rate of 150% of direct labor cost. It estimates the competition will bid between $63765 and $77935. a) What is the estimated cost of direct labor for the job? b) What is the estimated cost of the job(Labor & MOH)? c) What should it bid to earn a 30% profit on cost? JU X IXarrow_forwardQuestion No.3 The Jewell plant has two categories of overhead: maintenance and inspection. Costs expected for these categories for the coming year are as follows: Maintenance Rs.360,000 Inspection 750,000 The plant currently applies overhead using direct labor hours and expected capacity of 100,000 direct labor hours. The following data has been assembled for use in developing a bid for a proposed job. Bid prices are calculated as full manufacturing cost plus a 20% mark-up. Direct materials Rs.2,100 Direct labor 5,625 Machine hours 450 Number of inspections 4 Direct labor hours 550 Total expected machine hours for all jobs during the year are 60,000, and the total expected number of inspections is 4,000. Required: Compute the total cost of the potential job using direct labor hours to assign overhead. Determine the bid price for the potential job. Compute the total cost of the job using…arrow_forward

- Exercise 2-29 (Static) Pricing services using job order costing LO A1 Hansel Company has requested bids from several architects to design its new corporate headquarters. Frey Architects is bidding on the job. Frey estimates that the job will require the following direct labor. Direct Labor Architects Staff Clerical Estimated Hours 150 300 500 Required 1 Frey applies overhead to jobs at 175% of direct labor cost. Frey wants to earn at least $80,000 profit on the architectural job. Based on past experience and market research, it estimates that the competition will bid between $285,000 and $350,000 for the job. Hourly Rate 1. What is Frey's estimated cost of the architectural job? 2. If Frey bids a price of $285,000, what is its expected profit? Will it earn its target profit of $80,000? 3. What bid price would earn the desired $80,000 target profit? Direct labor $ 300 75 20 Complete this question by entering your answers in the tabs below. Required 2 Required 3 What is Frey's estimated…arrow_forwardVariable costs and activity bases in decision making The owner of Dawg Prints, a printing company, is planning direct labor needs for the upcoming year. The owner has provided you with the following information for next year's plans: Each color on the banner must be printed one at a time. Thus, for example, a four-color banner will need to be run through the printing operation four separate times. The total production volume last year was 600 banners, as shown below. The four-color banner is a new product offering for the upcoming year. The owner believes that the expected 600-unit increase in volume from last year means that direct labor expenses should increase by 100% (600 + 600). What do you think?arrow_forwardPayroll computation with incentive bonus Fifteen workers are assigned to a group project. The production standard calls for 500 units to be completed each hour to meet a customers set deadline for the products. If the required units can be delivered before the target date on the order, the customer will pay a substantial premium for early delivery. The company, wishing to encourage the workers to produce beyond the established standard, has offered an excess-production bonus that will be added to each project employees pay. The bonus is to be computed as follows: a. Groupsexcessproductionoverstandard50%Standardunitsforweek=bonuspercentage b. Individuals hourly wage rate bonus percentage = hourly bonus rate c. Hourly wage rate + hourly bonus rate = new hourly rate for week d. Total hours worked new hourly rate = earnings for week The production record for the week shows the following: Required: 1. Determine the hourly bonus rate. (Round the bonus percentage to four decimal places and the bonus rate to the nearest whole cent.) 2. What are the total wages of L. Weitmarschen, who worked 40 hours at a base rate of 15 per hour? 3. What are the total wages of R. Emerson, who worked 35 hours at a base rate of 20 per hour?arrow_forward

- Labor classification trade-off Skidmore Electronics manufactures consumer electronic products. The company has three assembly labor classifications, S-1, S-2, and S-3. The three classifications are paid 15, 18, and 22 per hour, respectively. The assembly activity for a new smartphone is as follows: A product engineer proposes using a higher-rated employee to perform the assembly on the new phone. His analysis has shown that an S-3 employee can perform the assembly in 0.35 hour per unit. A. Determine the Assembly activity cost using the S-3 labor classification. B. Is the product engineers proposal supported?arrow_forwardD Question 9 The Conrad Company uses a normal job-costing system at its New Brunswick plant. Its job-costing system has two direct-cost categories (direct materials and direct manufacturing labor) and one manufacturing overhead cost pool (the machining department overhead, allocated to jobs based on machine-hours). The 2020 budget and actual numbers for the plant are as follows: Tim 1 H Budgeted Actual Manufacturing Overhead $2,530.000 $2,400,000 Direct Manufacturing Labor Cost $1,560,000 $1.720,000 Direct Manufacturing Labor 270,000 280,000 Hours Machine-Hours 72,300 80,000 During February, the job-cost record for Job 494 contained the following: Direct Materials Used $14,500 Direct Manufacturing Labor Costs $27,800 270,000 280,000 Hours 72,300 80.000 Machine-Hours During February, the job-cost record for Job 494 contained the following: Direct Materials Used $14,500 Direct Manufacturing Labor $27,800 Costs Direct Manufacturing Labor- 1,250 Hours Machine-Hours 540 The total…arrow_forwardView Policies Current Attempt in Progress Wilson Company manufactures a line of lightweight running shoes. CEO Charles Wilson estimated that the company would incur $7,200,000 in manufacturing overhead during the coming year. Additionally, he estimated the company would operate at a level requiring 400,000 direct labor hours and 400,000 machine hours. (a) Assume that Wilson Company uses direct labor hours as its manufacturing overhead application base. Calculate the company's predetermined overhead rate. Company's predetermined overhead rate $ eTextbook and Media Save for Later /DLH Attempts: 0 of 4 used (b) The parts of this question must be completed in order. This part will be available when you complete the part above. (c) The parts of this question must be completed in order. This part will be available when you complete the part above. (d) The parts of this question must be completed in order. This part will be available when you complete the part above. Submit Answerarrow_forward

- O d. Establishing goals Almu O e. Choosing among alternatives 128 Company XYZ is currently producing and selling 100 units. At this level, the total direct materials cost is $500, the total direct labor cost is $1,000 and the total manufacturing overhead cost is $1,220, which includes $800 fixed manufacturing overhead cost. The company's total selling and administrative expenses are $2.600, which include $1,500 fixed selling and administrative costs. Assume that the company wishes to increase the number of units produced and sold to 102 units, what would be the incremental cost? (rounded to nearest ($) value) Finish a O a. 60 О. 30 Oc 38 O d. 54 O e. None of the given answers NEXT PAGE IOUS PAGE ACCT2121 Origin Ggeneral-chat ASUS TUF GAMLarrow_forwardhedule detailing the weekly total production of per week, and the cost of each unit of capital is tz uolzsano Carrow_forwardion list Requirements 2. 3. 1. Compute Pelican Design's direct labor rate and its predetermined overhead allocation rate for 2024. K- Compute the total cost of each job. If Jackson wants to earn profits equal to 20% of service revenue, what fee should she charge each of these two clients? 4. Why does Pelican Design assign costs to jobs? estion 6 estion 7 Pelican Design, Inc. is a Web site design and consulting firm. The firm uses a job order costing system in which each client is a different job. Pelican Design assigns direct labor, licensing costs, and travel costs directly to each job. It allocates indirect costs to jobs based on a predetermined overhead allocation rate, computed as a percentage of direct labor costs. Print Done First, enter the direct costs for each job. Then Pelican Desig Estimated Cost of Delicious Treats a Data table Direct labor hours (professionals) Direct labor costs (professionals) Support staff salaries Computer leases. Office supplies Office rent Print At…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License